This version of the form is not currently in use and is provided for reference only. Download this version of

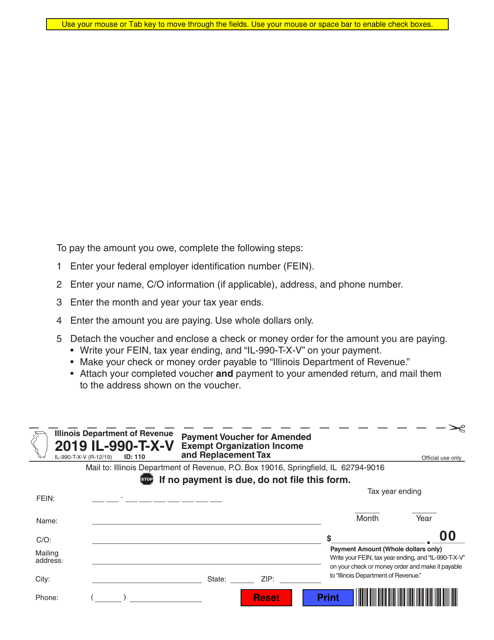

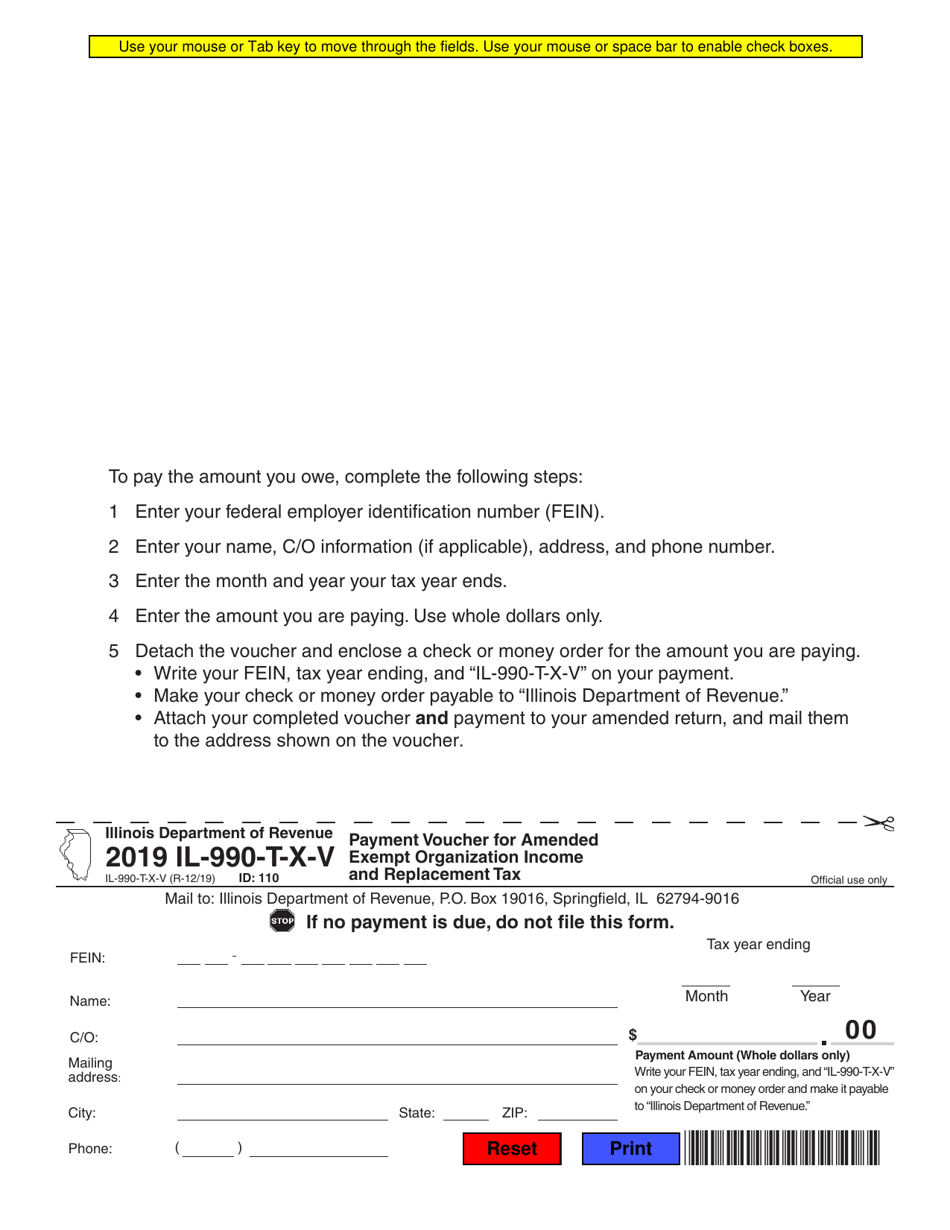

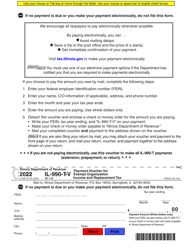

Form IL-990-T-X-V

for the current year.

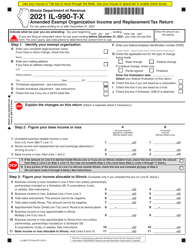

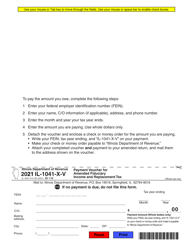

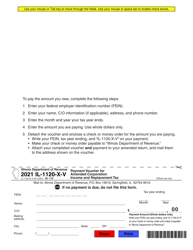

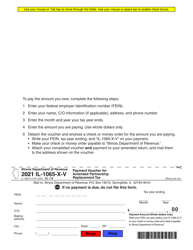

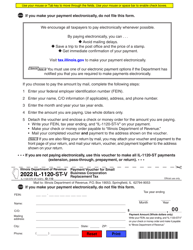

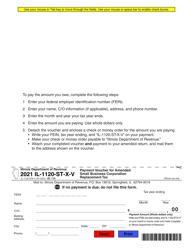

Form IL-990-T-X-V Payment Voucher for Amended Exempt Organization Income and Replacement Tax - Illinois

What Is Form IL-990-T-X-V?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-990-T-X-V?

A: Form IL-990-T-X-V is a payment voucher for amended exempt organization income and replacement tax in Illinois.

Q: Who needs to use Form IL-990-T-X-V?

A: Exempt organizations in Illinois who need to make a payment for amended income and replacement tax.

Q: What is the purpose of Form IL-990-T-X-V?

A: The purpose of Form IL-990-T-X-V is to provide a voucher for making payments for amended exempt organization income and replacement tax in Illinois.

Q: How do I fill out Form IL-990-T-X-V?

A: You must fill in your organization's name, address, federal employer identification number (FEIN), amended return type, payment amount, and other required information.

Q: Are there any additional forms required with Form IL-990-T-X-V?

A: It depends on your specific situation. You may need to include other forms or attachments when submitting Form IL-990-T-X-V.

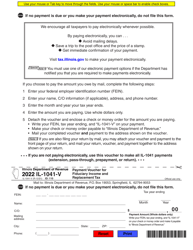

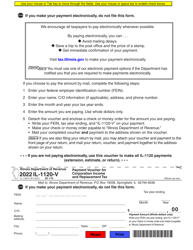

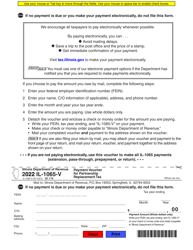

Q: Can I file Form IL-990-T-X-V electronically?

A: As of now, Form IL-990-T-X-V cannot be filed electronically. You must mail the completed form and payment.

Q: Is there a penalty for late filing or payment of Form IL-990-T-X-V?

A: Yes, there may be penalties for late filing or payment. It is important to file and pay on time to avoid penalties and interest.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T-X-V by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.