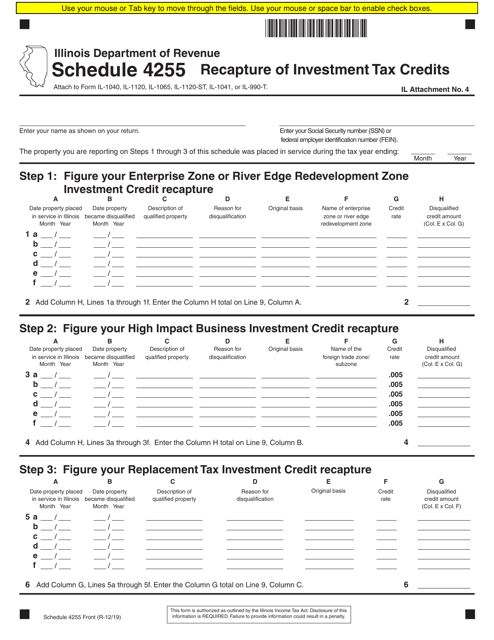

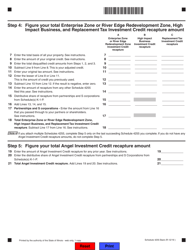

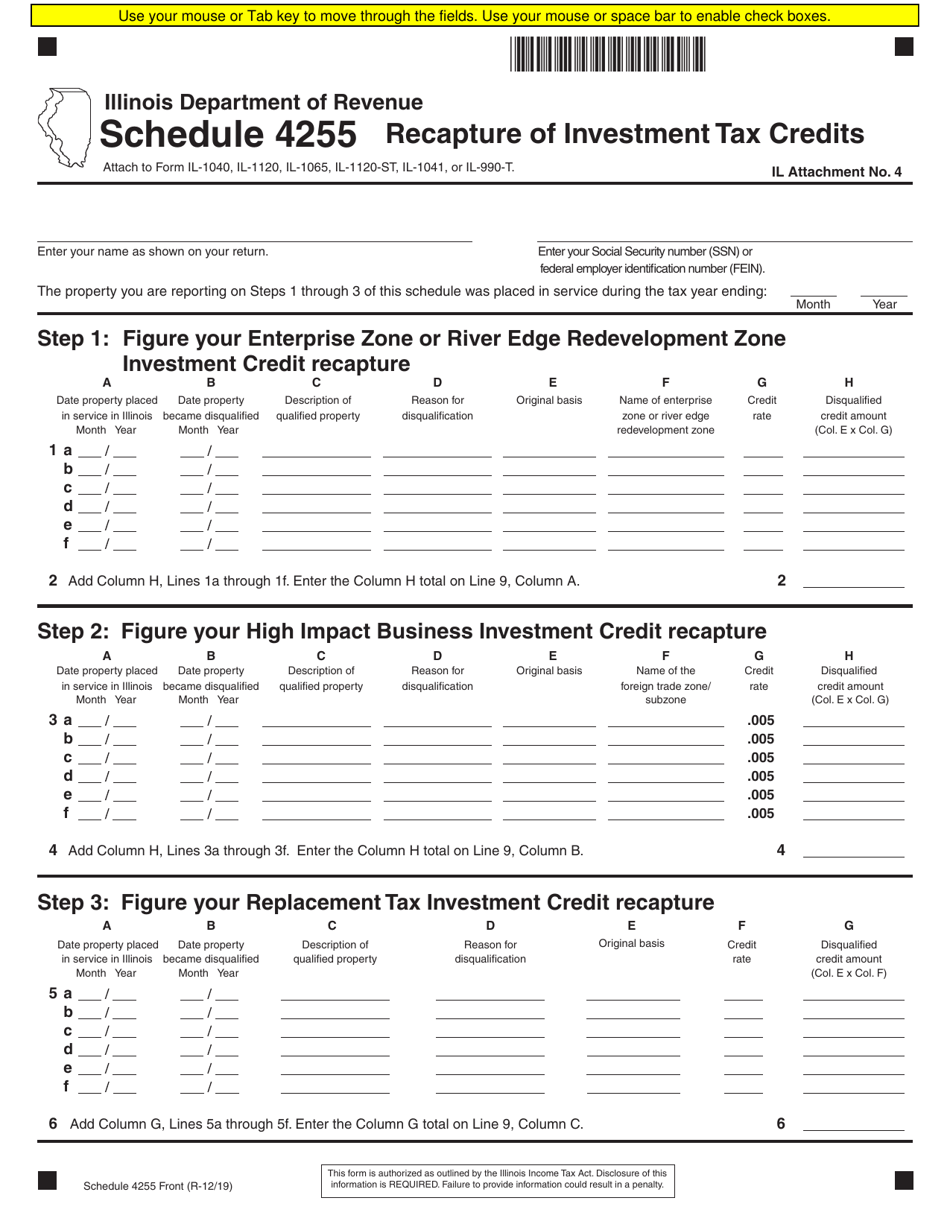

Schedule 4255 Recapture of Investment Tax Credits - Illinois

What Is Schedule 4255?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 4255?

A: Schedule 4255 is a tax form that deals with the recapture of investment tax credits.

Q: What are investment tax credits?

A: Investment tax credits are tax incentives provided to businesses that make certain qualifying investments.

Q: What is recapture?

A: Recapture is when a previously claimed tax credit needs to be paid back or reversed.

Q: Why would investment tax credits need to be recaptured?

A: Investment tax credits may need to be recaptured if certain conditions or requirements are not met.

Q: Is this specific to Illinois?

A: Yes, Schedule 4255 deals specifically with the recapture of investment tax credits in Illinois.

Q: Who needs to file Schedule 4255?

A: Businesses in Illinois that have claimed investment tax credits and need to recapture them are required to file Schedule 4255.

Q: What information is required to complete Schedule 4255?

A: To complete Schedule 4255, you will need information related to the previously claimed investment tax credits, including the amount claimed and any applicable recapture amounts.

Q: What happens if Schedule 4255 is not filed correctly?

A: If Schedule 4255 is not filed correctly or if recapture amounts are not paid when required, it may result in penalties or additional tax liabilities for the business.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 4255 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.