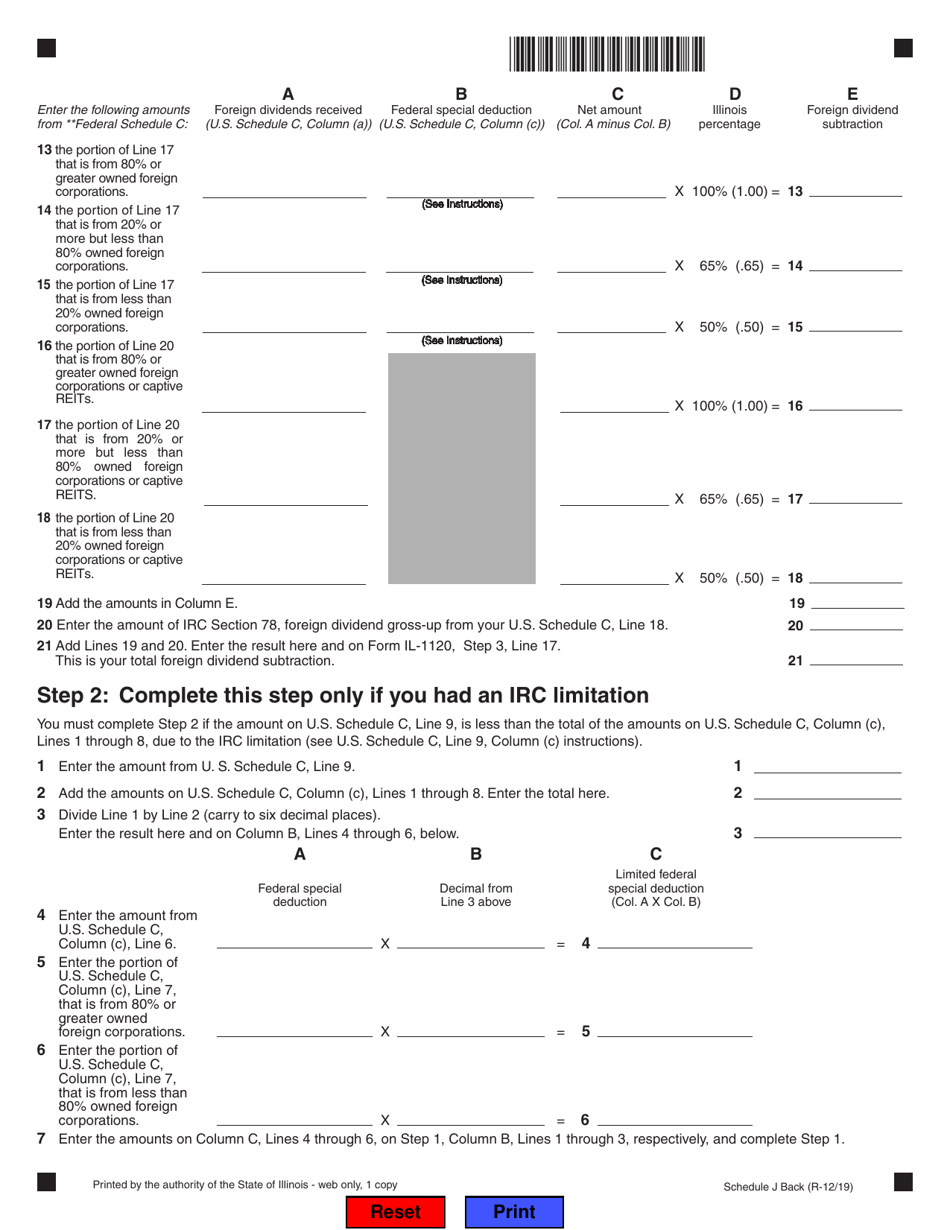

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule J

for the current year.

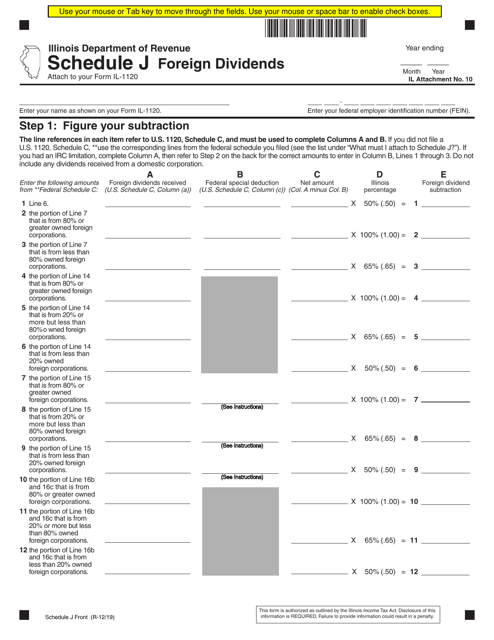

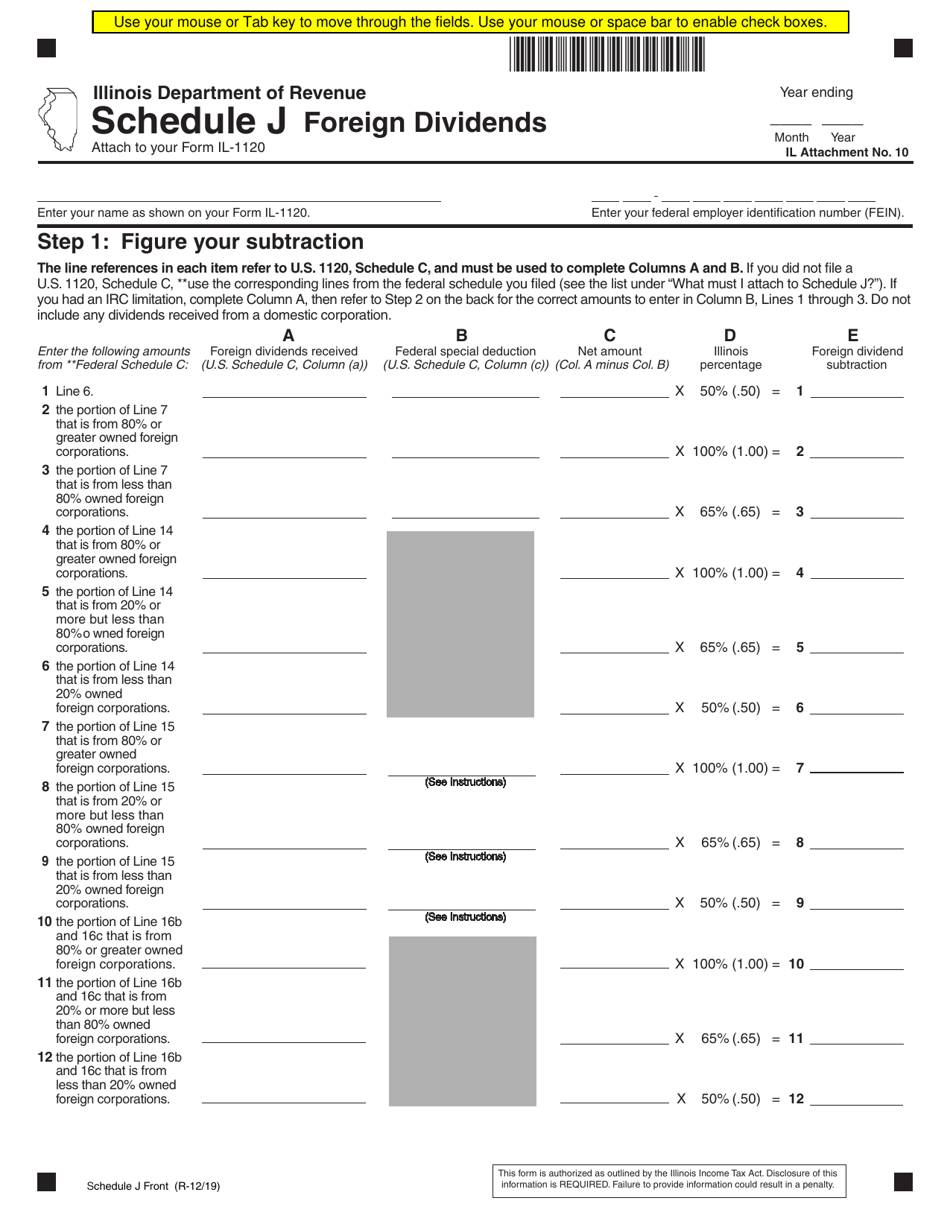

Schedule J Foreign Dividends - Illinois

What Is Schedule J?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule J?

A: Schedule J is a tax form used to report foreign dividends in Illinois.

Q: What are foreign dividends?

A: Foreign dividends are payments received from foreign companies or corporations.

Q: Do I need to file Schedule J?

A: You need to file Schedule J if you have received foreign dividends and you are a resident of Illinois.

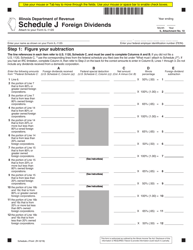

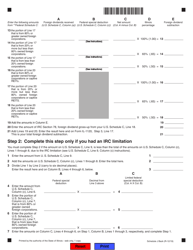

Q: How do I complete Schedule J?

A: To complete Schedule J, you will need to gather all the information about your foreign dividends, such as the amount received, the name of the foreign company, and any taxes withheld.

Q: Is there a deadline for filing Schedule J?

A: The deadline for filing Schedule J is the same as the deadline for filing your Illinois state tax return, which is typically April 15th.

Q: Are there any penalties for not filing Schedule J?

A: Yes, if you fail to file Schedule J when required, you may be subject to penalties and interest.

Q: Can I e-file Schedule J?

A: Yes, you can e-file Schedule J along with your Illinois state tax return if you are using tax software that supports this form.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule J by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.