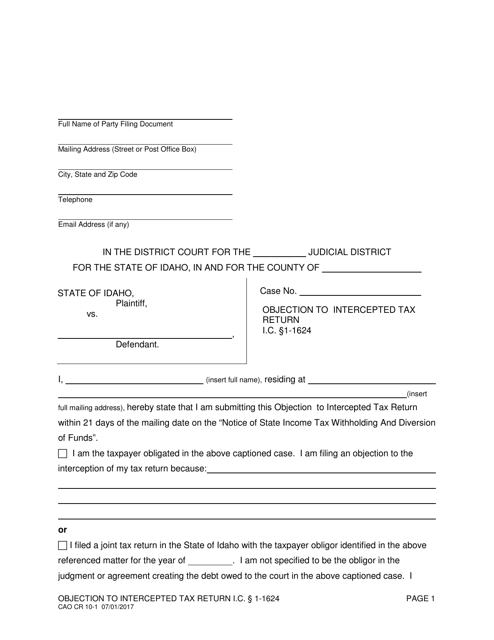

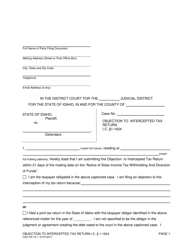

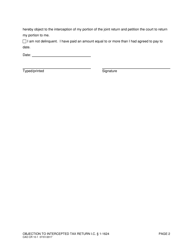

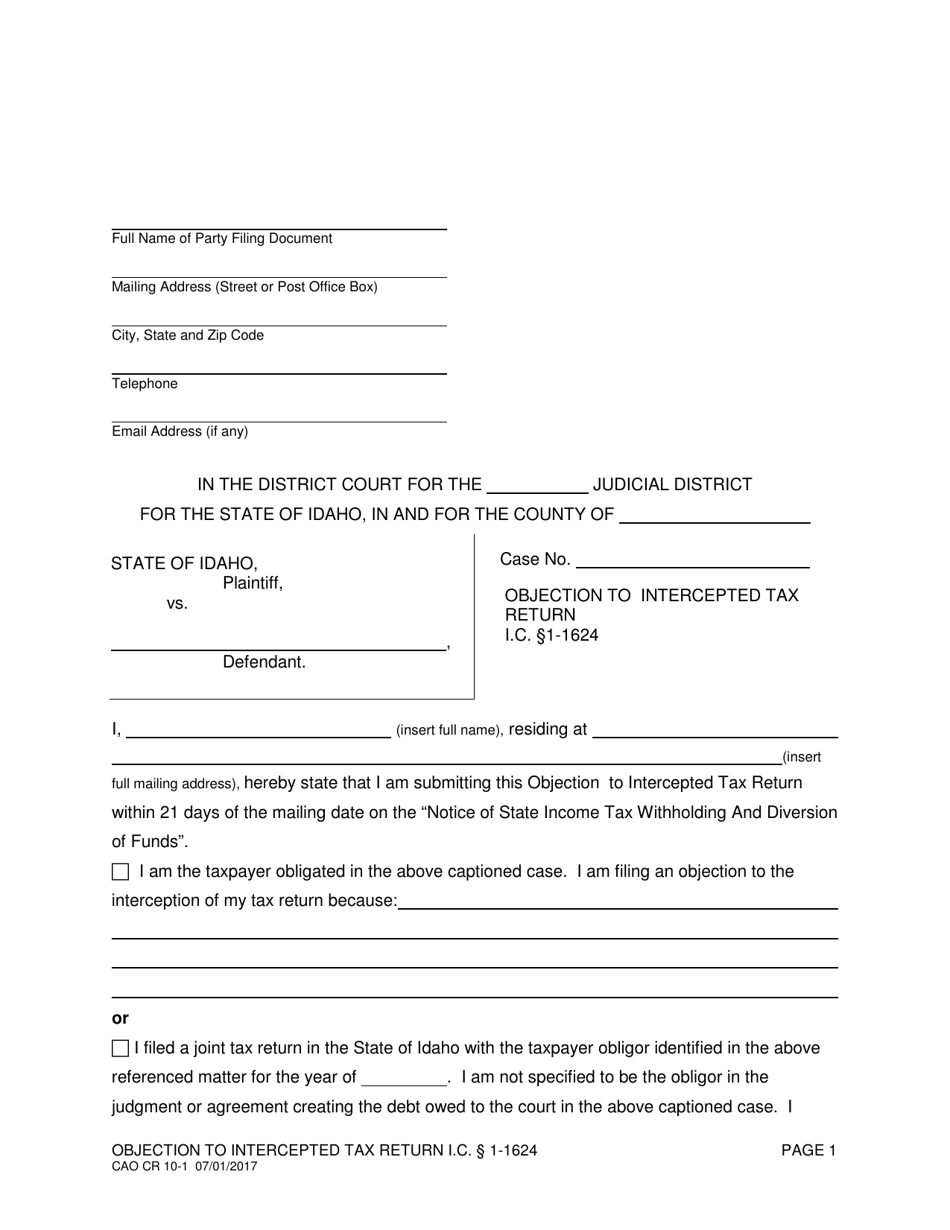

Form CAO CR10-1 Objection to Intercepted Tax Return - Idaho

What Is Form CAO CR10-1?

This is a legal form that was released by the Idaho District Courts - a government authority operating within Idaho. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CAO CR10-1?

A: Form CAO CR10-1 is a form used to object to the interception of a tax return in Idaho.

Q: What is an intercepted tax return?

A: An intercepted tax return is a tax refund that has been taken by a government agency to satisfy a debt owed by the taxpayer.

Q: How can I object to an intercepted tax return in Idaho?

A: You can object to an intercepted tax return in Idaho by filing Form CAO CR10-1.

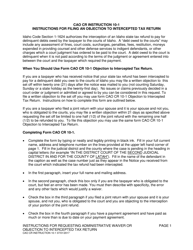

Q: Are there any specific requirements for filing Form CAO CR10-1?

A: Yes, there are specific requirements for filing Form CAO CR10-1. You should carefully review the instructions provided with the form.

Q: Is there a deadline for filing Form CAO CR10-1?

A: Yes, there is a deadline for filing Form CAO CR10-1. You should file the form within 30 days of receiving notice of the interception.

Q: What happens after I file Form CAO CR10-1?

A: After you file Form CAO CR10-1, the Idaho State Tax Commission will review your objection and make a determination.

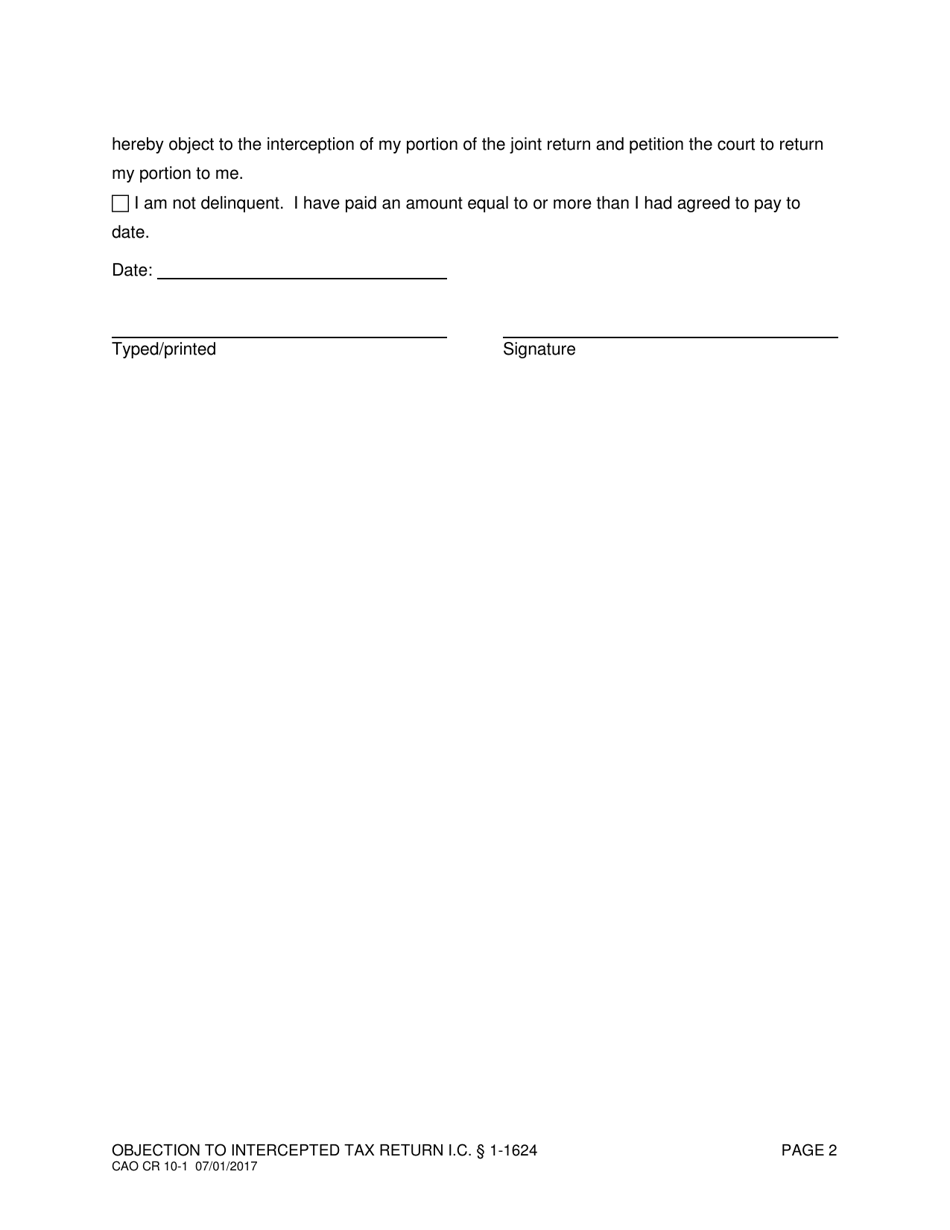

Q: What should I do if my objection is denied?

A: If your objection is denied, you may have the option to further appeal the decision. You should seek legal advice to explore your options.

Q: Can I still file my tax return if it has been intercepted?

A: Yes, you can still file your tax return even if it has been intercepted. However, any refund due to you may be applied to your outstanding debt.

Q: Is there any fee for filing Form CAO CR10-1?

A: No, there is no fee for filing Form CAO CR10-1.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Idaho District Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAO CR10-1 by clicking the link below or browse more documents and templates provided by the Idaho District Courts.