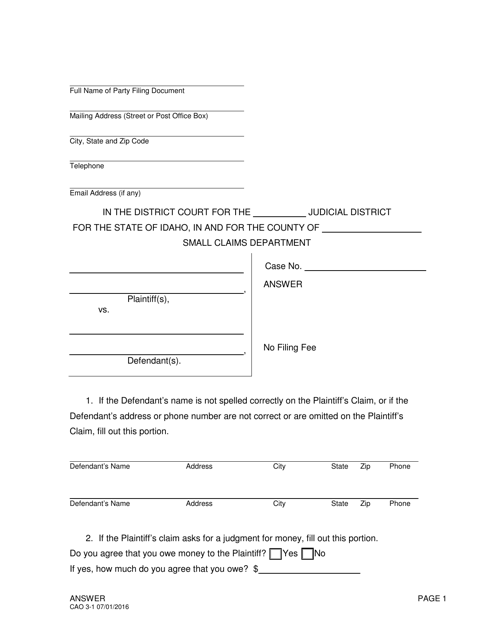

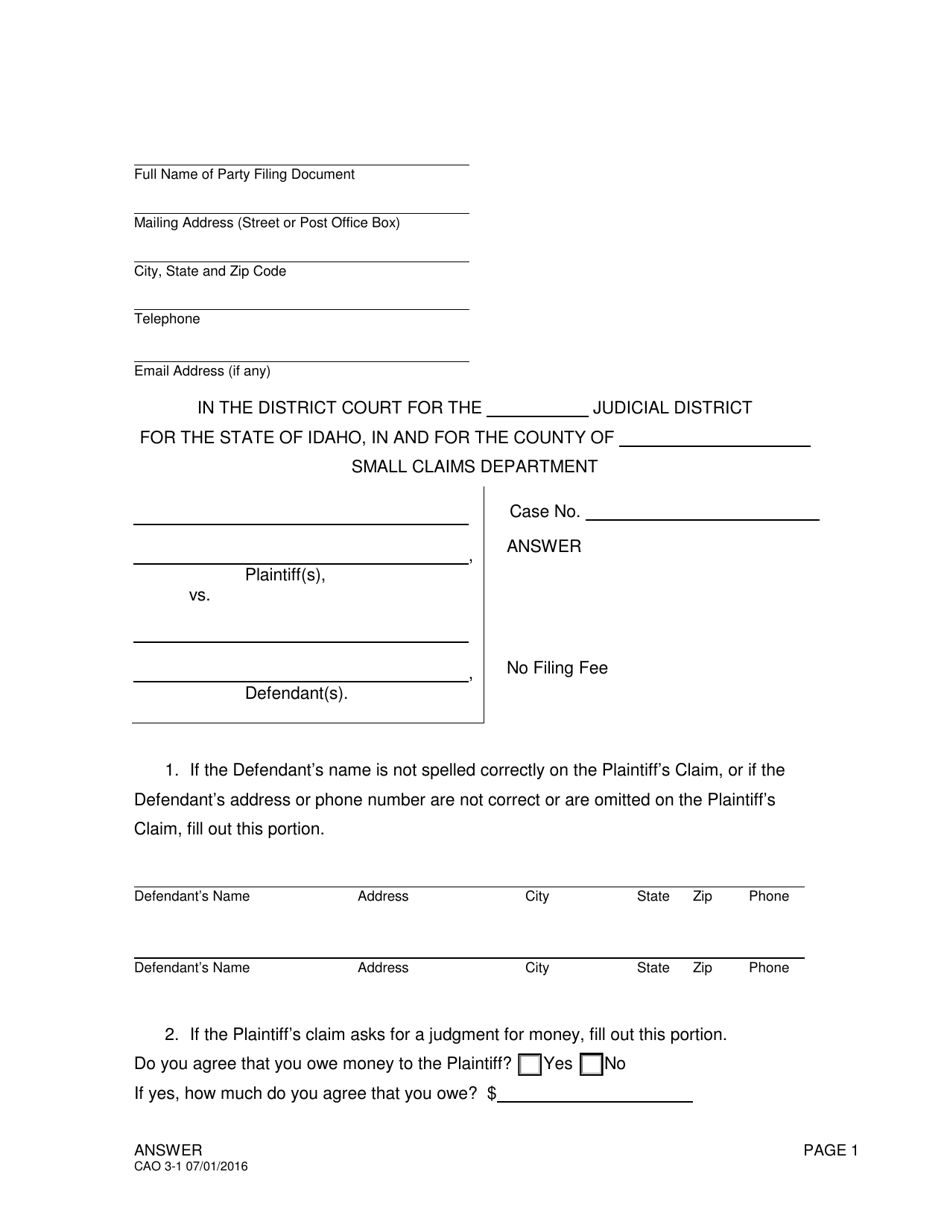

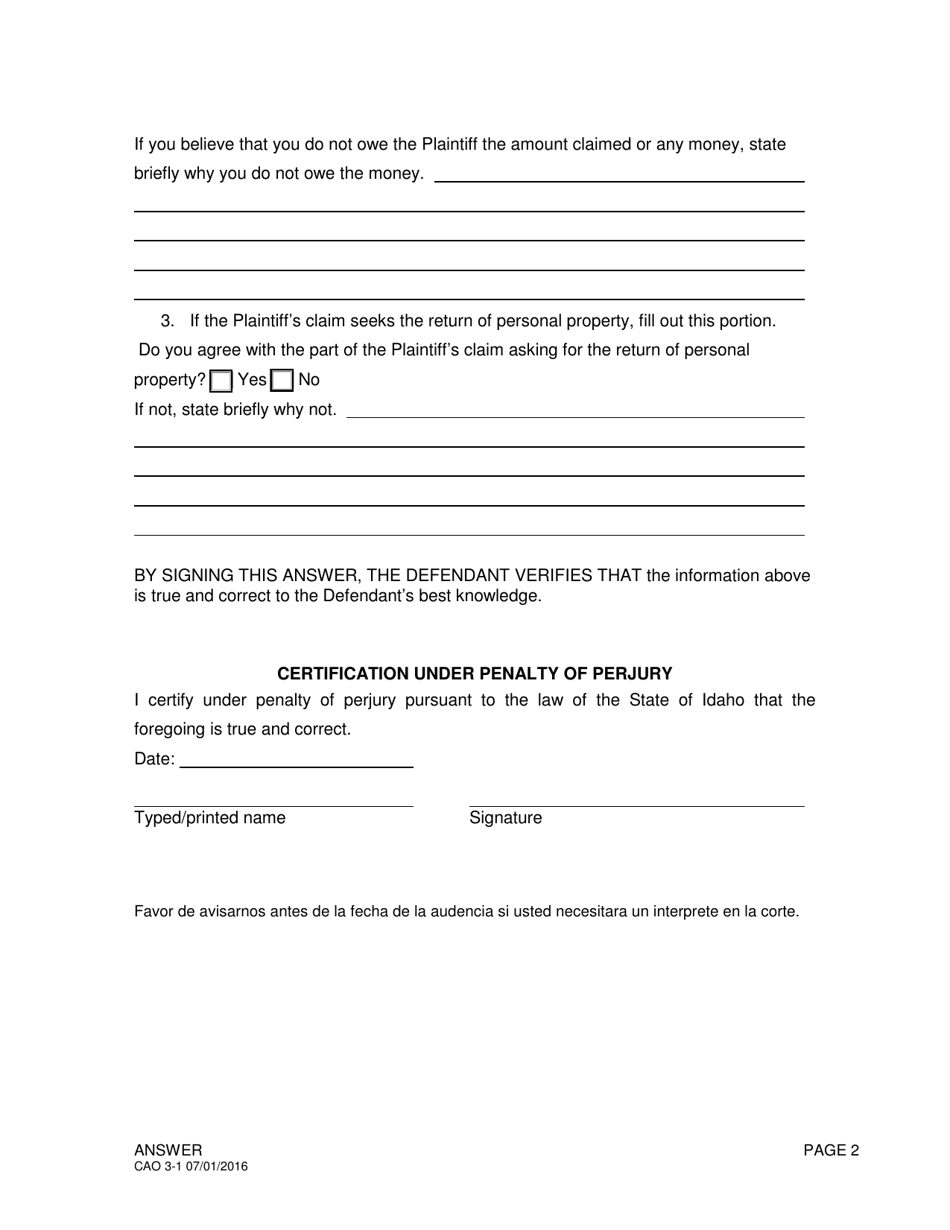

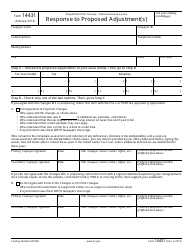

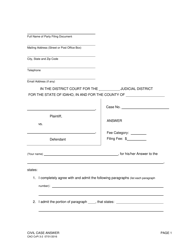

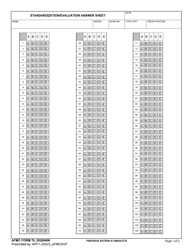

Form CAO3-1 Answer - Idaho

What Is Form CAO3-1?

This is a legal form that was released by the Idaho District Courts - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAO3-1?

A: Form CAO3-1 is a form used in the state of Idaho.

Q: What is the purpose of Form CAO3-1?

A: The purpose of Form CAO3-1 is to report changes in ownership or control of a business in Idaho.

Q: Who needs to fill out Form CAO3-1?

A: Any business that undergoes a change in ownership or control in Idaho needs to fill out Form CAO3-1.

Q: Is there a deadline for submitting Form CAO3-1?

A: Yes, Form CAO3-1 must be submitted within 60 days of the change in ownership or control.

Q: What information is required on Form CAO3-1?

A: Form CAO3-1 requires information such as the old and new owners' names, addresses, and percentages of ownership.

Q: Are there any fees associated with Form CAO3-1?

A: No, there are no fees associated with submitting Form CAO3-1.

Q: What happens after submitting Form CAO3-1?

A: After submitting Form CAO3-1, the Idaho Secretary of State will update the business records to reflect the change in ownership or control.

Q: Can I file Form CAO3-1 by mail?

A: Yes, Form CAO3-1 can also be filed by mail to the Idaho Secretary of State's office.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Idaho District Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAO3-1 by clicking the link below or browse more documents and templates provided by the Idaho District Courts.