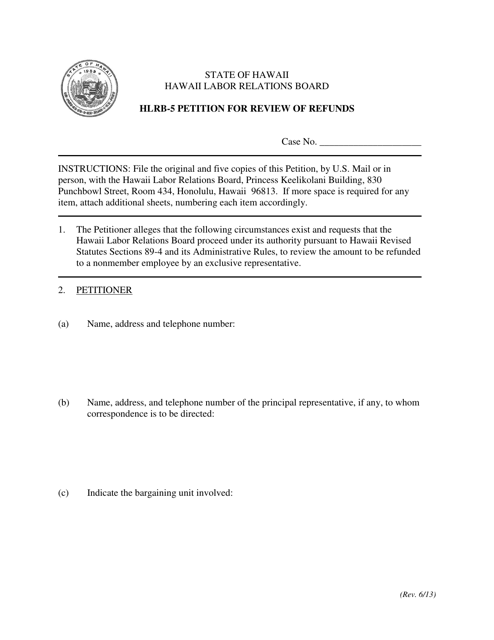

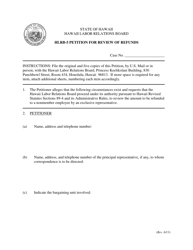

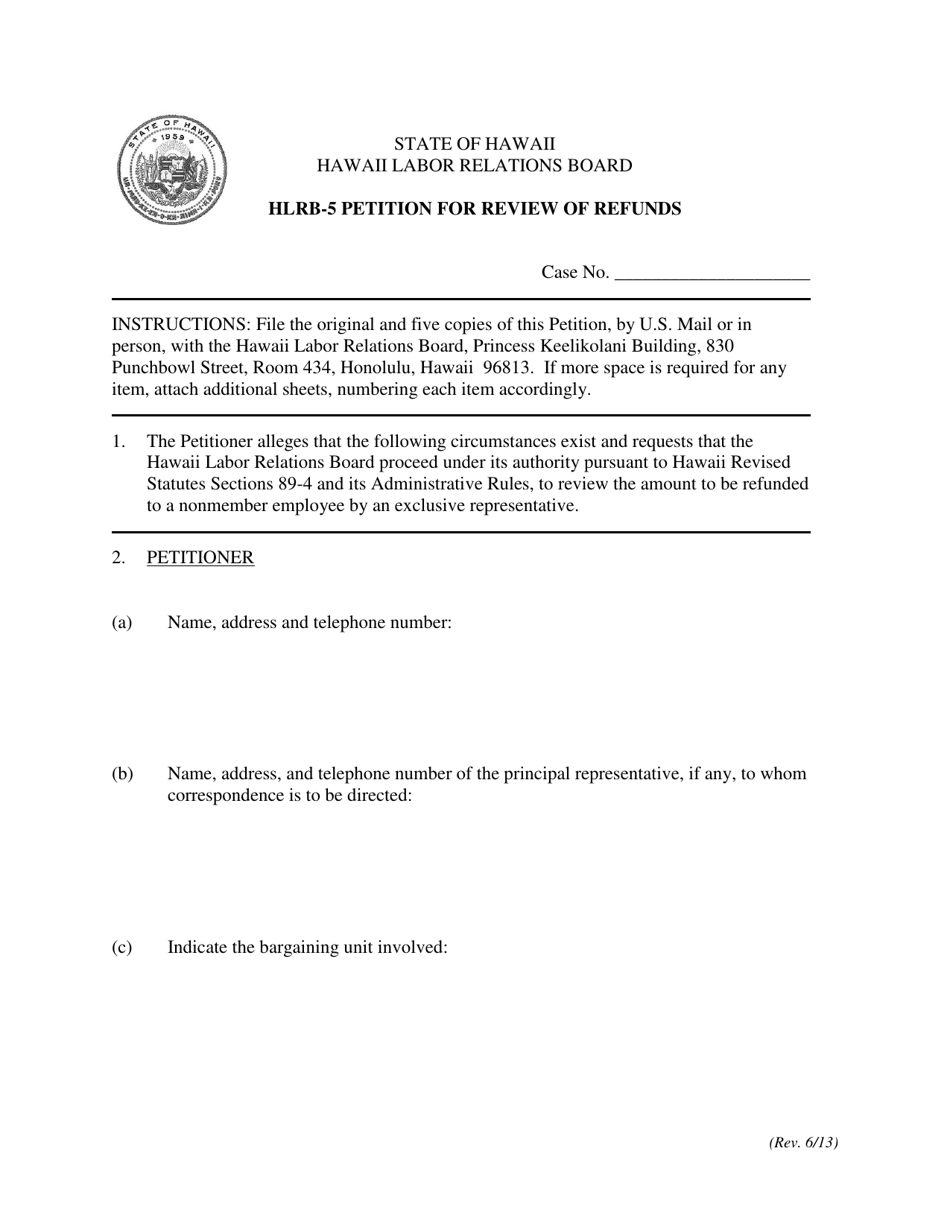

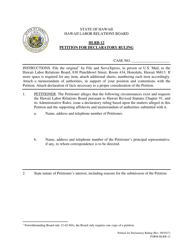

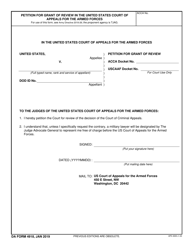

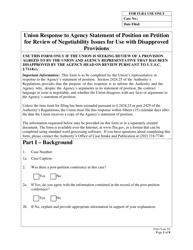

Form HLRB-5 Petition for Review of Refunds - Hawaii

What Is Form HLRB-5?

This is a legal form that was released by the Hawaii Department of Labor & Industrial Relations - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

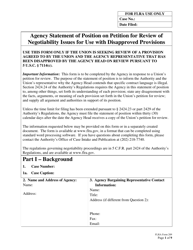

Q: What is Form HLRB-5?

A: Form HLRB-5 is a petition for review of refunds in the state of Hawaii.

Q: What is the purpose of Form HLRB-5?

A: The purpose of Form HLRB-5 is to request a review of refunds in cases where the taxpayer disagrees with the decision made by the Department of Taxation.

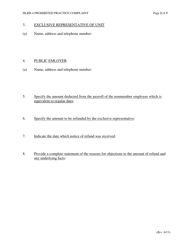

Q: Who can use Form HLRB-5?

A: Form HLRB-5 can be used by individuals or businesses who want to challenge the refund decision made by the Department of Taxation in Hawaii.

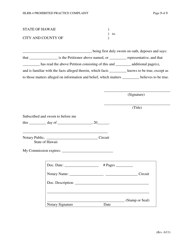

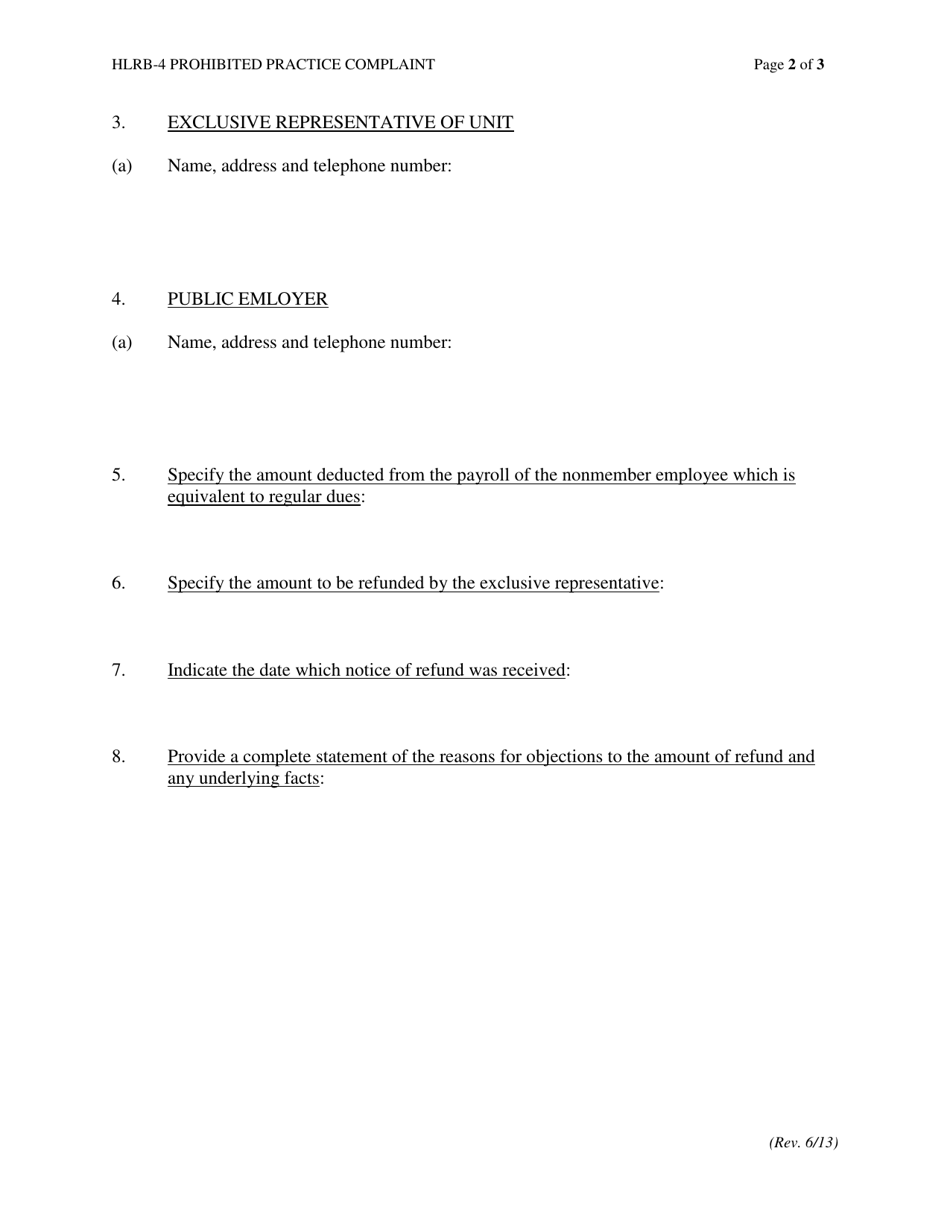

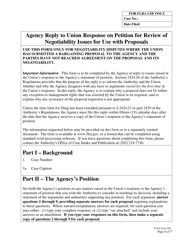

Q: How should Form HLRB-5 be filled out?

A: Form HLRB-5 should be filled out completely and accurately, providing the necessary information about the taxpayer, the tax refund in question, and the reasons for requesting a review.

Q: What supporting documents should be included with Form HLRB-5?

A: Supporting documents that can help to substantiate the reasons for the review request should be included with Form HLRB-5. These may include tax returns, receipts, or any other relevant documentation.

Q: Is there a deadline for filing Form HLRB-5?

A: Yes, there is a deadline for filing Form HLRB-5. The form must be filed within 30 days from the date of the refund decision by the Department of Taxation.

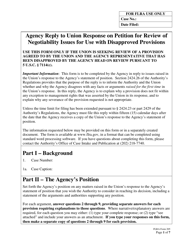

Q: What happens after submitting Form HLRB-5?

A: After submitting Form HLRB-5, the Hawaii State Tax Office will review the petition and the supporting documents provided. They will then make a decision on whether to grant or deny the request for review.

Q: Can I appeal the decision made on Form HLRB-5?

A: Yes, if you disagree with the decision made on Form HLRB-5, you have the option to appeal it through the appropriate channels, as outlined by the Department of Taxation in Hawaii.

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Hawaii Department of Labor & Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HLRB-5 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Labor & Industrial Relations.