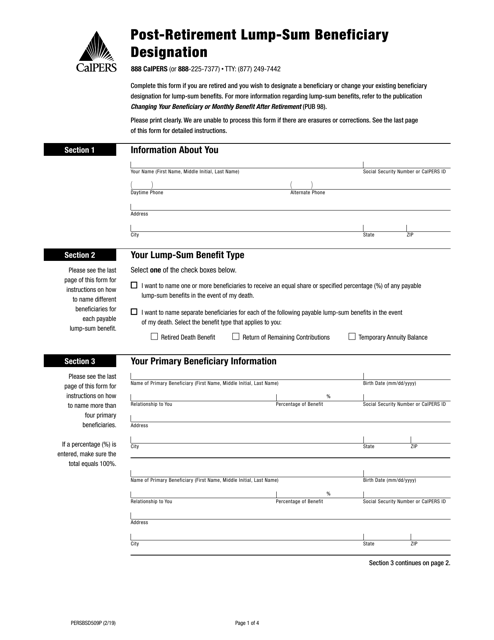

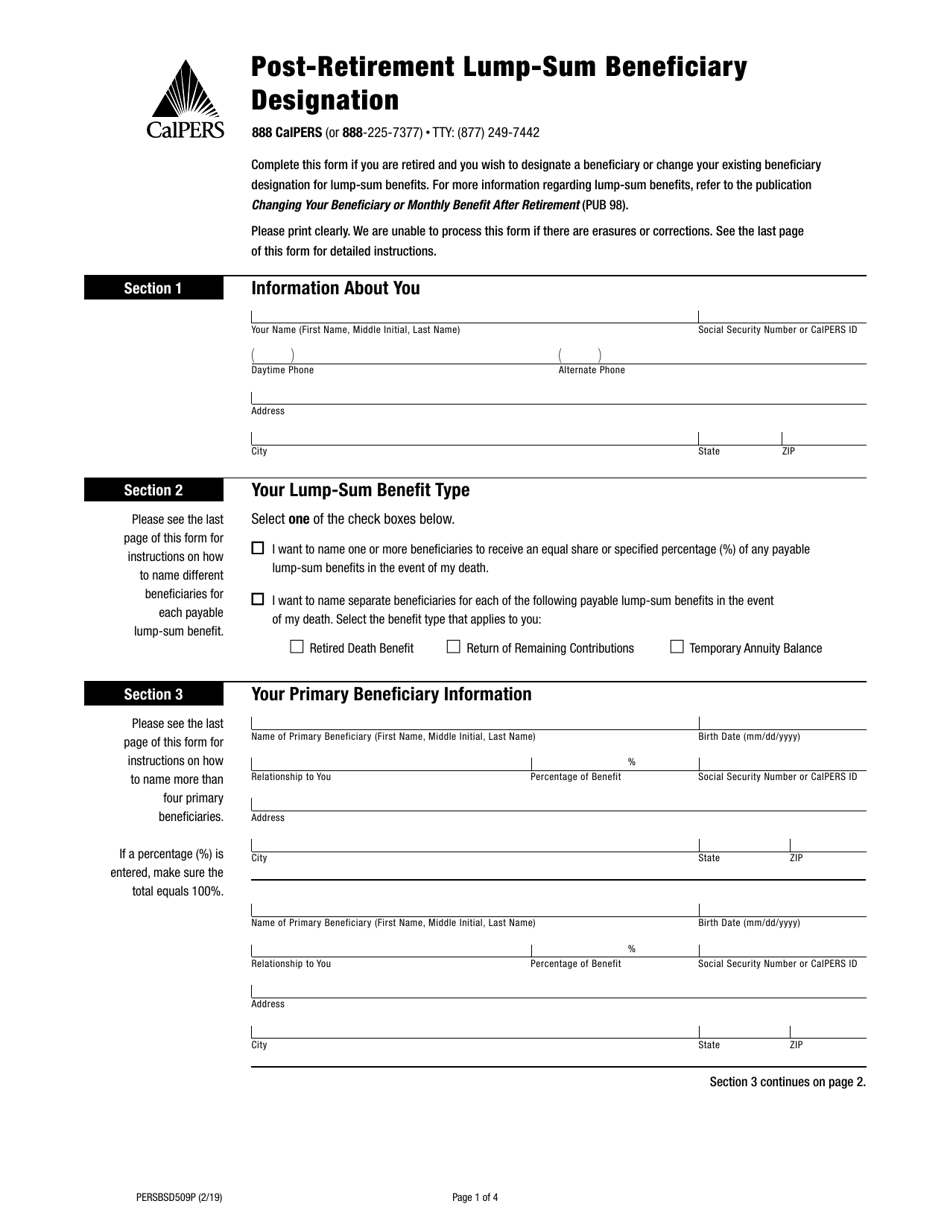

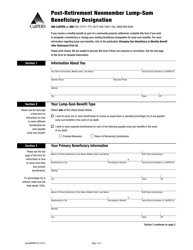

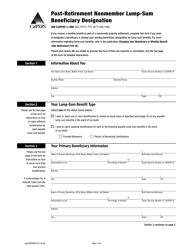

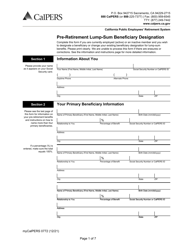

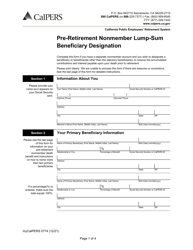

Form PERS-BSD-509P Post-retirement Lump-Sum Beneficiary Designation - California

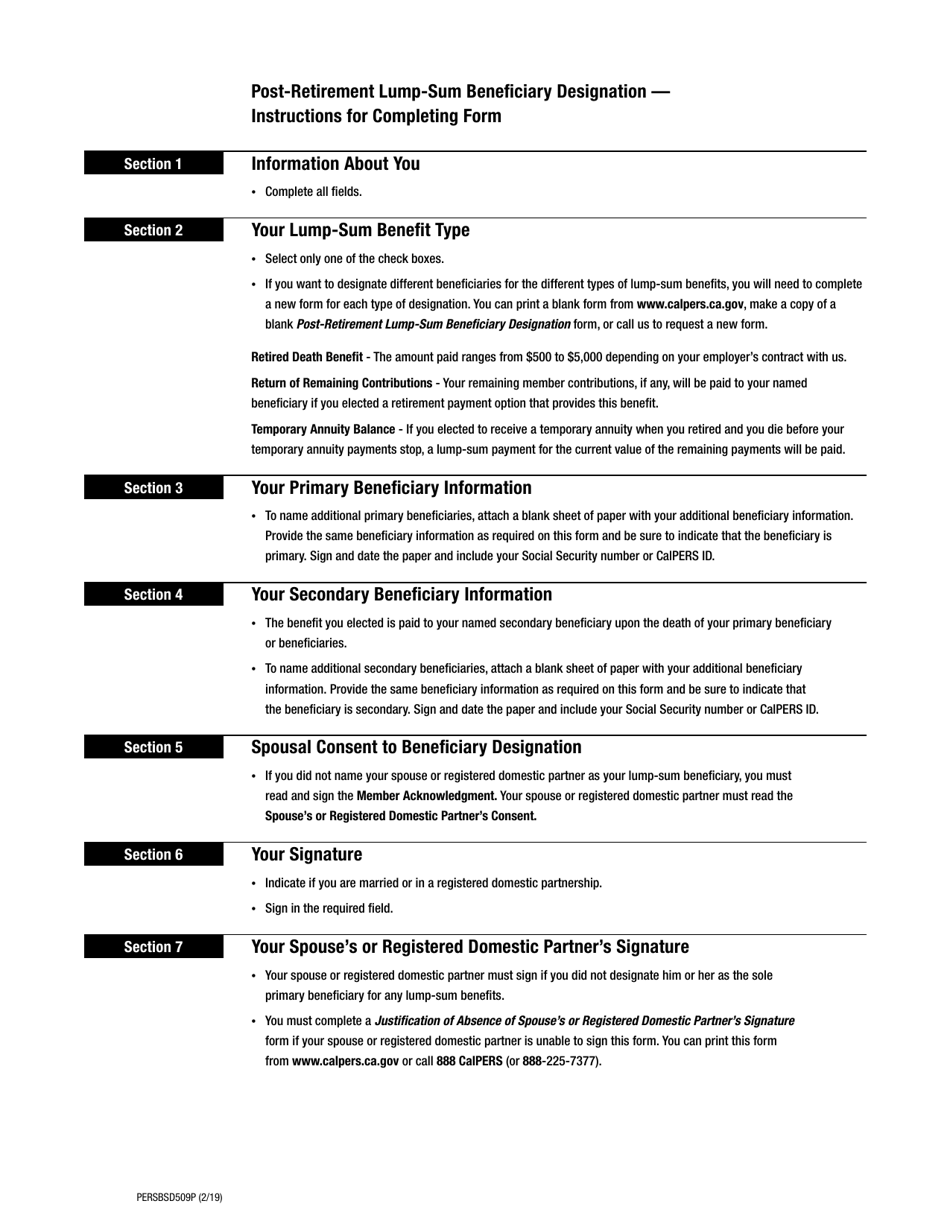

What Is Form PERS-BSD-509P?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PERS-BSD-509P form?

A: The PERS-BSD-509P form is the Post-retirement Lump-Sum Beneficiary Designation form for the state of California.

Q: What does the PERS-BSD-509P form do?

A: The PERS-BSD-509P form allows retired members of the Public Employees' Retirement System (PERS) in California to designate a beneficiary to receive a lump-sum payment after their death.

Q: Who can use the PERS-BSD-509P form?

A: The PERS-BSD-509P form can be used by retired members of the Public Employees' Retirement System (PERS) in California who wish to designate a beneficiary for a lump-sum payment.

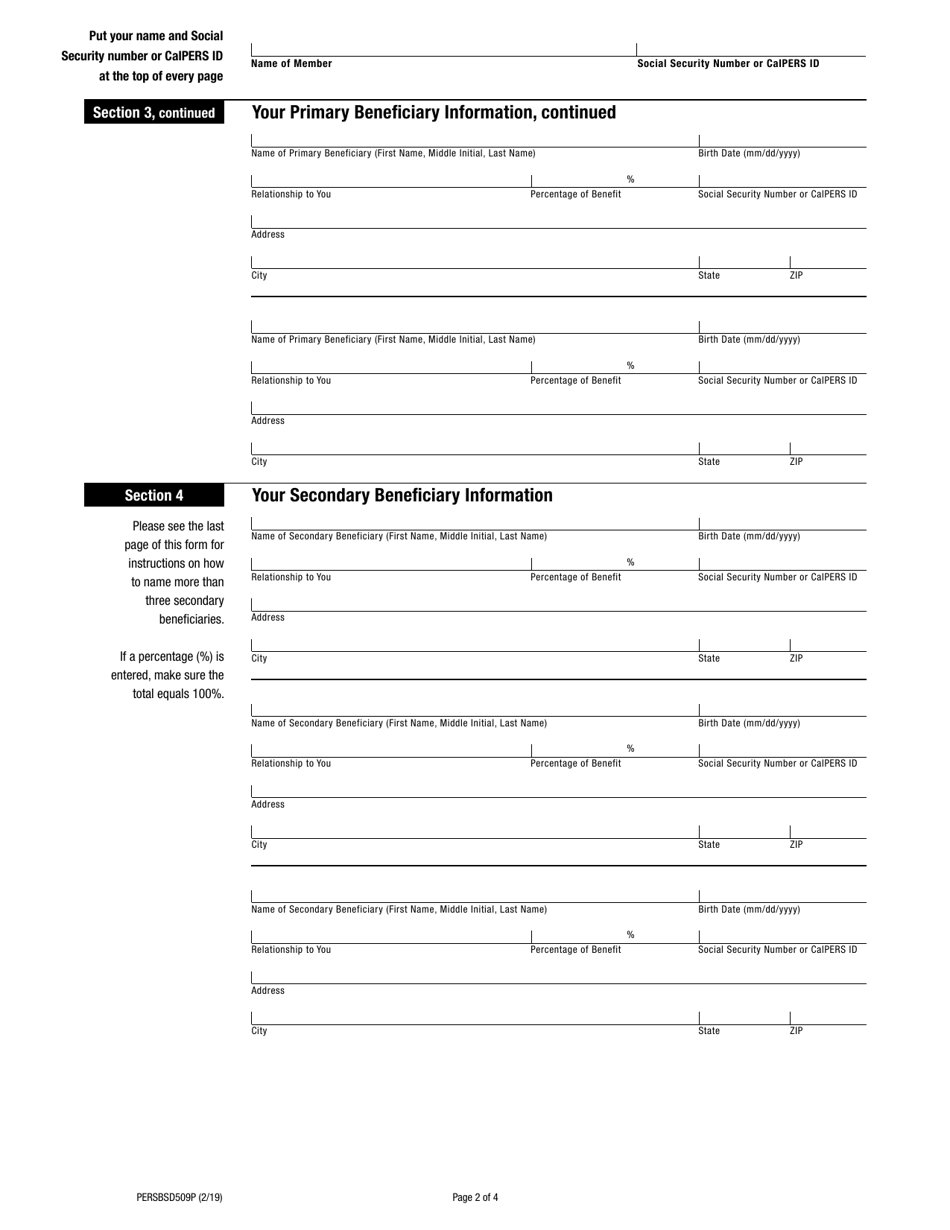

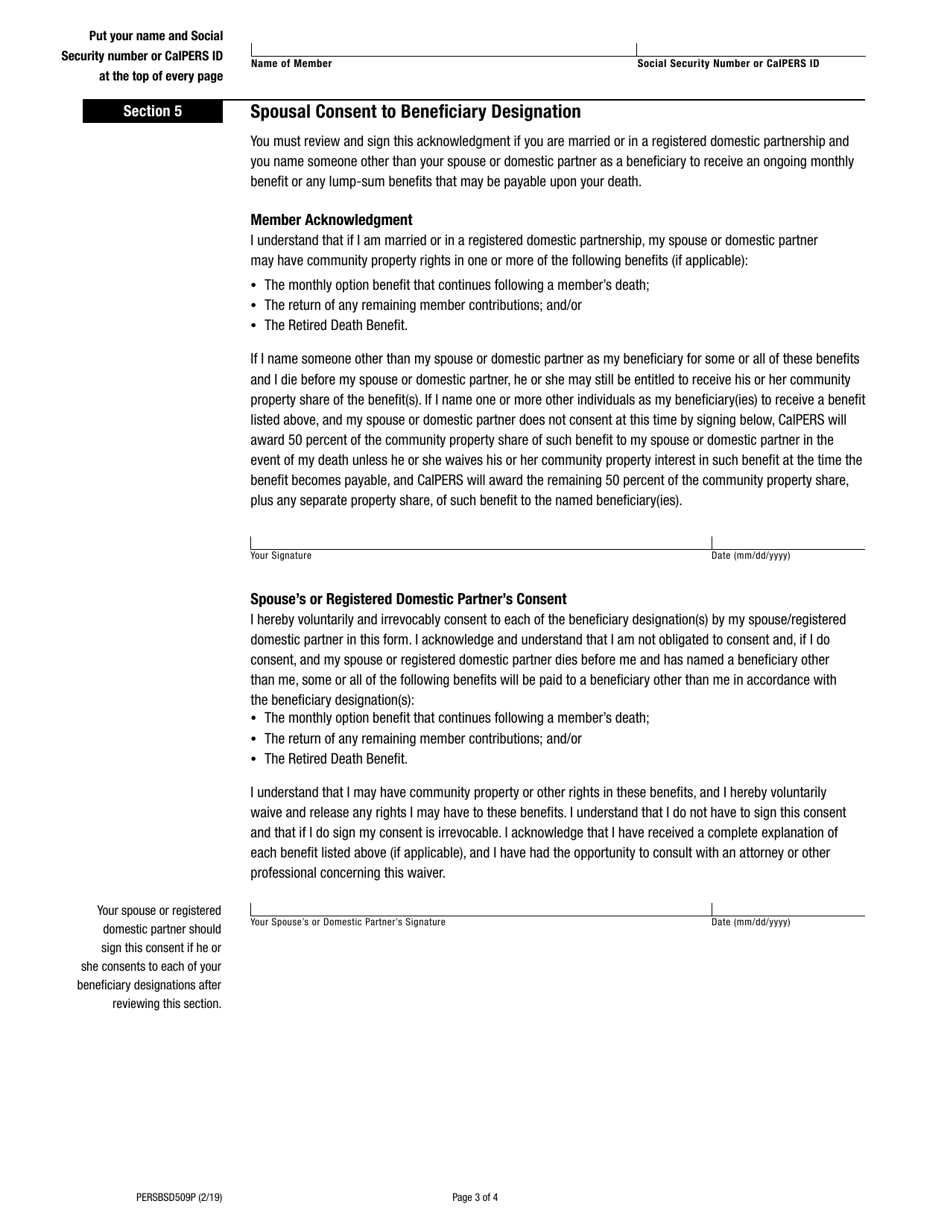

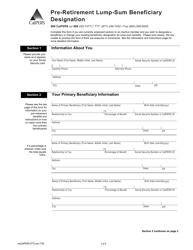

Q: How do I fill out the PERS-BSD-509P form?

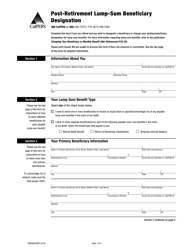

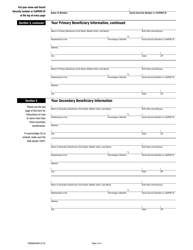

A: To fill out the PERS-BSD-509P form, you will need to provide your personal information, such as your name, address, and Social Security number, as well as the name and contact information of your designated beneficiary.

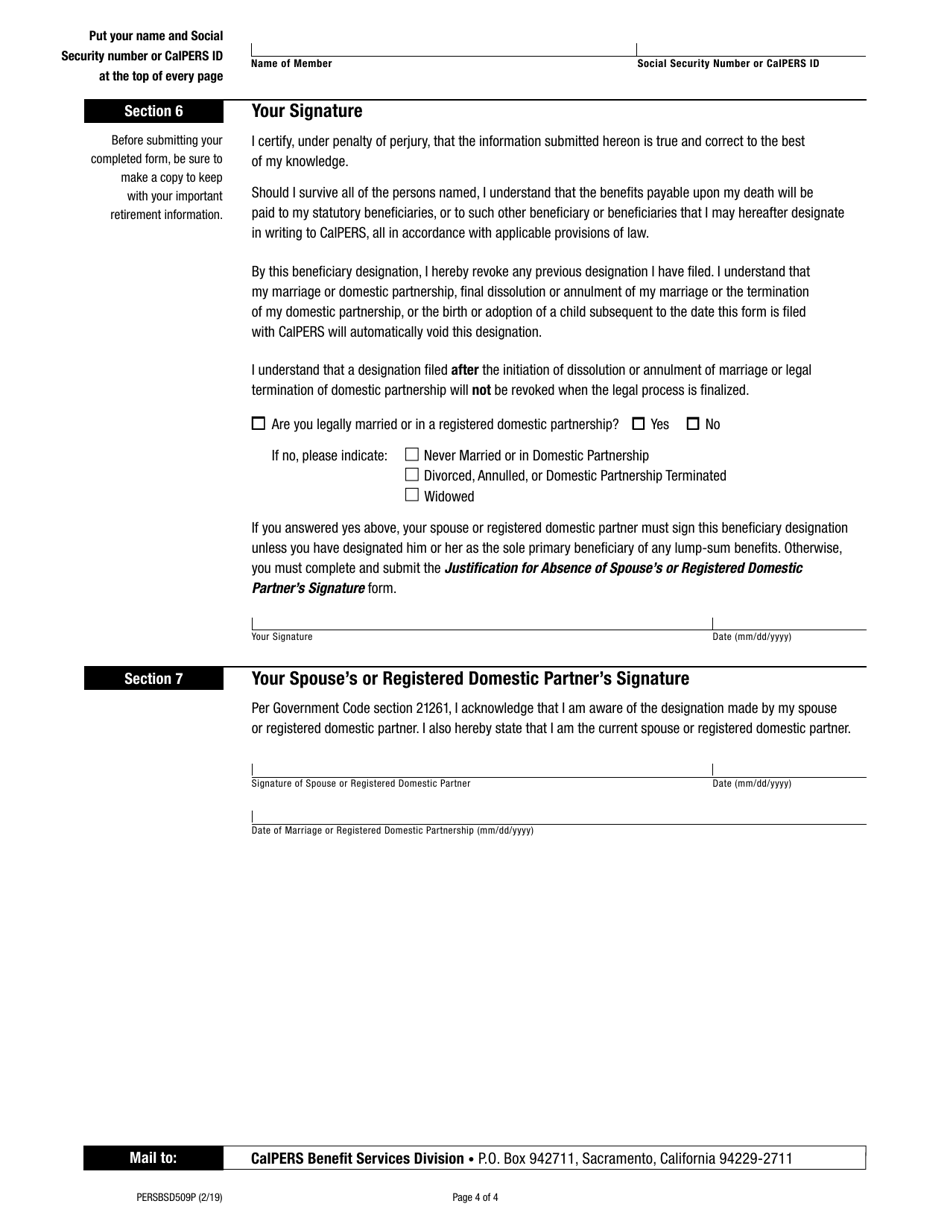

Q: Is there a deadline for submitting the PERS-BSD-509P form?

A: Yes, there is a deadline for submitting the PERS-BSD-509P form. It must be filed with the Public Employees' Retirement System (PERS) within 90 days of your retirement date.

Q: Can I change my beneficiary after submitting the PERS-BSD-509P form?

A: Yes, you can change your beneficiary after submitting the PERS-BSD-509P form. You will need to complete a new form and submit it to the Public Employees' Retirement System (PERS) in California.

Q: What happens if I do not submit a PERS-BSD-509P form?

A: If you do not submit a PERS-BSD-509P form, the lump-sum payment will be distributed according to the default beneficiary rules of the Public Employees' Retirement System (PERS).

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PERS-BSD-509P by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.