This version of the form is not currently in use and is provided for reference only. Download this version of

Form AR-OI

for the current year.

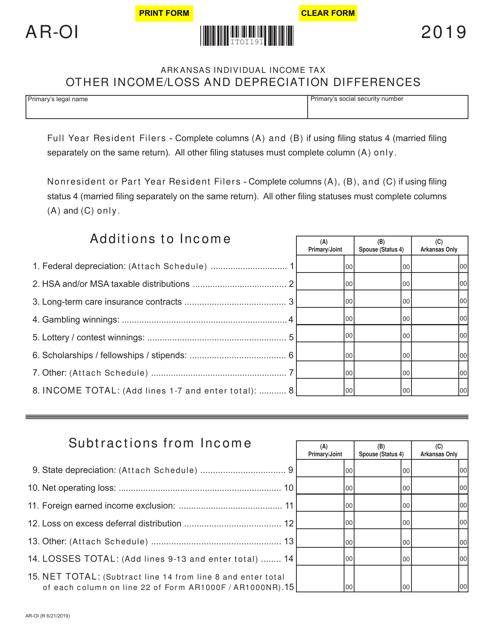

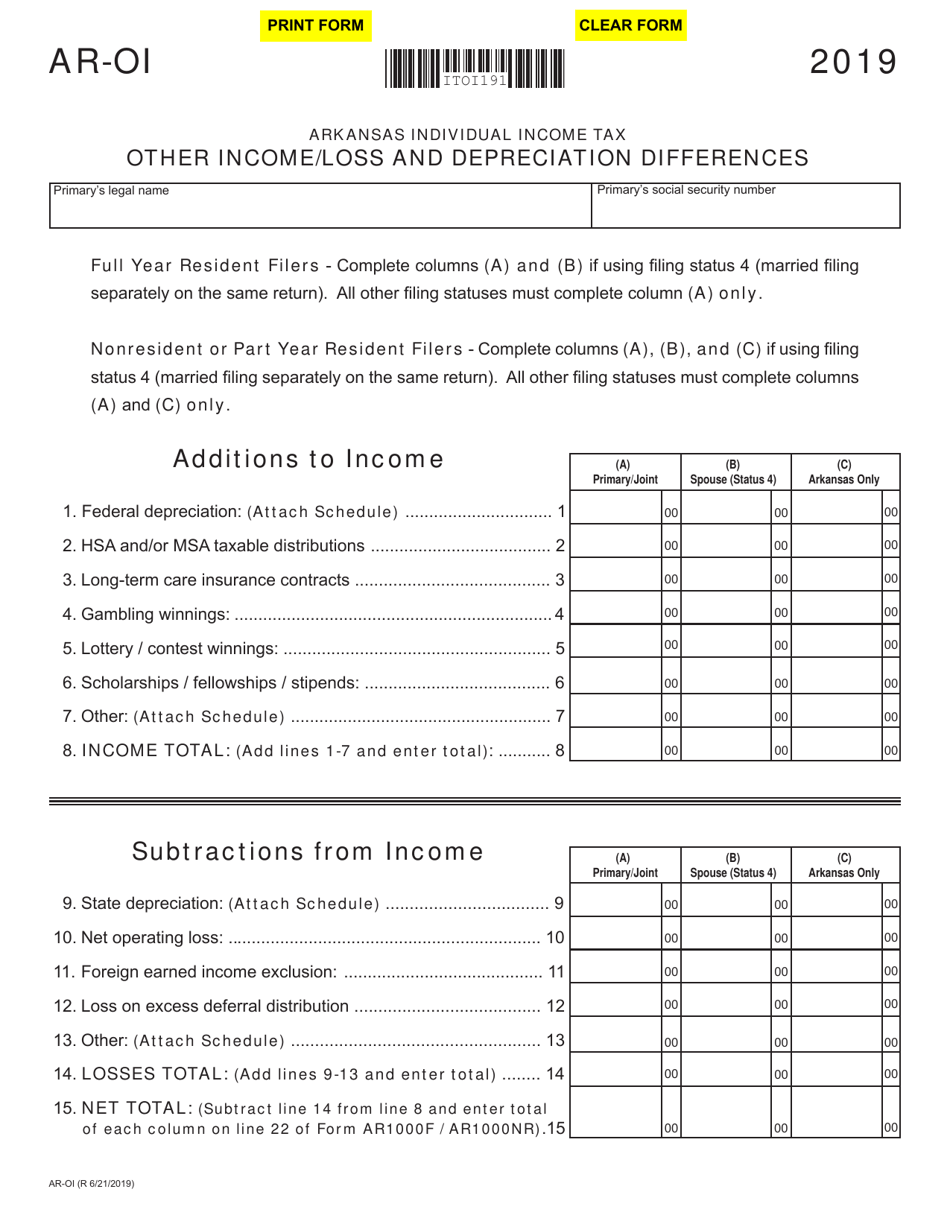

Form AR-OI Other Income / Loss and Depreciation Differences - Arkansas

What Is Form AR-OI?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR-OI?

A: Form AR-OI is a tax form used in Arkansas to report other income/loss and depreciation differences.

Q: Who needs to file Form AR-OI?

A: Any individual or business in Arkansas that has other income/loss or depreciation differences may need to file Form AR-OI.

Q: What should I report on Form AR-OI?

A: You should report any other income or loss that is not reported on your federal tax return, as well as any differences in depreciation deductions.

Q: When is Form AR-OI due?

A: Form AR-OI is generally due by the same date as your Arkansas state tax return, which is typically April 15th.

Q: Can I e-file Form AR-OI?

A: Yes, Arkansas supports e-filing for Form AR-OI. You can file electronically through the Arkansas Taxpayer Access Point (TAP) system.

Q: What if I need more time to file Form AR-OI?

A: If you need more time to file Form AR-OI, you can request an extension by submitting Form AR1055.

Q: Are there any penalties for late or inaccurate filing of Form AR-OI?

A: Yes, there may be penalties for late or inaccurate filing of Form AR-OI, including potential interest charges and penalties for underreporting or underpaying tax.

Q: Should I include supporting documents with Form AR-OI?

A: You should keep any supporting documents for your records, but you generally do not need to include them with your Form AR-OI when filing.

Form Details:

- Released on June 21, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-OI by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.