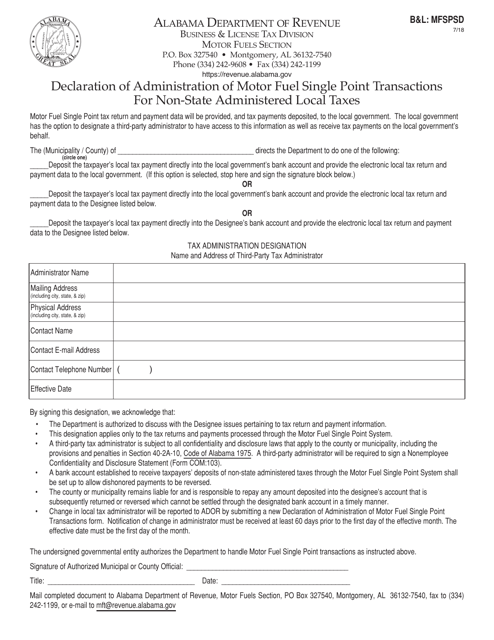

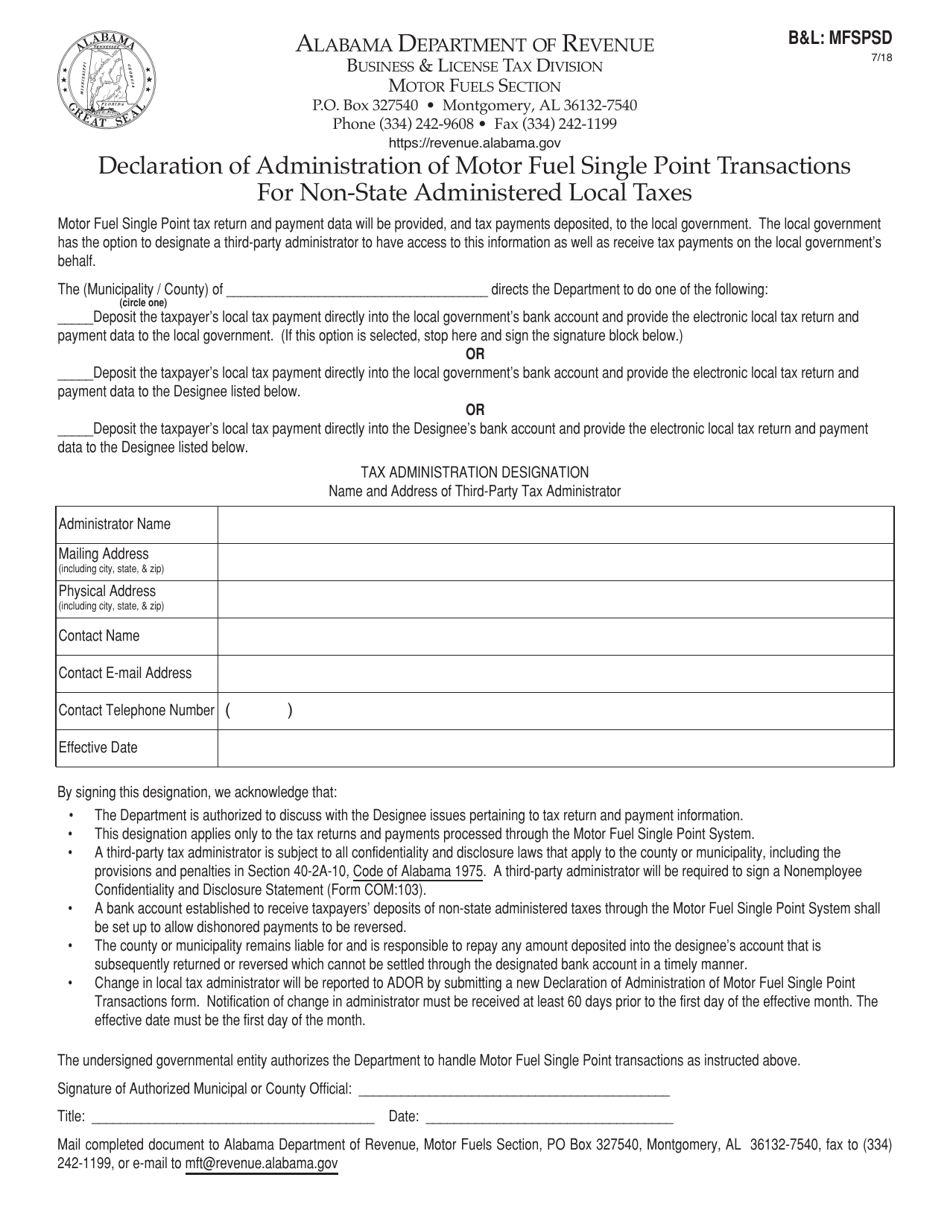

Form B&L: MFSPSD Declaration of Administration of Motor Fuel Single Point Transactions for Non-state Administered Local Taxes - Alabama

What Is Form B&L: MFSPSD?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MFSPSD Declaration of Administration of Motor Fuel Single Point Transactions for Non-state Administered Local Taxes?

A: It is a form used in Alabama to declare the administration of motor fuel single point transactions for non-state administered local taxes.

Q: When is this form used?

A: This form is used when declaring the administration of motor fuel single point transactions for non-state administered local taxes in Alabama.

Q: Who needs to complete this form?

A: Anyone who is involved in the administration of motor fuel single point transactions for non-state administered local taxes in Alabama needs to complete this form.

Q: Is this form specific to Alabama?

A: Yes, this form is specific to Alabama.

Q: Are there any fees associated with submitting this form?

A: There may be fees associated with submitting this form. Please refer to the instructions or contact the Alabama Department of Revenue for more information.

Q: Can this form be submitted electronically?

A: Yes, this form can be submitted electronically. Refer to the instructions for details on electronic filing options.

Q: What information is required on this form?

A: The form requires information related to motor fuel single point transactions for non-state administered local taxes, such as the name and address of the an administrator, taxpayer identification numbers, and transaction details.

Q: What should I do if I have questions or need assistance?

A: If you have questions or need assistance with this form, you should contact the Alabama Department of Revenue for guidance.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B&L: MFSPSD by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.