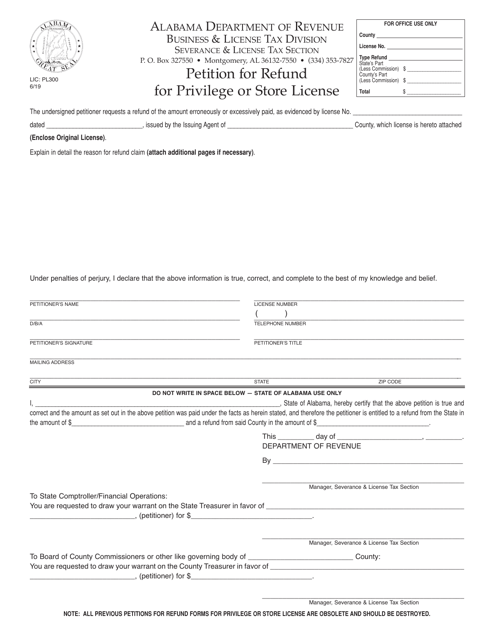

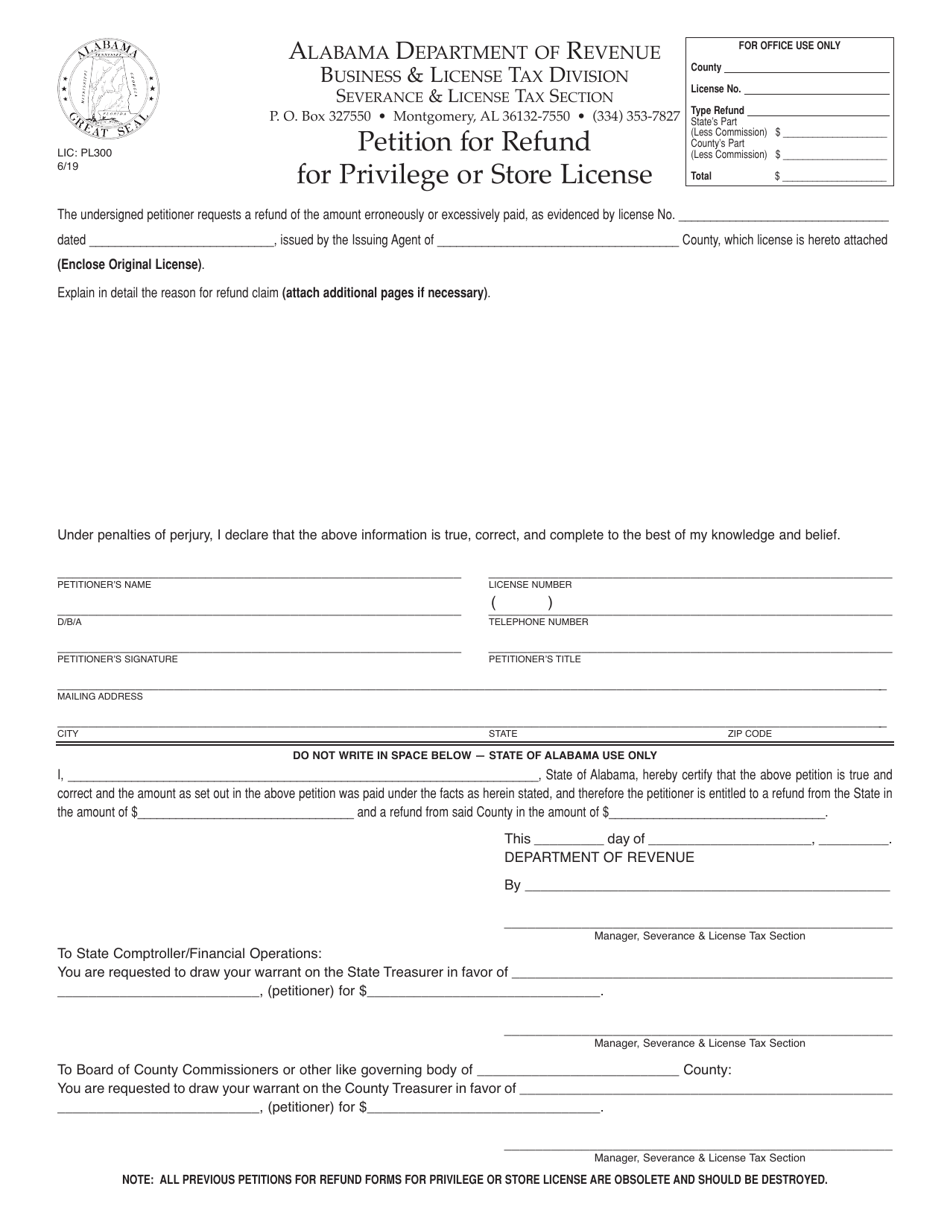

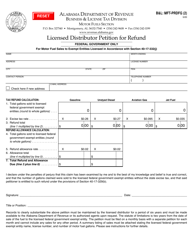

Form LIC: PL300 Petition for Refund for Privilege or Store License - Alabama

What Is Form LIC: PL300?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LIC: PL300?

A: Form LIC: PL300 is a Petition for Refund for Privilege or Store License in Alabama.

Q: What is the purpose of Form LIC: PL300?

A: The purpose of Form LIC: PL300 is to request a refund for privilege or store license in Alabama.

Q: Is there a fee to file Form LIC: PL300?

A: No, there is no fee to file Form LIC: PL300.

Q: What information is required on Form LIC: PL300?

A: Form LIC: PL300 requires information such as the taxpayer's name, address, license number, and the reason for the refund request.

Q: What supporting documents should be included with Form LIC: PL300?

A: Supporting documents such as copies of licenses, receipts, and any other relevant documents should be included with Form LIC: PL300.

Q: How long does it take to process a refund request submitted with Form LIC: PL300?

A: The processing time for refund requests submitted with Form LIC: PL300 may vary, but you can expect a response from the Alabama Department of Revenue within a reasonable time.

Q: Are there any specific eligibility criteria for requesting a refund with Form LIC: PL300?

A: Yes, there may be specific eligibility criteria for requesting a refund with Form LIC: PL300. It is recommended to review the instructions or contact the Alabama Department of Revenue for more information.

Q: Can I amend my refund request submitted with Form LIC: PL300?

A: Yes, you can amend your refund request submitted with Form LIC: PL300 by submitting a revised form with updated information.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LIC: PL300 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.