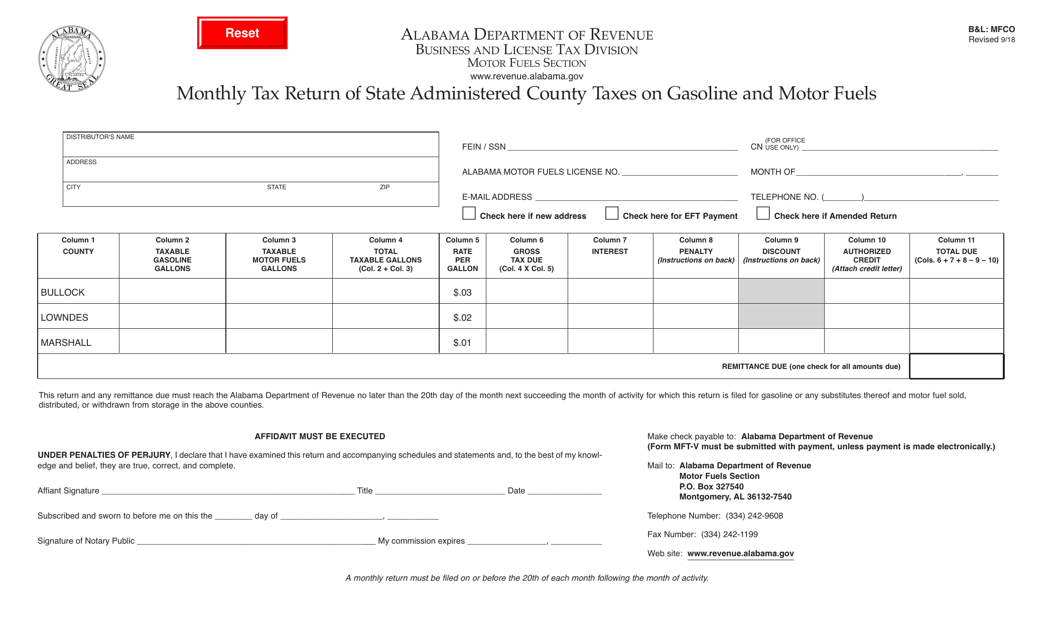

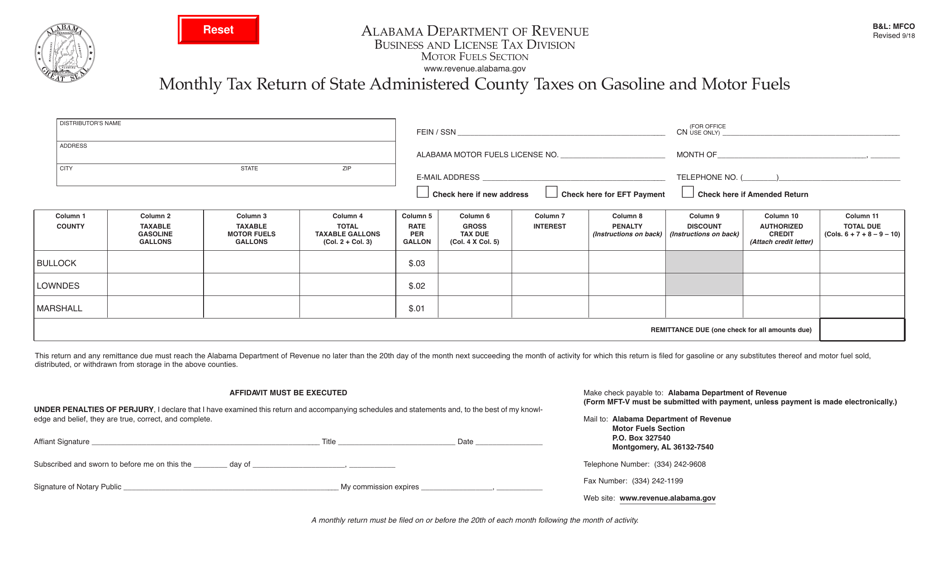

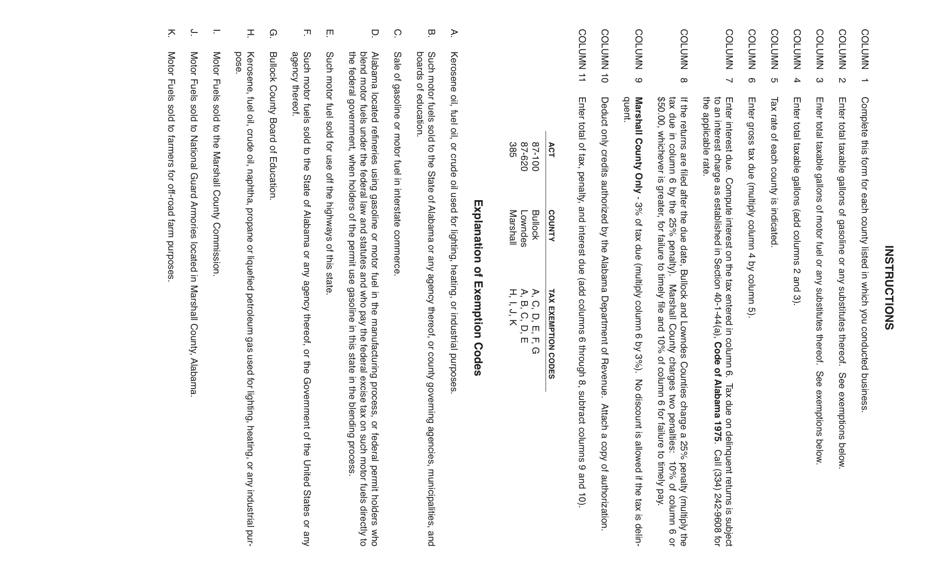

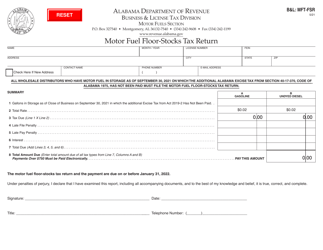

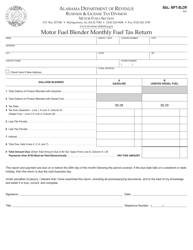

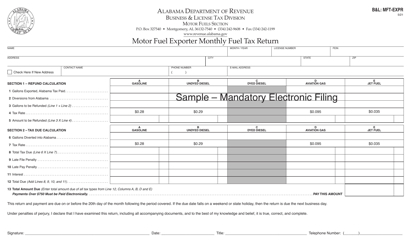

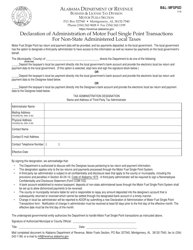

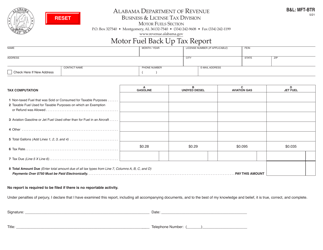

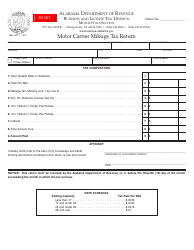

Form B&L: MFCO Monthly Tax Return of State Administered County Taxes on Gasoline and Motor Fuels - Alabama

What Is Form B&L: MFCO?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B&L?

A: Form B&L is the MFCO Monthly Tax Return of State Administered County Taxes on Gasoline and Motor Fuels.

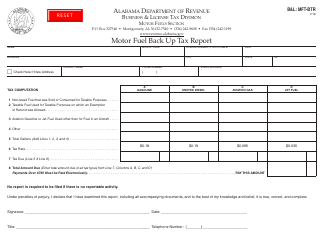

Q: What taxes does Form B&L cover?

A: Form B&L covers state administered county taxes on gasoline and motor fuels.

Q: Which state is Form B&L specific to?

A: Form B&L is specific to the state of Alabama.

Q: What is the purpose of Form B&L?

A: The purpose of Form B&L is to report and remit state administered county taxes on gasoline and motor fuels in Alabama.

Q: How often does Form B&L need to be filed?

A: Form B&L needs to be filed monthly.

Q: Who needs to file Form B&L?

A: Any entity or individual who is liable for state administered county taxes on gasoline and motor fuels in Alabama needs to file Form B&L.

Q: Are there any penalties for late or incorrect filing of Form B&L?

A: Yes, there may be penalties for late or incorrect filing of Form B&L. It is important to accurately and timely file the form to avoid penalties.

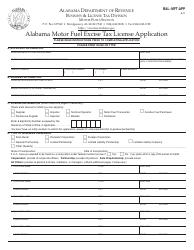

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: MFCO by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.