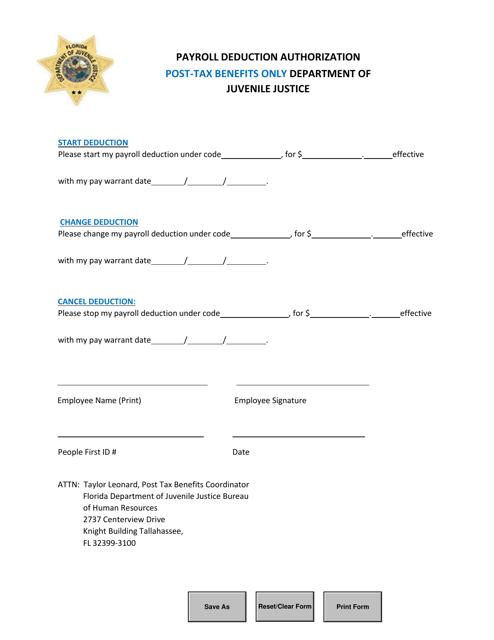

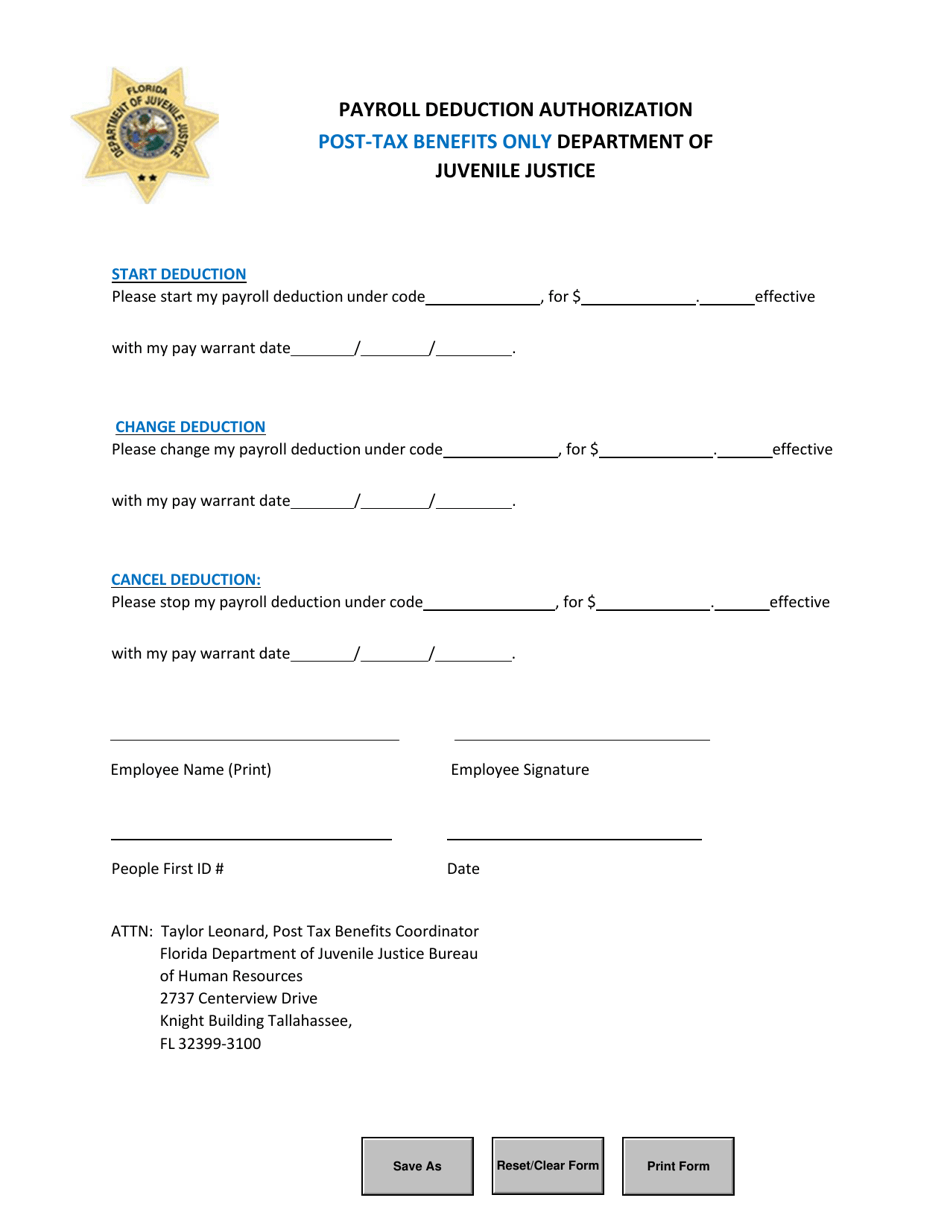

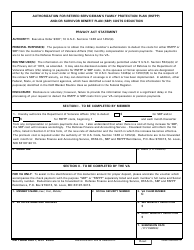

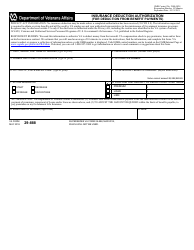

Payroll Deduction Authorization - Post-tax Benefits Only - Florida

Payroll Deduction Authorization - Post-tax Benefits Only is a legal document that was released by the Florida Department of Juvenile Justice - a government authority operating within Florida.

FAQ

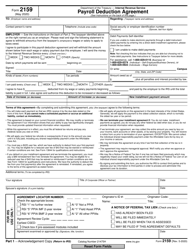

Q: What is a payroll deduction authorization?

A: A payroll deduction authorization is a consent form that allows your employer to deduct a specified amount of money from your paycheck for a specific purpose.

Q: What are post-tax benefits?

A: Post-tax benefits are employee benefits that are paid for with after-tax dollars.

Q: What is the purpose of a payroll deduction authorization for post-tax benefits?

A: The purpose of the payroll deduction authorization for post-tax benefits is to authorize your employer to deduct the necessary funds from your paycheck to cover the cost of these benefits.

Q: Do I need to sign a payroll deduction authorization for post-tax benefits?

A: Yes, you need to sign a payroll deduction authorization if you want your employer to deduct the necessary funds from your paycheck to cover the cost of post-tax benefits.

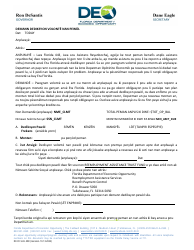

Q: Is a payroll deduction authorization only for residents of Florida?

A: No, a payroll deduction authorization for post-tax benefits can be required by employers in any state, not just Florida.

Form Details:

- The latest edition currently provided by the Florida Department of Juvenile Justice;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Juvenile Justice.