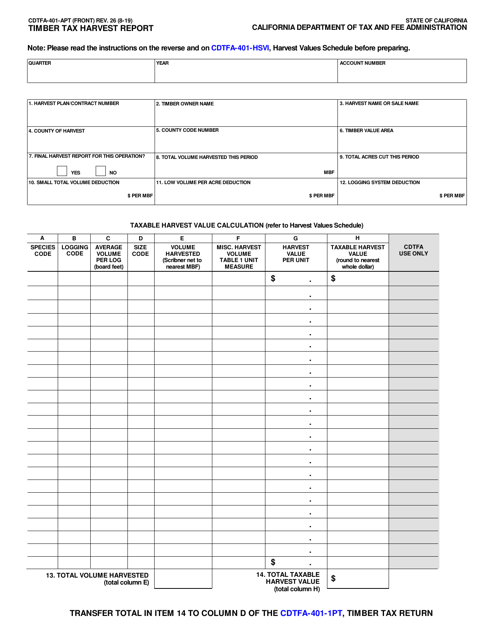

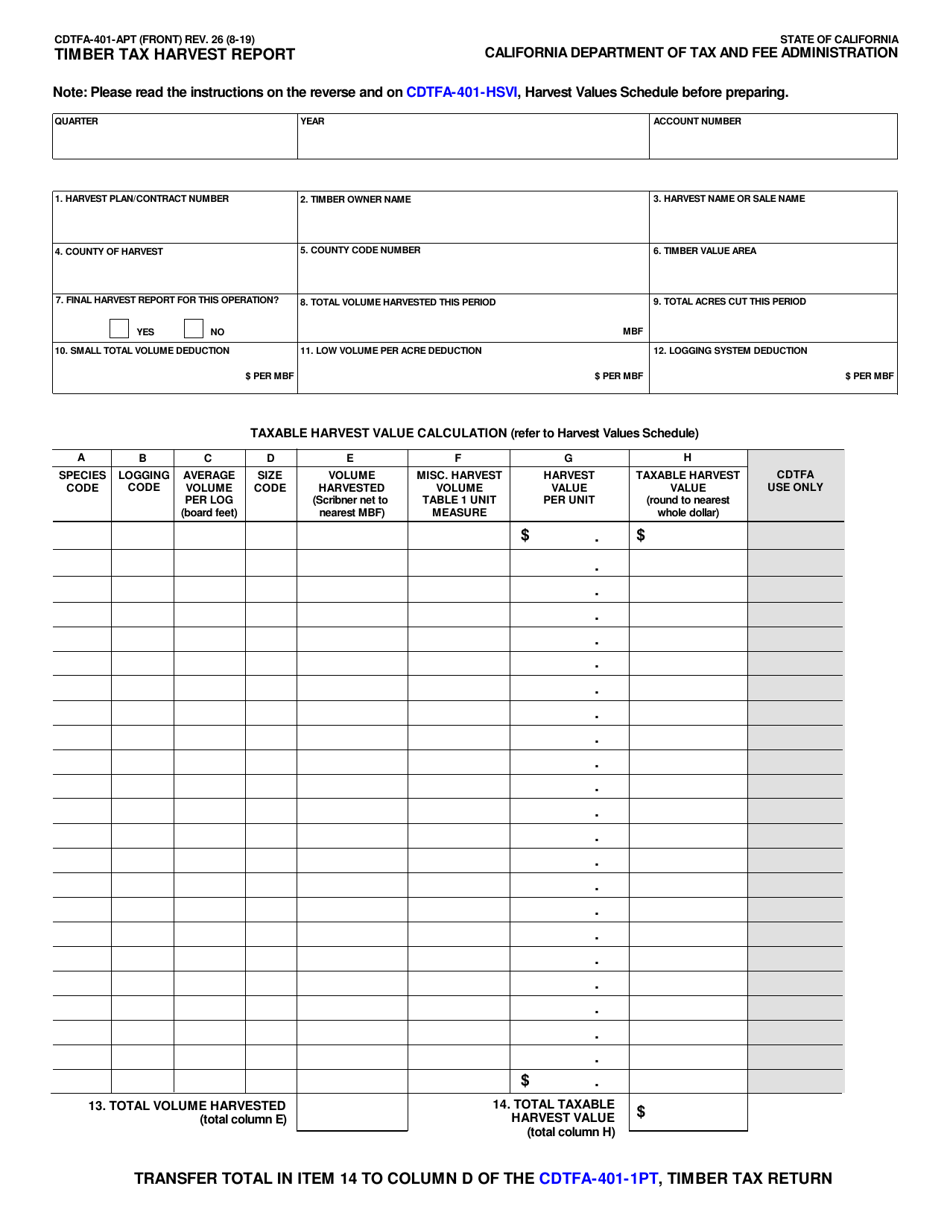

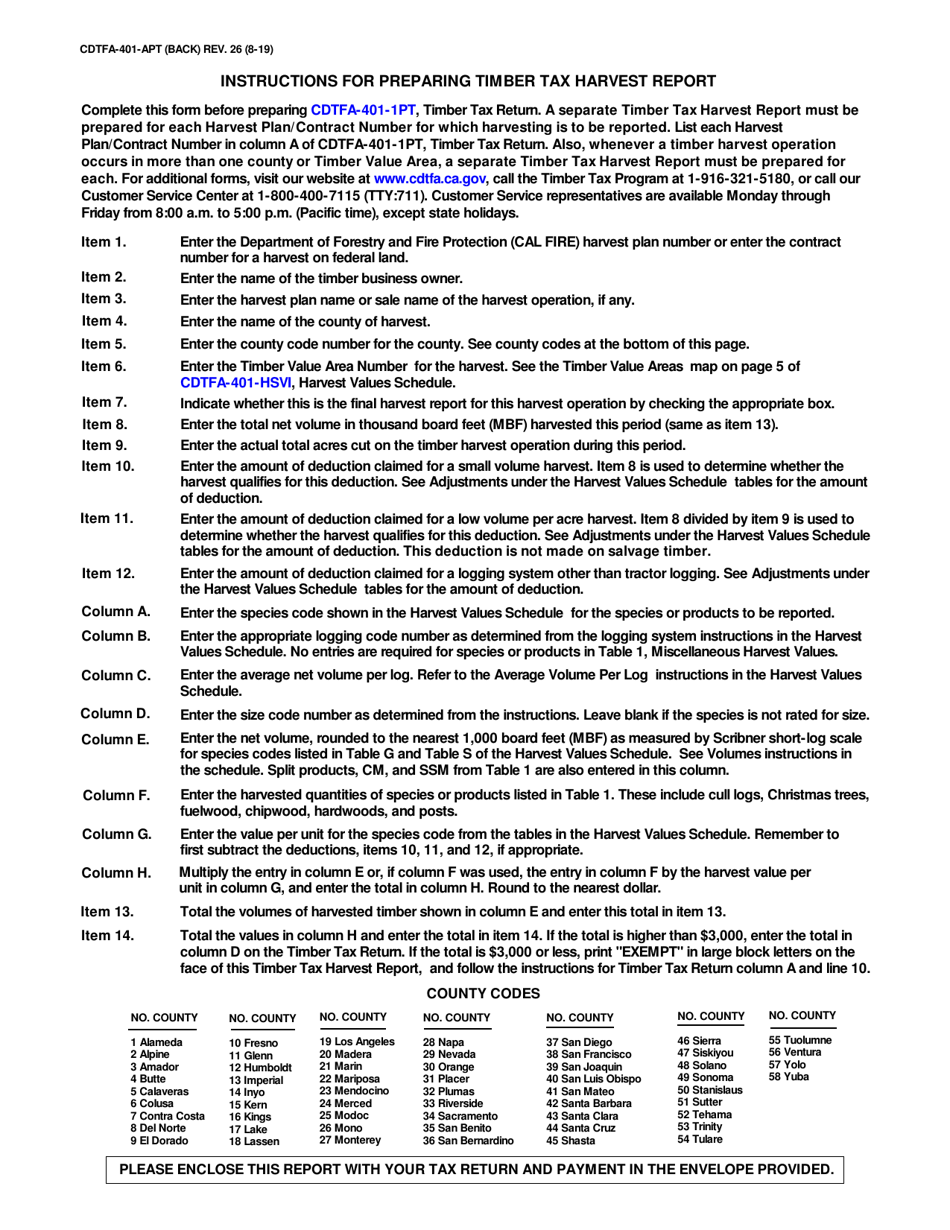

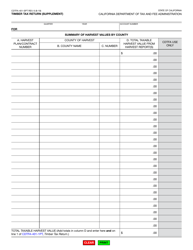

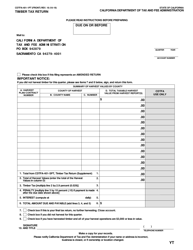

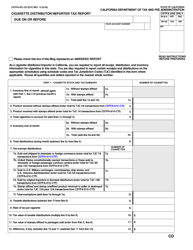

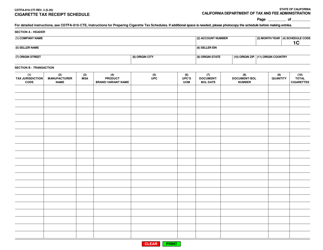

Form CDTFA-401-APT Timber Tax Harvest Report - California

What Is Form CDTFA-401-APT?

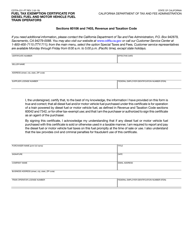

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-401-APT?

A: Form CDTFA-401-APT is a Timber TaxHarvest Report in California.

Q: Who needs to file Form CDTFA-401-APT?

A: Anyone engaged in timber operations and harvesting in California needs to file this form.

Q: What is the purpose of Form CDTFA-401-APT?

A: The purpose of this form is to report timber harvest activities and calculate the associated timber tax.

Q: When is Form CDTFA-401-APT due?

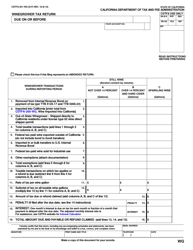

A: This form is due on a quarterly basis and must be filed no later than the last day of the month following the end of the quarter.

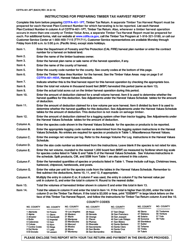

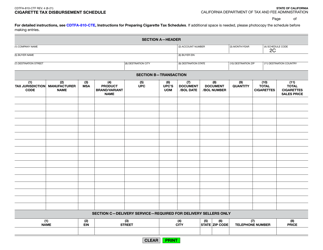

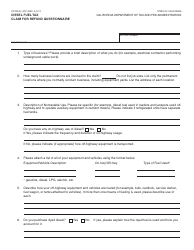

Q: What information is required on Form CDTFA-401-APT?

A: The form requires details such as the timber operator's information, harvest and sale information, and calculation of timber tax.

Q: Are there any penalties for not filing Form CDTFA-401-APT?

A: Yes, failure to file this form or filing it late may result in penalties and interest being assessed.

Q: Can I e-file Form CDTFA-401-APT?

A: Currently, e-filing is not available for Form CDTFA-401-APT. It must be filed by mail.

Q: Is there a fee for filing Form CDTFA-401-APT?

A: There is no fee for filing this form.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-401-APT by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.