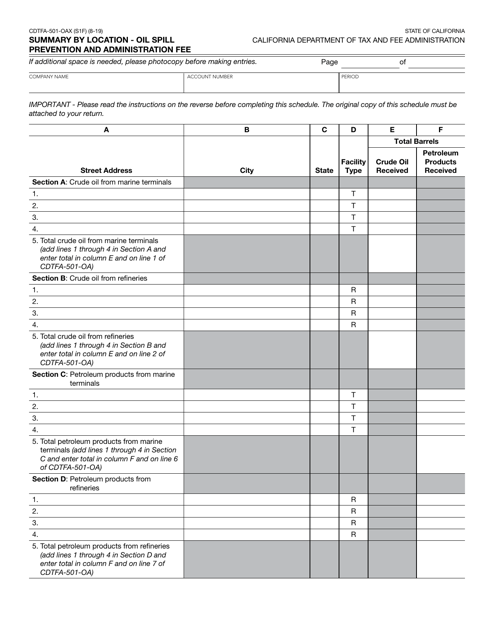

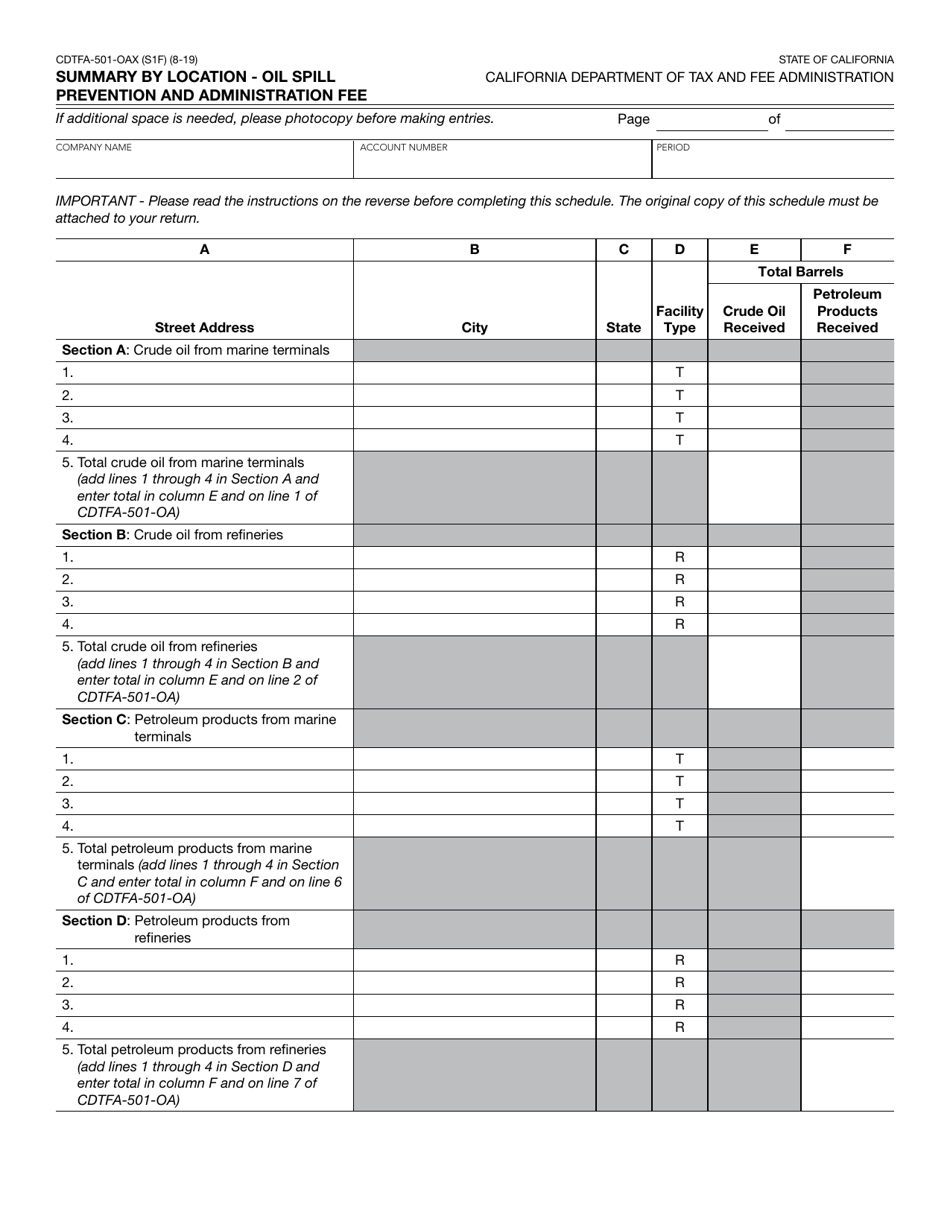

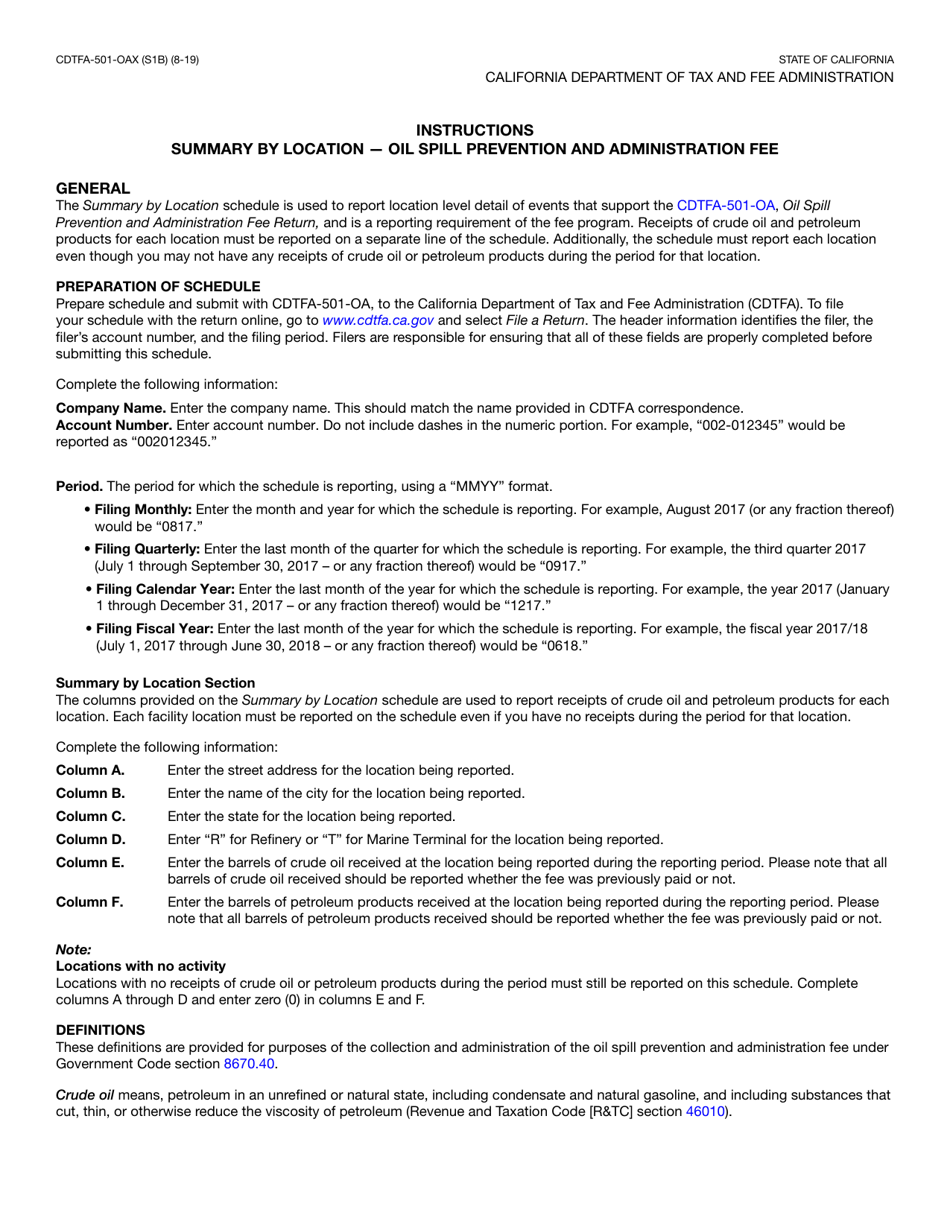

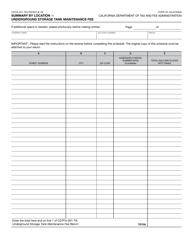

Form CDTFA-501-OAX Summary by Location - Oil Spill Prevention and Administration Fee - California

What Is Form CDTFA-501-OAX?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-OAX?

A: Form CDTFA-501-OAX is a summary form for reporting oil spill prevention and administration fee in California.

Q: What does the Oil Spill Prevention and Administration Fee cover?

A: The Oil Spill Prevention and Administration Fee covers costs associated with preventing and administrating oil spills in California.

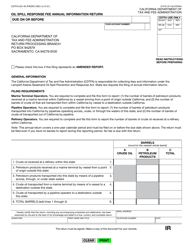

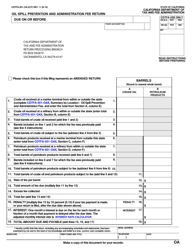

Q: Who needs to file Form CDTFA-501-OAX?

A: Businesses engaged in activities that produce, handle, store, transport, or transfer oil in California need to file Form CDTFA-501-OAX.

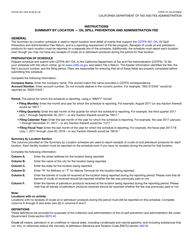

Q: What information is required on Form CDTFA-501-OAX?

A: Form CDTFA-501-OAX requires information such as the business name, location, total gallons of oil handled, and the amount of fee due.

Q: How often should Form CDTFA-501-OAX be filed?

A: Form CDTFA-501-OAX should be filed on an annual basis.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-OAX by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.