This version of the form is not currently in use and is provided for reference only. Download this version of

Form CALHR878

for the current year.

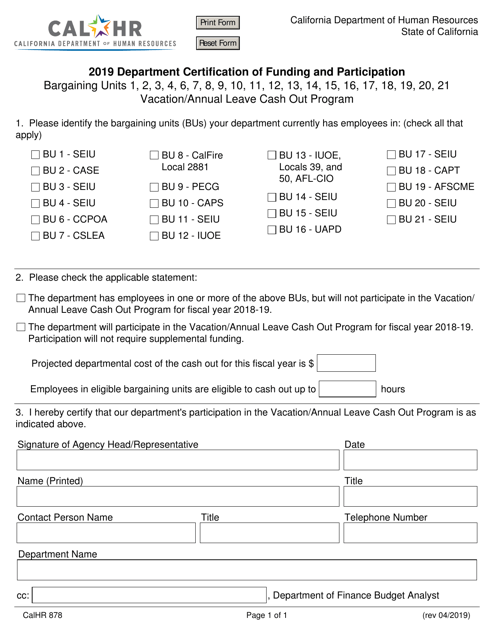

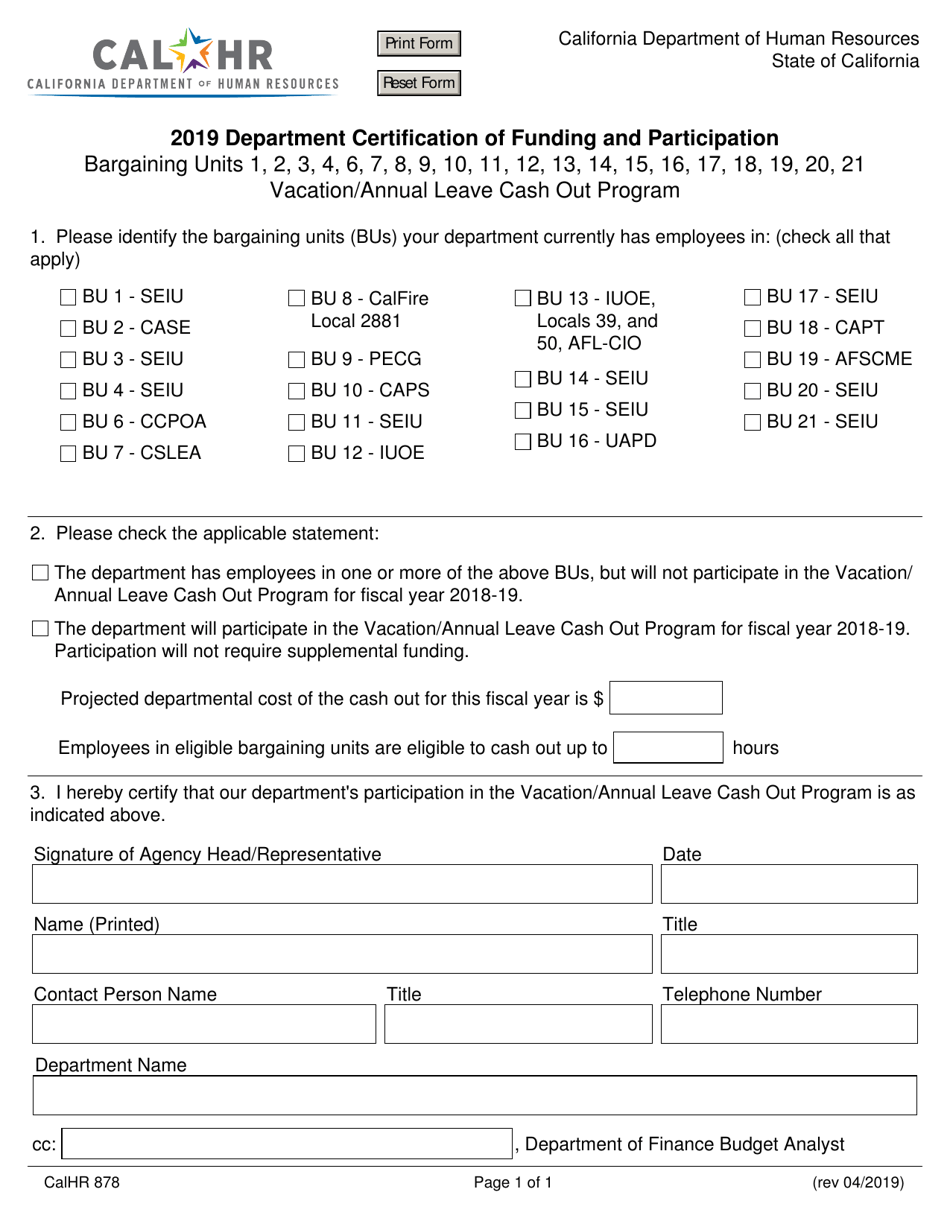

Form CALHR878 Department Certification of Funding and Participation - Vacation / Annual Leave Cash out Program - California

What Is Form CALHR878?

This is a legal form that was released by the California Department of Human Resources - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CALHR878?

A: CALHR878 is a form used by the California Department of Human Resources (CALHR) to certify the funding and participation in the Vacation/Annual Leave cash out program.

Q: What is the Vacation/Annual Leave cash out program?

A: The Vacation/Annual Leave cash out program allows eligible employees in California to receive a payment for their unused vacation or annual leave hours.

Q: Who is eligible for the Vacation/Annual Leave cash out program?

A: Eligibility for the program varies depending on the specific policies of each department or agency. Employees should consult their HR department to determine if they qualify.

Q: What is the purpose of the CALHR878 form?

A: The CALHR878 form is used to verify that the funding for the vacation/annual leave cash out program is available and that the employee meets the eligibility requirements.

Q: Is the Vacation/Annual Leave cash out program available in all California departments?

A: The availability of the program may vary between departments. Employees should check with their HR department to determine if the program is offered.

Q: How often can an employee participate in the Vacation/Annual Leave cash out program?

A: The frequency of participation depends on the specific policies of each department. Employees should refer to their HR department for more information.

Q: Are there any tax implications for participating in the Vacation/Annual Leave cash out program?

A: Yes, cashing out vacation or annual leave may have tax implications. Employees should consult with a tax professional or refer to the relevant tax laws and regulations.

Q: What should I do if I have additional questions about the CALHR878 form or the Vacation/Annual Leave cash out program?

A: For additional questions or clarifications, employees should reach out to their HR department or the California Department of Human Resources.

Q: Can the Vacation/Annual Leave cash out program be used during a leave of absence or sabbatical?

A: The eligibility and use of the program during a leave of absence or sabbatical may vary depending on department policies. Employees should consult with their HR department for more information.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the California Department of Human Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CALHR878 by clicking the link below or browse more documents and templates provided by the California Department of Human Resources.