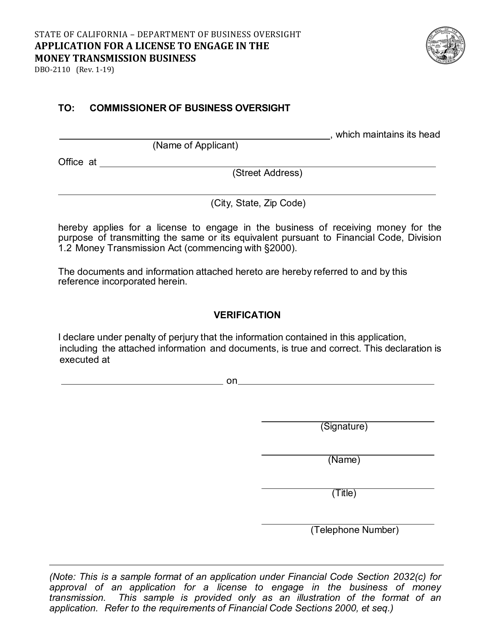

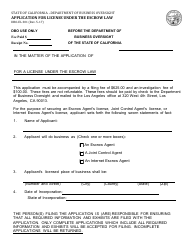

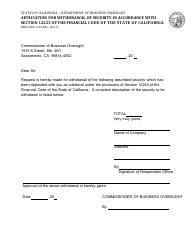

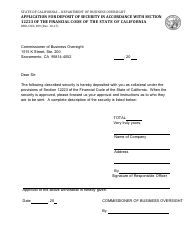

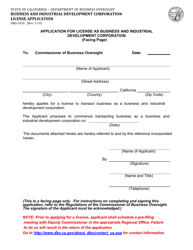

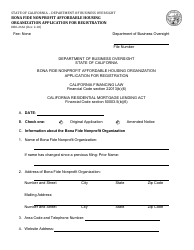

Form DBO-2110 Application for a License to Engage in the Money Transmission Business - California

What Is Form DBO-2110?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DBO-2110?

A: Form DBO-2110 is the application for a license to engage in the money transmission business in California.

Q: Who needs to fill out Form DBO-2110?

A: Any individual or entity wishing to engage in the money transmission business in California needs to fill out Form DBO-2110.

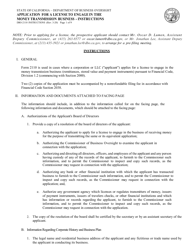

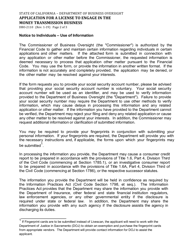

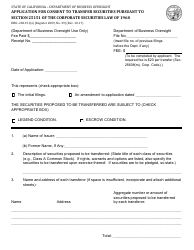

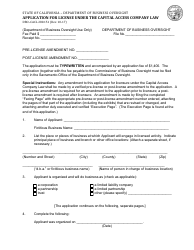

Q: What information is required on Form DBO-2110?

A: Form DBO-2110 requires information about the applicant's personal and business details, financial information, and compliance with relevant laws.

Q: Are there any fees associated with submitting Form DBO-2110?

A: Yes, there are application and investigation fees associated with submitting Form DBO-2110. The specific fees vary depending on the type of license being sought.

Q: How long does it take to process the application?

A: The processing time for Form DBO-2110 can vary, but it generally takes several months to complete the review and approval process.

Q: Are there any specific requirements to qualify for a money transmission license in California?

A: Yes, there are specific requirements such as having a minimum net worth and maintaining a surety bond or alternate form of security.

Q: What happens after the application is approved?

A: Once the application is approved, the applicant will receive a license to engage in the money transmission business in California.

Q: Can a license be revoked or suspended?

A: Yes, a license can be revoked or suspended if the licensee fails to comply with the laws and regulations governing money transmission in California.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-2110 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.