This version of the form is not currently in use and is provided for reference only. Download this version of

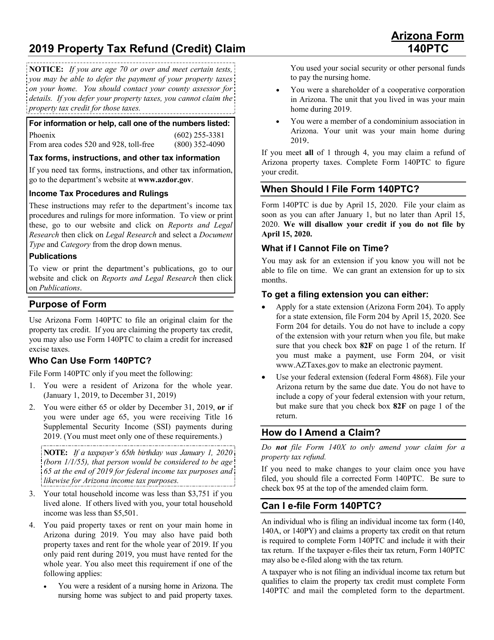

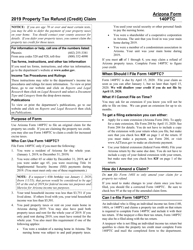

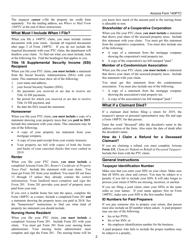

Instructions for Arizona Form 140PTC, ADOR10567

for the current year.

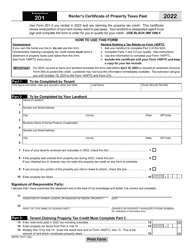

Instructions for Arizona Form 140PTC, ADOR10567 Property Tax Refund (Credit) Claim - Arizona

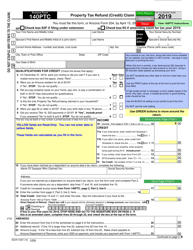

This document contains official instructions for Arizona Form 140PTC , and Form ADOR10567 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 140PTC (ADOR10567) is available for download through this link.

FAQ

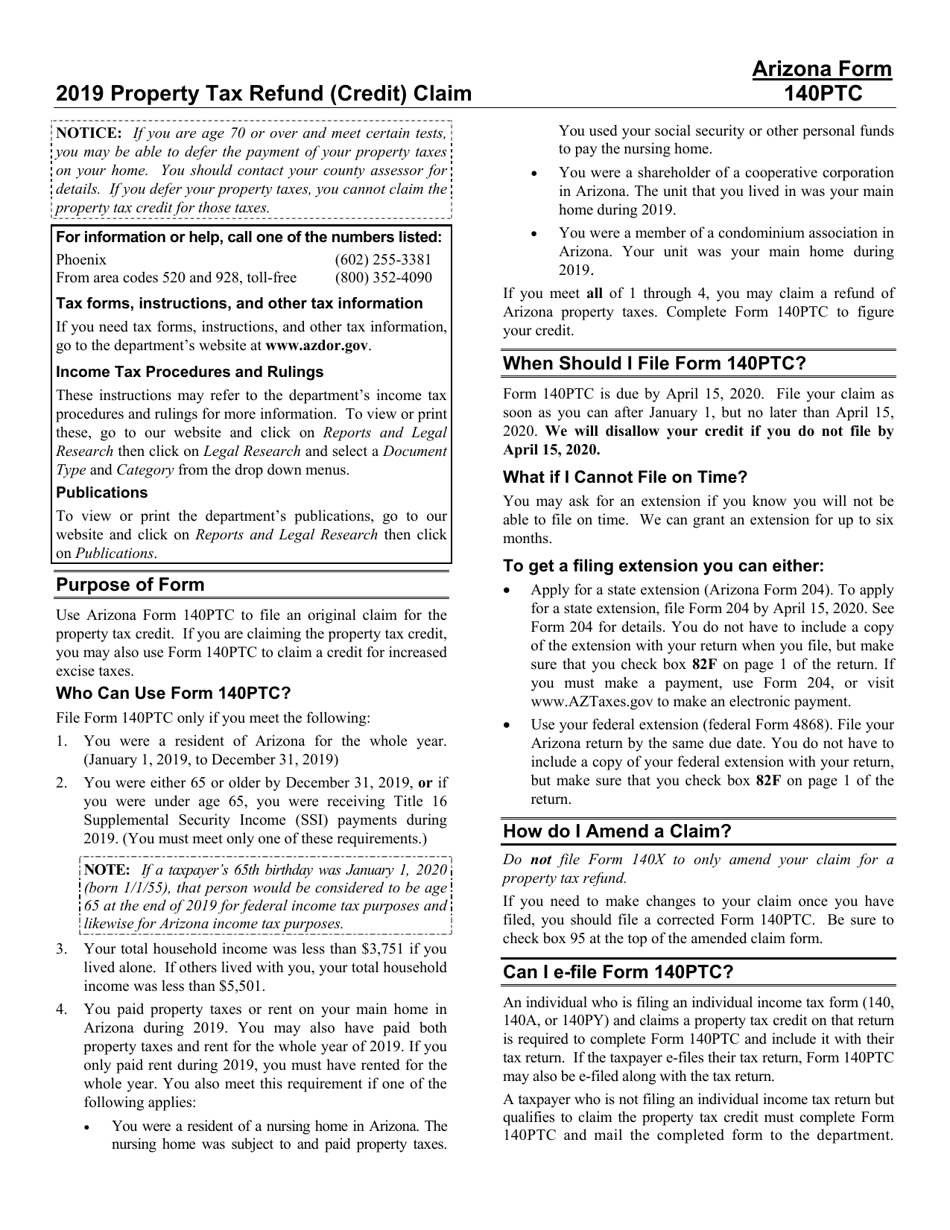

Q: What is Arizona Form 140PTC?

A: Arizona Form 140PTC is a form used to claim a property tax refund (credit) in Arizona.

Q: Who can use Arizona Form 140PTC?

A: Arizona residents who meet certain criteria can use Form 140PTC to claim a property tax refund.

Q: What is the purpose of Arizona Form 140PTC?

A: The purpose of Arizona Form 140PTC is to provide eligible residents with a refund or credit for property taxes paid.

Q: Is there an income limit to use Arizona Form 140PTC?

A: Yes, there is an income limit to use Arizona Form 140PTC. You must meet certain income requirements to be eligible.

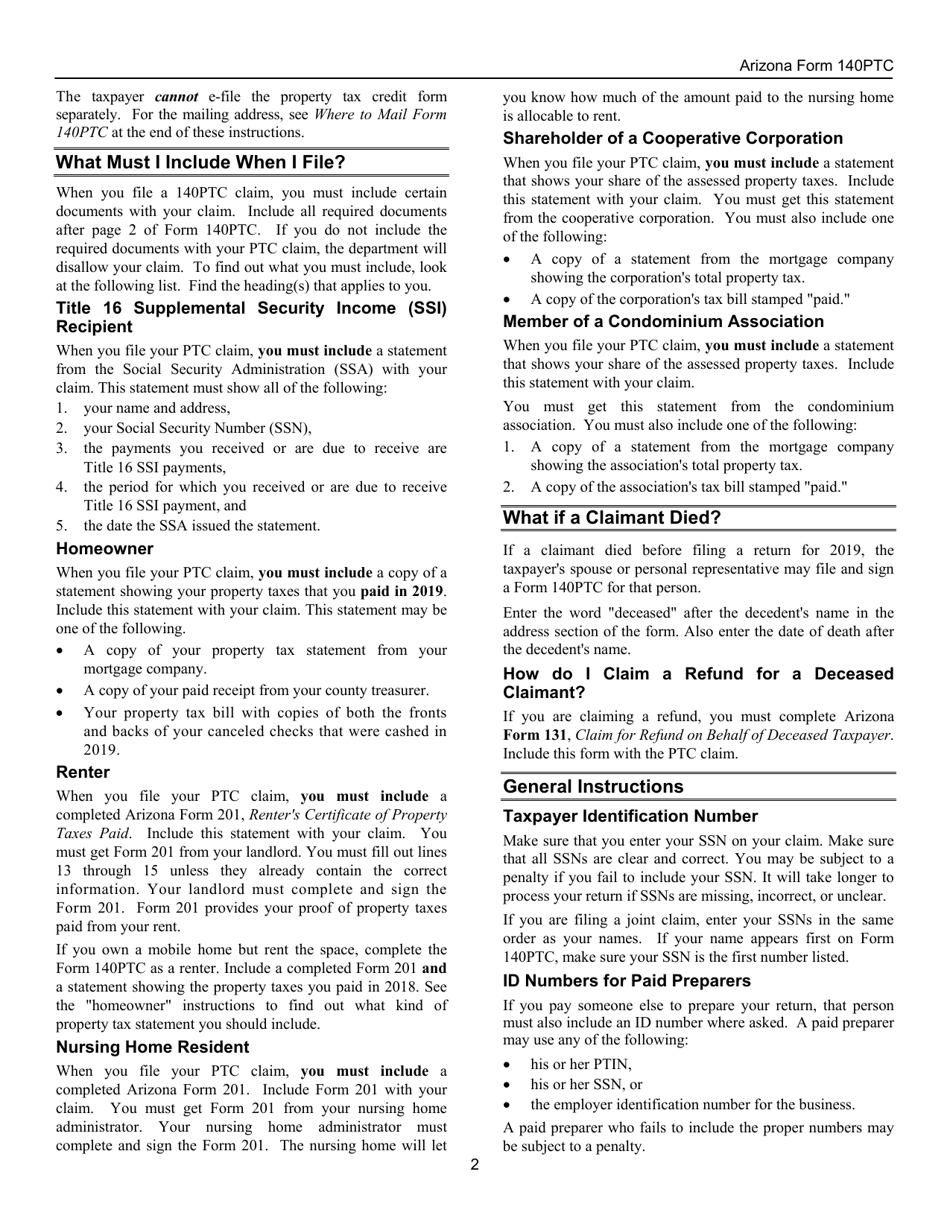

Q: What documents do I need to complete Arizona Form 140PTC?

A: You will need your property tax statement, federal tax return, and other supporting documents to complete Arizona Form 140PTC.

Q: When is the deadline to file Arizona Form 140PTC?

A: The deadline to file Arizona Form 140PTC is typically April 15th of the following year, but it may vary.

Q: Can I file Arizona Form 140PTC electronically?

A: No, Arizona Form 140PTC cannot be filed electronically. It must be mailed to the Arizona Department of Revenue.

Q: How long does it take to receive the property tax refund?

A: It typically takes 8-12 weeks to process and receive the property tax refund after filing Arizona Form 140PTC.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.