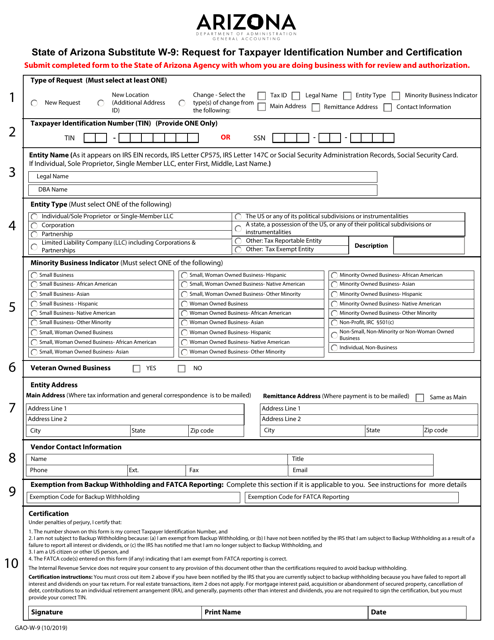

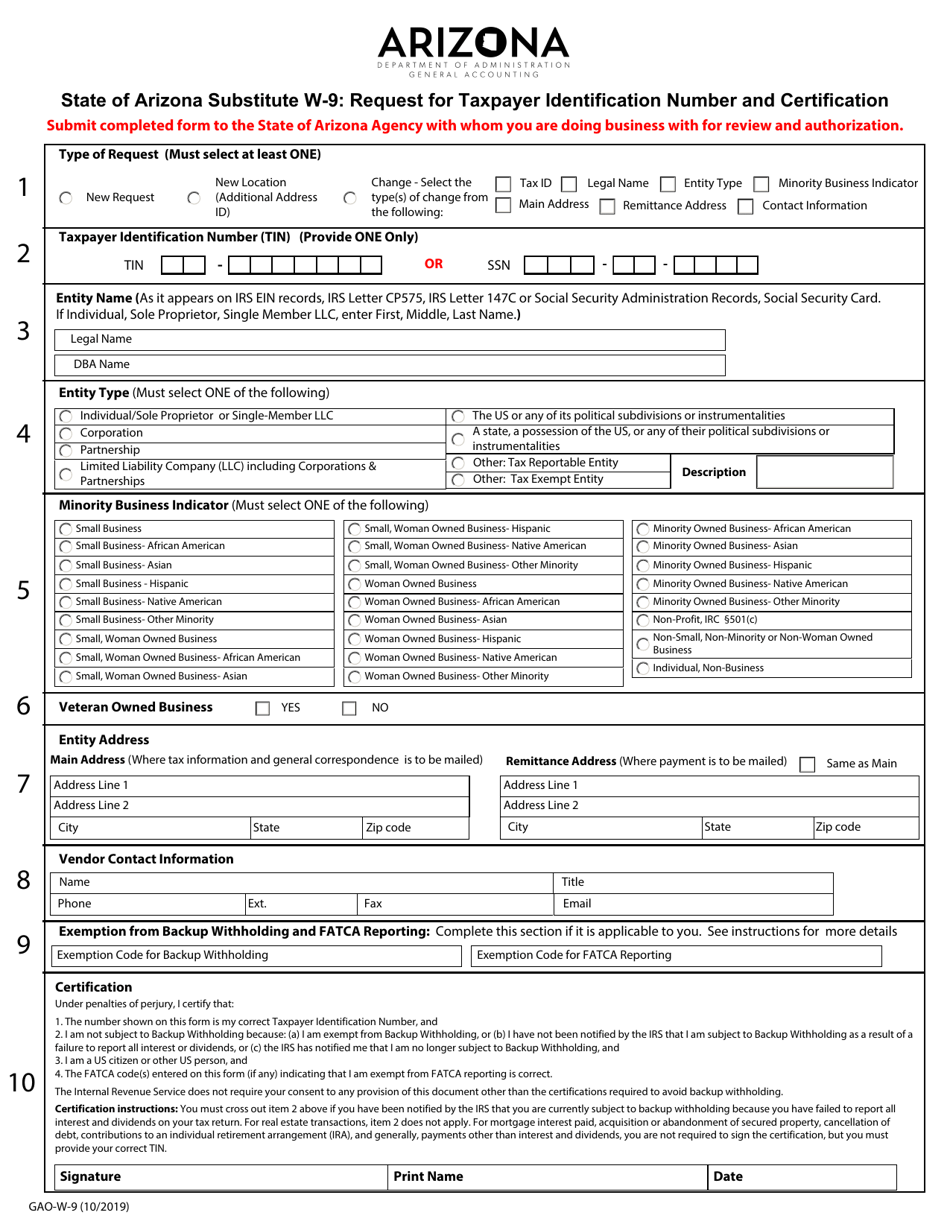

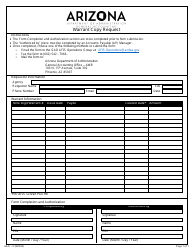

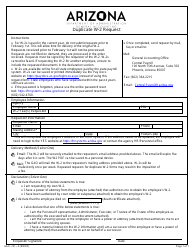

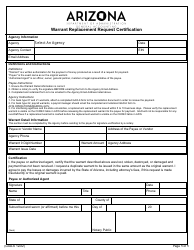

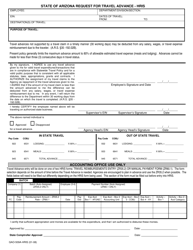

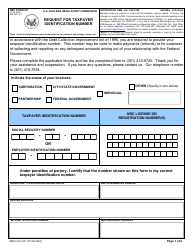

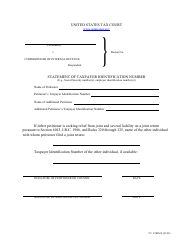

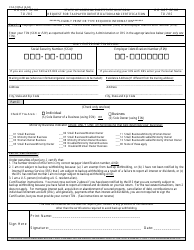

Form GAO-W-9 Request for Taxpayer Identification Number and Certification - Arizona

What Is Form GAO-W-9?

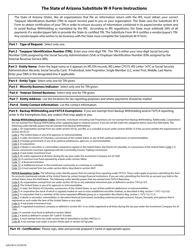

This is a legal form that was released by the Arizona Department of Administration - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GAO-W-9?

A: Form GAO-W-9 is a Request for Taxpayer Identification Number and Certification form.

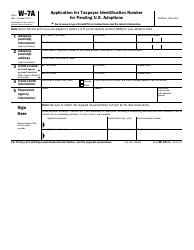

Q: Who needs to fill out Form GAO-W-9 in Arizona?

A: Anyone who is required to provide their taxpayer identification number (TIN) for tax purposes in Arizona may need to fill out Form GAO-W-9.

Q: What is the purpose of Form GAO-W-9?

A: The purpose of Form GAO-W-9 is to gather the taxpayer identification number (TIN) of an individual or business entity for tax reporting purposes.

Q: Are there any penalties for not filling out Form GAO-W-9?

A: Failure to provide a correct TIN or to fill out Form GAO-W-9 may result in penalties imposed by the Internal Revenue Service (IRS). It is important to provide accurate and complete information.

Q: Do I need to submit Form GAO-W-9 every year?

A: You may need to submit Form GAO-W-9 every year if you are required to provide your taxpayer identification number (TIN) for tax purposes in Arizona.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Arizona Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GAO-W-9 by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration.