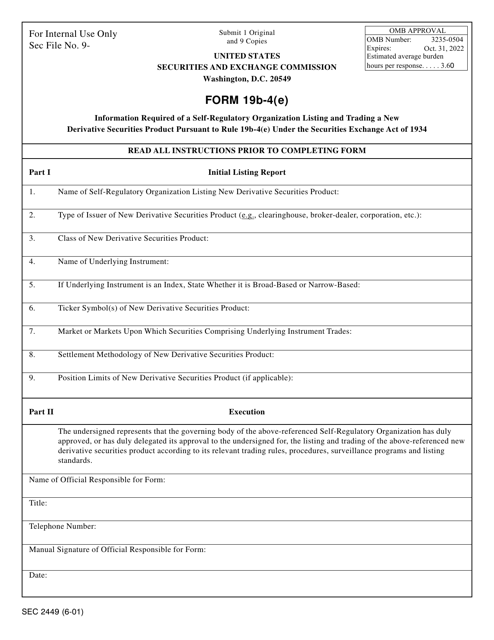

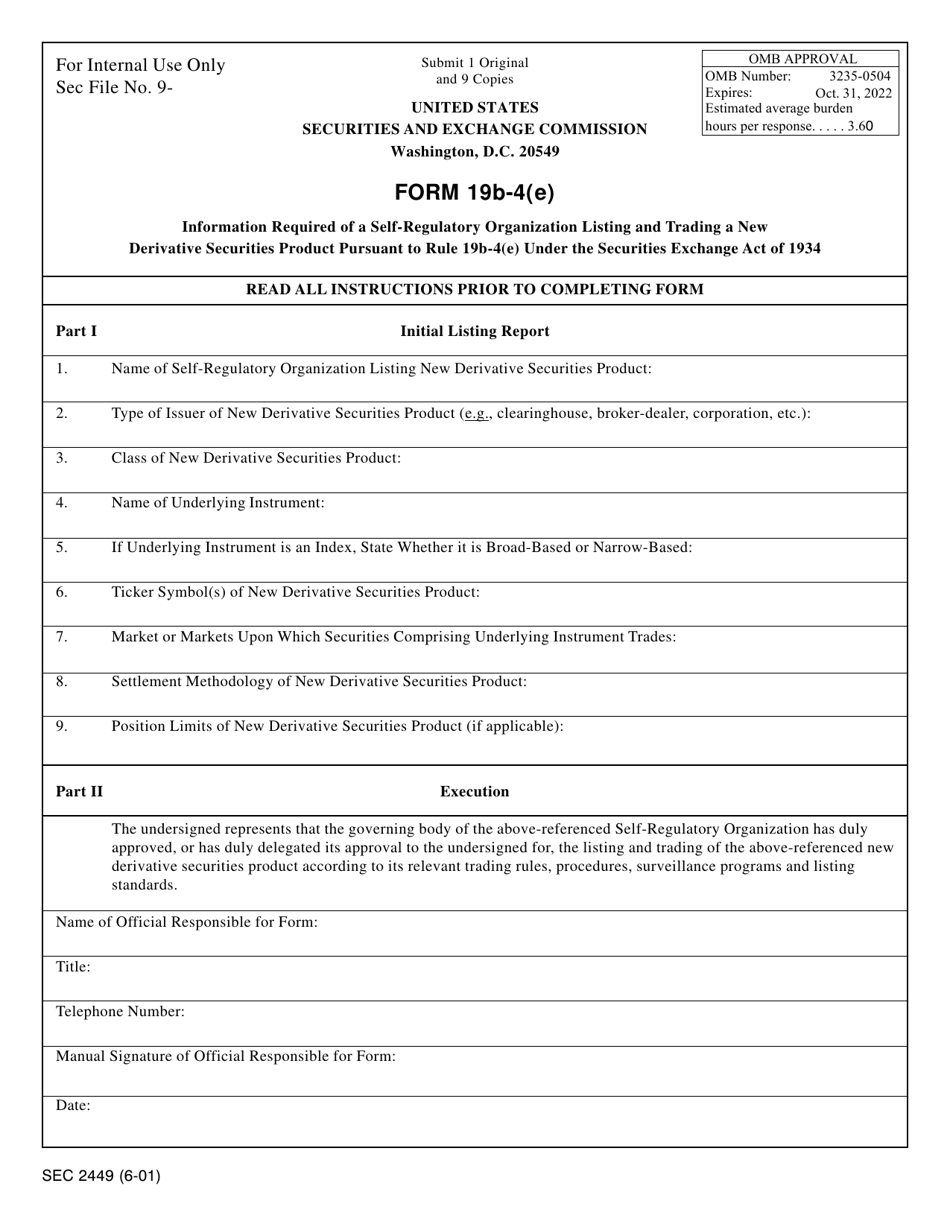

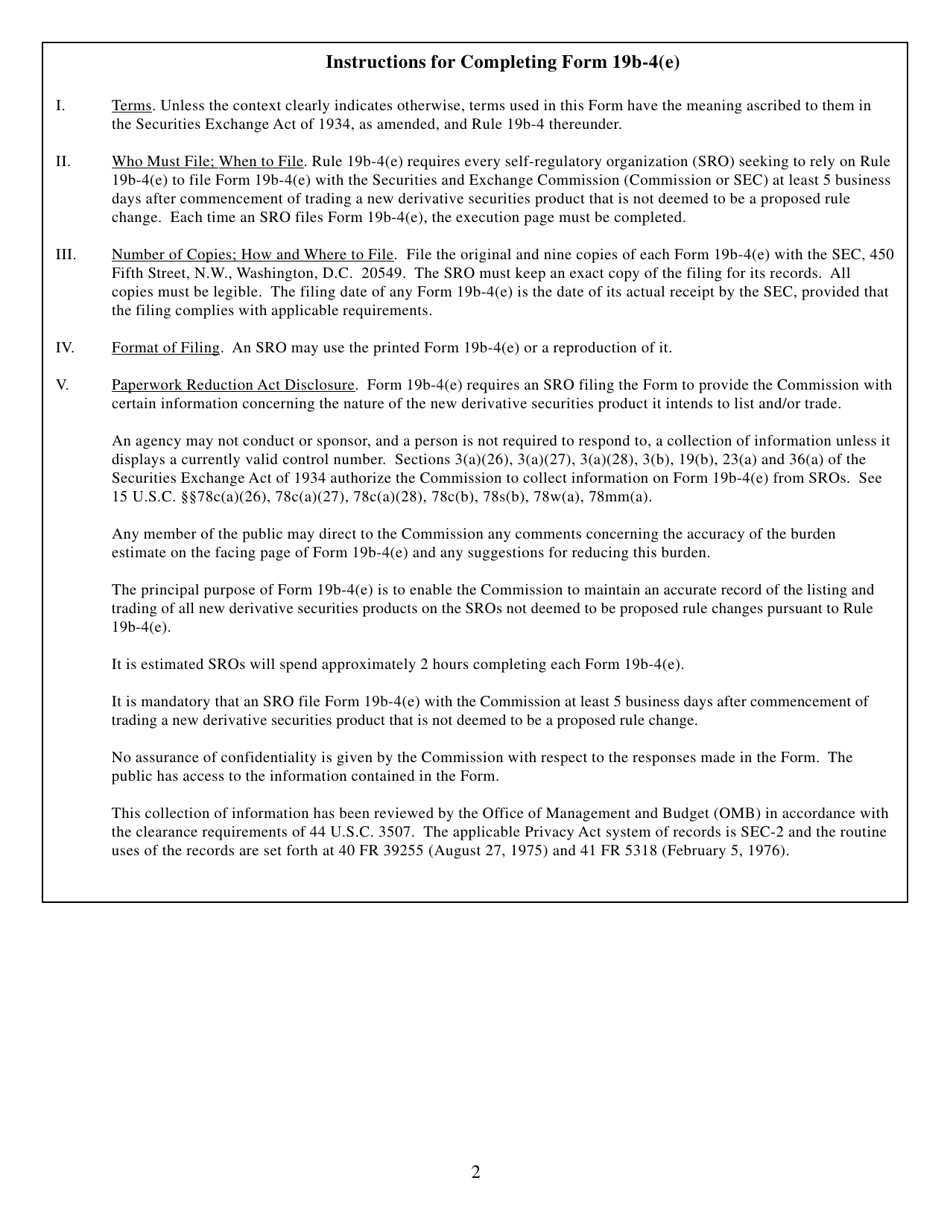

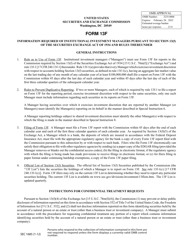

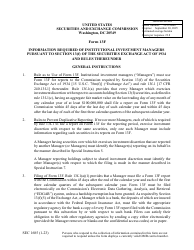

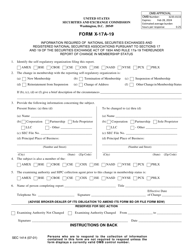

Form 19B-4(E) (SEC Form 2449) Information Required of a Self-regulatory Organization Listing and Trading a New Derivative Securities Product Pursuant to Rule 19b-4(E) Under the Securities Exchange Act of 1934

What Is Form 19B-4(E) (SEC Form 2449)?

This is a legal form that was released by the U.S. Securities and Exchange Commission on June 1, 2001 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 19B-4(E)?

A: Form 19B-4(E) is a form required by the Securities and Exchange Commission (SEC) for self-regulatory organizations (SROs) listing and trading new derivative securities products.

Q: What does SEC Form 2449 refer to?

A: SEC Form 2449 refers to Form 19B-4(E), which is used by SROs when listing and trading new derivative securities products.

Q: What is the purpose of Form 19B-4(E)?

A: The purpose of Form 19B-4(E) is to provide the SEC with information about the new derivative securities product being listed and traded by the SRO.

Q: What is Rule 19b-4(E)?

A: Rule 19b-4(E) is a rule under the Securities Exchange Act of 1934 that governs the listing and trading of new derivative securities products.

Q: Who needs to file Form 19B-4(E)?

A: Self-regulatory organizations (SROs) that are listing and trading new derivative securities products need to file Form 19B-4(E) with the SEC.

Q: What information is required in Form 19B-4(E)?

A: Form 19B-4(E) requires information about the SRO, the new derivative securities product, the listing criteria, and other relevant details.

Q: When should Form 19B-4(E) be filed?

A: Form 19B-4(E) should be filed with the SEC at least 10 days before the SRO intends to list and trade the new derivative securities product.

Q: What happens after filing Form 19B-4(E)?

A: After filing Form 19B-4(E), the SEC will review the information provided and may approve or disapprove the listing and trading of the new derivative securities product.

Form Details:

- Released on June 1, 2001;

- The latest available edition released by the U.S. Securities and Exchange Commission;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 19B-4(E) (SEC Form 2449) by clicking the link below or browse more documents and templates provided by the U.S. Securities and Exchange Commission.