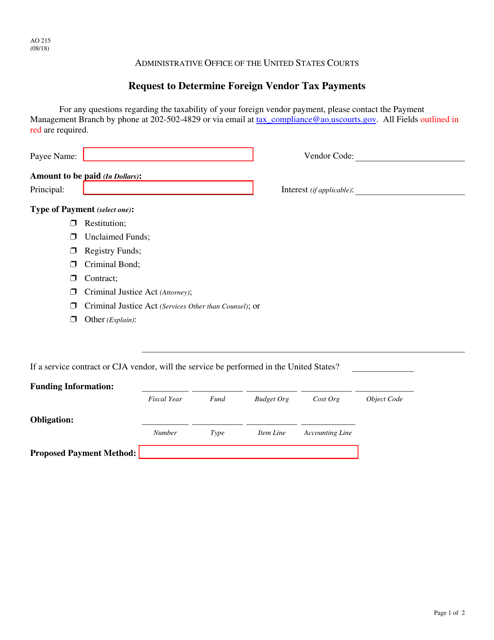

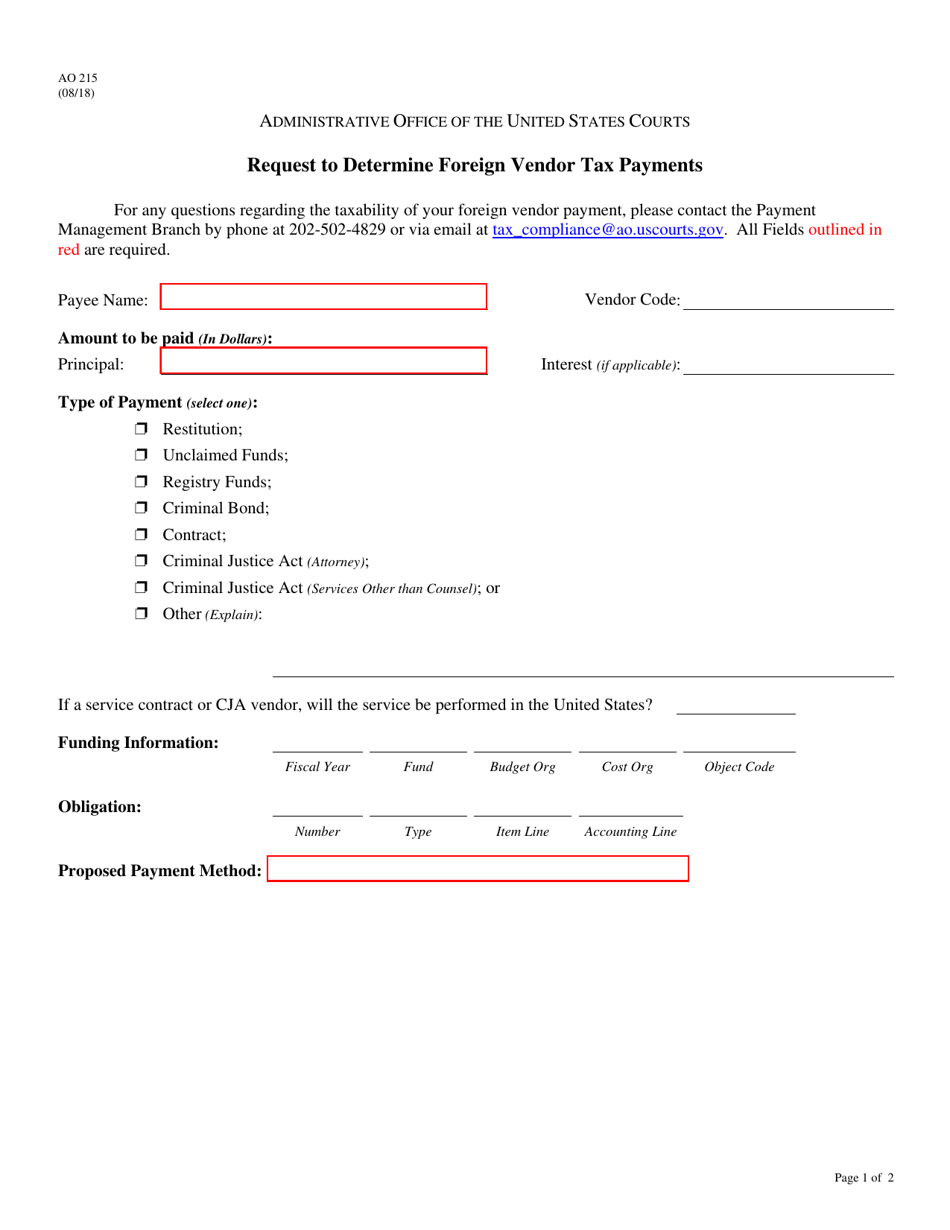

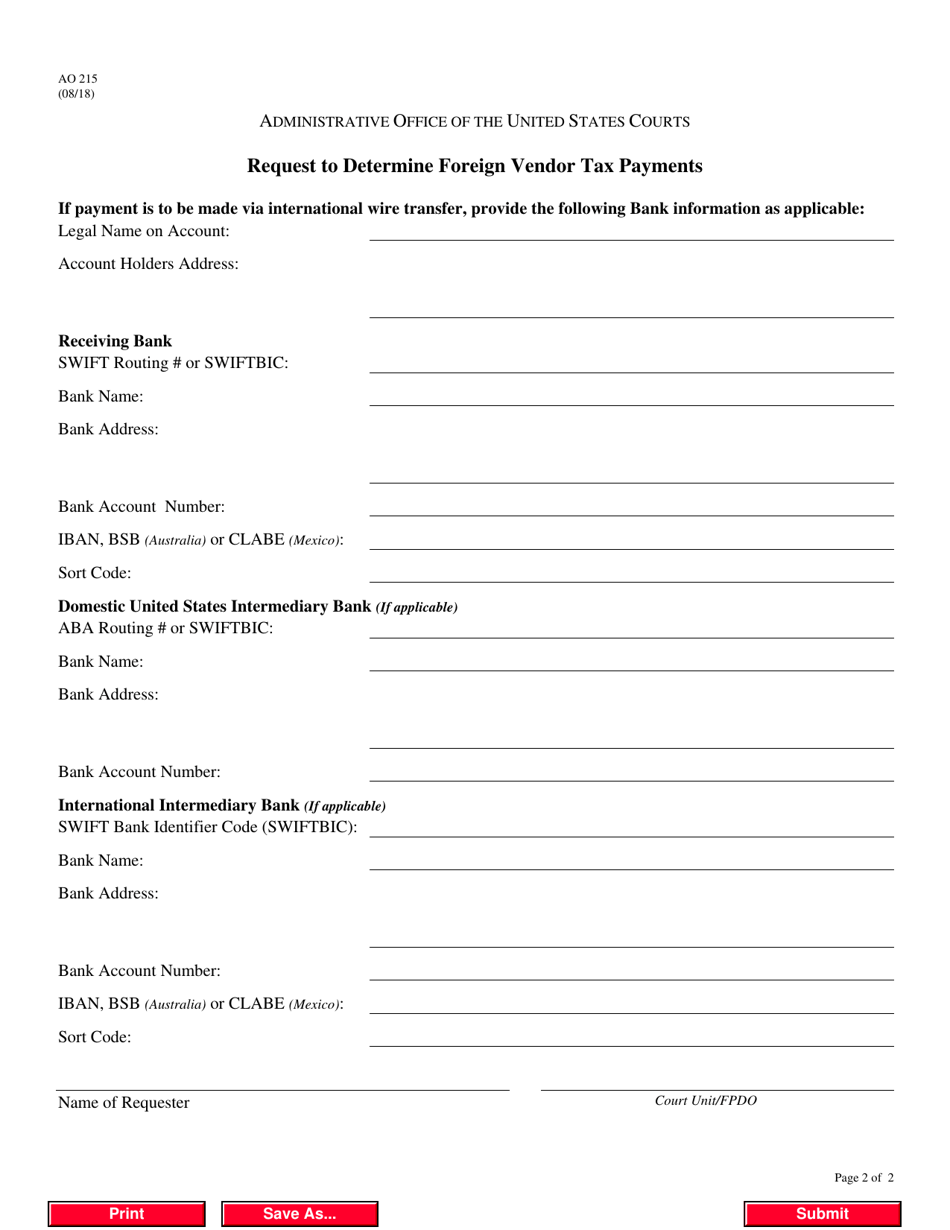

Form AO215 Request to Determine Foreign Vendor Tax Payments

What Is Form AO215?

This is a legal form that was released by the United States Courts on August 1, 2018 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AO215?

A: Form AO215 is a request to determine foreign vendor tax payments.

Q: Who uses form AO215?

A: This form is used by individuals or businesses that need to determine the tax payments made to foreign vendors.

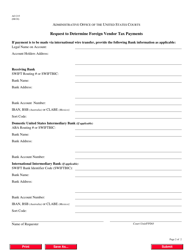

Q: What information is required on form AO215?

A: Form AO215 requires information about the foreign vendor, including their name, address, and tax identification number.

Q: Why would someone need to use form AO215?

A: Form AO215 is used to determine the tax payments made to foreign vendors for reporting and compliance purposes.

Form Details:

- Released on August 1, 2018;

- The latest available edition released by the United States Courts;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AO215 by clicking the link below or browse more documents and templates provided by the United States Courts.