This version of the form is not currently in use and is provided for reference only. Download this version of

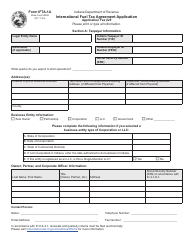

Form MCFT-1A (State Form 53994)

for the current year.

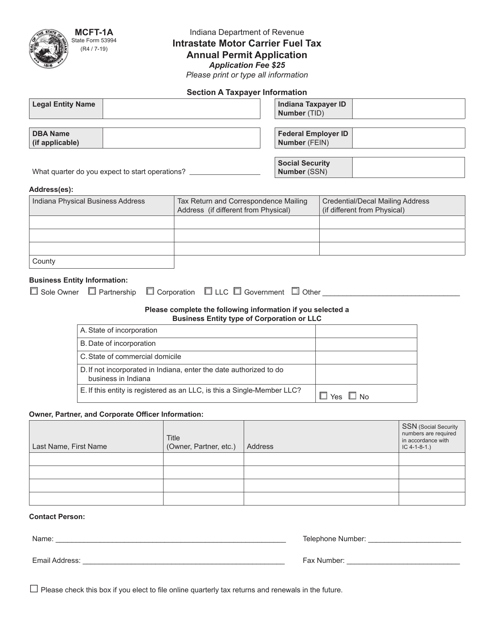

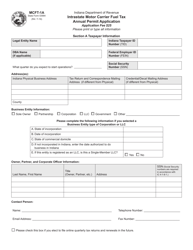

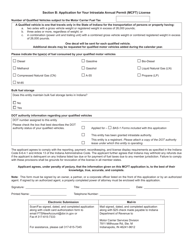

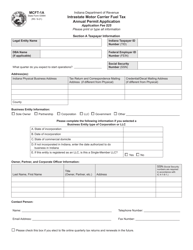

Form MCFT-1A (State Form 53994) Intrastate Motor Carrier Fuel Tax Annual Permit Application - Indiana

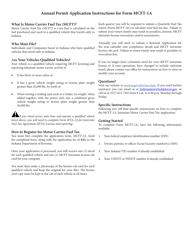

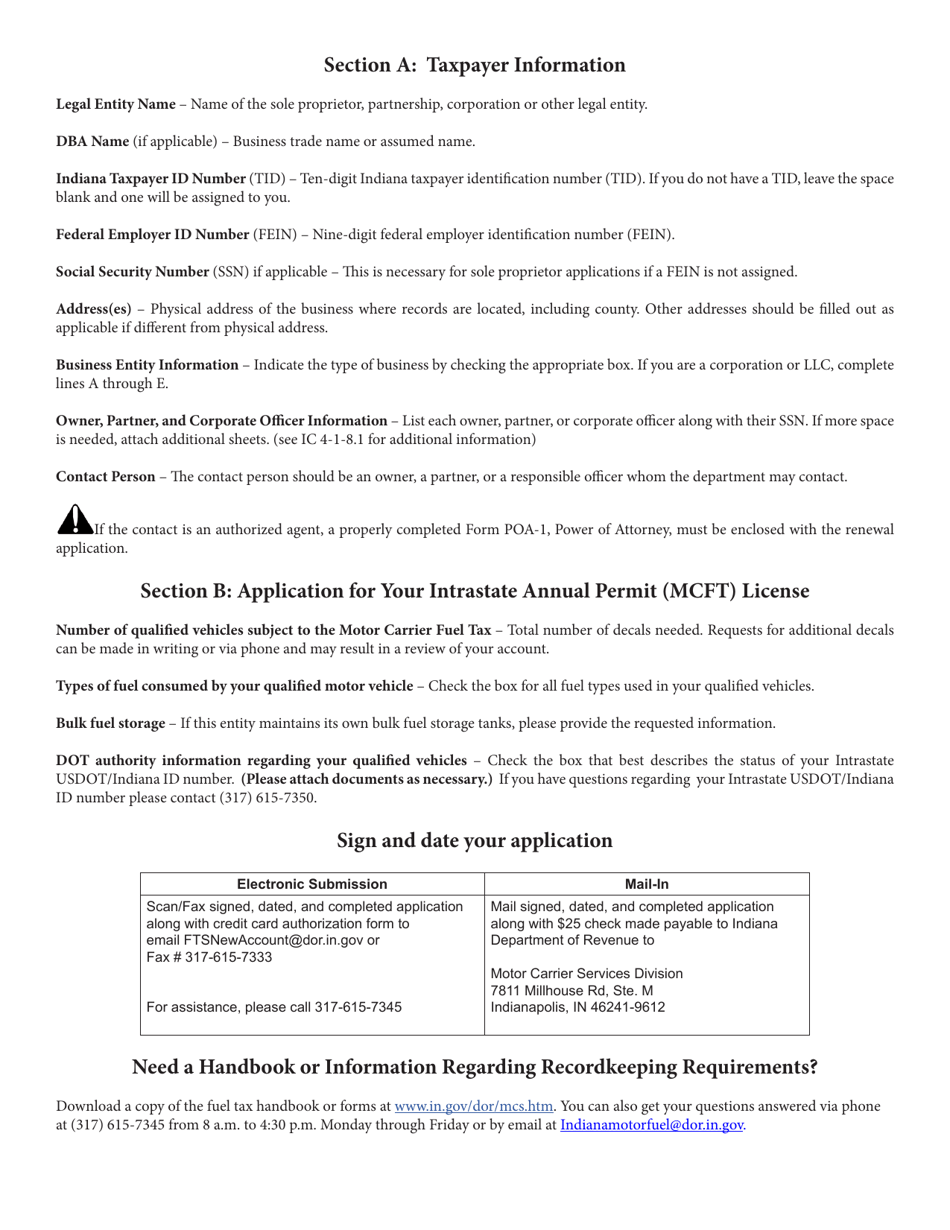

What Is Form MCFT-1A (State Form 53994)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

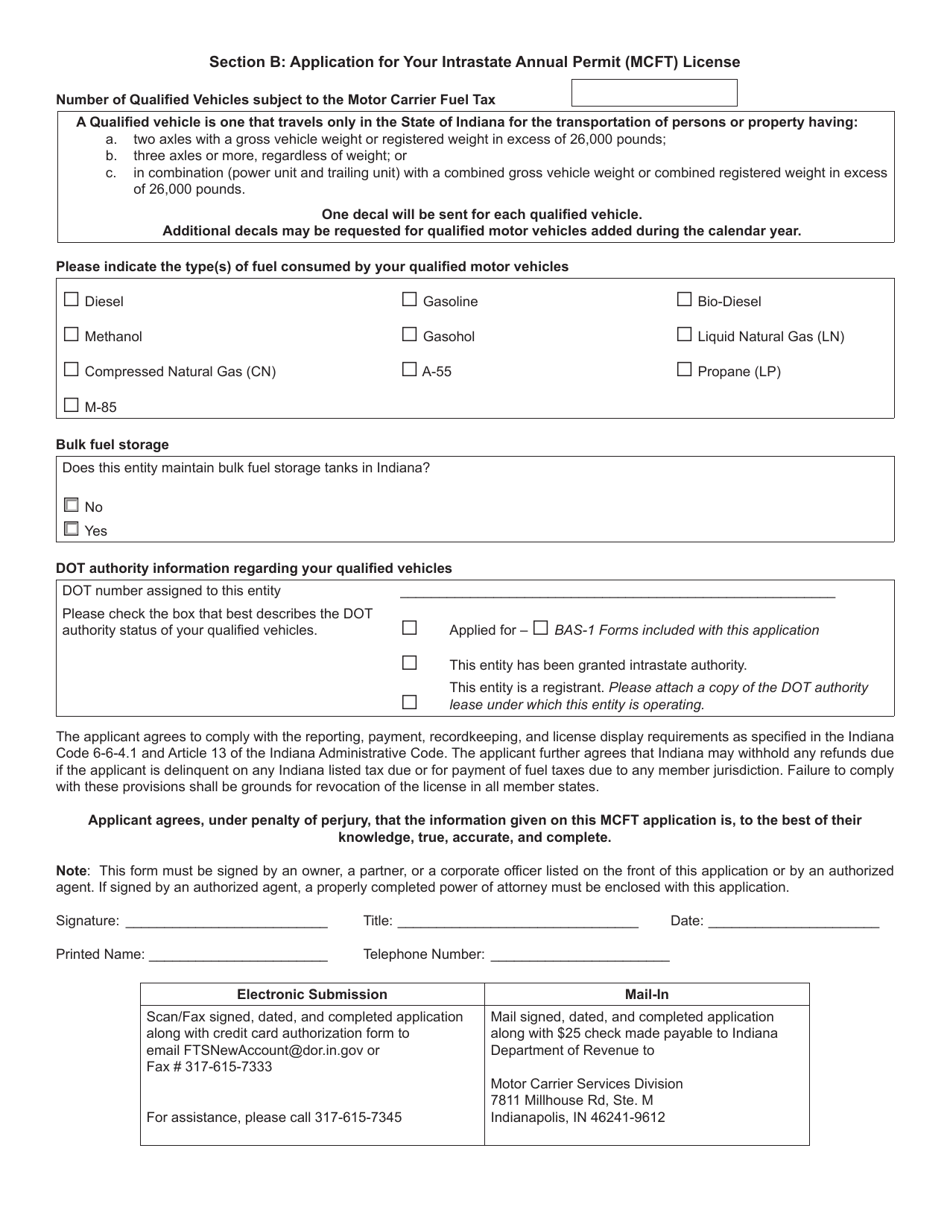

Q: What is MCFT-1A?

A: MCFT-1A is an application form for the Intrastate Motor Carrier Fuel Tax Annual Permit in Indiana.

Q: What is the purpose of MCFT-1A?

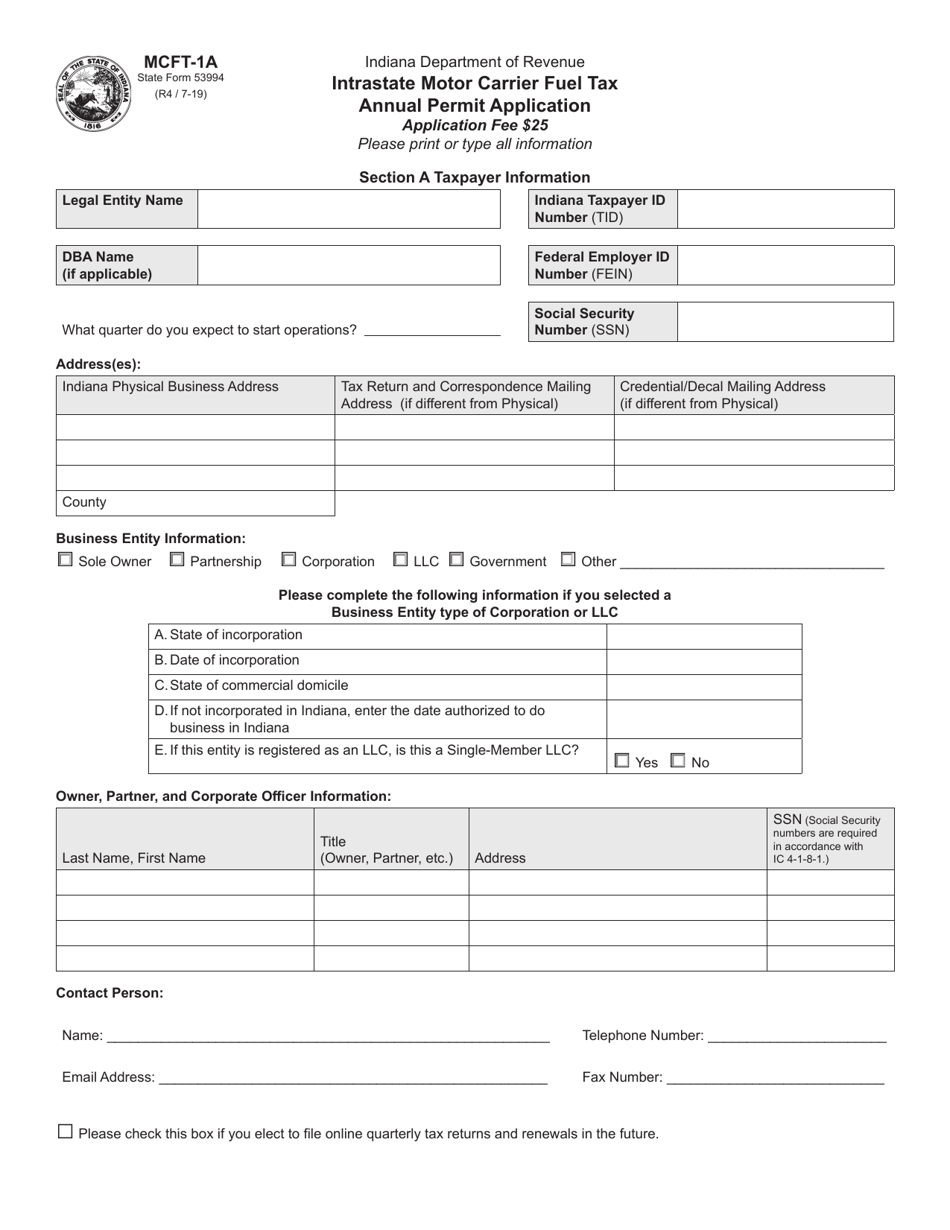

A: The purpose of MCFT-1A is to apply for the annual fuel tax permit for intrastate motor carriers in Indiana.

Q: Who needs to fill out MCFT-1A?

A: Motor carriers operating within Indiana who are required to pay fuel tax must fill out MCFT-1A.

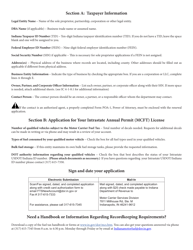

Q: What information do I need to provide in MCFT-1A?

A: You will need to provide information about your business, including the type of carrier, fleet information, and fuel usage.

Q: Is there a fee for filing MCFT-1A?

A: Yes, there is a fee for filing MCFT-1A. The fee amount can be found on the application form.

Q: When should I submit MCFT-1A?

A: MCFT-1A should be submitted on an annual basis before the due date specified by the Indiana Department of Revenue.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MCFT-1A (State Form 53994) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.