This version of the form is not currently in use and is provided for reference only. Download this version of

Form IFTA-1A (State Form 54049)

for the current year.

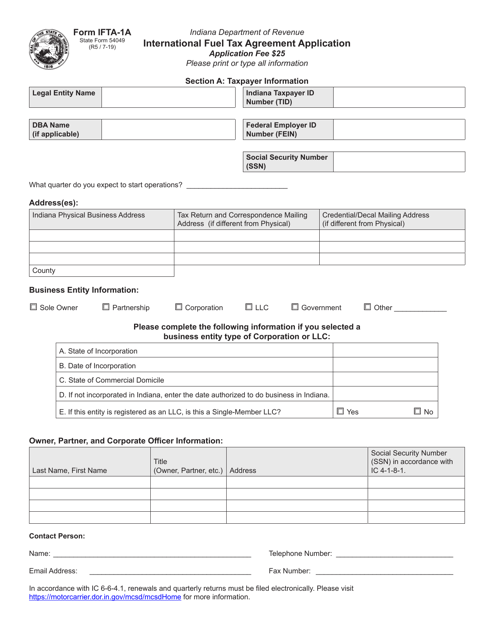

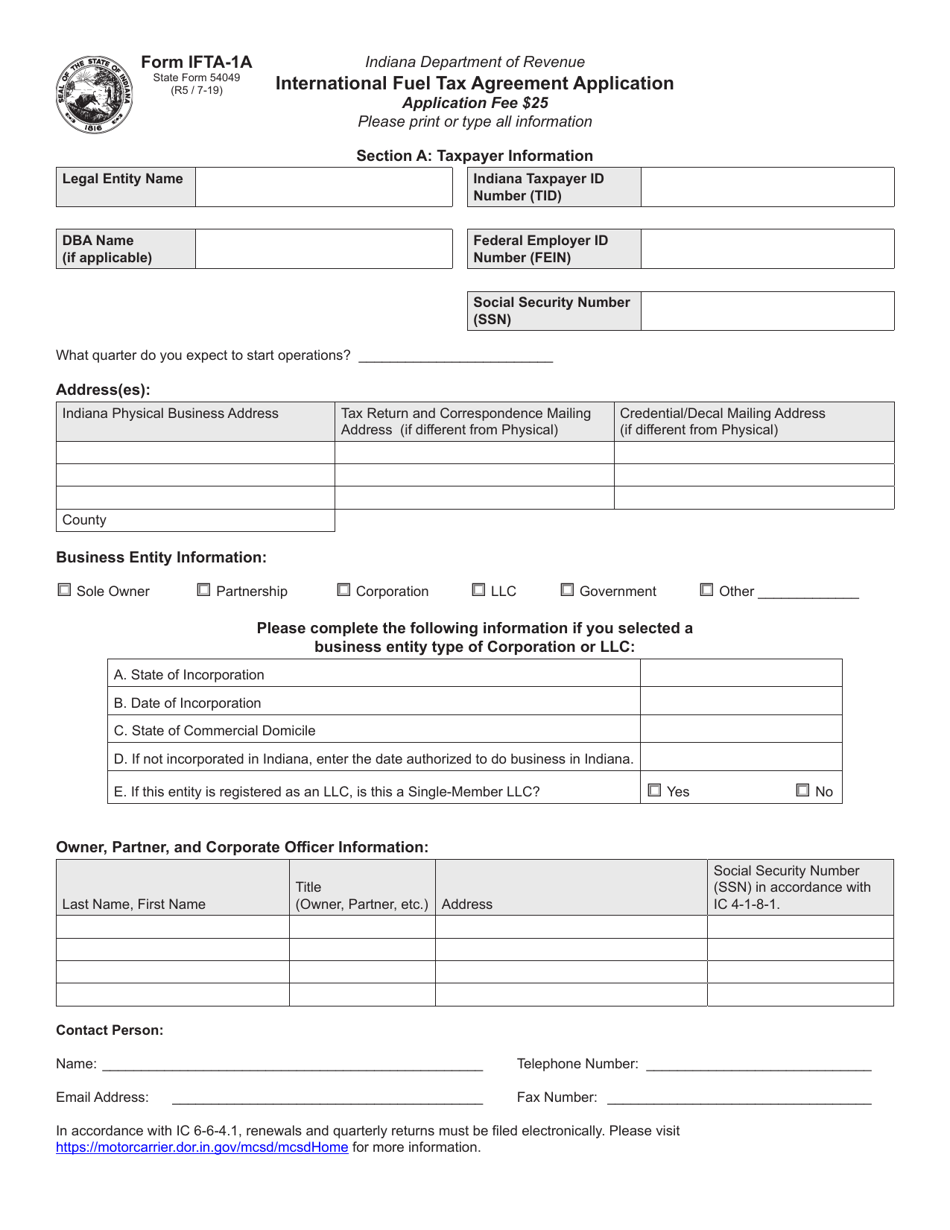

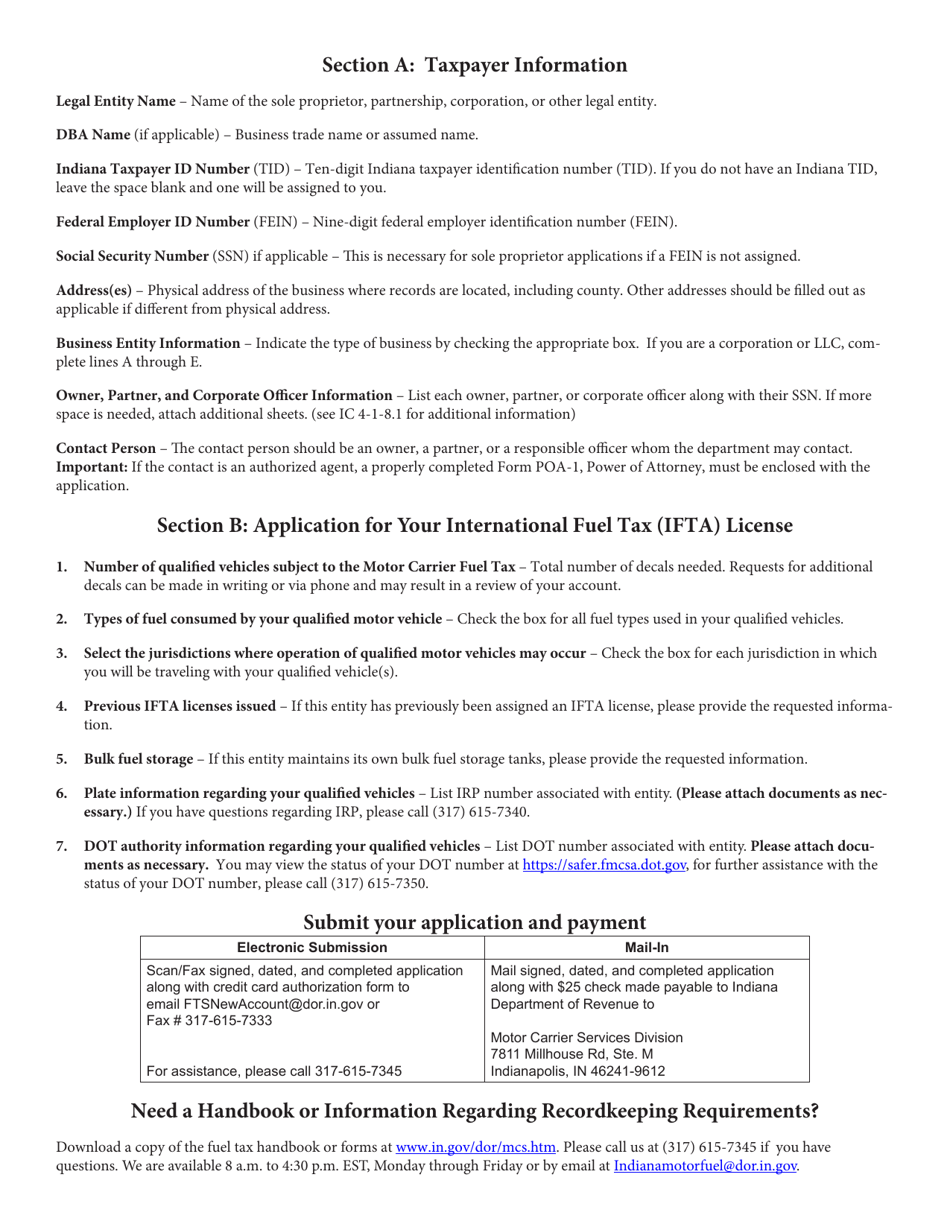

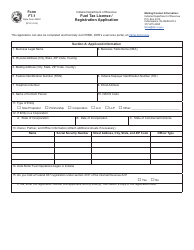

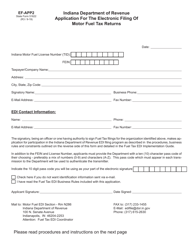

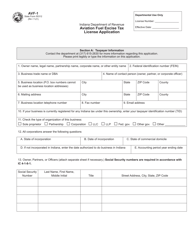

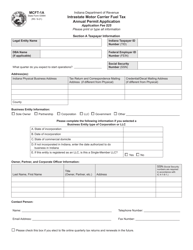

Form IFTA-1A (State Form 54049) International Fuel Tax Agreement Application - Indiana

What Is Form IFTA-1A (State Form 54049)?

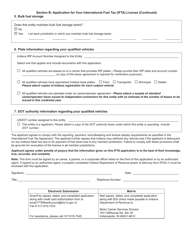

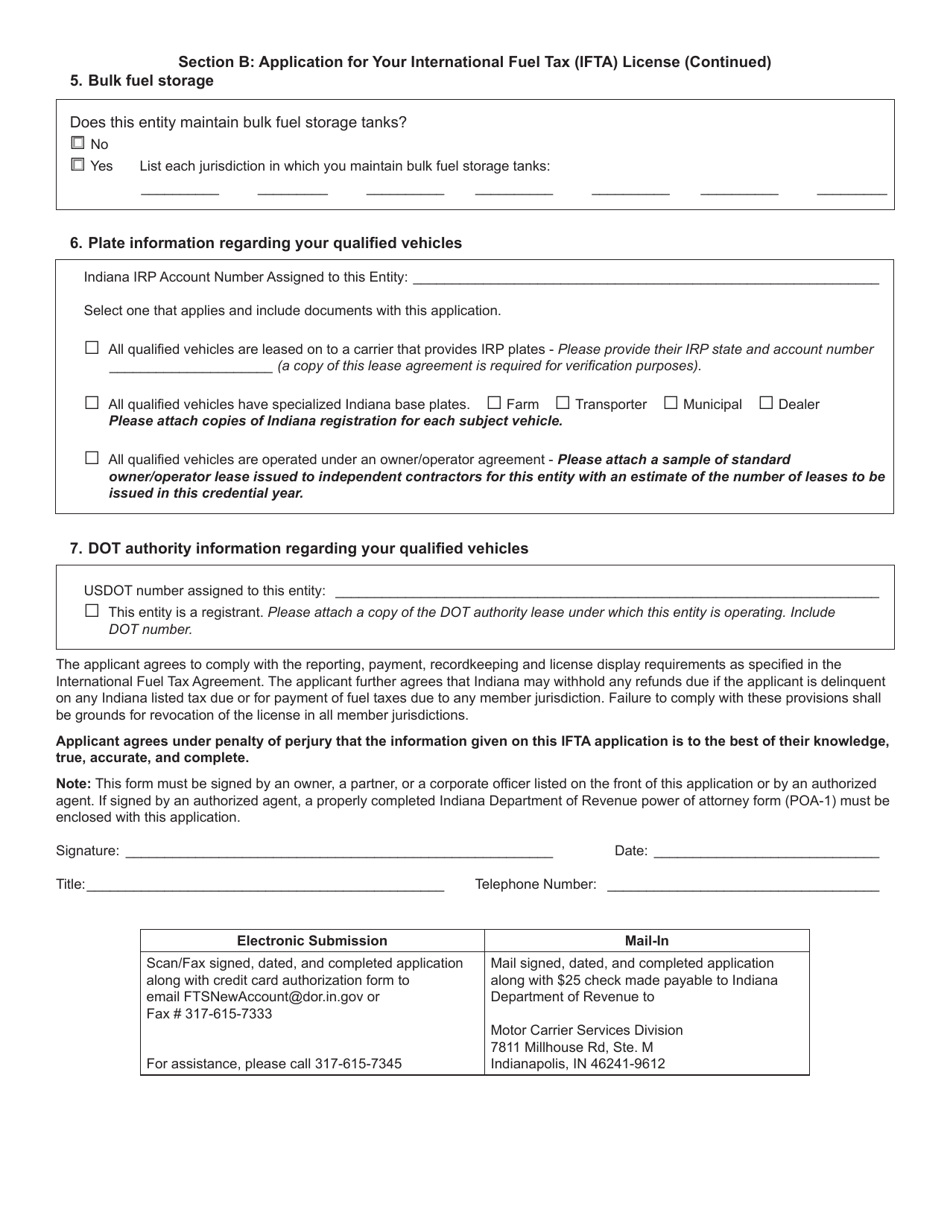

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

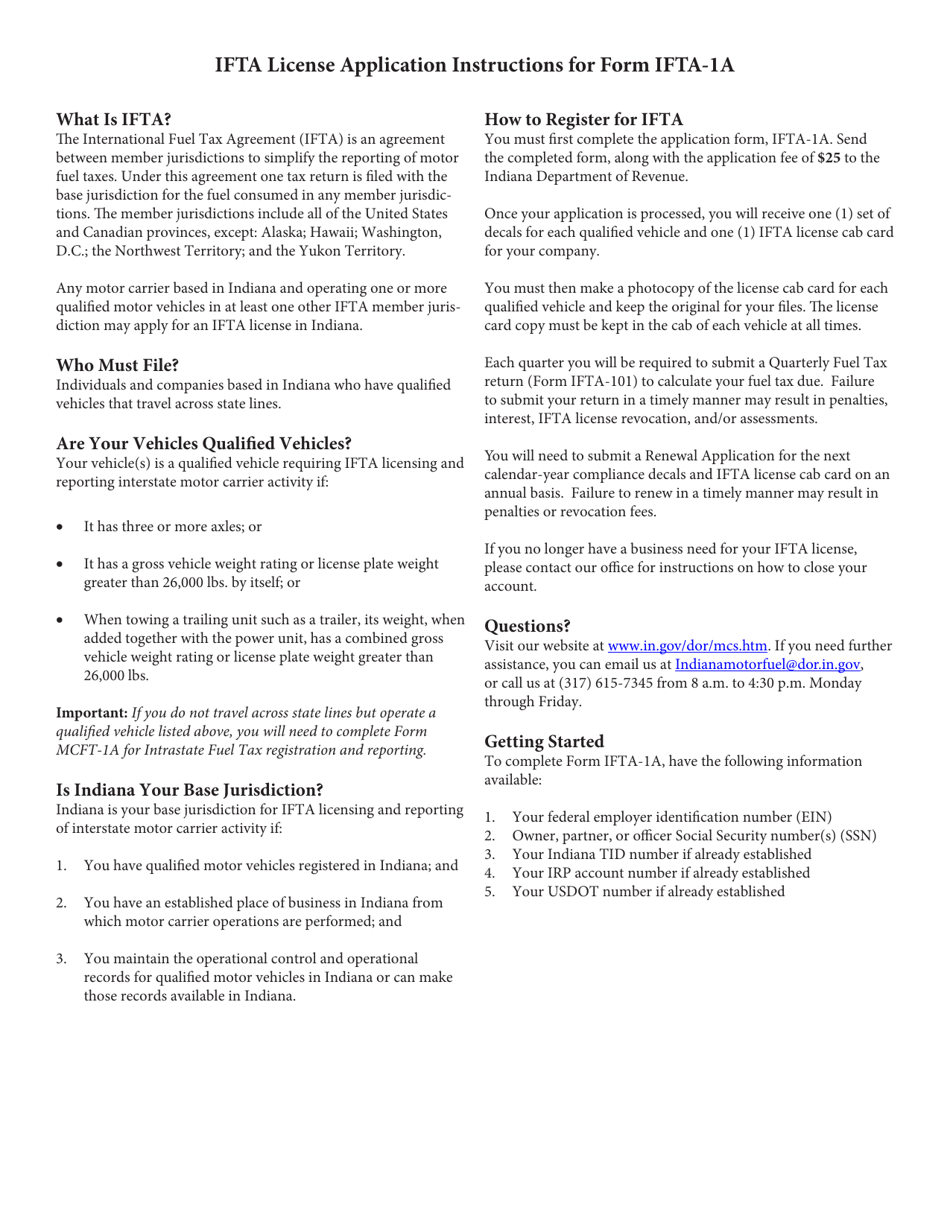

Q: What is Form IFTA-1A?

A: Form IFTA-1A is the International Fuel Tax Agreement Application.

Q: What is the purpose of Form IFTA-1A?

A: The purpose of Form IFTA-1A is to apply for the International Fuel Tax Agreement.

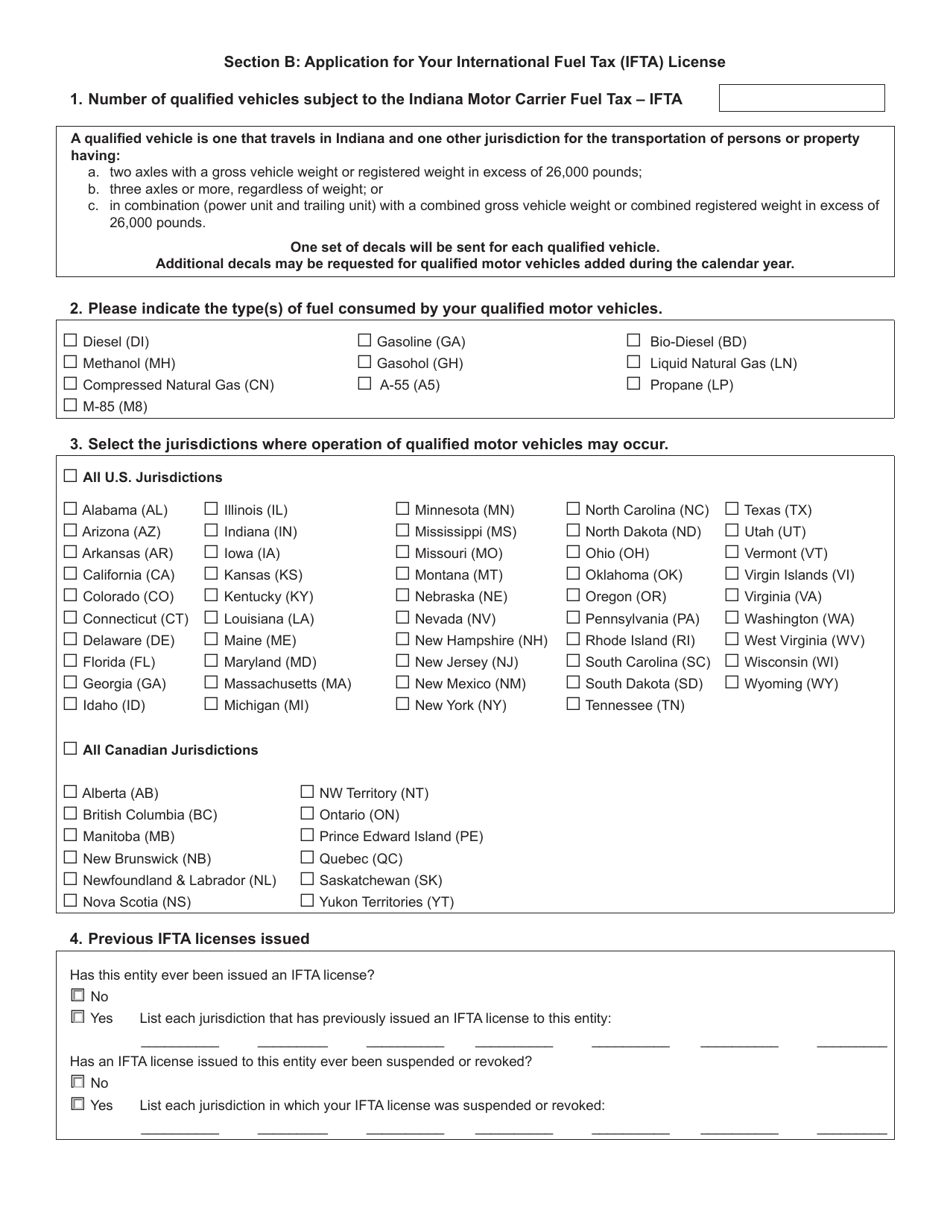

Q: What is the International Fuel Tax Agreement (IFTA)?

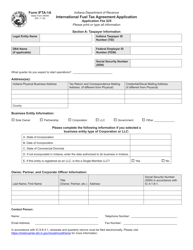

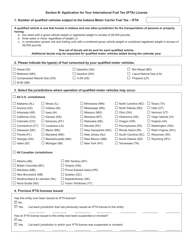

A: The International Fuel Tax Agreement (IFTA) is an agreement between the United States and Canadian provinces that simplifies the reporting and payment of fuel taxes for interstate motor carriers.

Q: Who needs to fill out Form IFTA-1A?

A: Interstate motor carriers that operate in multiple jurisdictions and use qualified motor vehicles need to fill out Form IFTA-1A.

Q: When should Form IFTA-1A be filed?

A: Form IFTA-1A should be filed before the first day of the calendar quarter for which you are applying.

Q: What information is required on Form IFTA-1A?

A: Form IFTA-1A requires information such as the carrier's name, address, federal employer identification number (FEIN), vehicle identification number (VIN), and total miles driven.

Q: Are there any fees associated with filing Form IFTA-1A?

A: Yes, there are fees associated with filing Form IFTA-1A. These fees vary depending on the jurisdiction and must be paid when submitting the application.

Q: How often do I need to file Form IFTA-1A?

A: Form IFTA-1A must be filed quarterly, meaning it needs to be filed every three months.

Q: What happens if I don't file Form IFTA-1A?

A: Failure to file Form IFTA-1A or pay the required taxes and fees can result in penalties and interest charges.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IFTA-1A (State Form 54049) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.