This version of the form is not currently in use and is provided for reference only. Download this version of

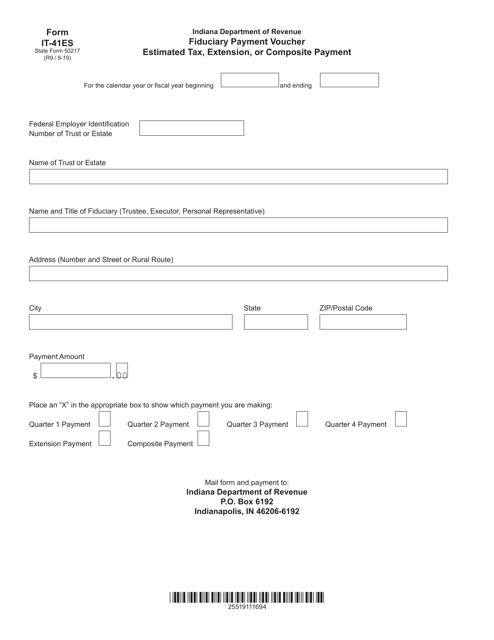

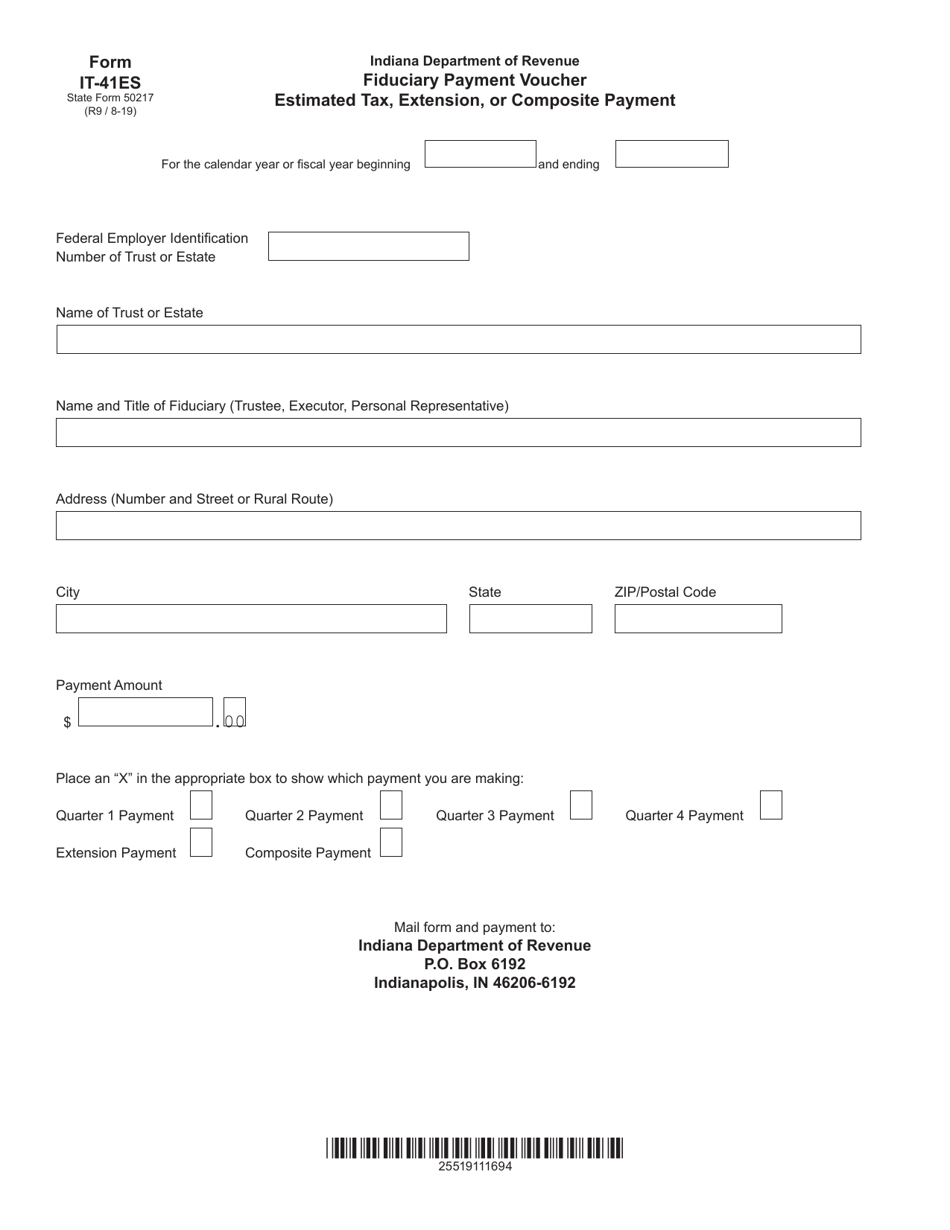

Form IT-41ES (State Form 50217)

for the current year.

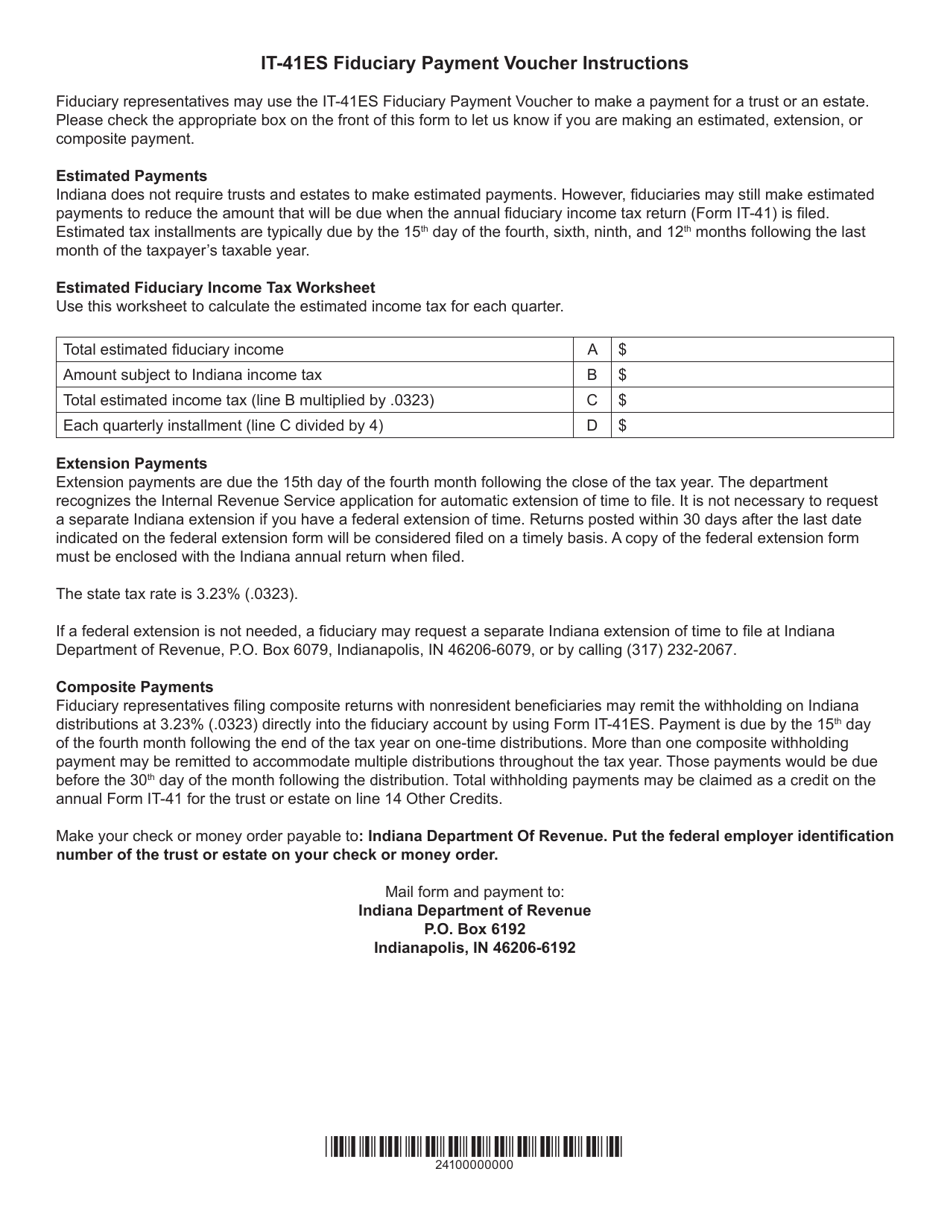

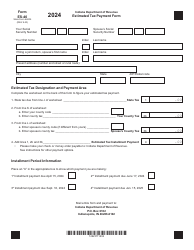

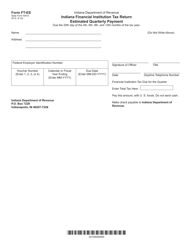

Form IT-41ES (State Form 50217) Fiduciary Payment Voucher - Estimated Tax, Extension, or Composite Payment - Indiana

What Is Form IT-41ES (State Form 50217)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-41ES?

A: Form IT-41ES is the Fiduciary Payment Voucher used for making estimated tax, extension, or composite payments in Indiana.

Q: What is the purpose of Form IT-41ES?

A: The purpose of Form IT-41ES is to remit estimated tax payments, request an extension of time to filefiduciary income tax returns, or make composite payments on behalf of nonresident shareholders.

Q: Who should use Form IT-41ES?

A: Fiduciaries who are responsible for paying estimated tax, seeking an extension, or making composite payments for nonresident shareholders in Indiana should use Form IT-41ES.

Q: When should Form IT-41ES be filed?

A: Form IT-41ES should be filed and payment should be made on a quarterly basis. The due dates are April 15, June 15, September 15, and January 15.

Q: Are there any penalties for not filing or paying with Form IT-41ES?

A: Yes, there may be penalties for late or insufficient payments. It is important to file and pay on time to avoid any penalties or interest charges.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-41ES (State Form 50217) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.