This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule D-1

for the current year.

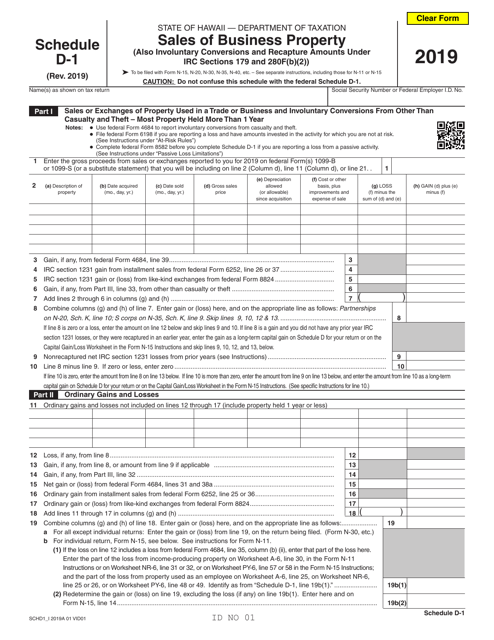

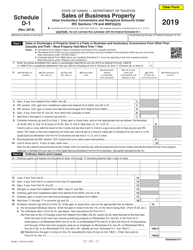

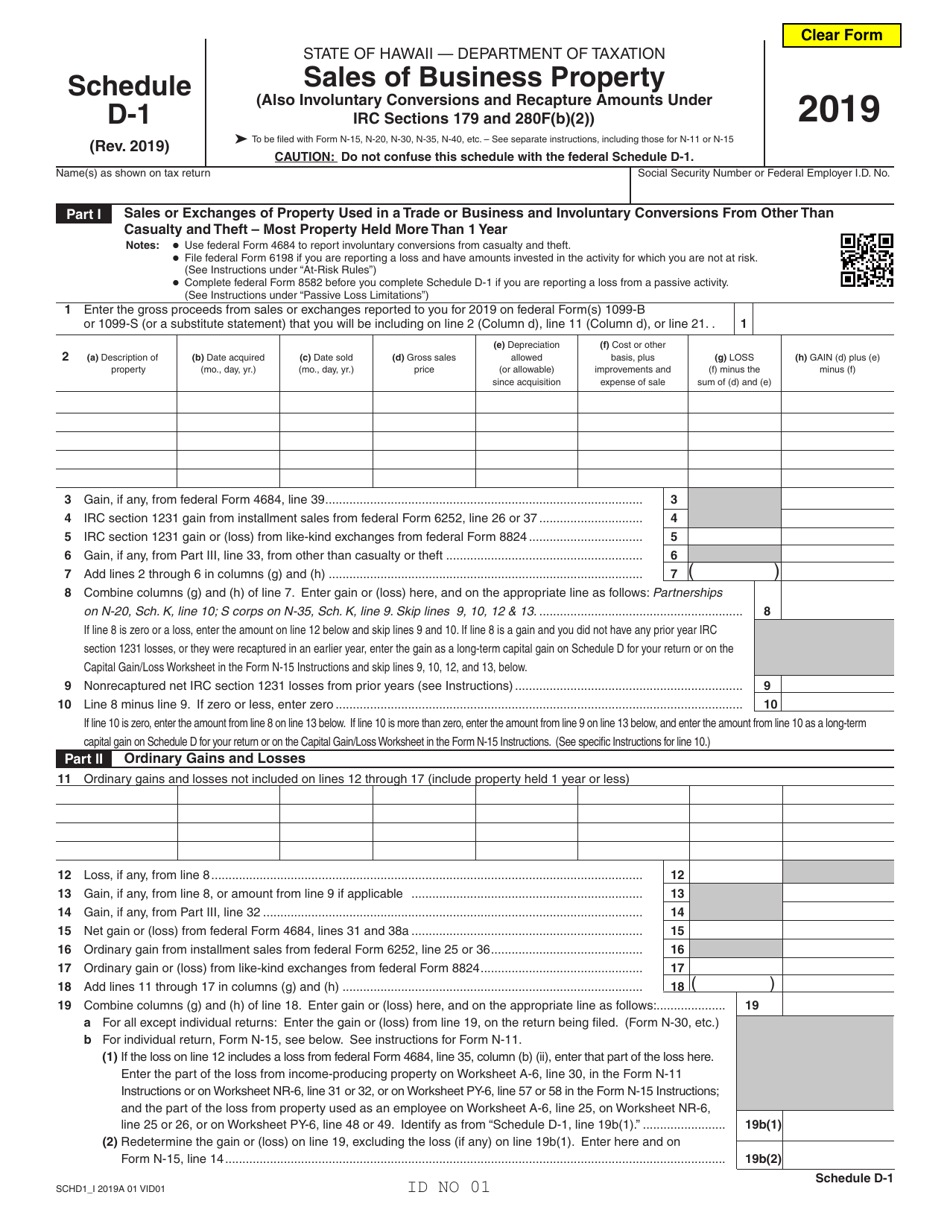

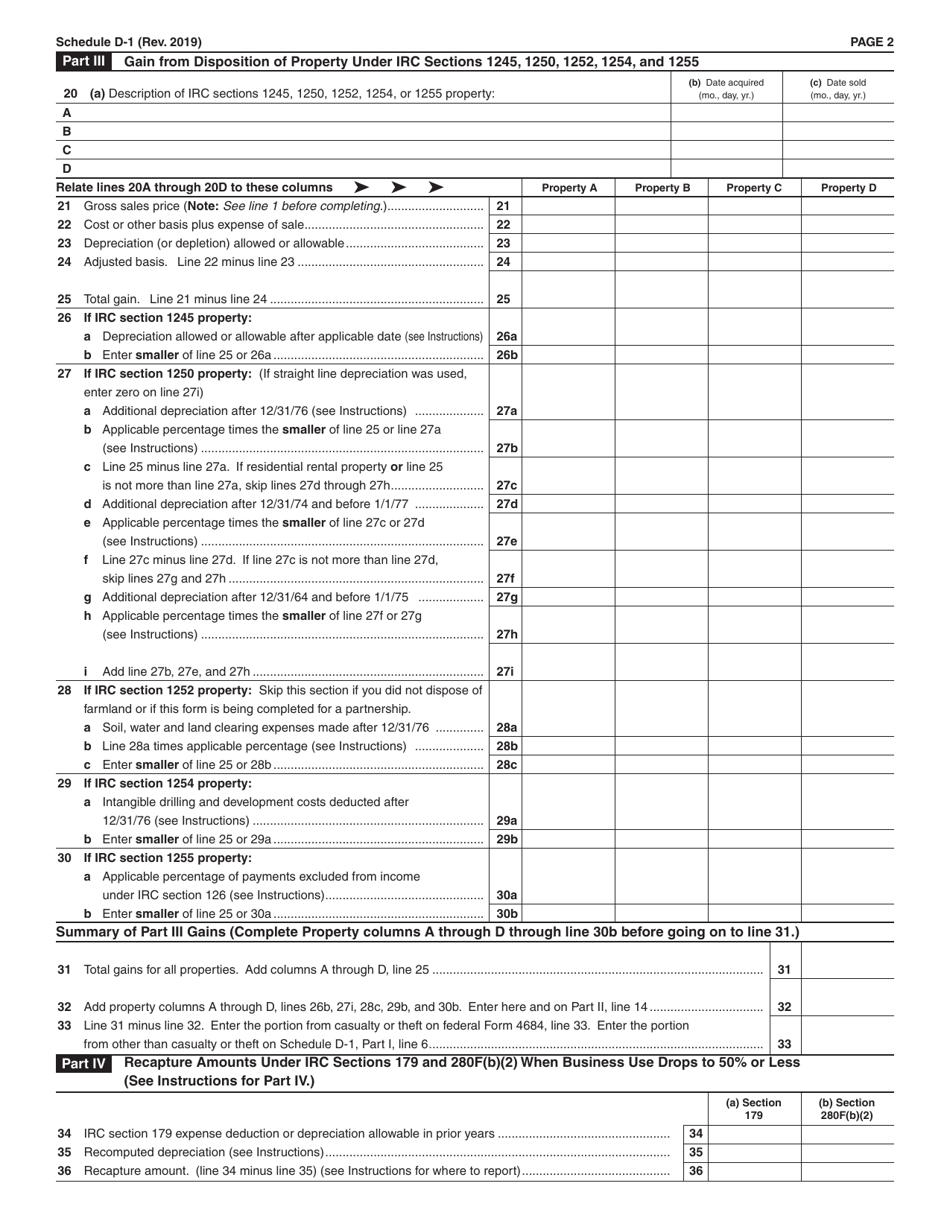

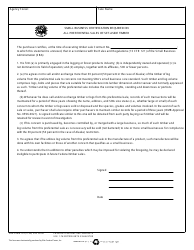

Schedule D-1 Sales of Business Property - Hawaii

What Is Schedule D-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D-1?

A: Schedule D-1 is a tax form used to report the sales of business property in Hawaii.

Q: Who needs to fill out Schedule D-1?

A: Individuals and businesses in Hawaii who have sold or disposed of business property need to fill out Schedule D-1.

Q: What information is required on Schedule D-1?

A: Schedule D-1 requires the taxpayer to provide details about the property sold, including its description, date of sale, and sale price.

Q: Are there any specific requirements for completing Schedule D-1?

A: Yes, taxpayers need to provide additional documentation and information, such as the cost or other basis of the property, depreciation claimed, and any rental use of the property.

Q: When is the deadline to file Schedule D-1?

A: The deadline to file Schedule D-1 in Hawaii is the same as the deadline for filing your state tax return, which is generally April 20th.

Q: What happens if I don't file Schedule D-1?

A: If you fail to file Schedule D-1 when required, you may be subject to penalties and interest on any tax owed.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule D-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.