This version of the form is not currently in use and is provided for reference only. Download this version of

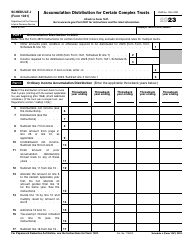

Form N-405

for the current year.

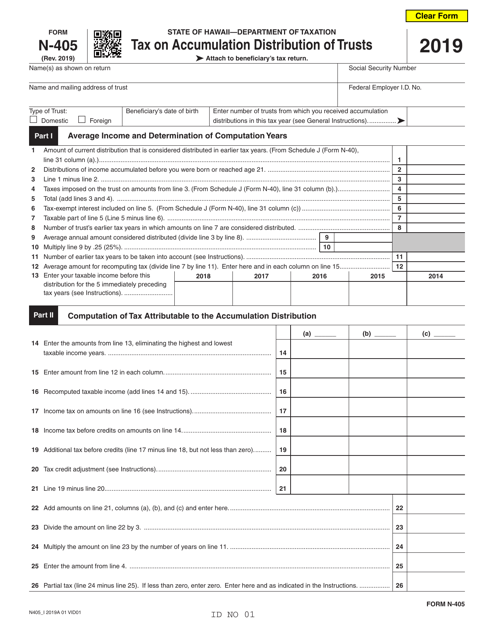

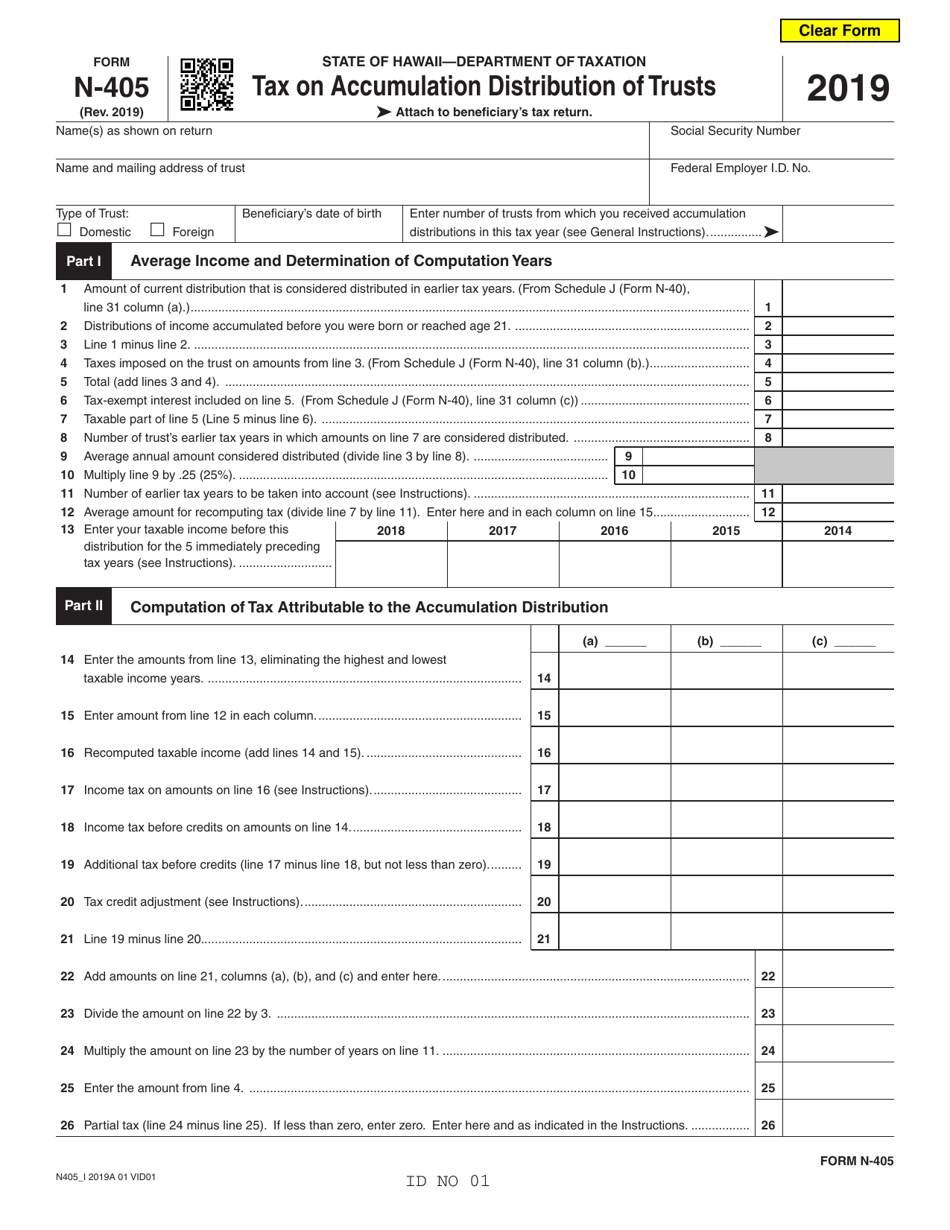

Form N-405 Tax on Accumulation Distribution of Trusts - Hawaii

What Is Form N-405?

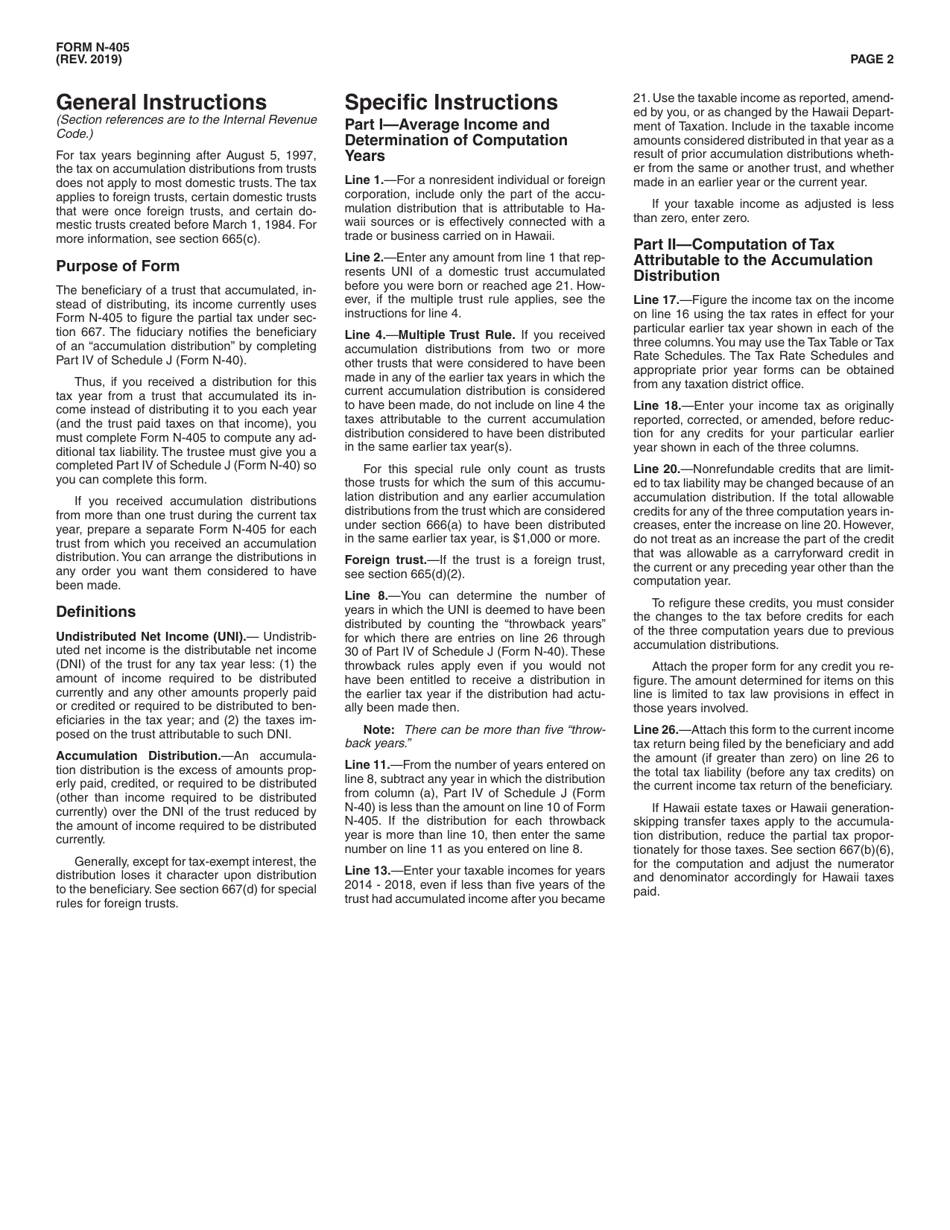

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-405?

A: Form N-405 is a tax form specifically for reporting accumulation distributions of trusts in Hawaii.

Q: What are accumulation distributions?

A: Accumulation distributions refer to the portion of a trust's income that is retained and not distributed to beneficiaries.

Q: Who needs to file Form N-405?

A: Anyone who is a trustee of a trust that has made accumulation distributions in Hawaii needs to file Form N-405.

Q: When is Form N-405 due?

A: Form N-405 is due on or before the 20th day of the 4th month following the close of the trust's taxable year.

Q: Are there any penalties for not filing Form N-405?

A: Yes, there are penalties for failure to file or for filing an incomplete or inaccurate Form N-405. It is important to file the form correctly and on time.

Q: Can I e-file Form N-405?

A: No, at the moment, Form N-405 can only be filed by mail. Electronic filing is not available for this form.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-405 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.