This version of the form is not currently in use and is provided for reference only. Download this version of

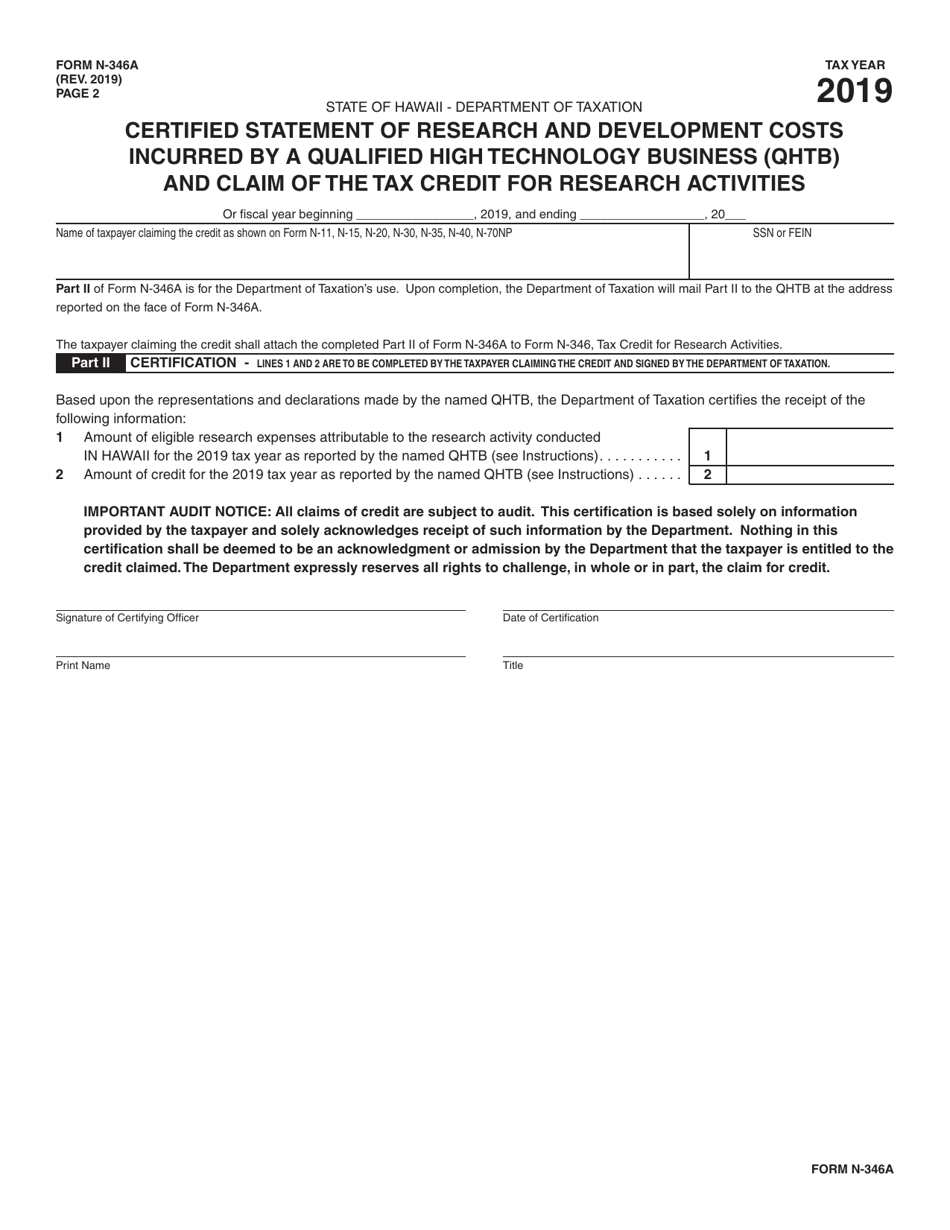

Form N-346A

for the current year.

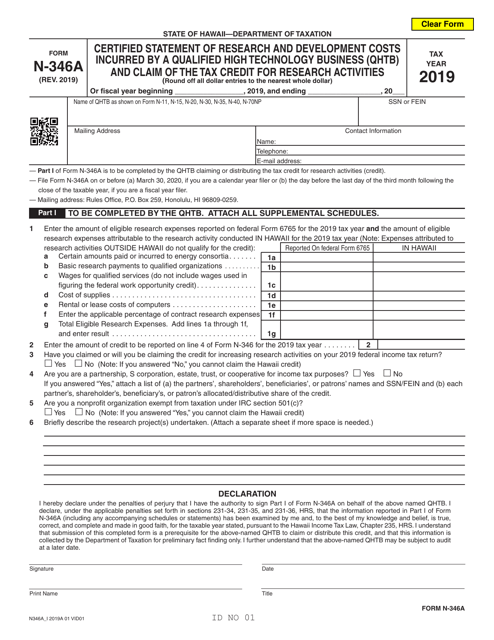

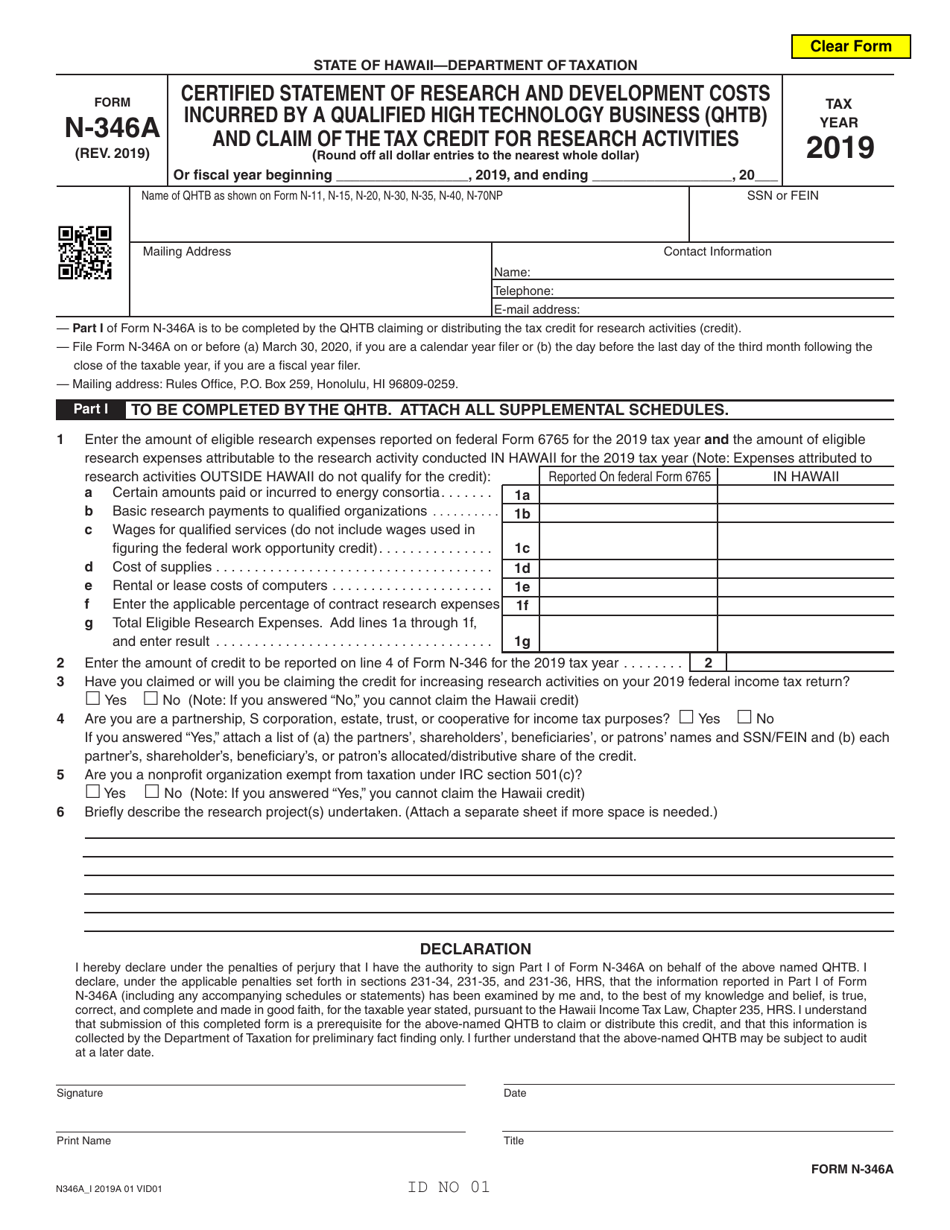

Form N-346A Certified Statement of Research and Development Costs Incurred by a Qualified High Technology Business (Qhtb) and Claim of the Tax Credit for Research Activities - Hawaii

What Is Form N-346A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-346A?

A: Form N-346A is a Certified Statement of Research and Development Costs Incurred by a Qualified High Technology Business (QHTB) and Claim of the Tax Credit for Research Activities. It is specific to Hawaii.

Q: What is a Qualified High Technology Business (QHTB)?

A: A Qualified High Technology Business (QHTB) is a business that primarily engages in research and development activities in Hawaii.

Q: What is the tax credit for research activities?

A: The tax credit for research activities is a credit that businesses can claim for their qualified research expenses.

Q: Who can file Form N-346A?

A: Businesses that are Qualified High Technology Businesses (QHTBs) in Hawaii can file Form N-346A.

Q: What information is required on Form N-346A?

A: Form N-346A requires businesses to provide detailed information about their research and development costs, as well as their eligibility for the tax credit.

Q: How can businesses claim the tax credit for research activities?

A: Businesses can claim the tax credit for research activities by completing Form N-346A and submitting it to the appropriate tax authorities in Hawaii.

Q: Are there any deadlines for filing Form N-346A?

A: Yes, businesses must file Form N-346A by the due date of their Hawaii income tax return for the taxable year in which the research and development costs were incurred.

Q: Can businesses amend their Form N-346A?

A: Yes, businesses can file an amended Form N-346A within three years from the due date of the original return or within three years from the time the tax was paid, whichever is later.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-346A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.