This version of the form is not currently in use and is provided for reference only. Download this version of

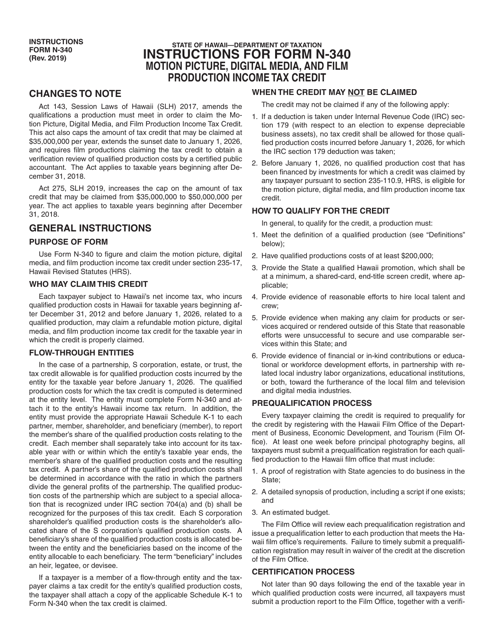

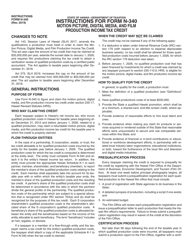

Instructions for Form N-340

for the current year.

Instructions for Form N-340 Motion Picture, Digital Media, and Film Production Tax Credit - Hawaii

This document contains official instructions for Form N-340 , Motion Picture, Film Production Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-340 is available for download through this link.

FAQ

Q: What is Form N-340?

A: Form N-340 is a tax credit form for motion picture, digital media, and film production in Hawaii.

Q: Who can use Form N-340?

A: Form N-340 can be used by individuals and businesses involved in motion picture, digital media, and film production in Hawaii.

Q: What is the purpose of Form N-340?

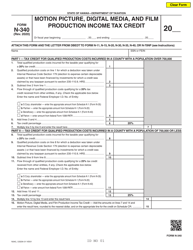

A: The purpose of Form N-340 is to claim the motion picture, digital media, and film production tax credit in Hawaii.

Q: How do I file Form N-340?

A: Form N-340 should be filed with the Hawaii Department of Taxation along with supporting documentation.

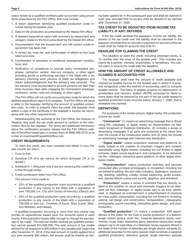

Q: What are the eligibility requirements for the tax credit?

A: Eligibility requirements for the tax credit include meeting certain production and expenditure criteria, as well as obtaining a tax certification from the Hawaii Film Office.

Q: What expenses are eligible for the tax credit?

A: Eligible expenses for the tax credit include qualified production costs incurred in Hawaii.

Q: What is the amount of the tax credit?

A: The amount of the tax credit is a percentage of qualified production costs, up to a certain cap.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations and restrictions on the tax credit, including a sunset provision, annual cap, and certain production requirements.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.