This version of the form is not currently in use and is provided for reference only. Download this version of

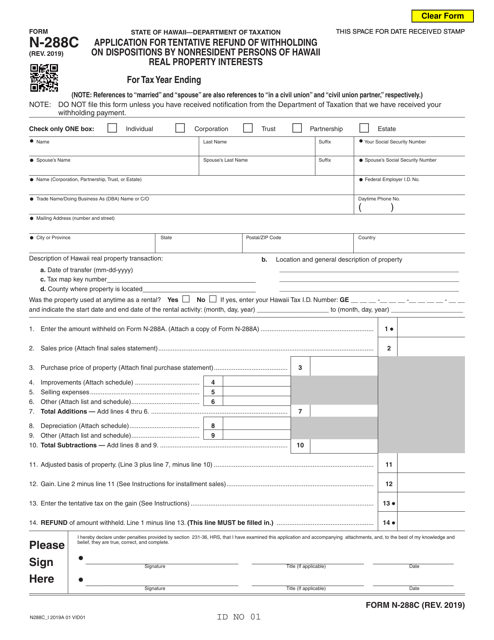

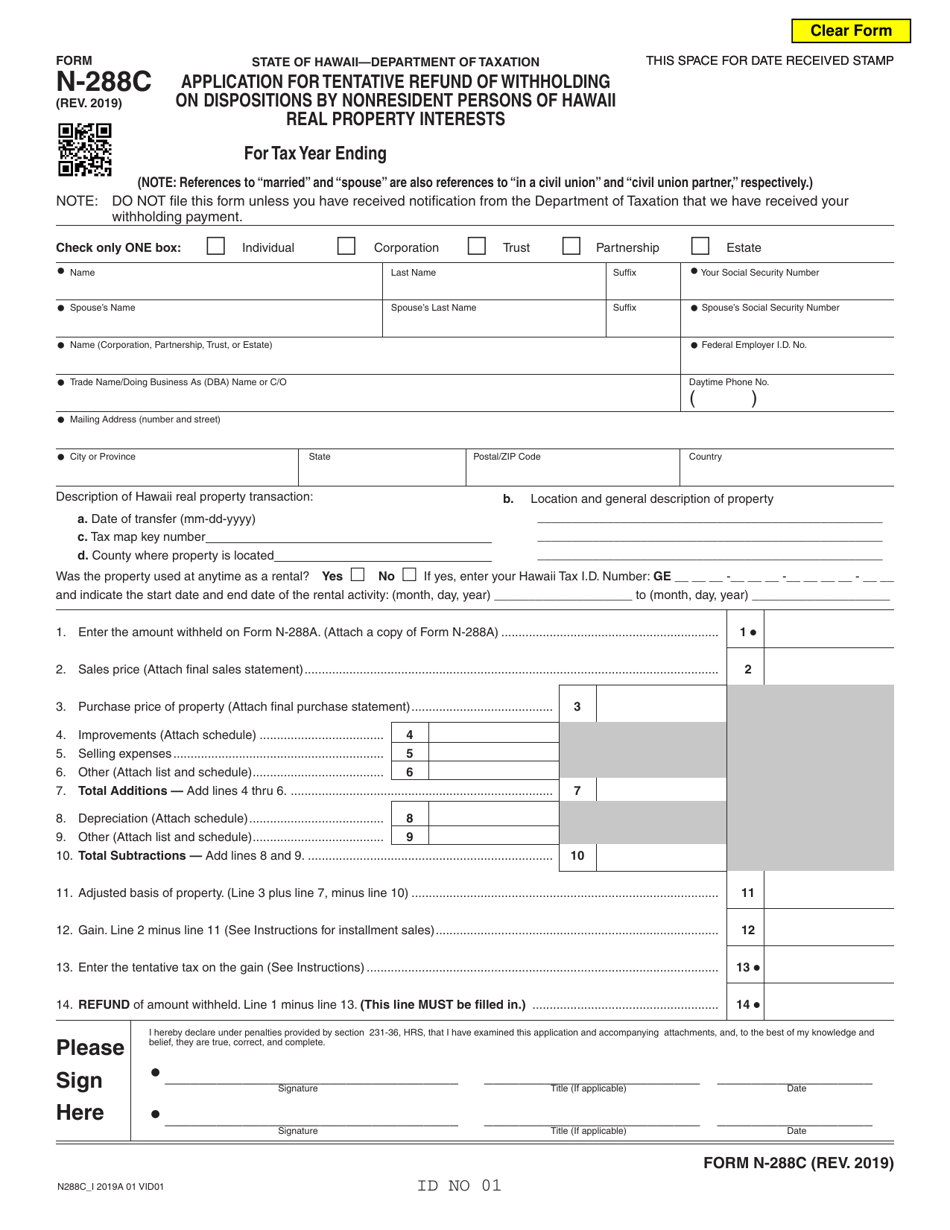

Form N-288C

for the current year.

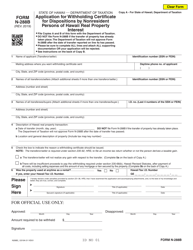

Form N-288C Application for Tentative Refund of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests - Hawaii

What Is Form N-288C?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288C?

A: Form N-288C is an application for tentative refund of withholding on dispositions by nonresident persons of Hawaii real property interests.

Q: Who can use Form N-288C?

A: Nonresident persons who have disposed of Hawaii real property interests and had withholding tax withheld can use Form N-288C.

Q: What is the purpose of Form N-288C?

A: The purpose of Form N-288C is to request a refund of withholding tax withheld on the disposition of Hawaii real property interests.

Q: When should I file Form N-288C?

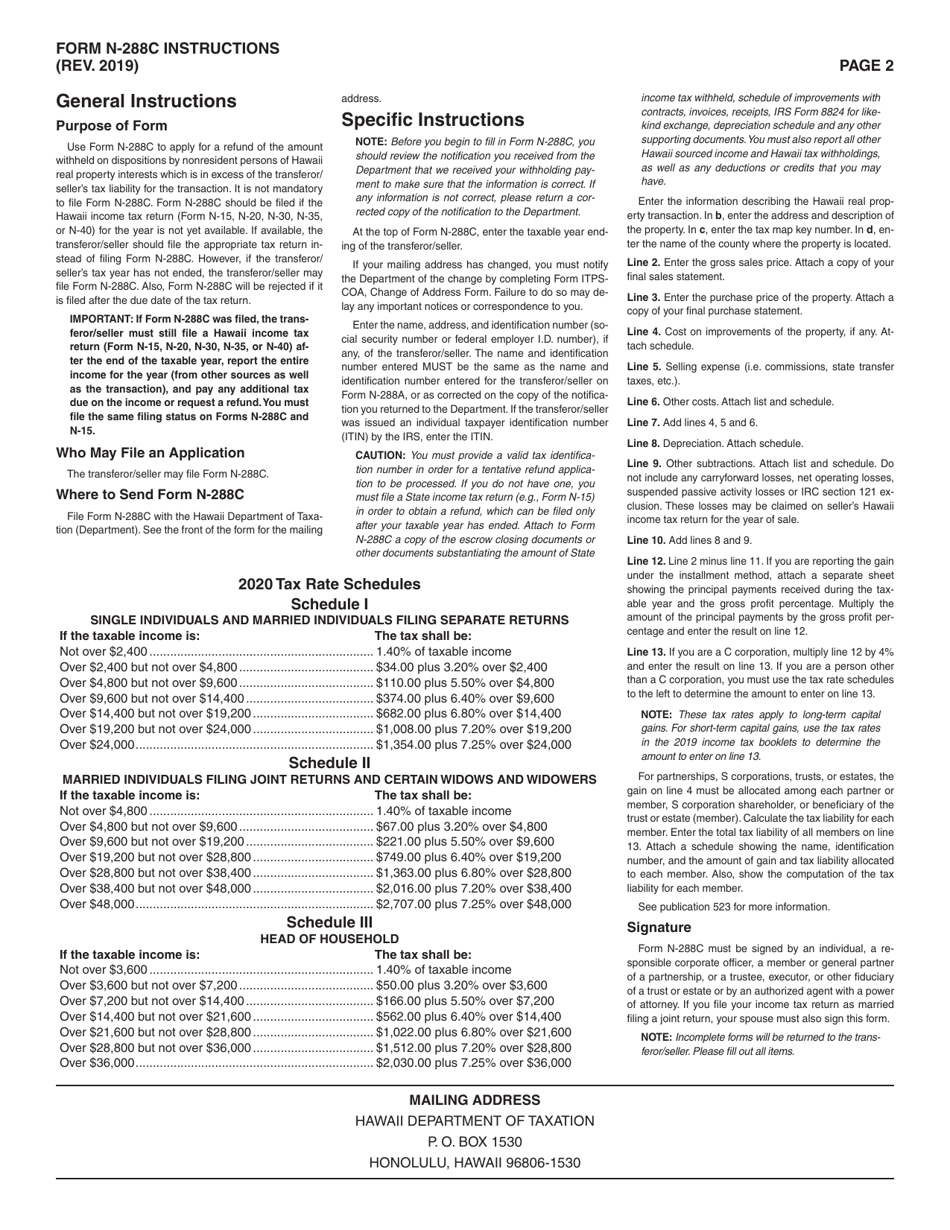

A: Form N-288C should be filed within 90 days after the date of disposition of the Hawaii real property interest.

Q: What supporting documents should I include with Form N-288C?

A: You should include a copy of the escrow statement, settlement statement, or other documentation showing the withholding tax that was withheld.

Q: How long does it take to process Form N-288C?

A: The processing time for Form N-288C can vary, but it typically takes several weeks to several months.

Q: Can I file Form N-288C electronically?

A: No, Form N-288C cannot be filed electronically. It must be filed by mail or in person.

Q: Is there a fee to file Form N-288C?

A: No, there is no fee to file Form N-288C.

Form Details:

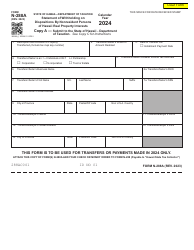

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288C by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.