This version of the form is not currently in use and is provided for reference only. Download this version of

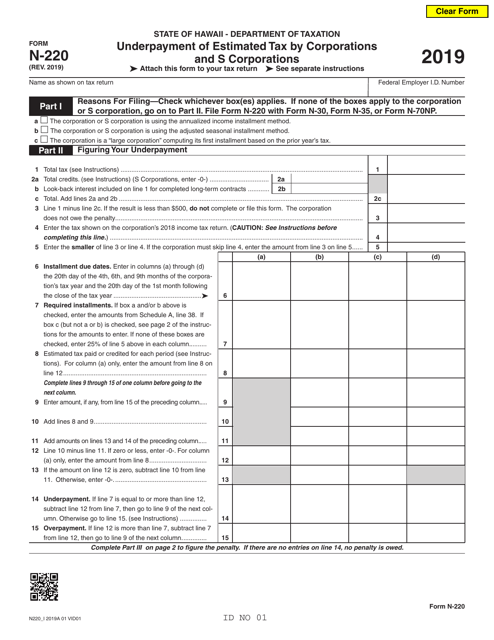

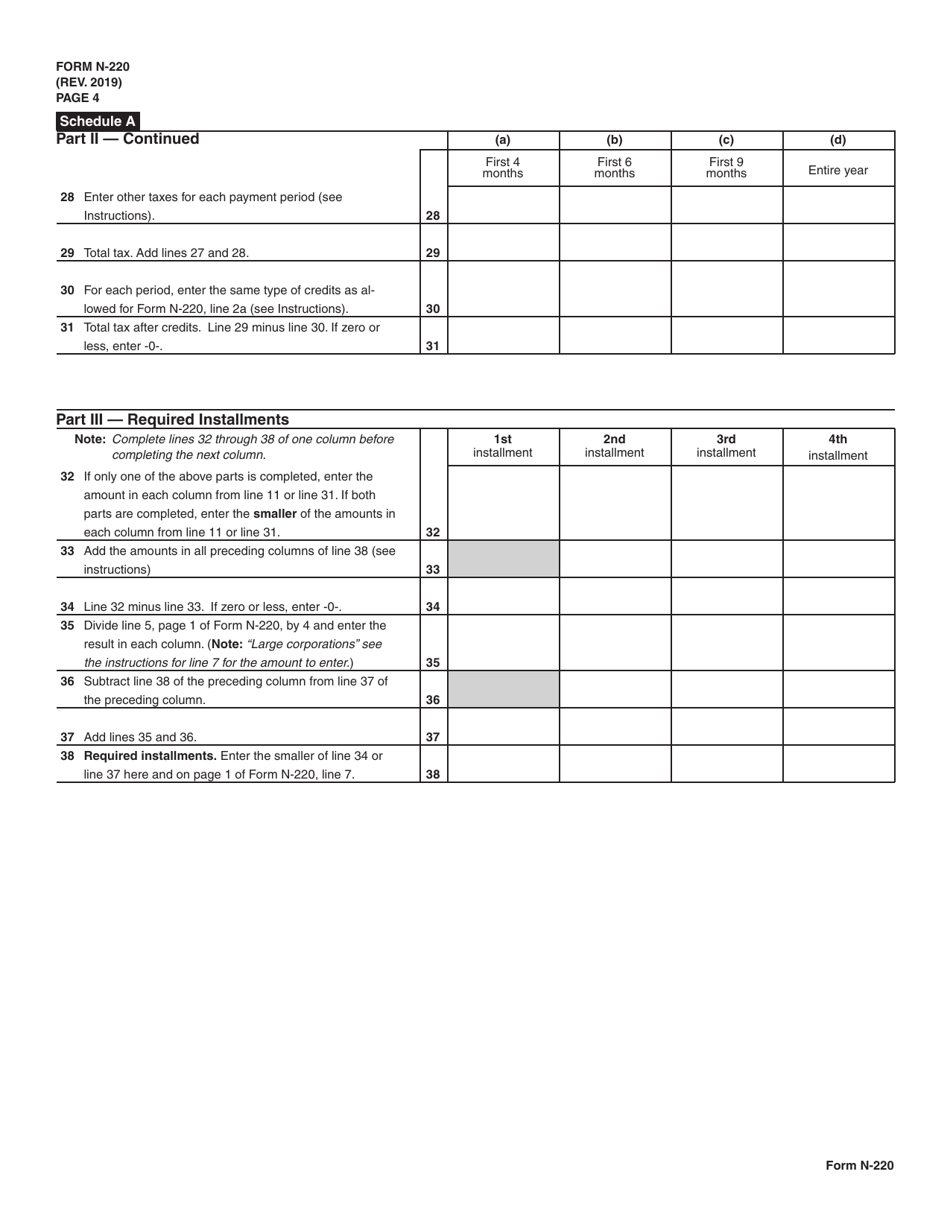

Form N-220

for the current year.

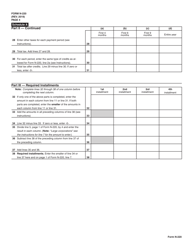

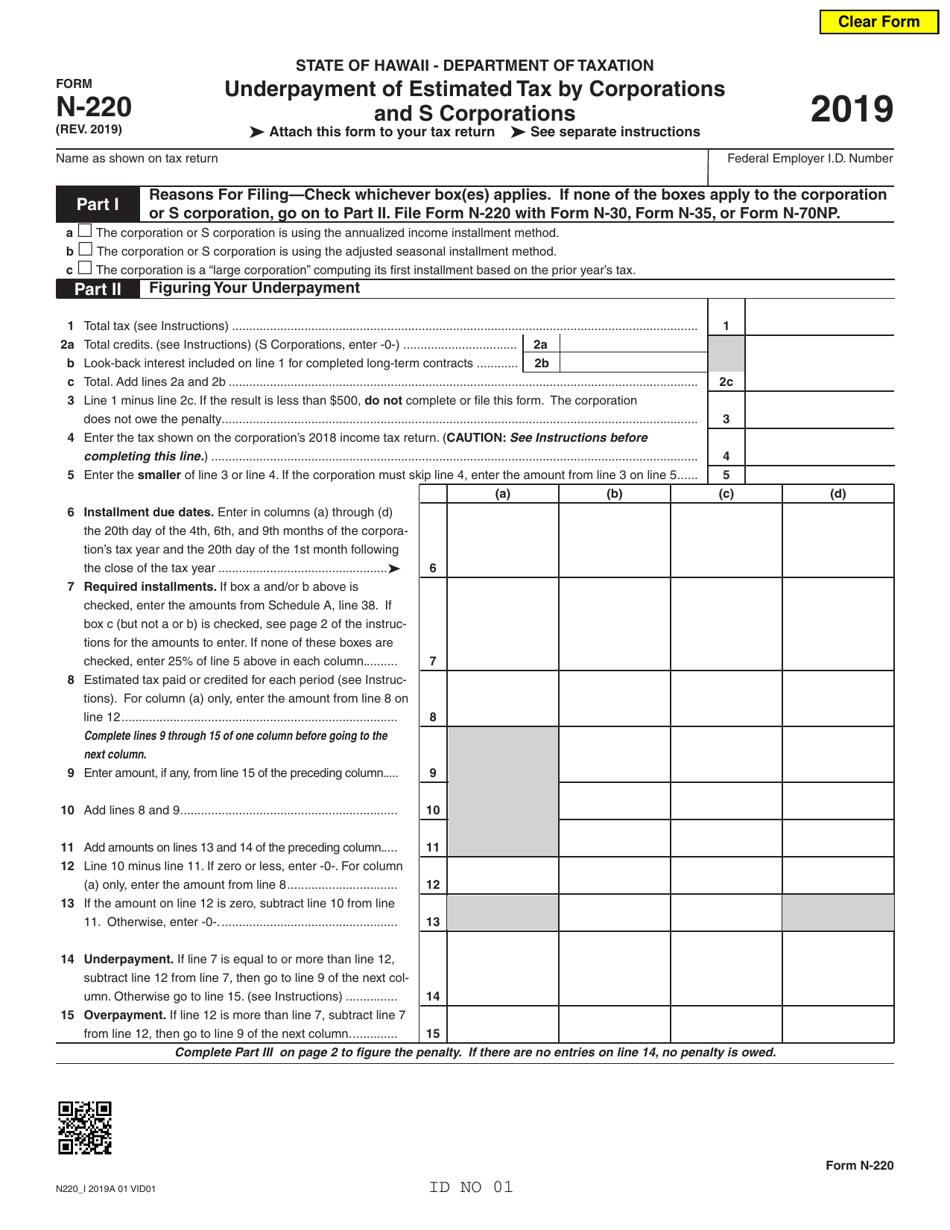

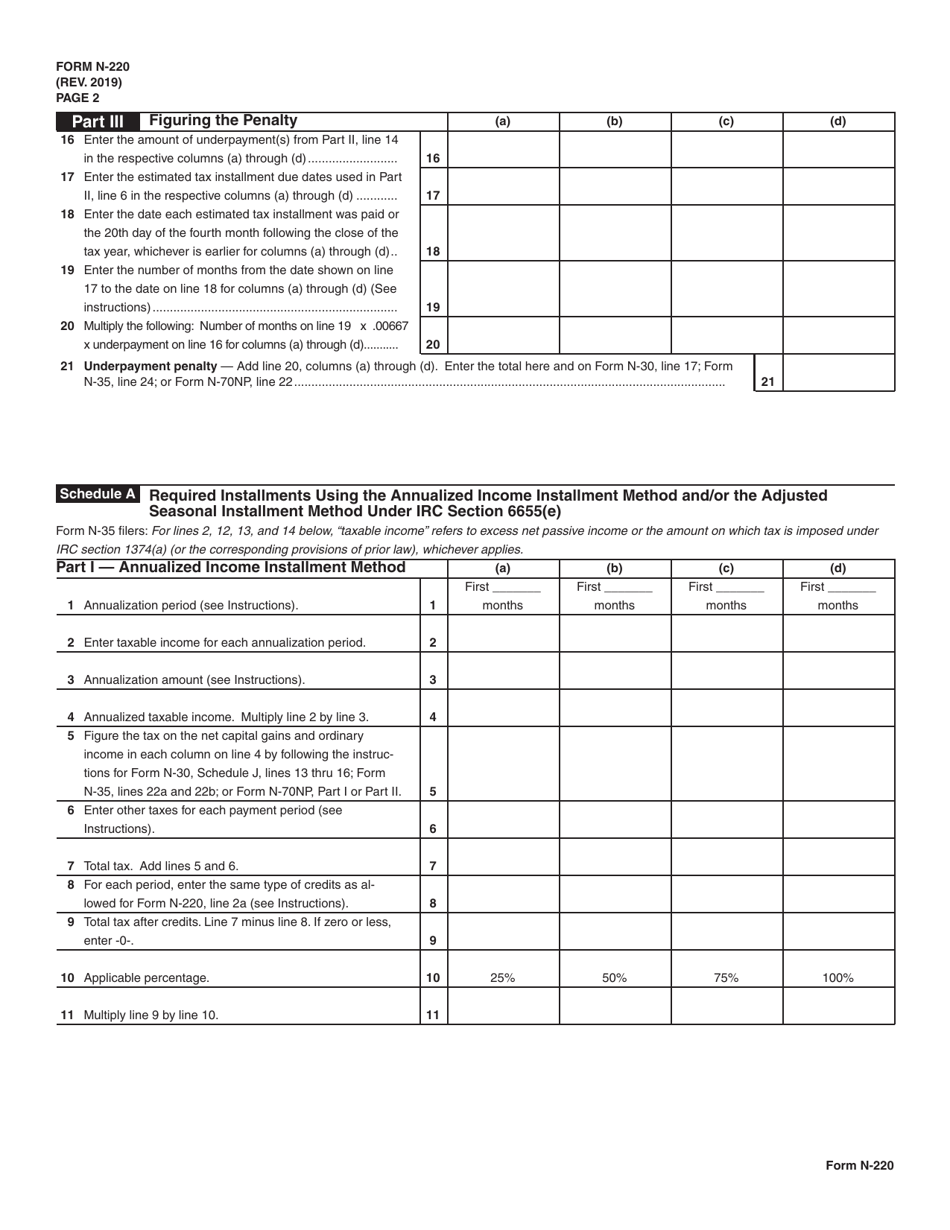

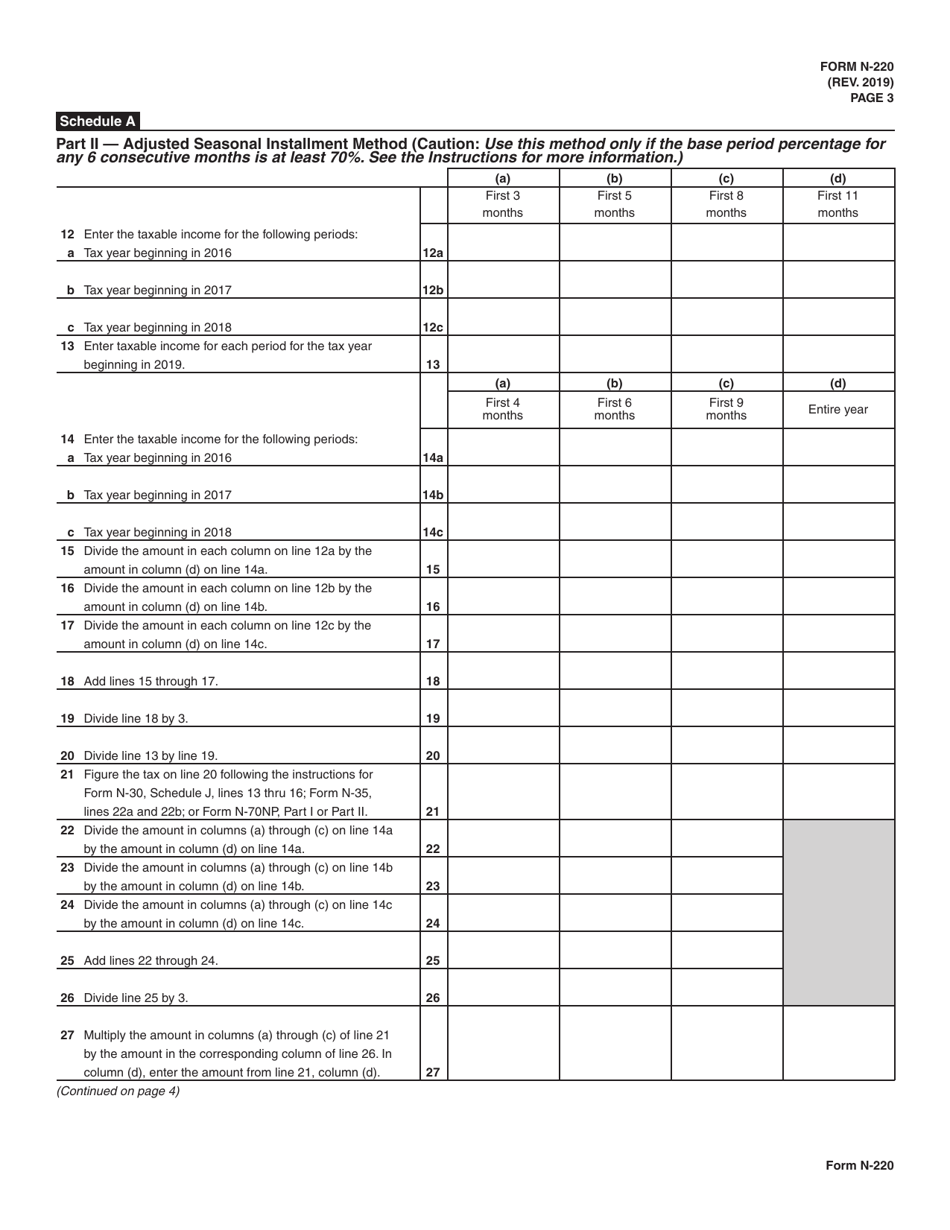

Form N-220 Underpayment of Estimated Tax by Corporations and S Corporations - Hawaii

What Is Form N-220?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-220?

A: Form N-220 is used to calculate and report underpayment of estimated tax by corporations and S corporations in Hawaii.

Q: Who should file Form N-220?

A: Corporations and S Corporations in Hawaii who have underpaid their estimated tax should file Form N-220.

Q: What is the purpose of Form N-220?

A: The purpose of Form N-220 is to calculate and report any underpayment of estimated tax by corporations and S corporations in Hawaii.

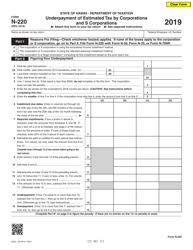

Q: When is Form N-220 due?

A: Form N-220 is due on the 20th day of the 5th month after the close of the tax year.

Q: Are there any penalties for not filing Form N-220?

A: Yes, there may be penalties for not filing Form N-220 or for underpaying estimated tax. It is important to file the form and pay any underpaid tax to avoid penalties.

Q: Can I e-file Form N-220?

A: No, electronic filing is not available for Form N-220. It must be filed by mail or in person.

Q: Do I need to include payment with Form N-220?

A: Yes, if you have underpaid your estimated tax, you must include payment with Form N-220 to avoid penalties.

Q: Can I file an amended Form N-220?

A: Yes, if you need to make changes or corrections to your original Form N-220, you can file an amended form, called Form N-220A.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-220 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.