This version of the form is not currently in use and is provided for reference only. Download this version of

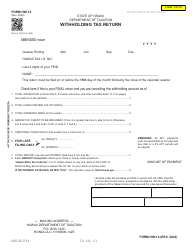

Form N-288

for the current year.

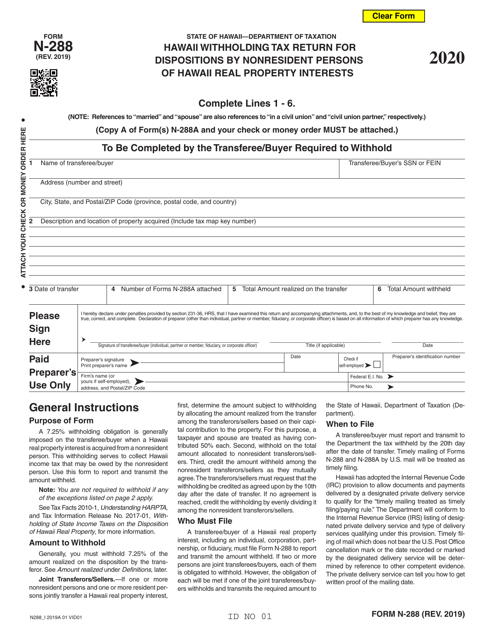

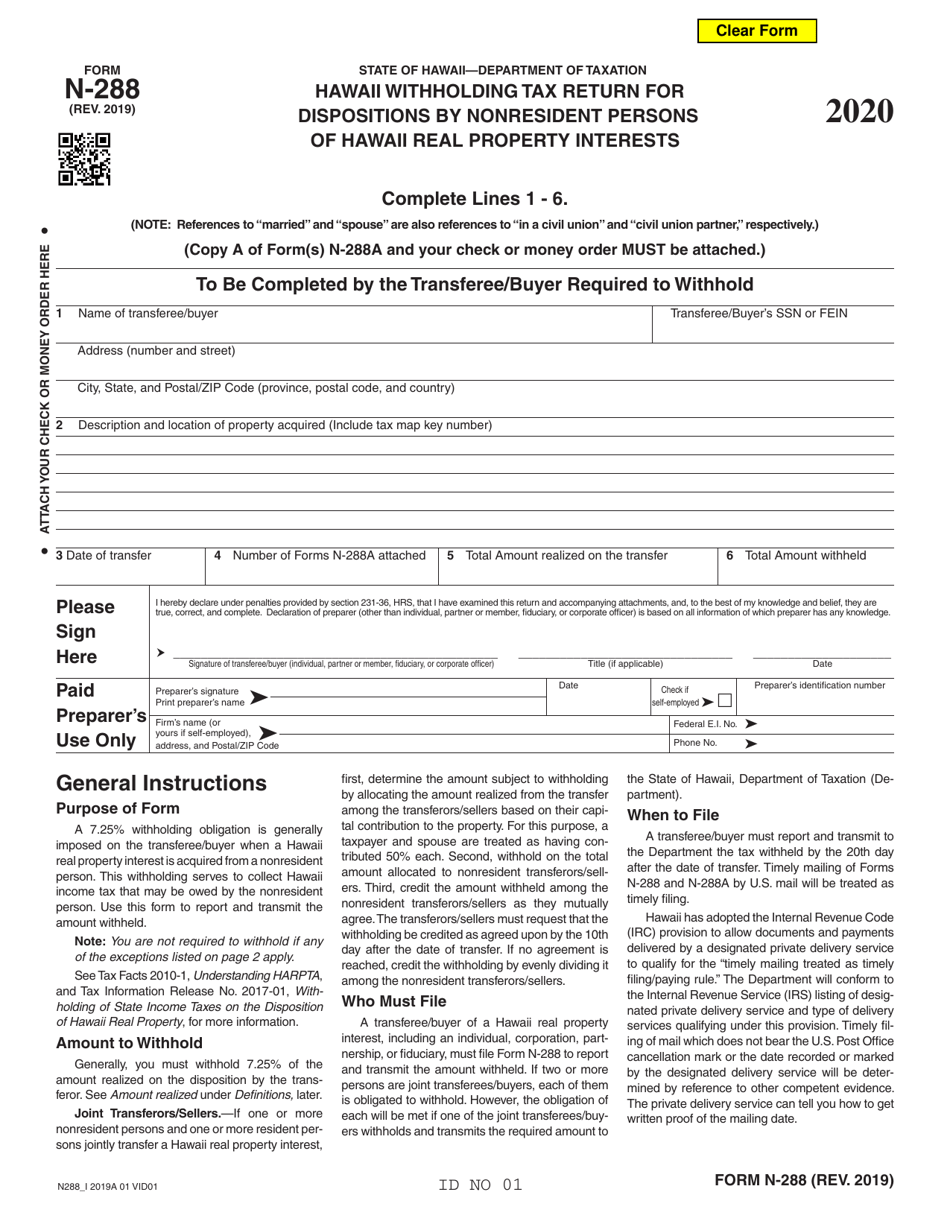

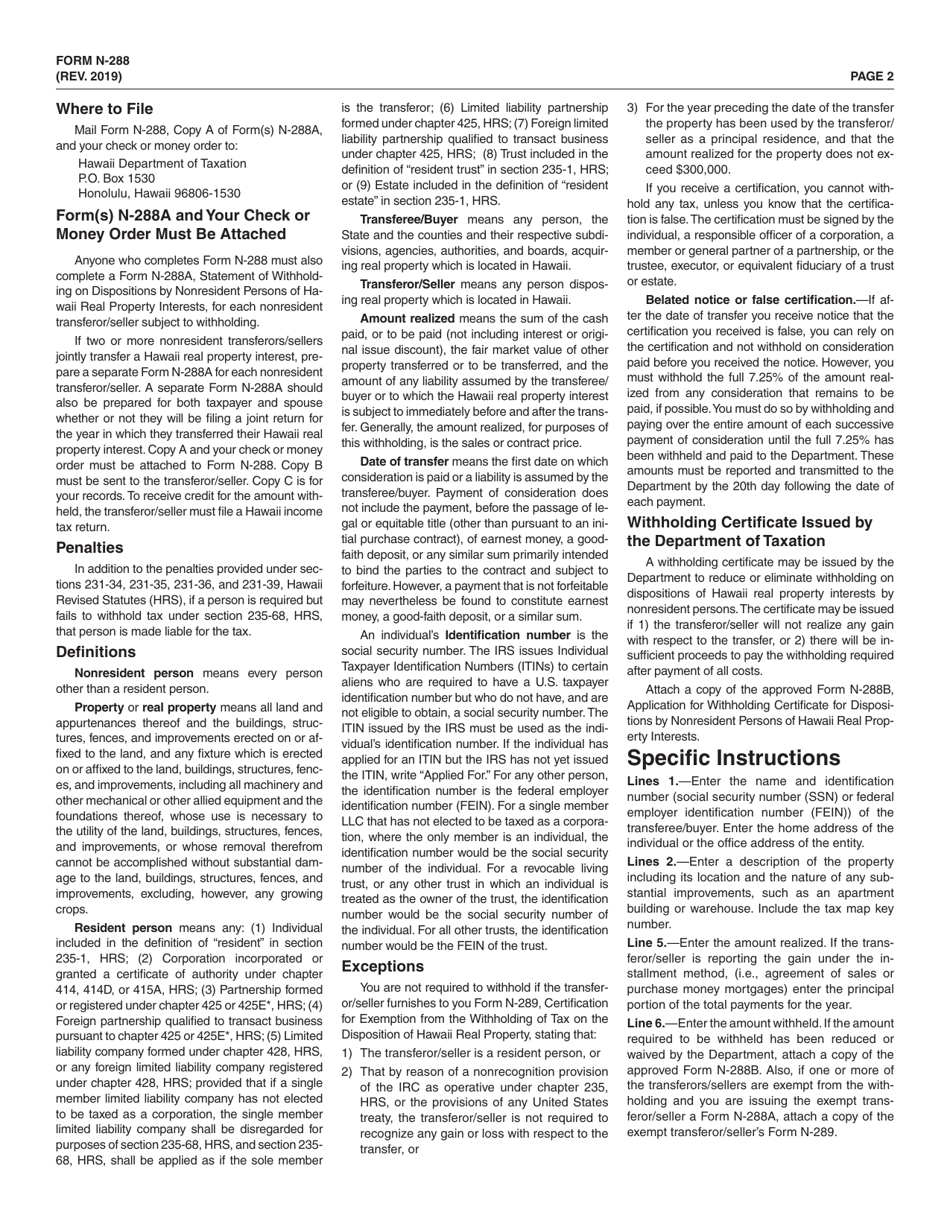

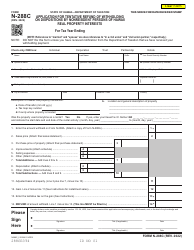

Form N-288 Hawaii Withholding Tax Return for Dispositions by Nonresident Persons of Hawaii Real Property Interests - Hawaii

What Is Form N-288?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288?

A: Form N-288 is the Hawaii Withholding Tax Return for Dispositions by Nonresident Persons of Hawaii Real Property Interests.

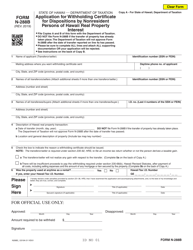

Q: Who needs to file Form N-288?

A: Nonresident persons who have disposed of Hawaii real property interests need to file Form N-288.

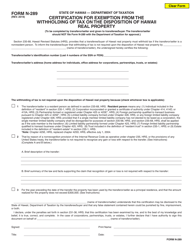

Q: What is the purpose of Form N-288?

A: The purpose of Form N-288 is to report and remit the withholding tax on the disposition of Hawaii real property interests by nonresident persons.

Q: What is the due date for filing Form N-288?

A: Form N-288 must be filed within 20 days after the transferor's or transferee's receipt of funds from the disposition of the Hawaii real property interest.

Q: Are there any penalties for not filing Form N-288?

A: Yes, there are penalties for not filing Form N-288, including interest on any unpaid tax.

Q: Can I e-file Form N-288?

A: No, Form N-288 cannot be filed electronically. It must be filed by mail.

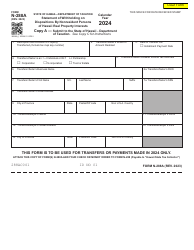

Q: Do I need to attach any supporting documents with Form N-288?

A: Yes, you need to attach a copy of the instrument creating the interest, a copy of the closing statement, and other relevant documents.

Q: How do I calculate the withholding tax on Form N-288?

A: The withholding tax is generally calculated at a rate of 7.25% of the total amount realized from the disposition, unless an exemption applies.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.