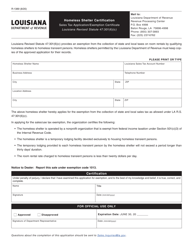

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form R-1070

for the current year.

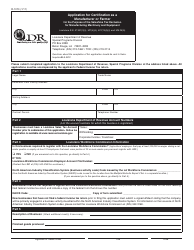

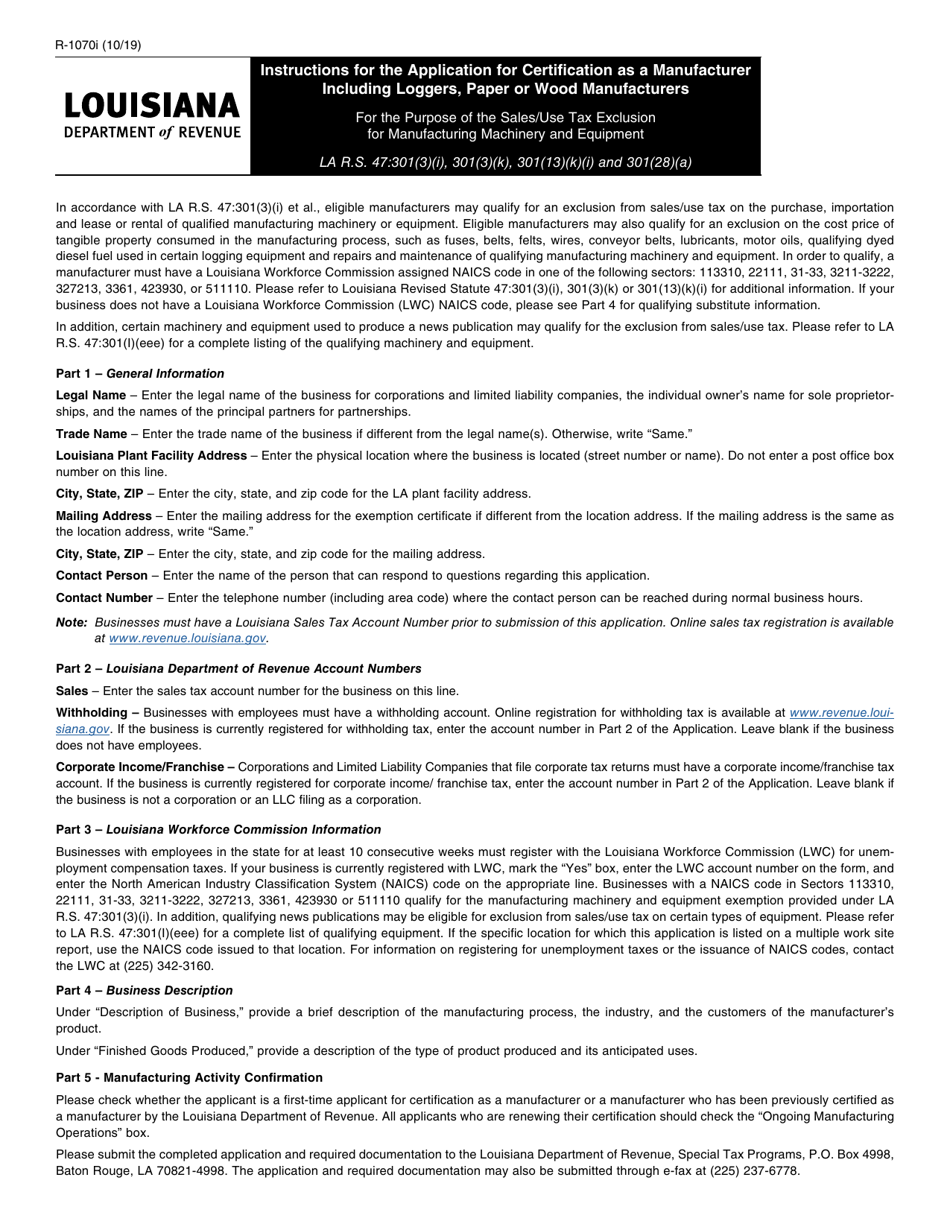

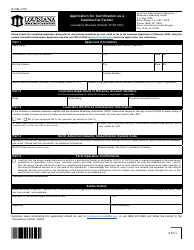

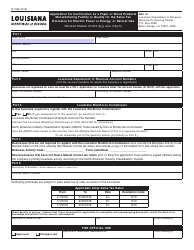

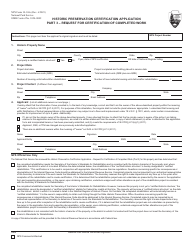

Instructions for Form R-1070 Application for Certification as a Manufacturer for the Purpose of the Sales / Use Tax Exclusion for Manufacturing Machinery and Equipment - Louisiana

This document contains official instructions for Form R-1070 , Application for Certification as a Manufacturer for the Purpose of the Sales/Use Tax Exclusion for Manufacturing Machinery and Equipment - a form released and collected by the Louisiana Department of Revenue. An up-to-date fillable Form R-1070 is available for download through this link.

FAQ

Q: What is Form R-1070?

A: Form R-1070 is an application for certification as a manufacturer for the purpose of the sales/use tax exclusion for manufacturing machinery and equipment in Louisiana.

Q: What is the purpose of Form R-1070?

A: The purpose of Form R-1070 is to apply for certification as a manufacturer in order to claim the sales/use tax exclusion for manufacturing machinery and equipment.

Q: Who needs to fill out Form R-1070?

A: Manufacturers who want to claim the sales/use tax exclusion for manufacturing machinery and equipment in Louisiana need to fill out Form R-1070.

Q: What is the sales/use tax exclusion for manufacturing machinery and equipment?

A: The sales/use tax exclusion for manufacturing machinery and equipment is a tax benefit that allows manufacturers to exclude certain machinery and equipment purchases from sales/use tax in Louisiana.

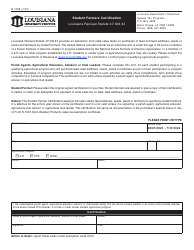

Q: What information is required on Form R-1070?

A: Form R-1070 requires information such as the manufacturer's name and address, business activities, description of machinery and equipment, and information on any previous certifications.

Q: Are there any fees associated with Form R-1070?

A: There are no fees associated with filing Form R-1070.

Q: What is the deadline for filing Form R-1070?

A: Form R-1070 should be filed with the Louisiana Department of Revenue within 180 days from the date the machinery and equipment is first placed into service.

Q: What are the consequences of providing false information on Form R-1070?

A: Providing false information on Form R-1070 may result in penalties and potential loss of the sales/use tax exclusion.

Q: Is there a separate form for claiming the sales/use tax exclusion for manufacturing machinery and equipment?

A: No, Form R-1070 is the form to be used for claiming the sales/use tax exclusion for manufacturing machinery and equipment in Louisiana.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.