This version of the form is not currently in use and is provided for reference only. Download this version of

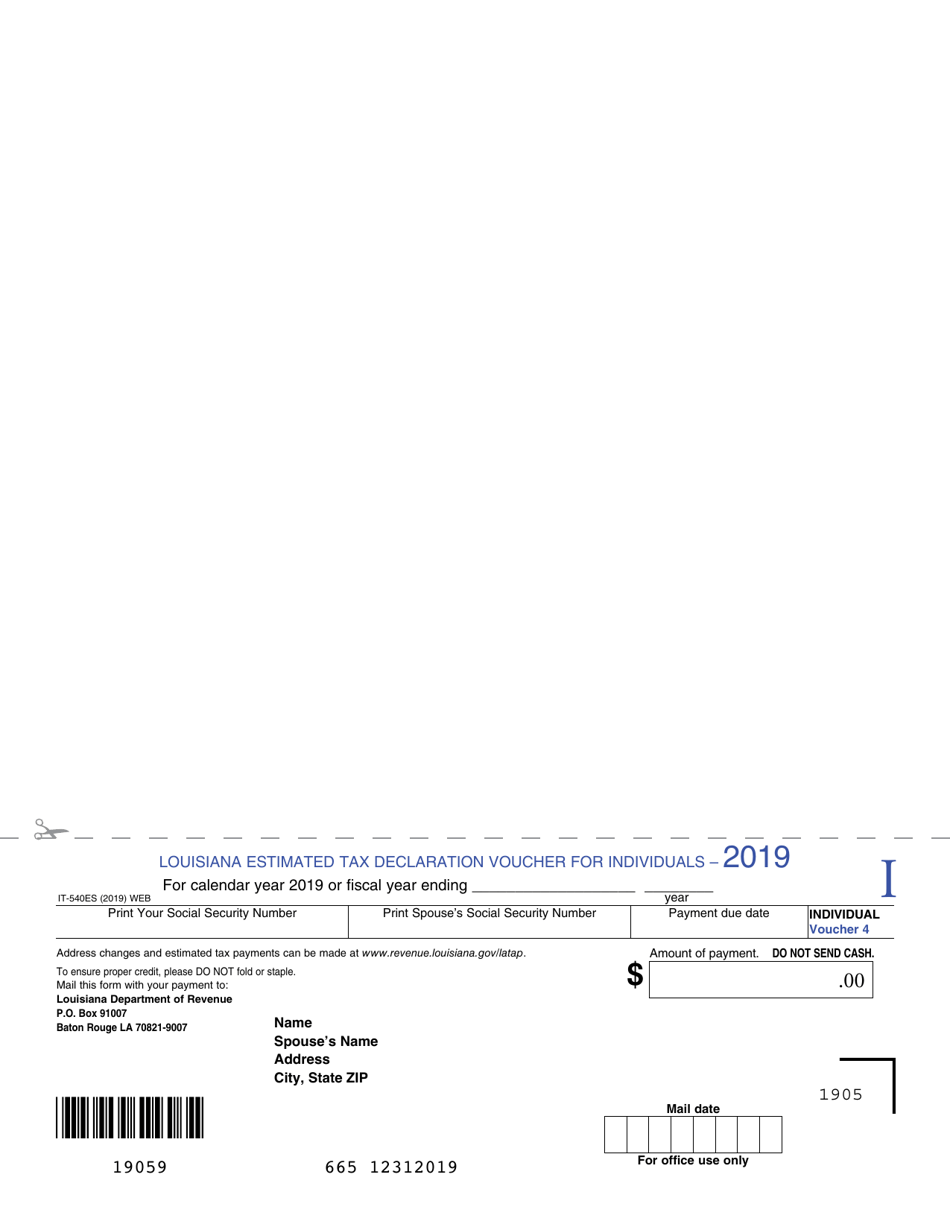

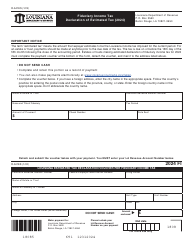

Form IT-540ES

for the current year.

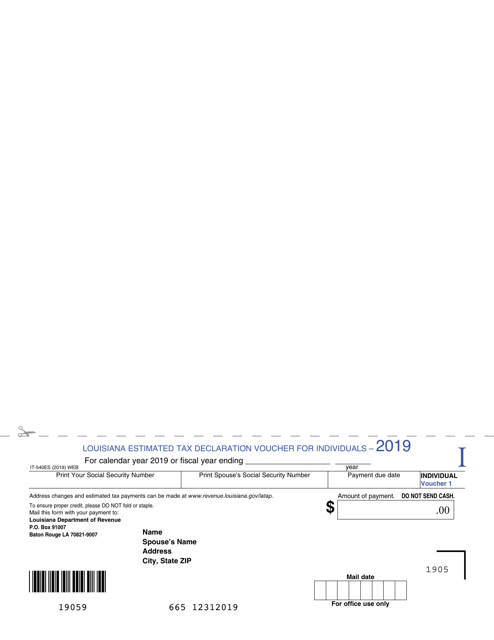

Form IT-540ES Louisiana Estimated Tax Declaration Voucher for Individuals - Louisiana

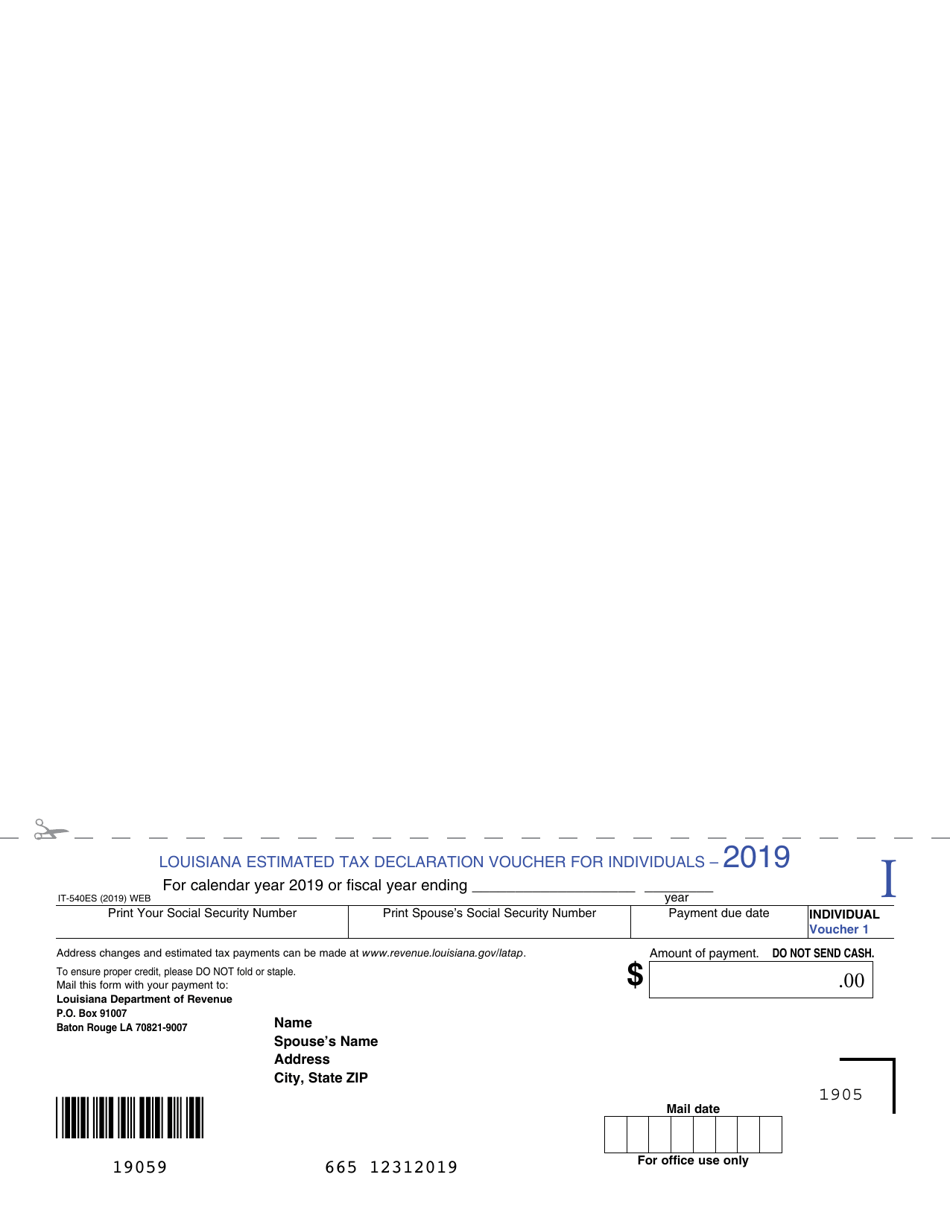

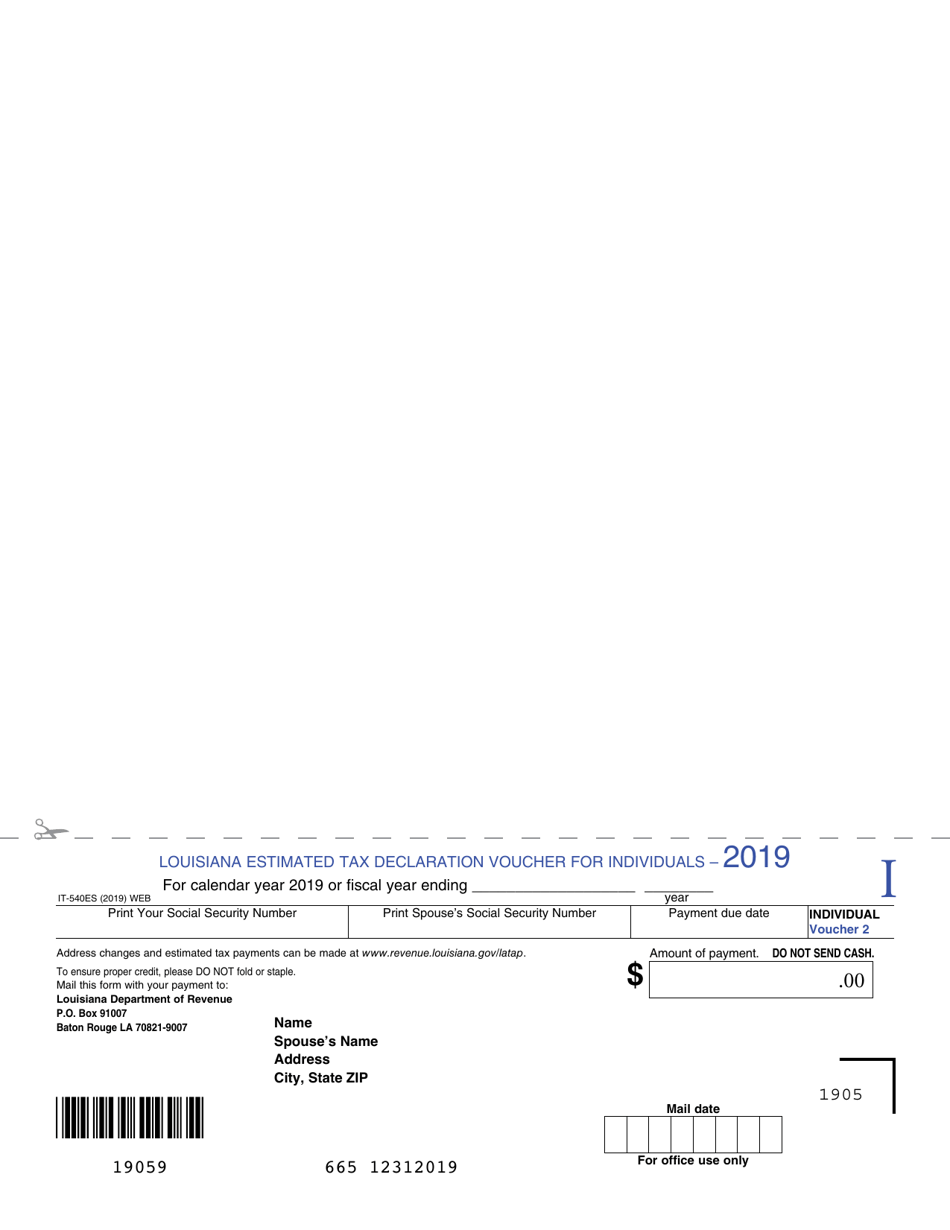

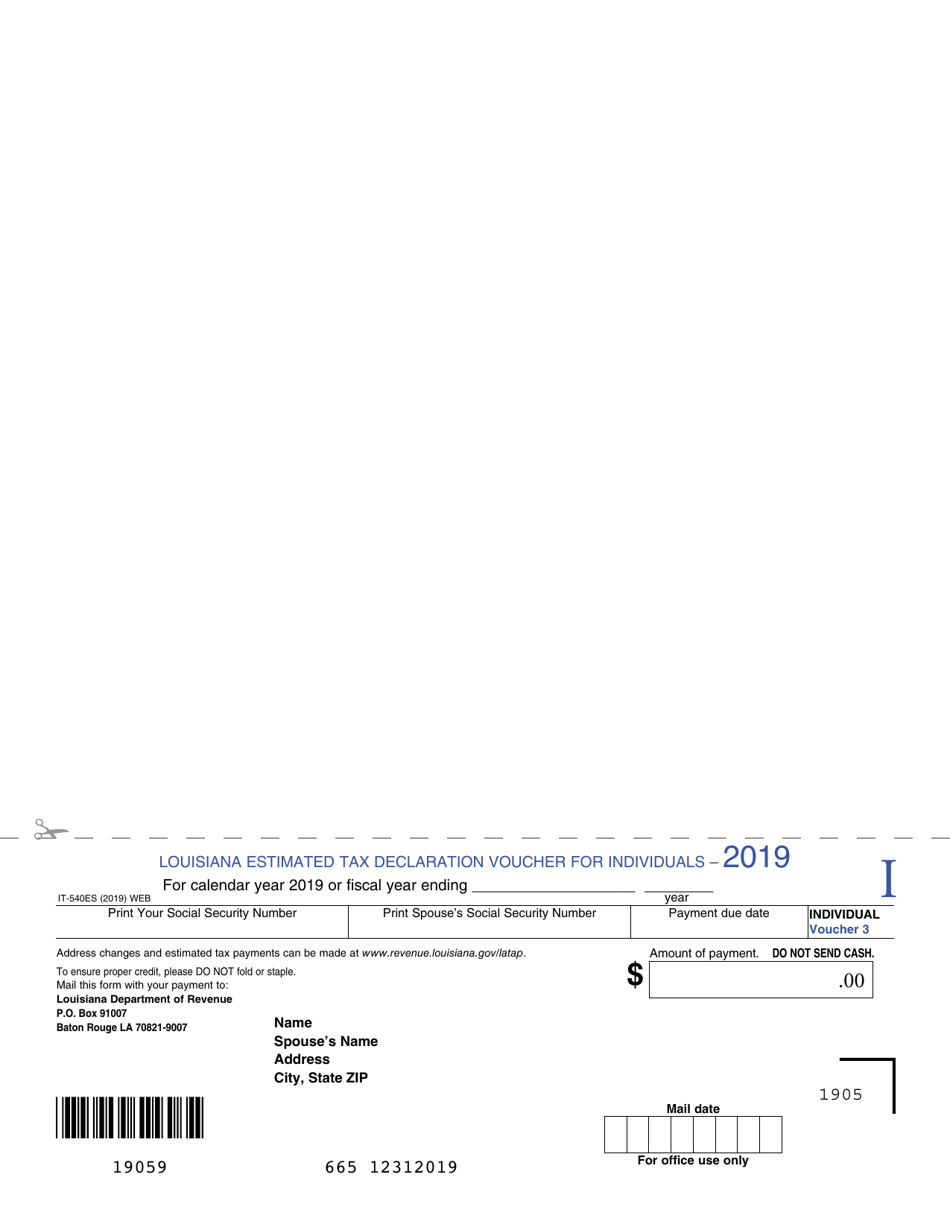

What Is Form IT-540ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-540ES?

A: Form IT-540ES is the Louisiana Estimated Tax Declaration Voucher for Individuals.

Q: Who needs to file Form IT-540ES?

A: Individuals in Louisiana who need to make estimated tax payments.

Q: What is the purpose of Form IT-540ES?

A: The purpose of Form IT-540ES is to declare and pay estimated income tax in advance.

Q: When is Form IT-540ES due?

A: Form IT-540ES is due on April 15th of each year, or for fiscal year filers, on the 15th day of the 4th, 6th, 9th, and 12th months of the fiscal year.

Q: How do I file Form IT-540ES?

A: Form IT-540ES can be filed electronically or by mail.

Q: What happens if I don't file Form IT-540ES?

A: If you are required to file Form IT-540ES and don't, you may be subject to penalties and interest on the underpaid estimated tax.

Q: Can I make changes to Form IT-540ES?

A: Yes, you can make changes to Form IT-540ES if needed.

Q: Do I need to attach any documents to Form IT-540ES?

A: No, you do not need to attach any documents to Form IT-540ES.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-540ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.