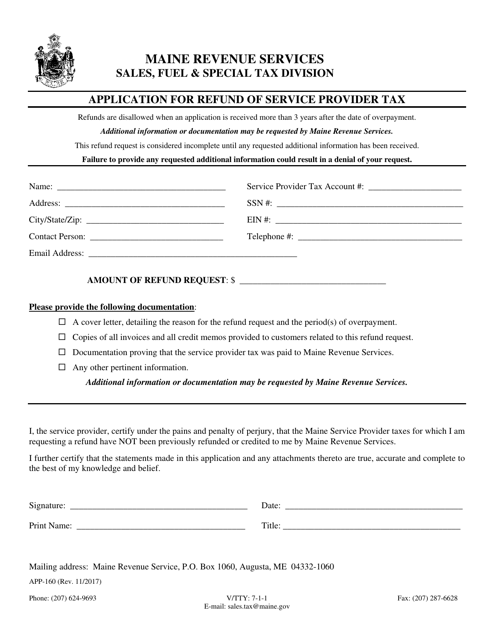

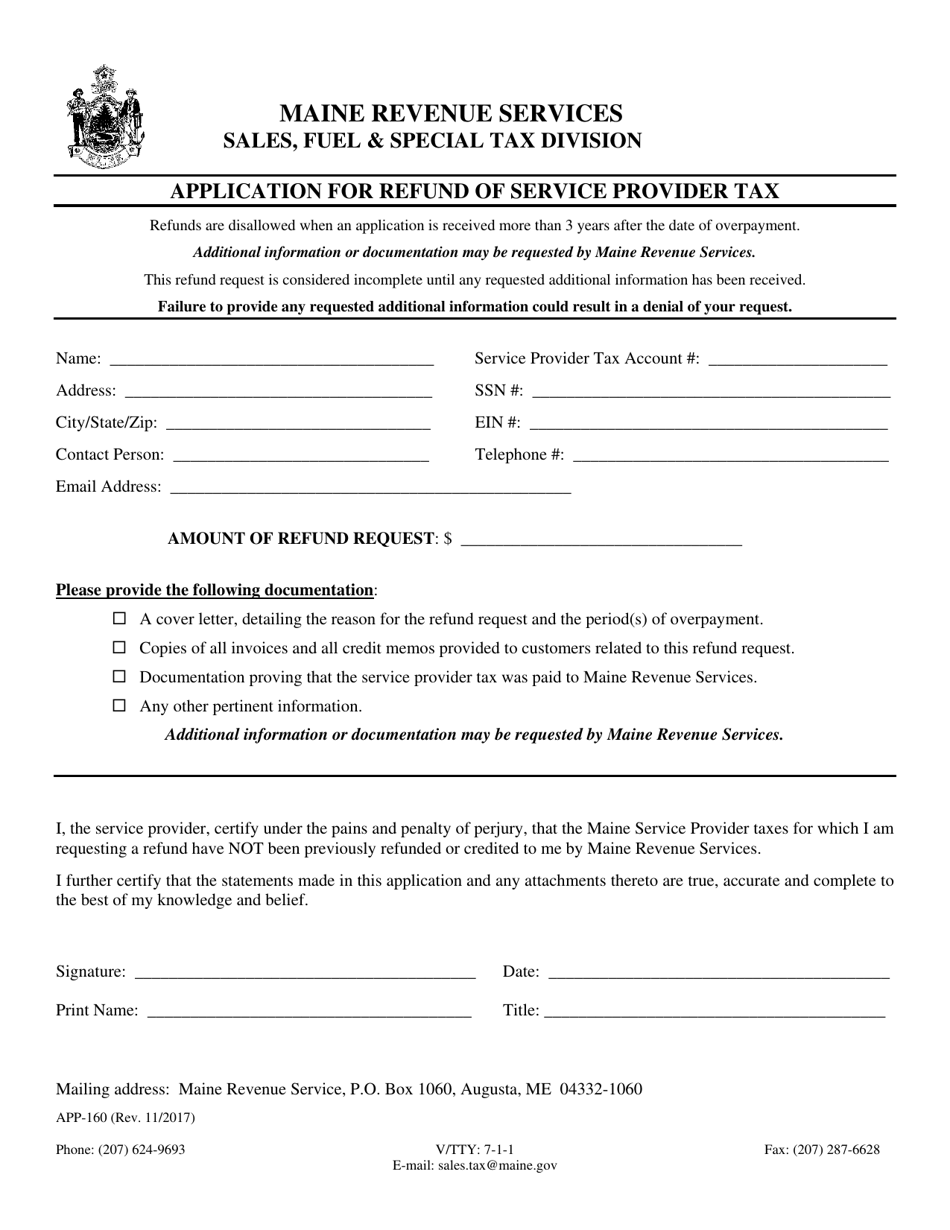

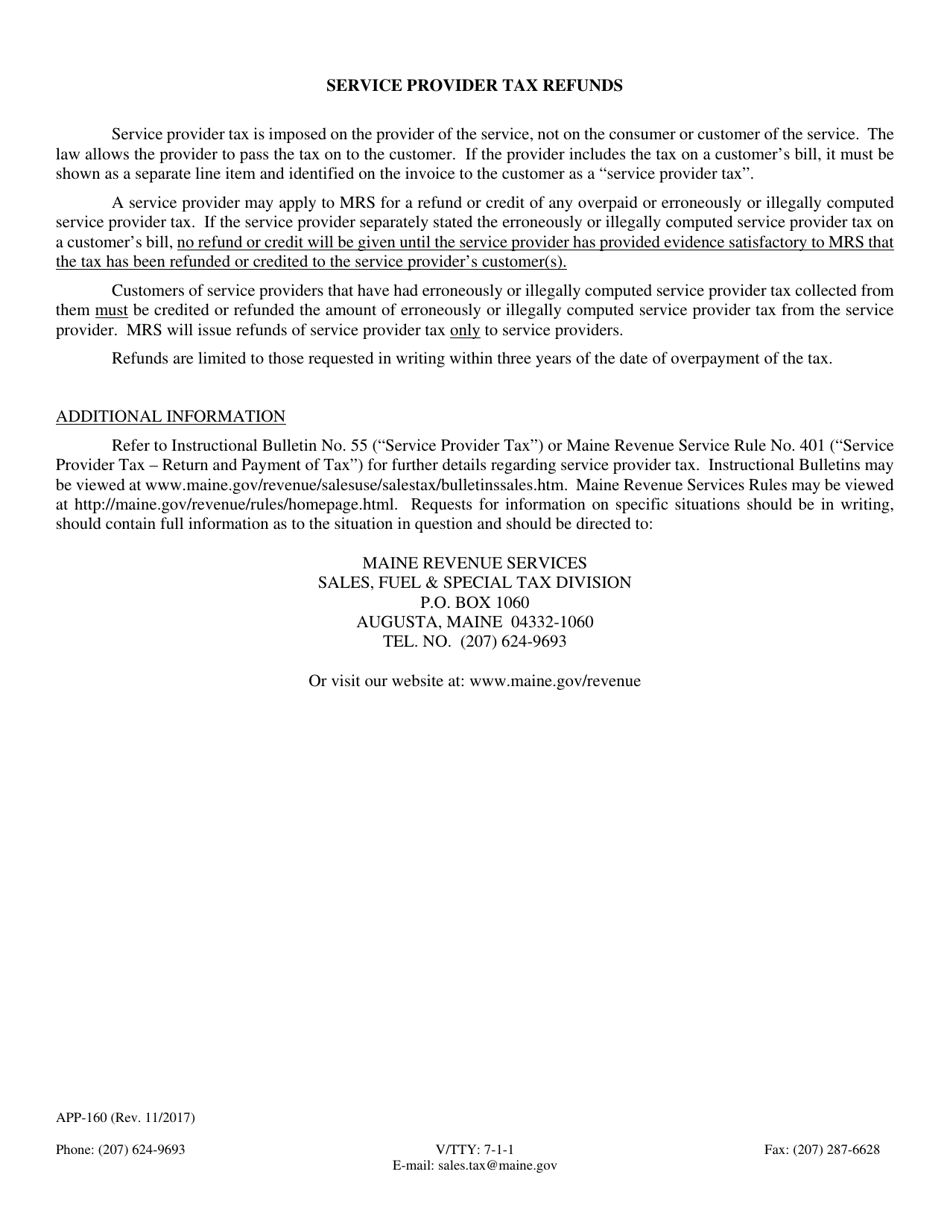

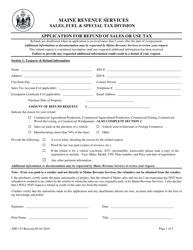

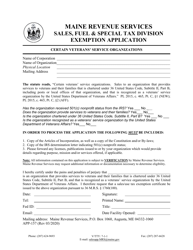

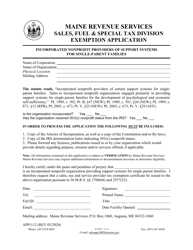

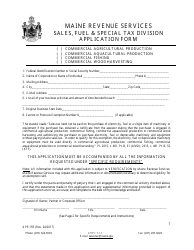

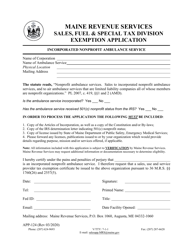

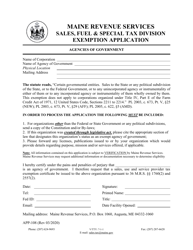

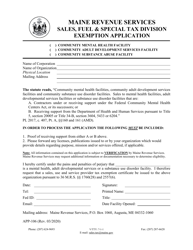

Form APP-160 Application for Refund of Service Provider Tax - Maine

What Is Form APP-160?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form APP-160?

A: Form APP-160 is the Application for Refund of Service Provider Tax - Maine.

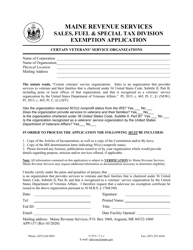

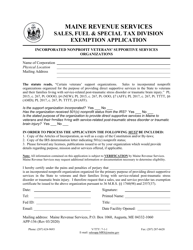

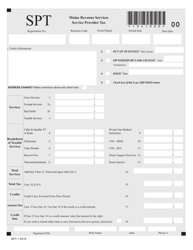

Q: Who should use Form APP-160?

A: Form APP-160 should be used by individuals or businesses who want to claim a refund of service providertax paid in Maine.

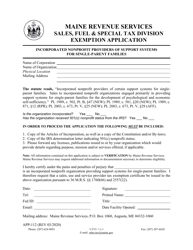

Q: What is the purpose of Form APP-160?

A: The purpose of Form APP-160 is to request a refund of service provider tax paid in Maine.

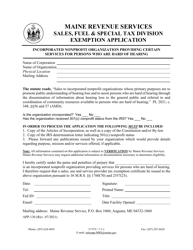

Q: Are there any filing fees for Form APP-160?

A: There are no filing fees associated with Form APP-160.

Q: What documentation do I need to include with Form APP-160?

A: You need to include supporting documents such as receipts or invoices that show the service provider tax paid.

Q: How long does it take to process a refund claim using Form APP-160?

A: It can take up to 12 weeks for the Maine Revenue Services to process a refund claim using Form APP-160.

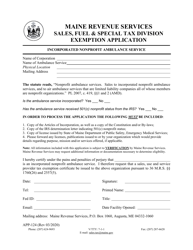

Q: Can I file Form APP-160 electronically?

A: Currently, electronic filing of Form APP-160 is not available. You must submit a paper form by mail.

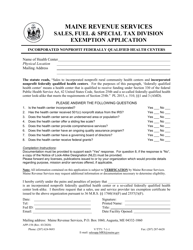

Q: What should I do if I have more questions about Form APP-160?

A: If you have more questions about Form APP-160, you can contact the Maine Revenue Services directly for assistance.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form APP-160 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.