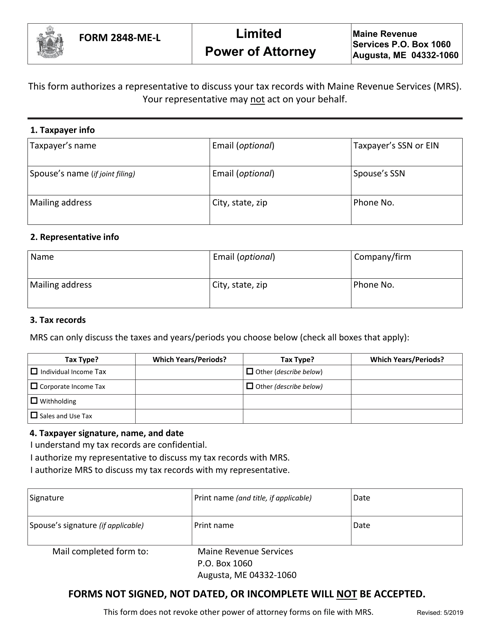

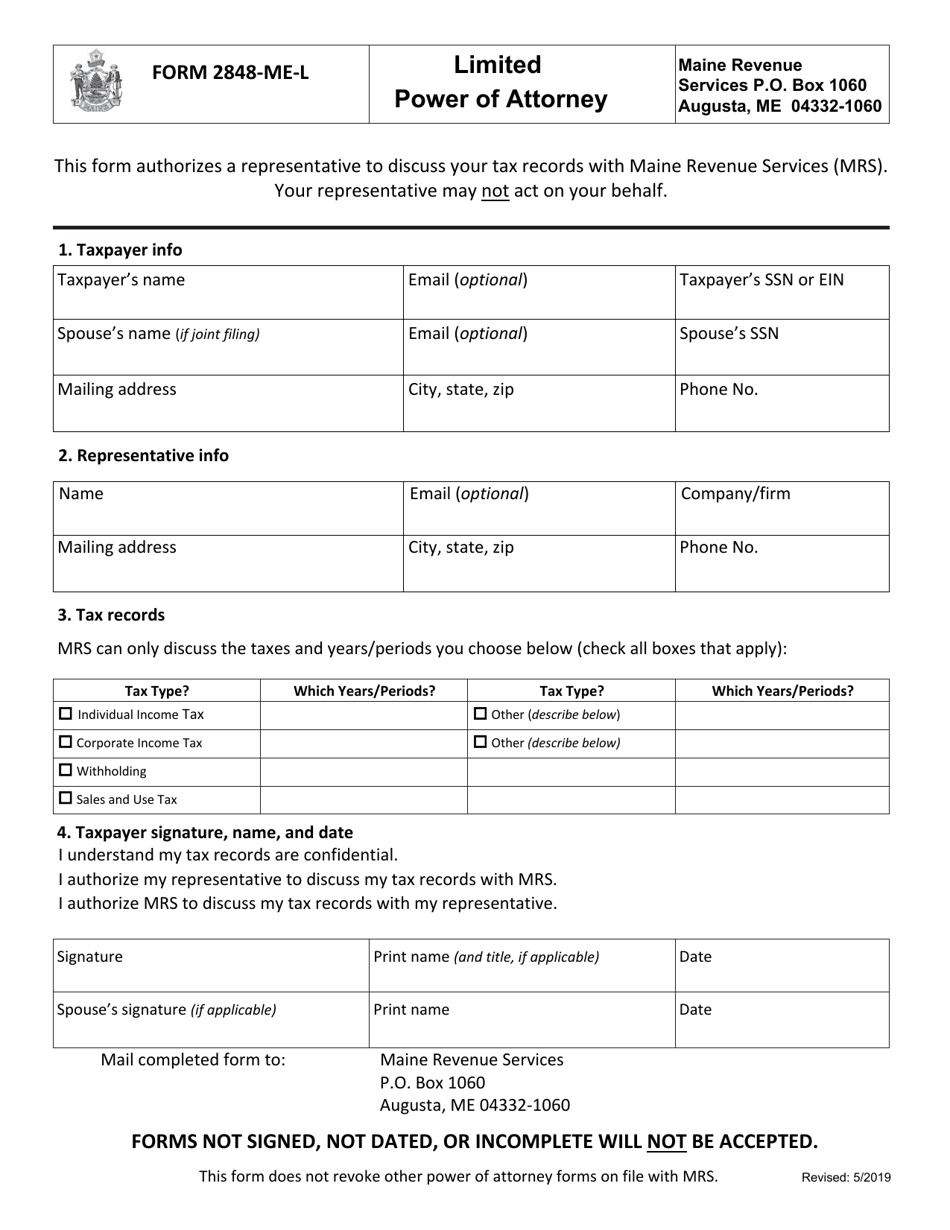

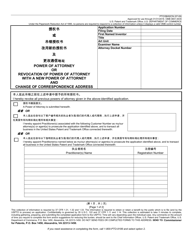

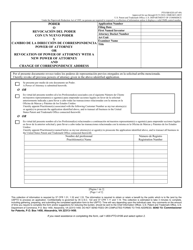

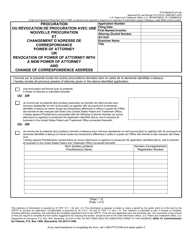

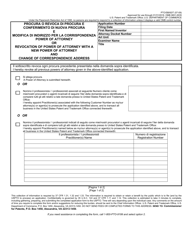

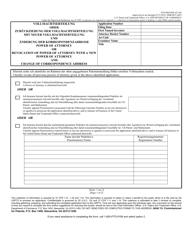

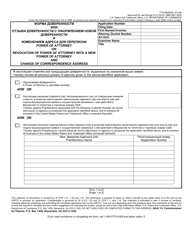

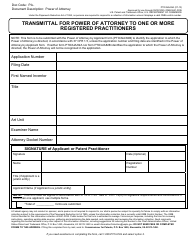

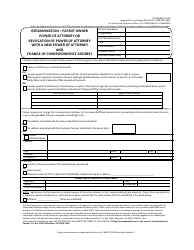

Form 2848-ME-L Limited Power of Attorney - Maine

What Is Form 2848‐ME‐L?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

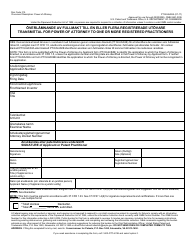

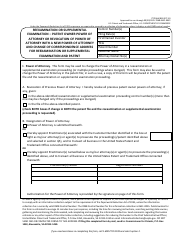

Q: What is Form 2848-ME-L?

A: Form 2848-ME-L is a Limited Power of Attorney specific to the state of Maine.

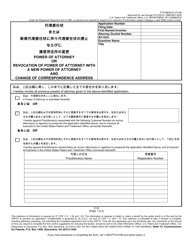

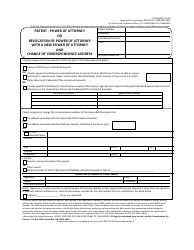

Q: What is a Limited Power of Attorney?

A: A Limited Power of Attorney grants someone the authority to act on your behalf for specific purposes or within specific limits.

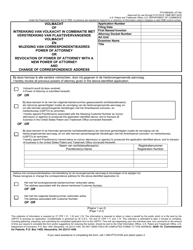

Q: What is the purpose of Form 2848-ME-L?

A: The purpose of Form 2848-ME-L is to authorize another individual to represent you in tax matters before the Maine Revenue Services.

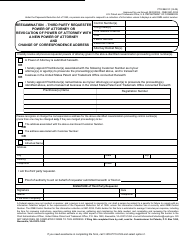

Q: Who can use Form 2848-ME-L?

A: Form 2848-ME-L can be used by individuals or businesses who need representation in tax matters in Maine.

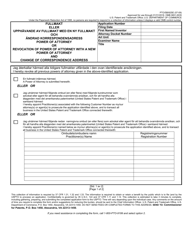

Q: Do I need to file Form 2848-ME-L with the Maine Revenue Services?

A: Yes, you need to file Form 2848-ME-L with the Maine Revenue Services to authorize someone to represent you in tax matters.

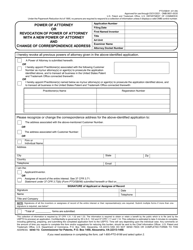

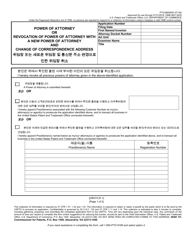

Q: Can I use Form 2848-ME-L for federal tax matters?

A: No, Form 2848-ME-L is specific to Maine tax matters. For federal tax matters, you need to use Form 2848.

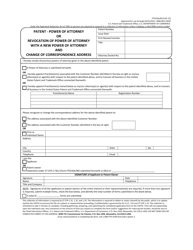

Q: How long does the authorization on Form 2848-ME-L last?

A: The authorization on Form 2848-ME-L remains in effect until it is revoked or expires, usually three years from the date of signature.

Q: Who can be appointed as a representative on Form 2848-ME-L?

A: An attorney, certified public accountant, enrolled agent, or an individual authorized to practice before the Maine Revenue Services can be appointed.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2848‐ME‐L by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.