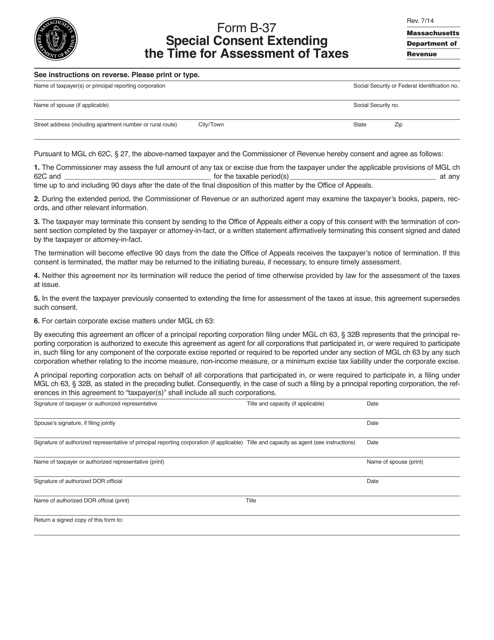

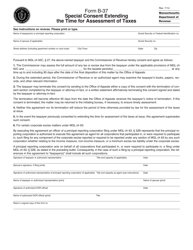

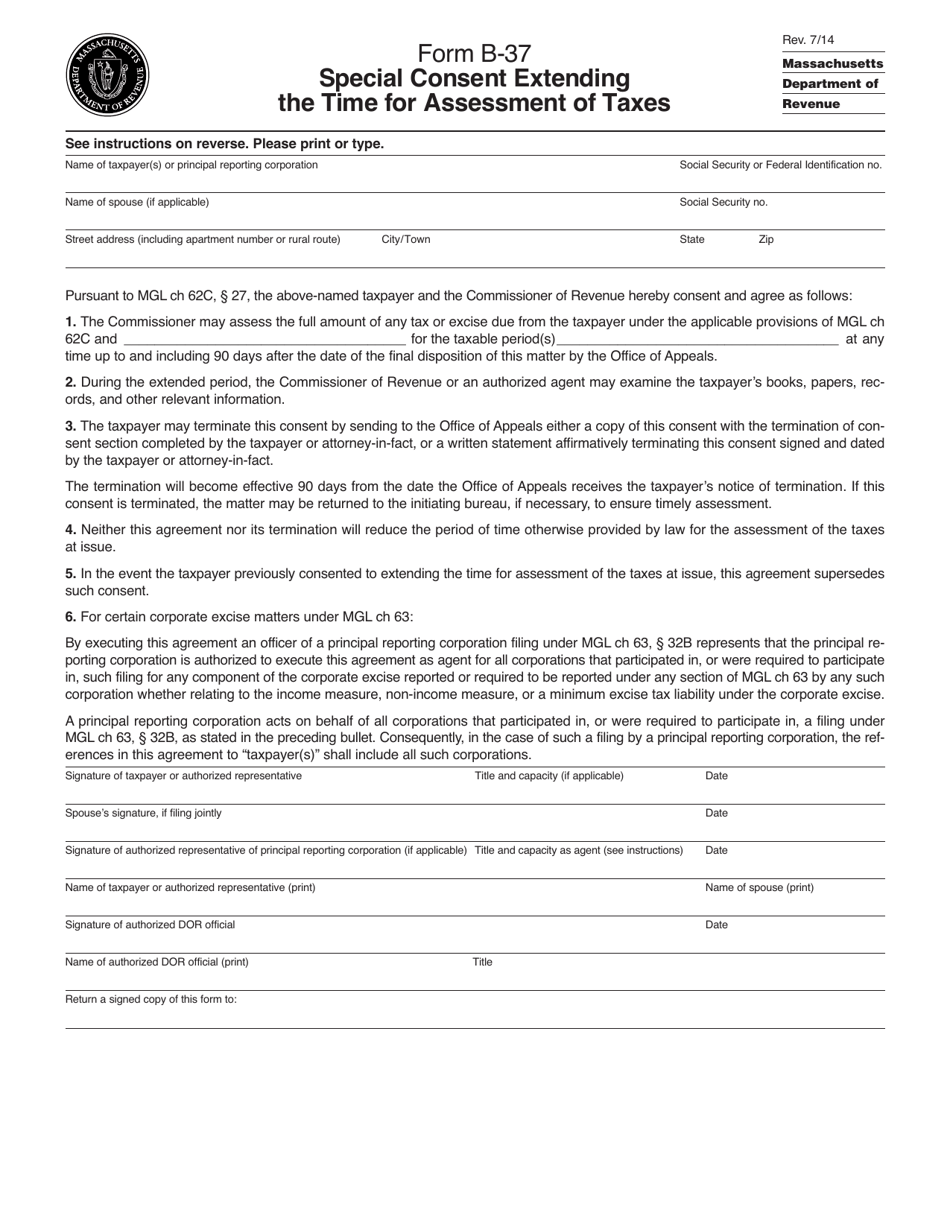

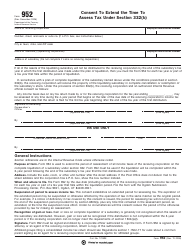

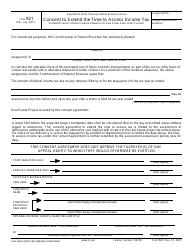

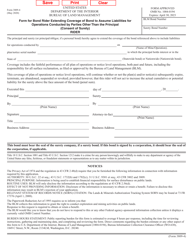

Form B-37 Special Consent Extending the Time for Assessment of Taxes - Massachusetts

What Is Form B-37?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form B-37?

A: Form B-37 is a special consent form in Massachusetts that allows the extension of time for the assessment of taxes.

Q: Why would I need to use Form B-37?

A: You would need to use Form B-37 if you need additional time for the assessment of taxes.

Q: Is there a fee to use Form B-37?

A: No, there is no fee to use Form B-37.

Q: Can Form B-37 be used for any type of taxes?

A: Yes, Form B-37 can be used for any type of taxes assessed by the Massachusetts Department of Revenue.

Q: When should I submit Form B-37?

A: Form B-37 should be submitted before the expiration of the original assessment period.

Q: What happens after I submit Form B-37?

A: After you submit Form B-37, the Massachusetts Department of Revenue will review your request and notify you of their decision.

Q: How long does the extension granted by Form B-37 last?

A: The length of the extension granted by Form B-37 will vary depending on the specific circumstances, as determined by the Massachusetts Department of Revenue.

Q: What if I need additional time beyond the extension granted by Form B-37?

A: If you need additional time beyond the extension granted by Form B-37, you will need to contact the Massachusetts Department of Revenue to discuss your situation.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-37 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.