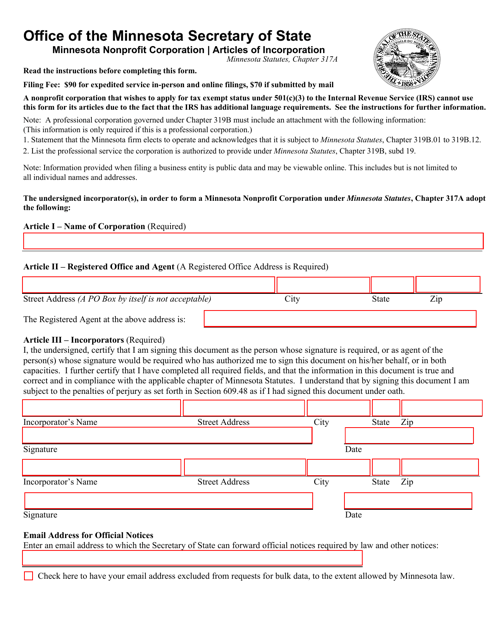

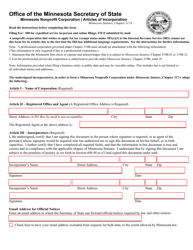

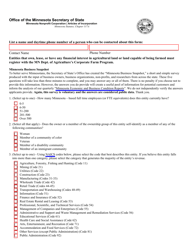

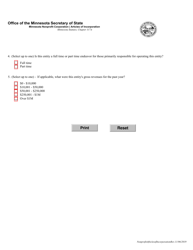

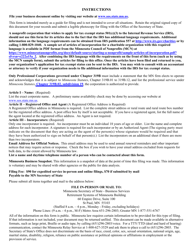

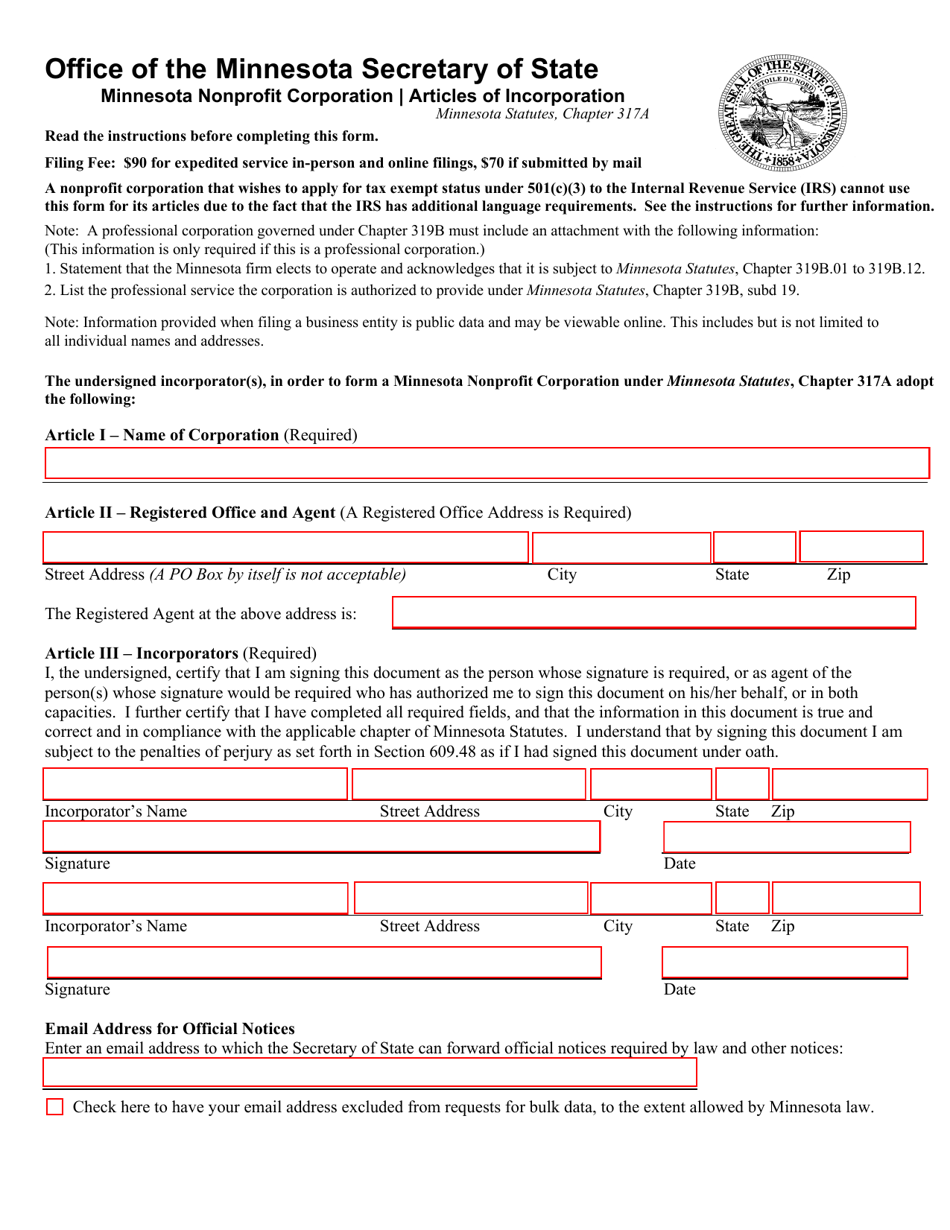

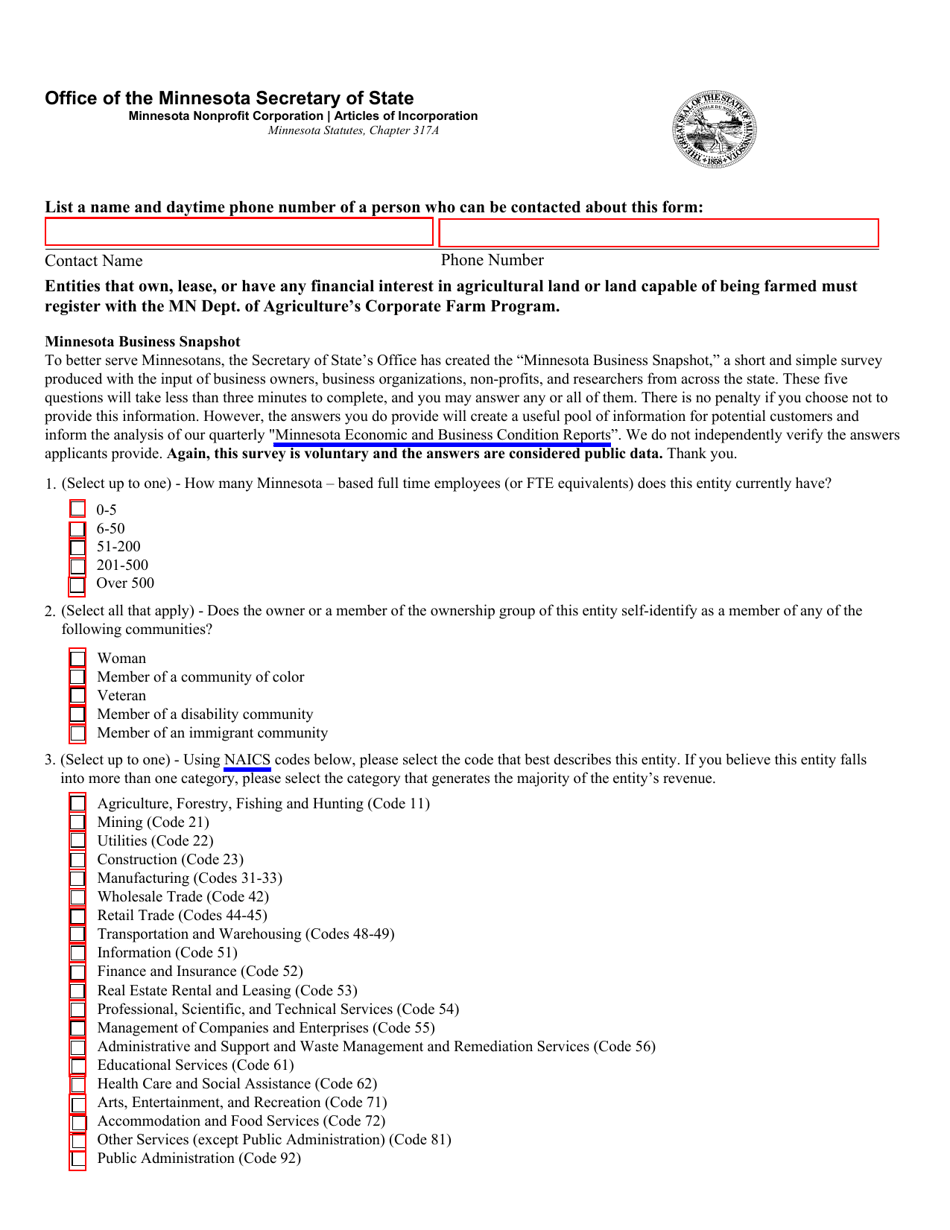

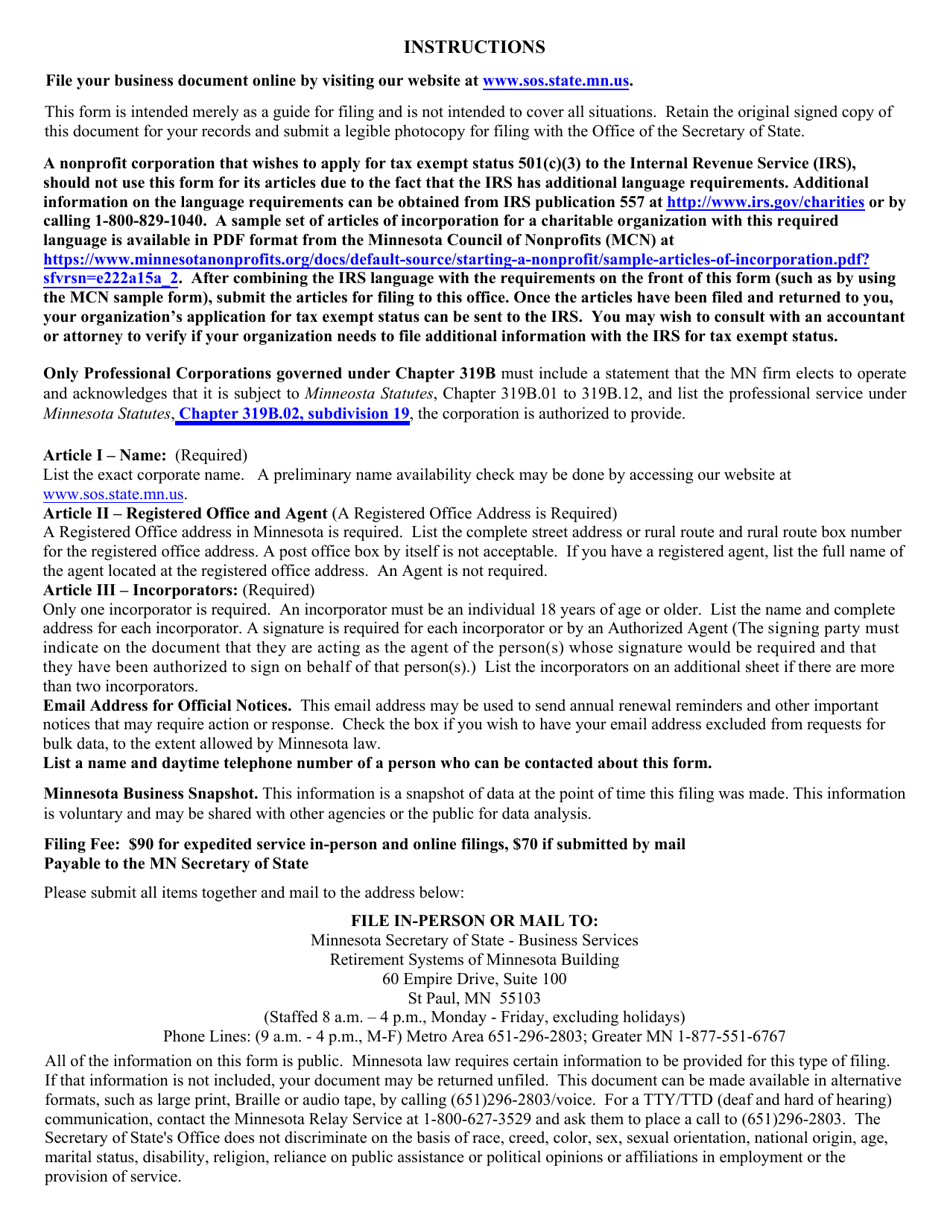

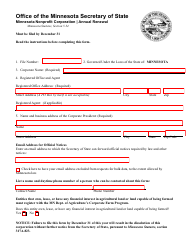

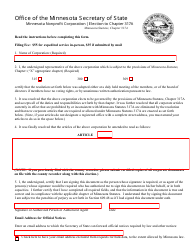

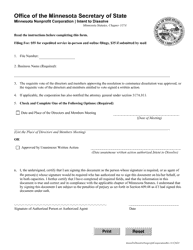

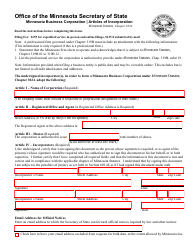

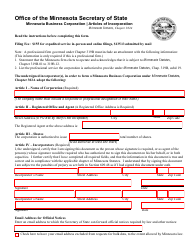

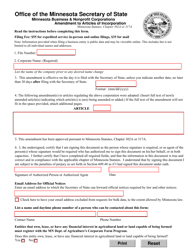

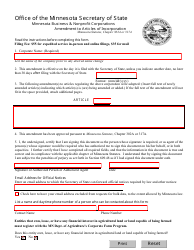

Articles of Incorporation for a Minnesota Nonprofit Corporation - Minnesota

Articles of Incorporation for a Minnesota Nonprofit Corporation is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What are Articles of Incorporation?

A: Articles of Incorporation are legal documents that establish the existence of a corporation and outline its basic structure and purpose.

Q: What is a nonprofit corporation?

A: A nonprofit corporation is an organization that is formed for a specific purpose other than making a profit. Its primary focus is on serving the community or advancing a particular cause.

Q: Why is it important to have Articles of Incorporation for a nonprofit?

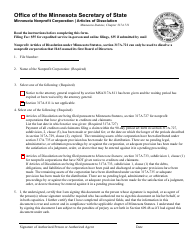

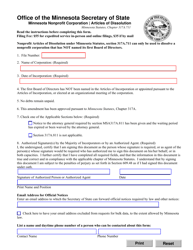

A: Articles of Incorporation are important because they legally establish the nonprofit corporation and provide guidelines for its operations and governance.

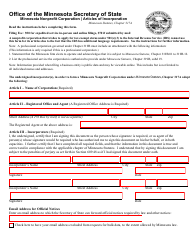

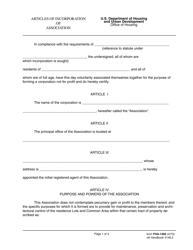

Q: What information is typically included in Articles of Incorporation?

A: Typically, Articles of Incorporation will include the corporation's name, purpose, registered agent, initial board of directors, and any limitations on its activities.

Q: Are there any specific requirements for nonprofit corporations in Minnesota?

A: Yes, in Minnesota, nonprofit corporations must include specific clauses in their Articles of Incorporation, such as a dissolution clause and a public benefit clause.

Q: Can I form a nonprofit corporation in Minnesota?

A: Yes, you can form a nonprofit corporation in Minnesota by filing the Articles of Incorporation with the Minnesota Secretary of State's office.

Q: Is there a fee to file the Articles of Incorporation?

A: Yes, there is a fee to file the Articles of Incorporation in Minnesota. The fee may vary, so it's best to check with the Secretary of State's office for the current fee schedule.

Q: Are there any ongoing requirements for nonprofit corporations in Minnesota?

A: Yes, nonprofit corporations in Minnesota are required to file an annual report and maintain certain records and compliance with state laws.

Q: Can I draft my own Articles of Incorporation?

A: Yes, you can draft your own Articles of Incorporation for a nonprofit corporation, but it is recommended to seek legal advice or use a template provided by the Secretary of State's office.

Form Details:

- Released on November 6, 2019;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.