This version of the form is not currently in use and is provided for reference only. Download this version of

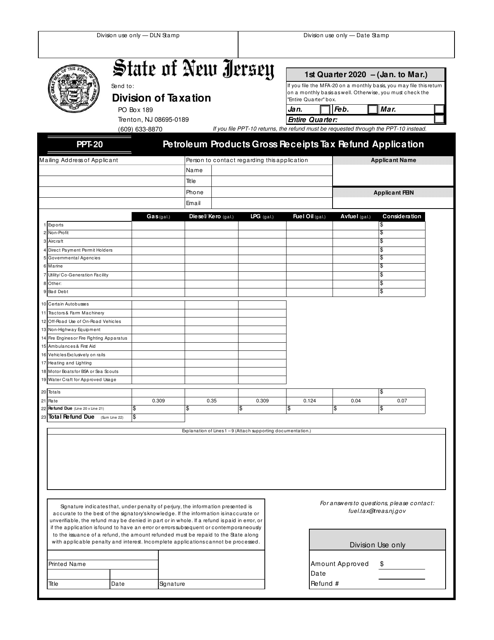

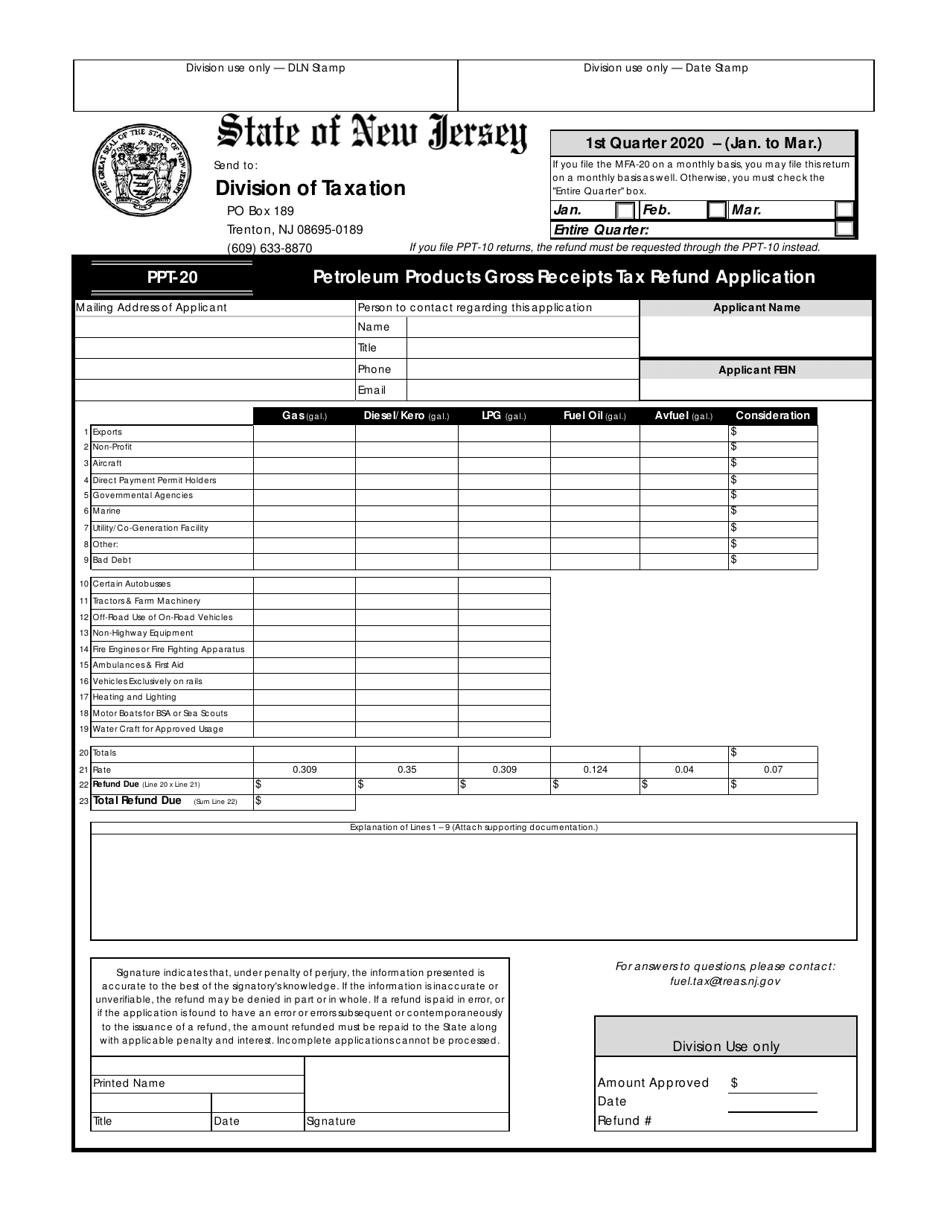

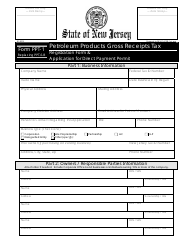

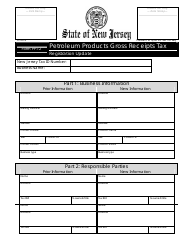

Form PPT-20

for the current year.

Form PPT-20 Petroleum Products Gross Receipts Tax Refund Application - 1st Quarter 2020 (Jan. to MAR.) - New Jersey

What Is Form PPT-20?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-20?

A: Form PPT-20 is the Petroleum ProductsGross Receipts Tax Refund Application.

Q: What is the purpose of Form PPT-20?

A: The purpose of Form PPT-20 is to apply for a refund of the Petroleum Products Gross Receipts Tax.

Q: Which quarter does Form PPT-20 cover?

A: Form PPT-20 covers the 1st quarter of the year, from January to March.

Q: What is the deadline for submitting Form PPT-20 for the 1st quarter of 2020?

A: The deadline for submitting Form PPT-20 for the 1st quarter of 2020 is typically in April.

Q: Who is eligible to use Form PPT-20?

A: Businesses or individuals who have paid the Petroleum Products Gross Receipts Tax and are eligible for a refund can use Form PPT-20.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PPT-20 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.