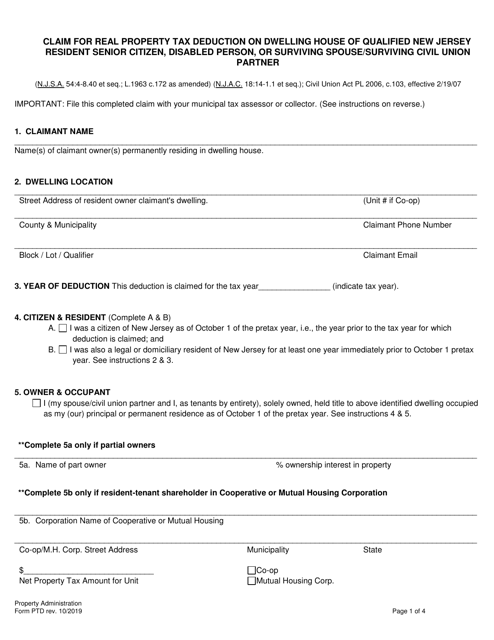

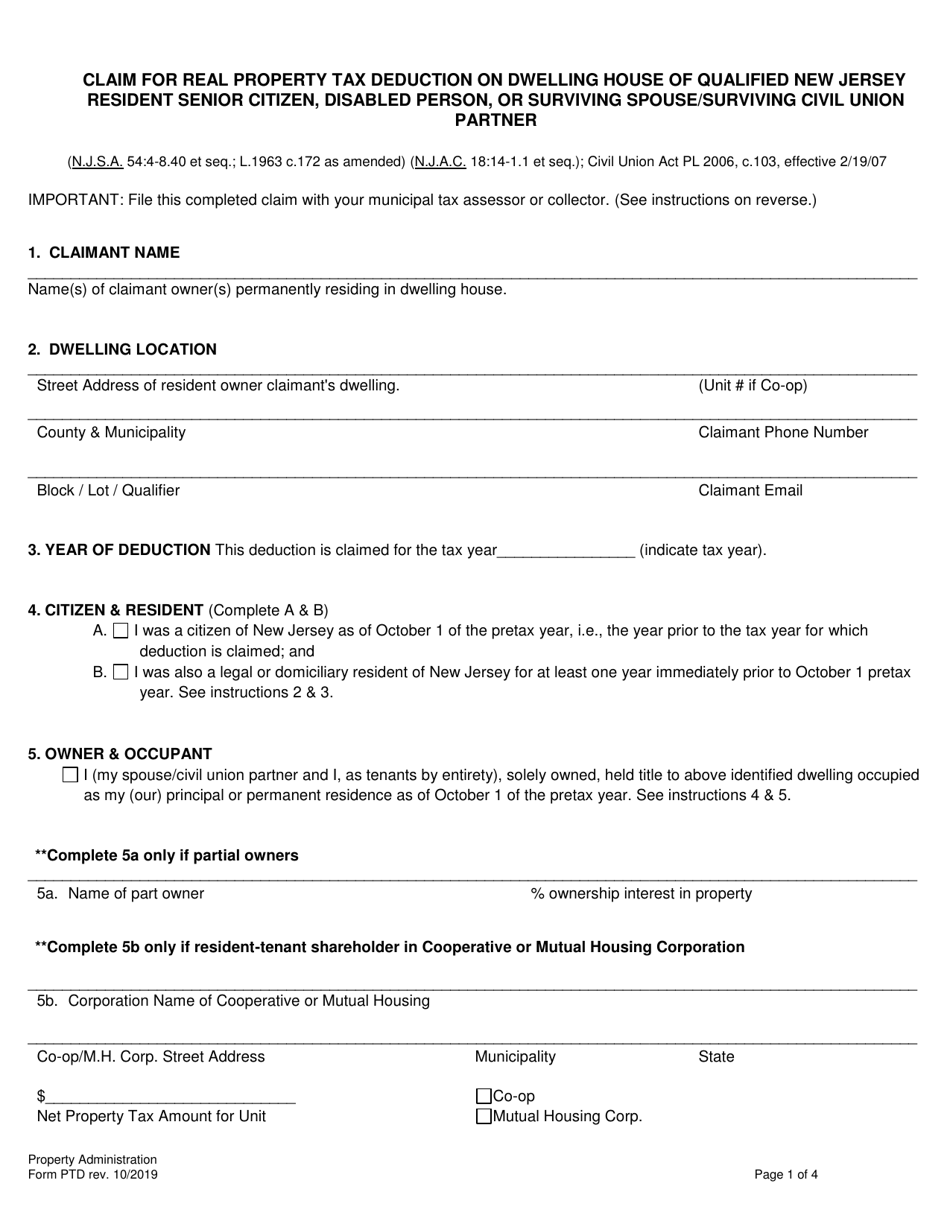

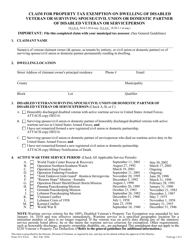

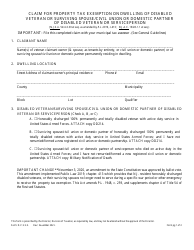

Form PTD Claim for Real Property Tax Deduction on Dwelling House of Qualified New Jersey Resident Senior Citizen, Disabled Person, or Surviving Spouse / Surviving Civil Union Partner - New Jersey

What Is Form PTD?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

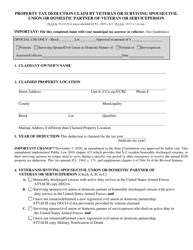

Q: Who can claim the Real PropertyTax Deduction on a dwelling house in New Jersey?

A: Qualified New Jersey Resident Senior Citizen, Disabled Person, or Surviving Spouse/Surviving Civil Union Partner

Q: What is the purpose of the Real Property Tax Deduction?

A: To provide tax relief to eligible individuals on their property taxes

Q: How do I apply for the Real Property Tax Deduction?

A: You need to complete the Form PTD and submit it to your municipal tax assessor's office

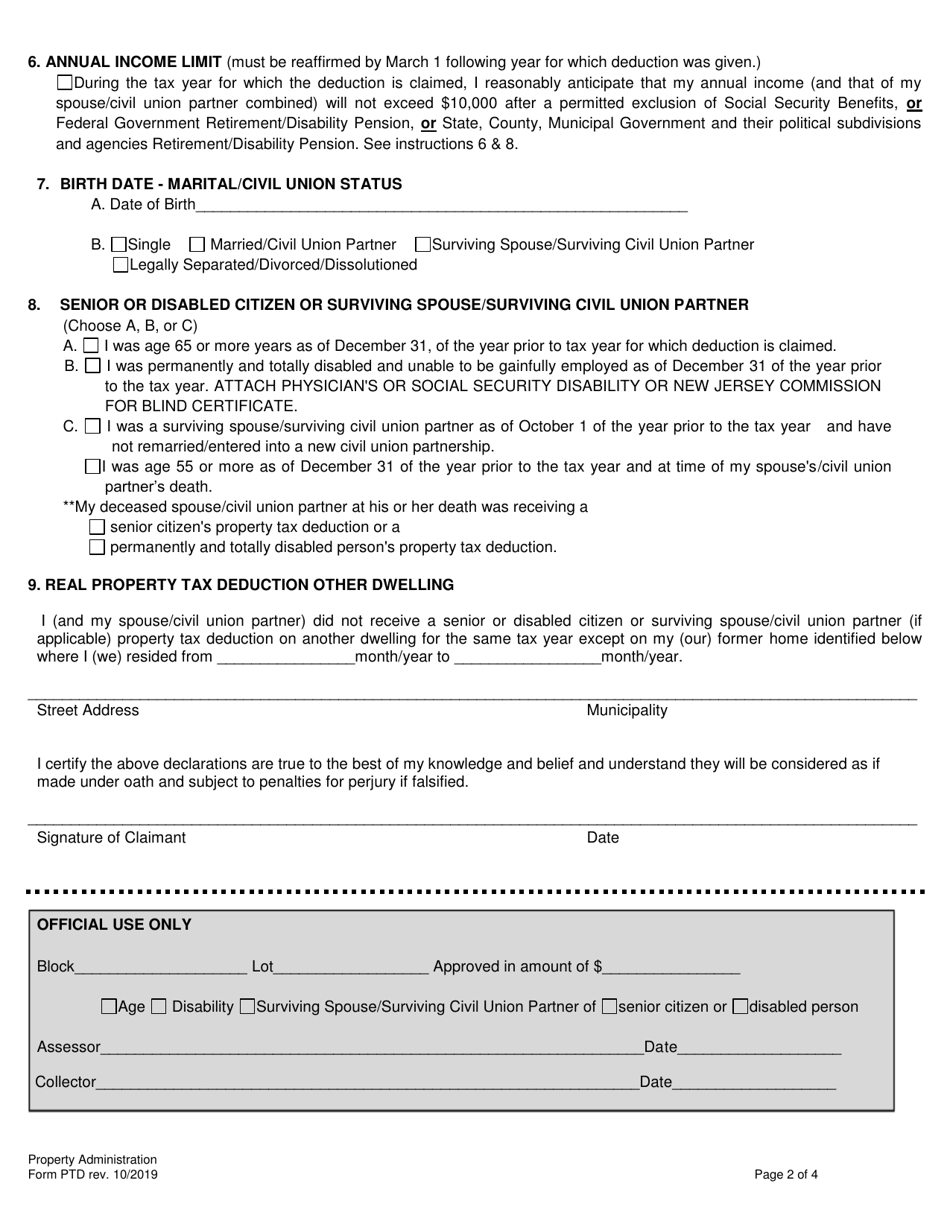

Q: Who is considered a qualified New Jersey resident senior citizen?

A: A person who is 65 years of age or older

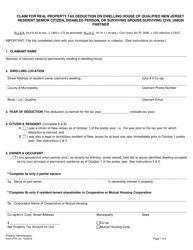

Q: What are the eligibility criteria for the Real Property Tax Deduction?

A: You must meet certain income, residency, and ownership requirements

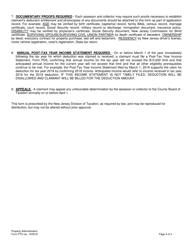

Q: What documents are required to support my application?

A: You may need to provide proof of age, disability, residency, and income

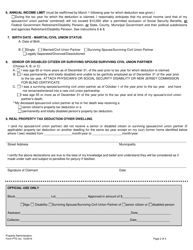

Q: What is the deadline to apply for the Real Property Tax Deduction?

A: The deadline is usually February 1st of each year

Q: How much is the Real Property Tax Deduction?

A: The amount varies depending on your income and other factors

Q: Can I claim the Real Property Tax Deduction if I rent a property?

A: No, the deduction is only available for homeowners

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTD by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.