This version of the form is not currently in use and is provided for reference only. Download this version of

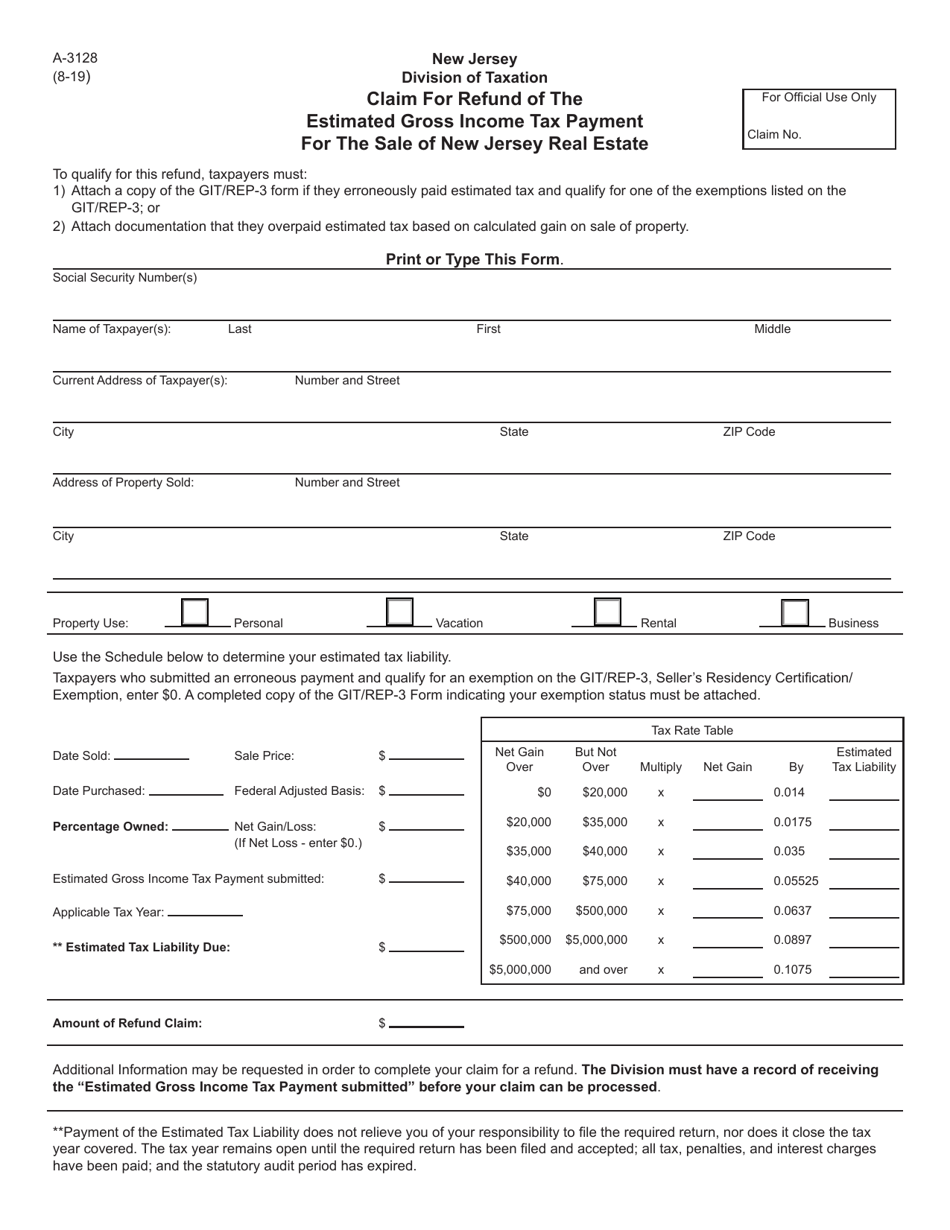

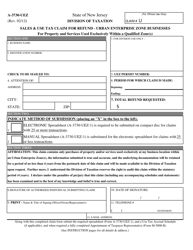

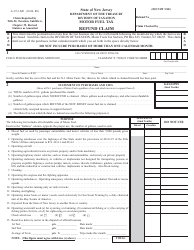

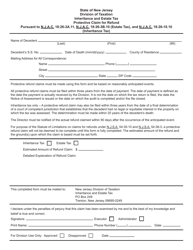

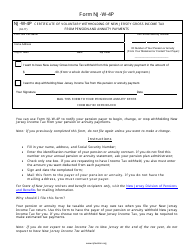

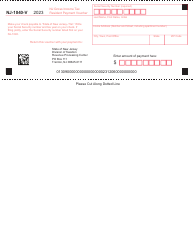

Form A-3128

for the current year.

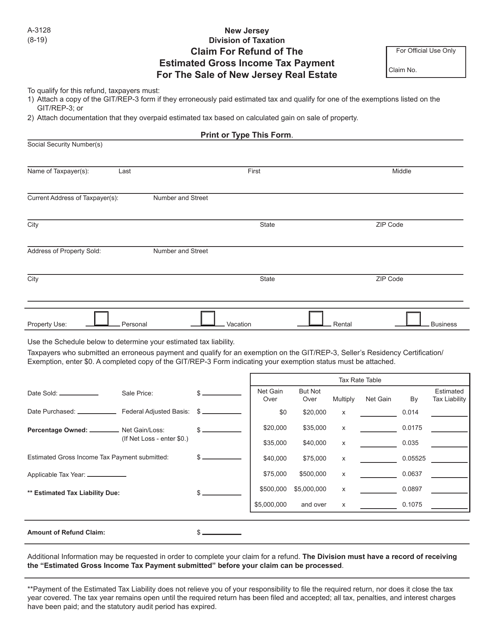

Form A-3128 Claim for Refund of the Estimated Gross Income Tax Payment for the Sale of New Jersey Real Estate - New Jersey

What Is Form A-3128?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-3128?

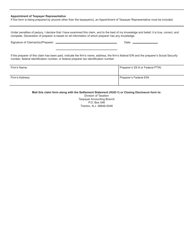

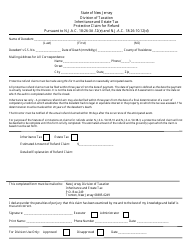

A: Form A-3128 is a claim for refund of the estimated gross income tax payment for the sale of New Jersey real estate.

Q: What does Form A-3128 apply to?

A: Form A-3128 applies to the estimated gross income tax payment for the sale of New Jersey real estate.

Q: What is the purpose of Form A-3128?

A: The purpose of Form A-3128 is to claim a refund of the estimated gross income tax payment made for the sale of New Jersey real estate.

Q: Who needs to file Form A-3128?

A: Anyone who has made an estimated gross income tax payment for the sale of New Jersey real estate and wants to claim a refund needs to file Form A-3128.

Q: Is there a deadline for filing Form A-3128?

A: Yes, the deadline for filing Form A-3128 is generally within four years from the due date of the return or the date the return was filed, whichever is later.

Q: Are there any fees associated with filing Form A-3128?

A: No, there are no fees associated with filing Form A-3128.

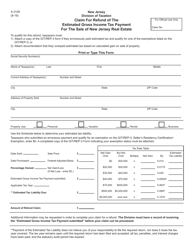

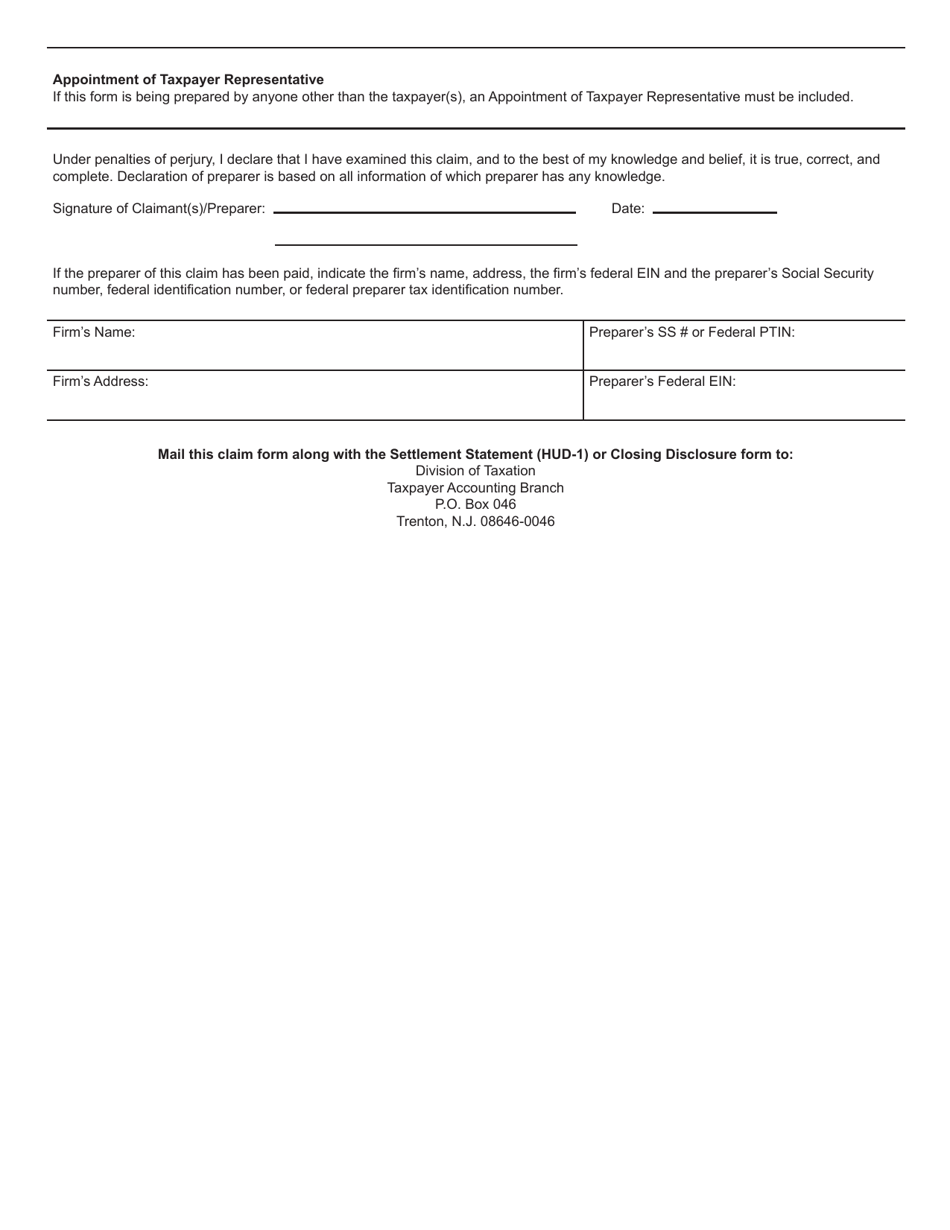

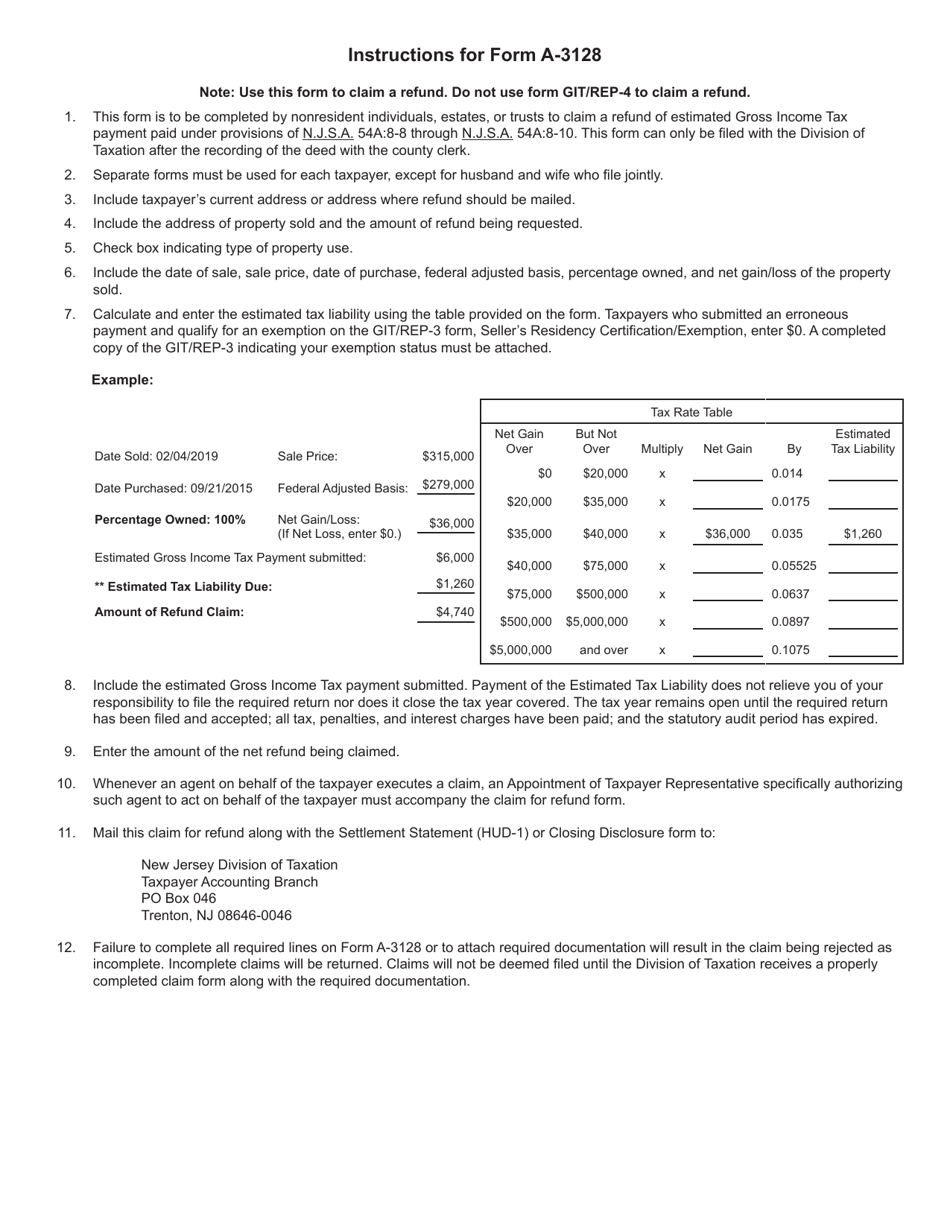

Q: What supporting documents do I need to submit with Form A-3128?

A: You may need to submit documents such as a copy of the settlement statement, copies of tax returns, and proof of payment.

Q: How long does it take to process a Form A-3128?

A: The processing time for Form A-3128 can vary, but it is typically processed within 12 weeks.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

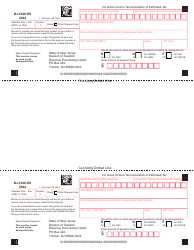

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-3128 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.