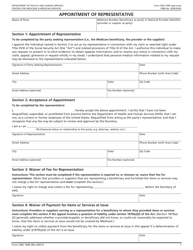

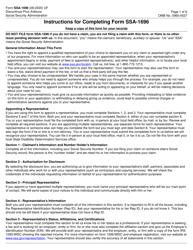

This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-5008-R

for the current year.

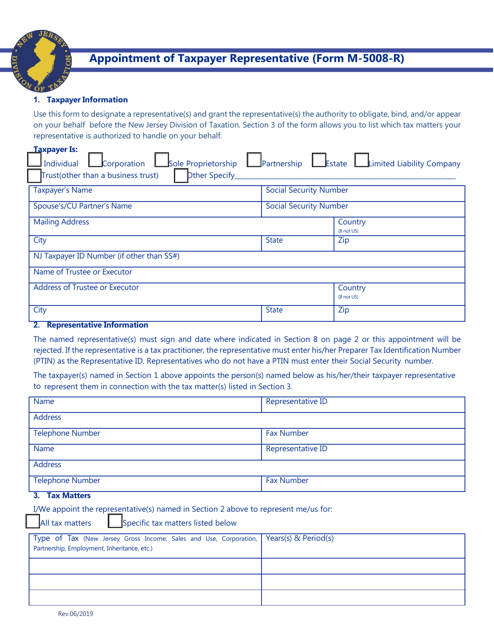

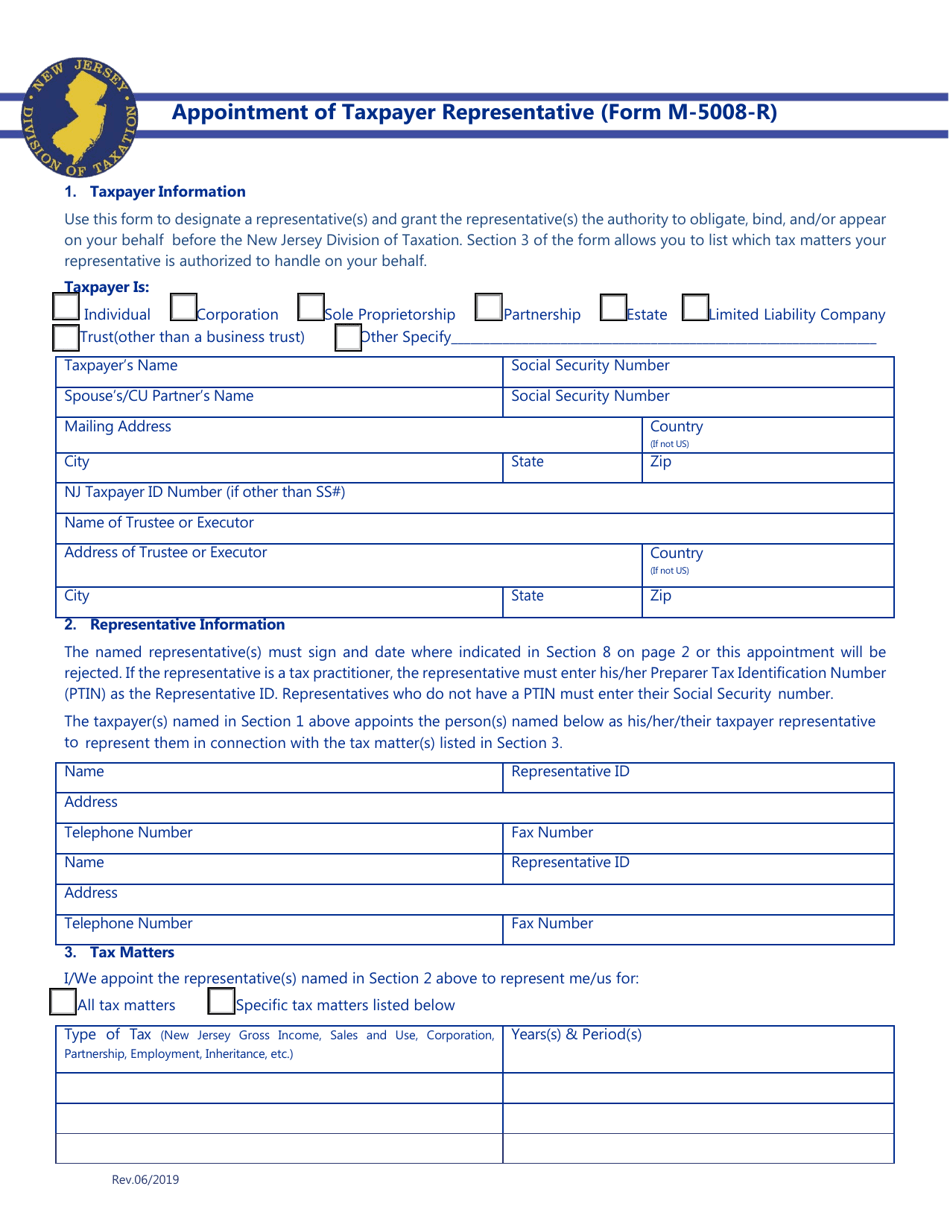

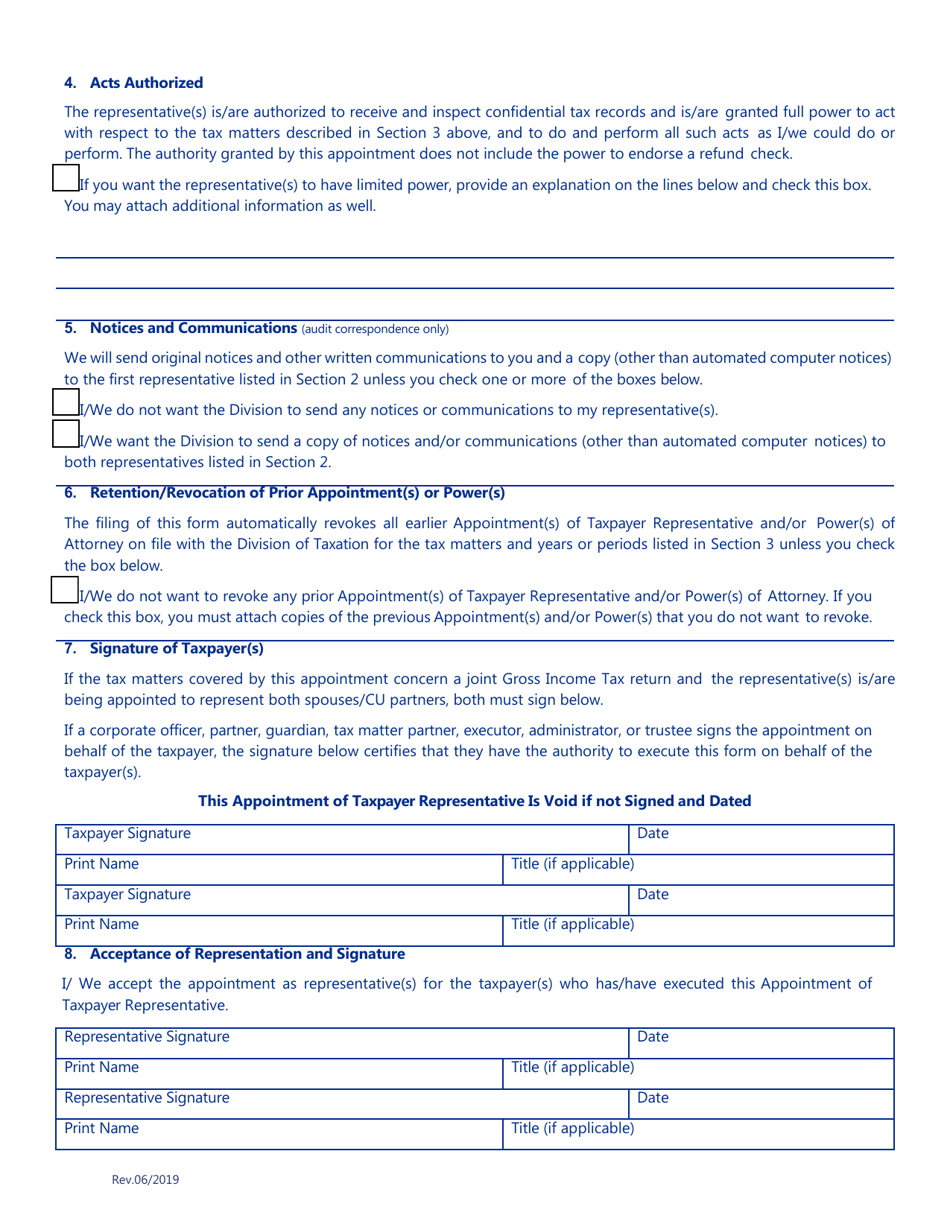

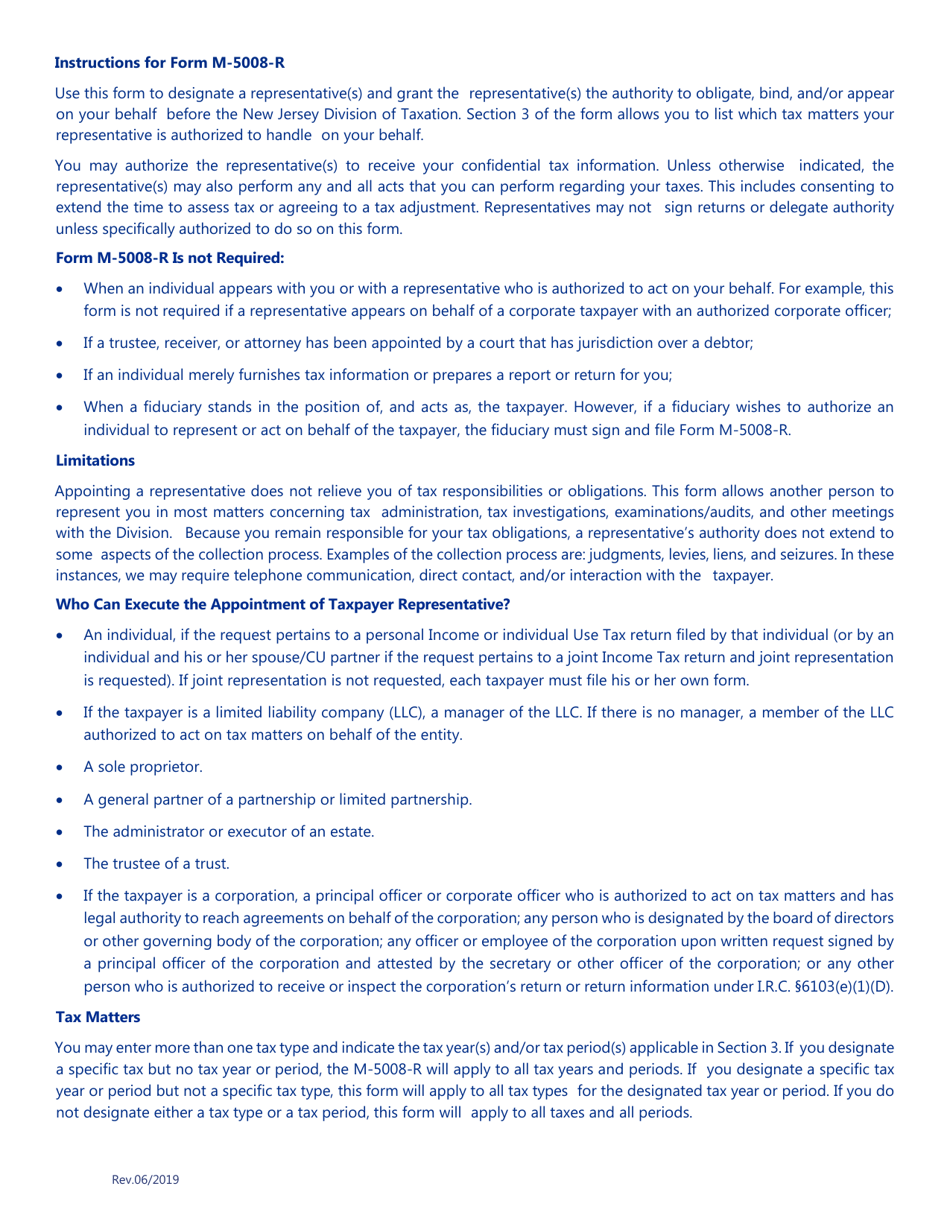

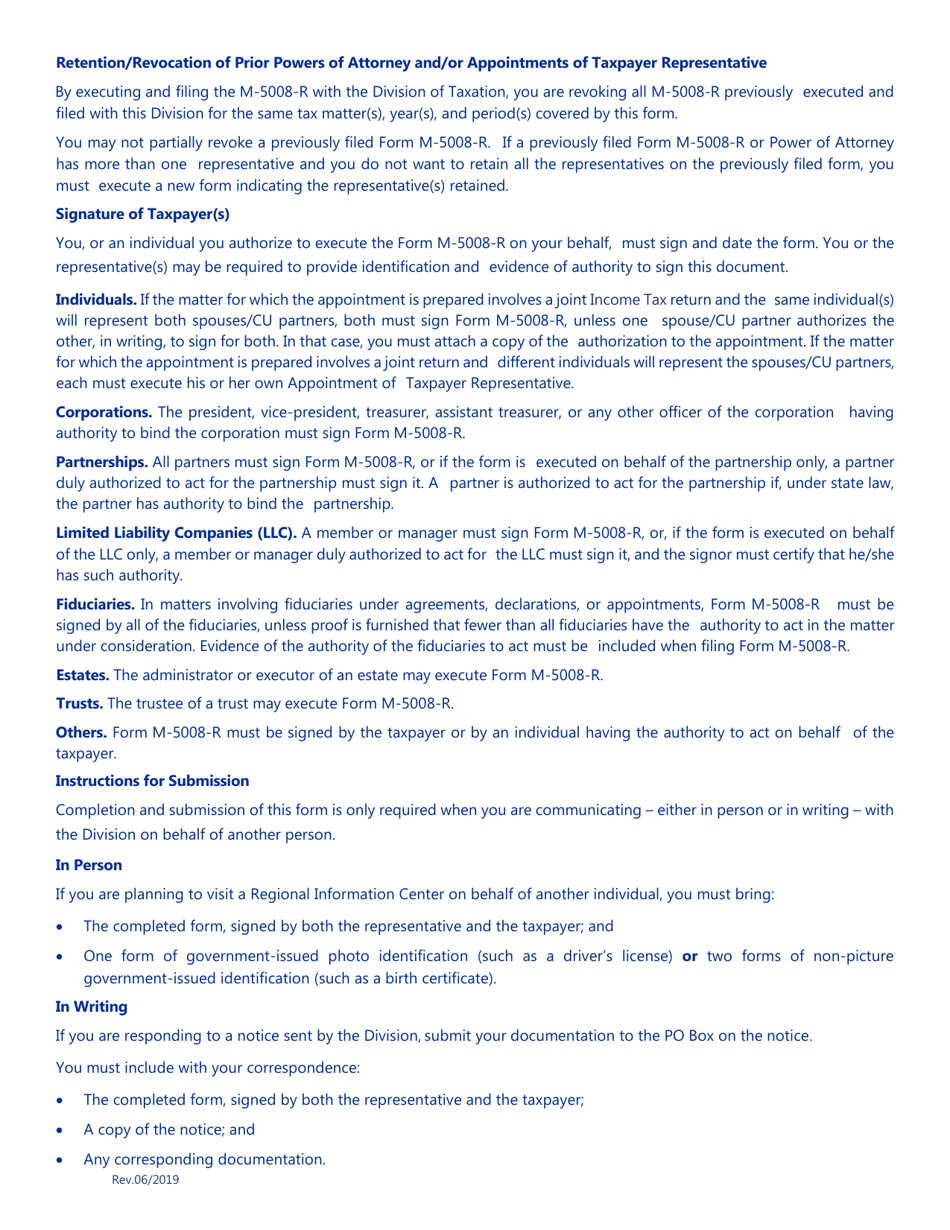

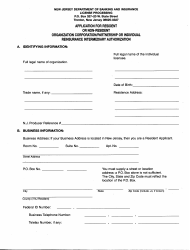

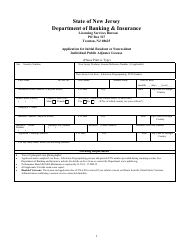

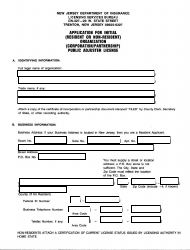

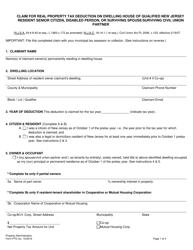

Form M-5008-R Appointment of Taxpayer Representative - New Jersey

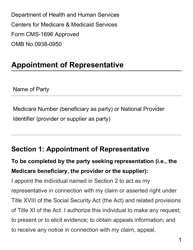

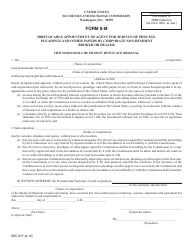

What Is Form M-5008-R?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

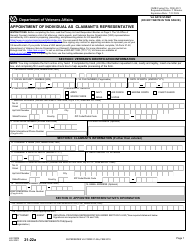

Q: What is Form M-5008-R?

A: Form M-5008-R is the Appointment of Taxpayer Representative form used in New Jersey.

Q: What is the purpose of Form M-5008-R?

A: The purpose of Form M-5008-R is to authorize a representative to act on behalf of a taxpayer in New Jersey.

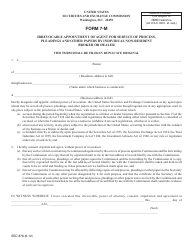

Q: Who should use Form M-5008-R?

A: Taxpayers in New Jersey who want to appoint a representative to handle their tax matters should use Form M-5008-R.

Q: Can Form M-5008-R be used for both individual and business taxes?

A: Yes, Form M-5008-R can be used for both individual and business taxes in New Jersey.

Q: Are there any filing fees for Form M-5008-R?

A: No, there are no filing fees for Form M-5008-R in New Jersey.

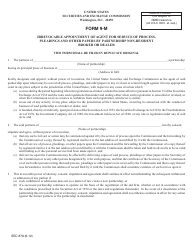

Q: How long does it take to process Form M-5008-R?

A: The processing time for Form M-5008-R may vary, but it generally takes a few weeks.

Q: Can Form M-5008-R be revoked?

A: Yes, taxpayers can revoke the appointment of a representative by submitting a written notice to the New Jersey Division of Taxation.

Q: Is there an expiration date for Form M-5008-R?

A: No, Form M-5008-R does not have an expiration date in New Jersey.

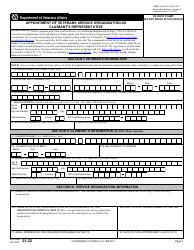

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-5008-R by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.