This version of the form is not currently in use and is provided for reference only. Download this version of

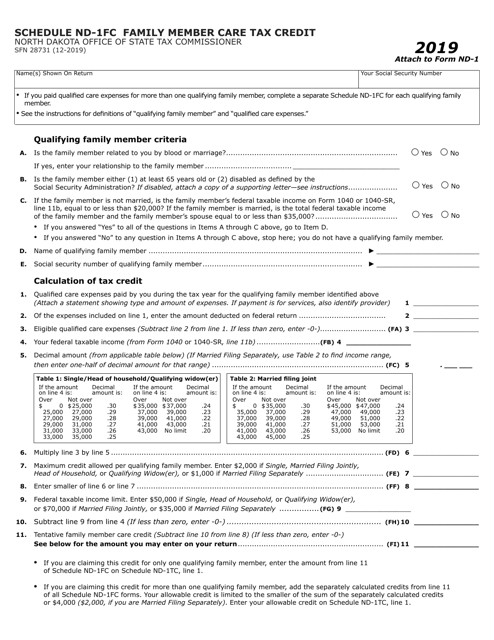

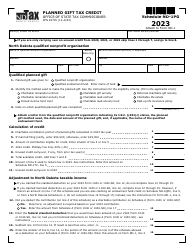

Form SFN28731 Schedule ND-1FC

for the current year.

Form SFN28731 Schedule ND-1FC Family Member Care Tax Credit - North Dakota

What Is Form SFN28731 Schedule ND-1FC?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28731?

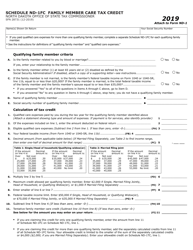

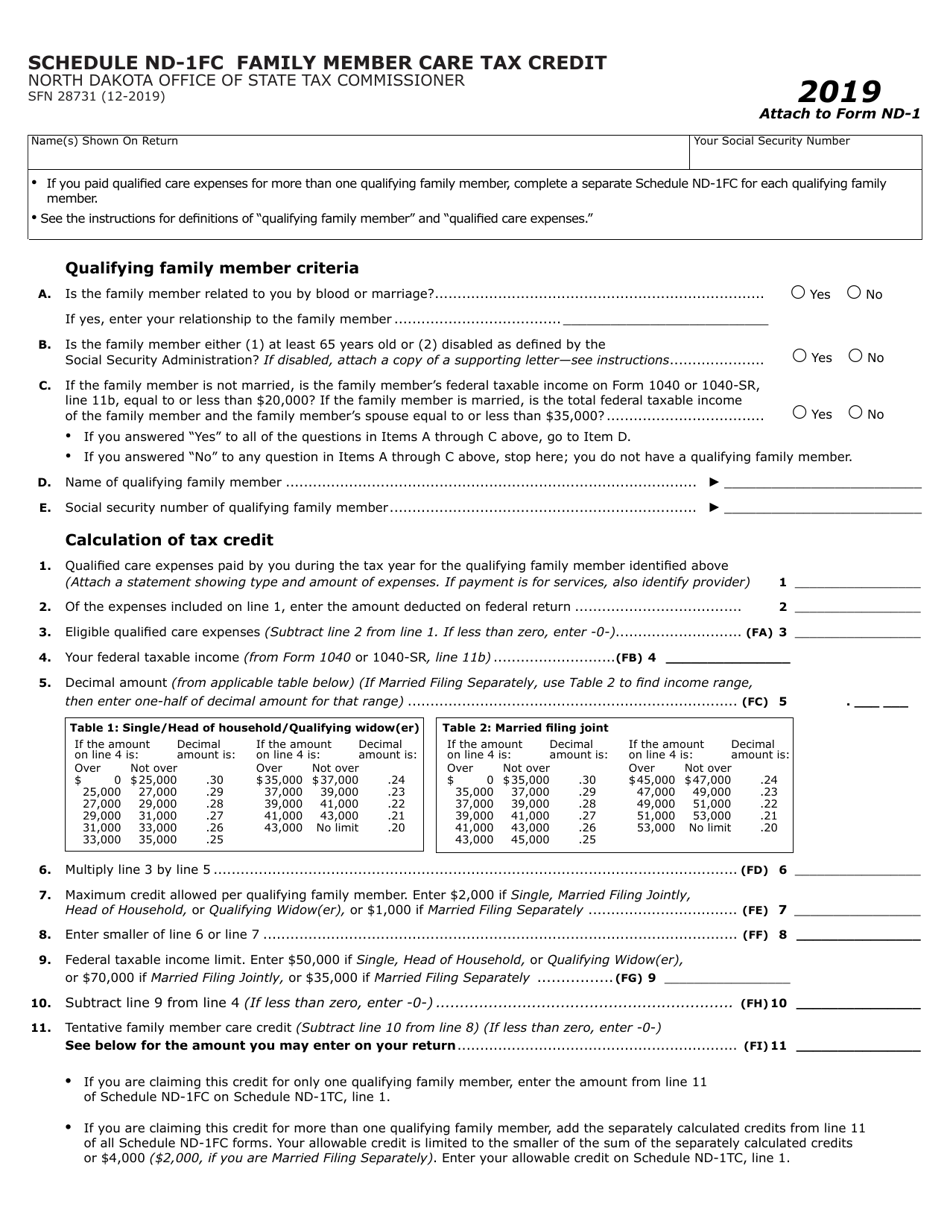

A: Form SFN28731 is Schedule ND-1FC, which is used to claim the Family Member Care Tax Credit in North Dakota.

Q: What is the Family Member Care Tax Credit in North Dakota?

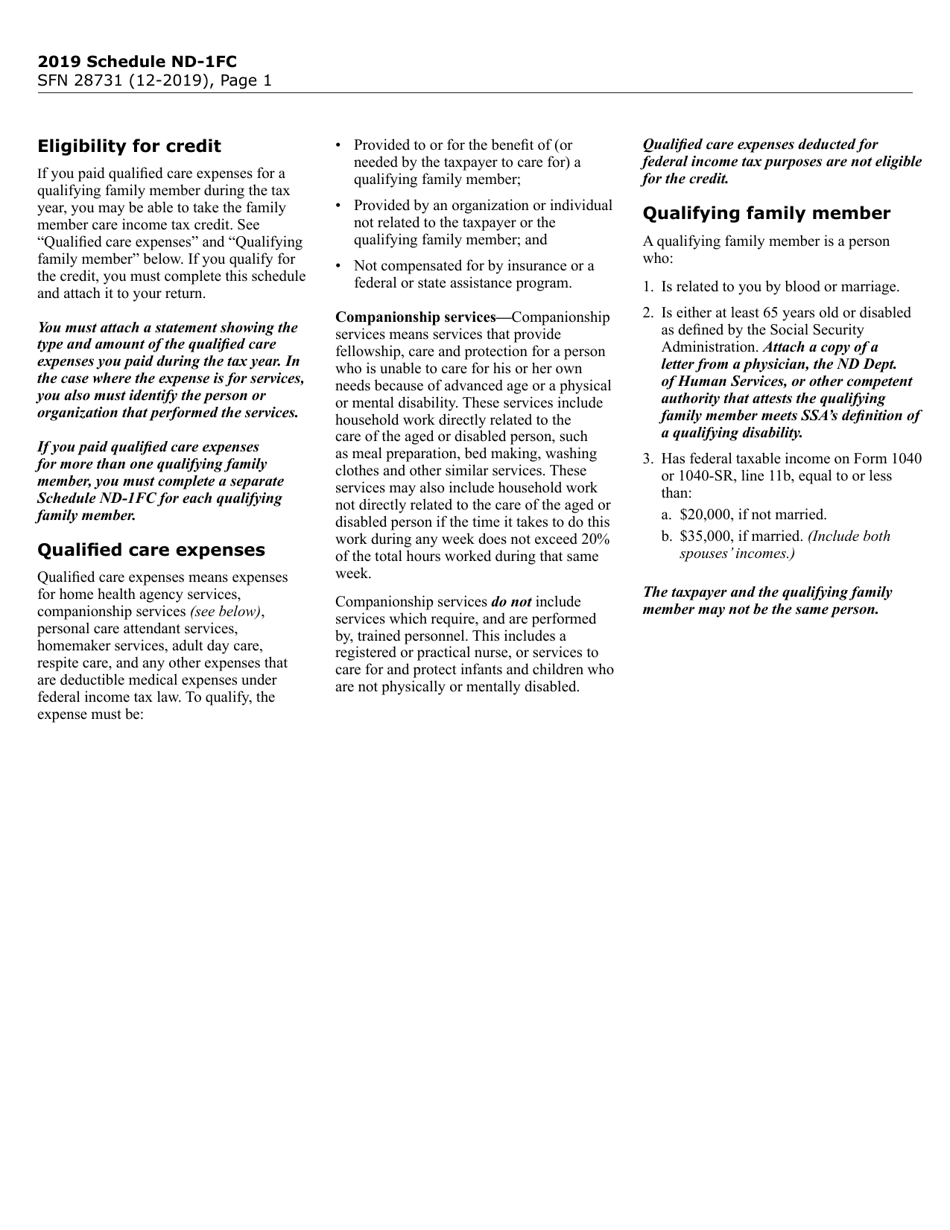

A: The Family Member Care Tax Credit is a credit that provides a tax benefit for taxpayers who incur expenses related to the care of a family member.

Q: Who is eligible for the Family Member Care Tax Credit?

A: To be eligible for the Family Member Care Tax Credit, you must meet certain criteria, such as being a North Dakota resident and incurring eligible care expenses for a qualified family member.

Q: What expenses are eligible for the Family Member Care Tax Credit?

A: Eligible expenses for the Family Member Care Tax Credit may include costs related to the care of a qualified family member, such as child care expenses or expenses for the care of a disabled family member.

Q: How do I claim the Family Member Care Tax Credit?

A: To claim the Family Member Care Tax Credit, you need to complete Schedule ND-1FC and include it with your North Dakota state income tax return.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28731 Schedule ND-1FC by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.