This version of the form is not currently in use and is provided for reference only. Download this version of

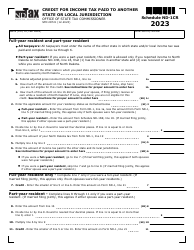

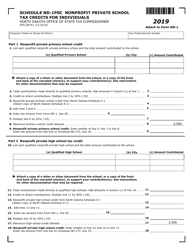

Form SFN28746 Schedule ND-1CS

for the current year.

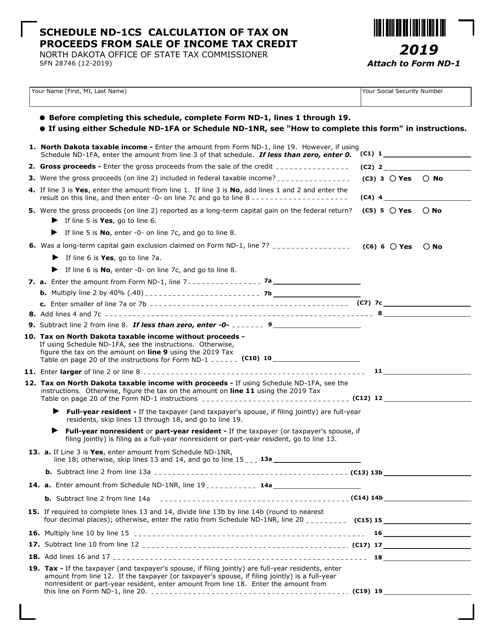

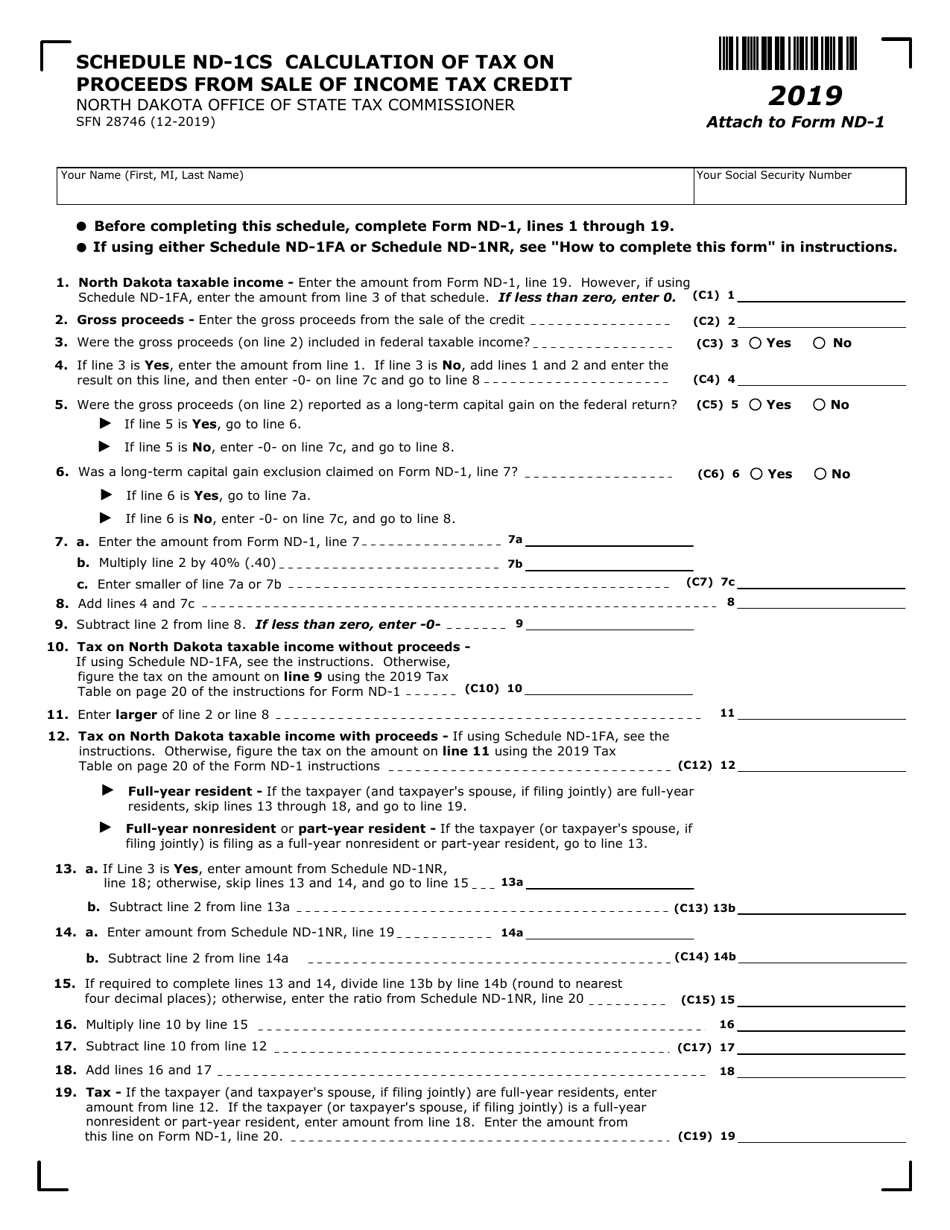

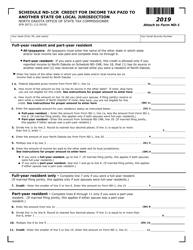

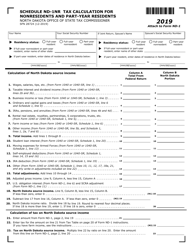

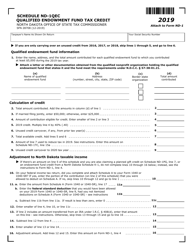

Form SFN28746 Schedule ND-1CS Calculation of Tax on Proceeds From Sale of Income Tax Credit - North Dakota

What Is Form SFN28746 Schedule ND-1CS?

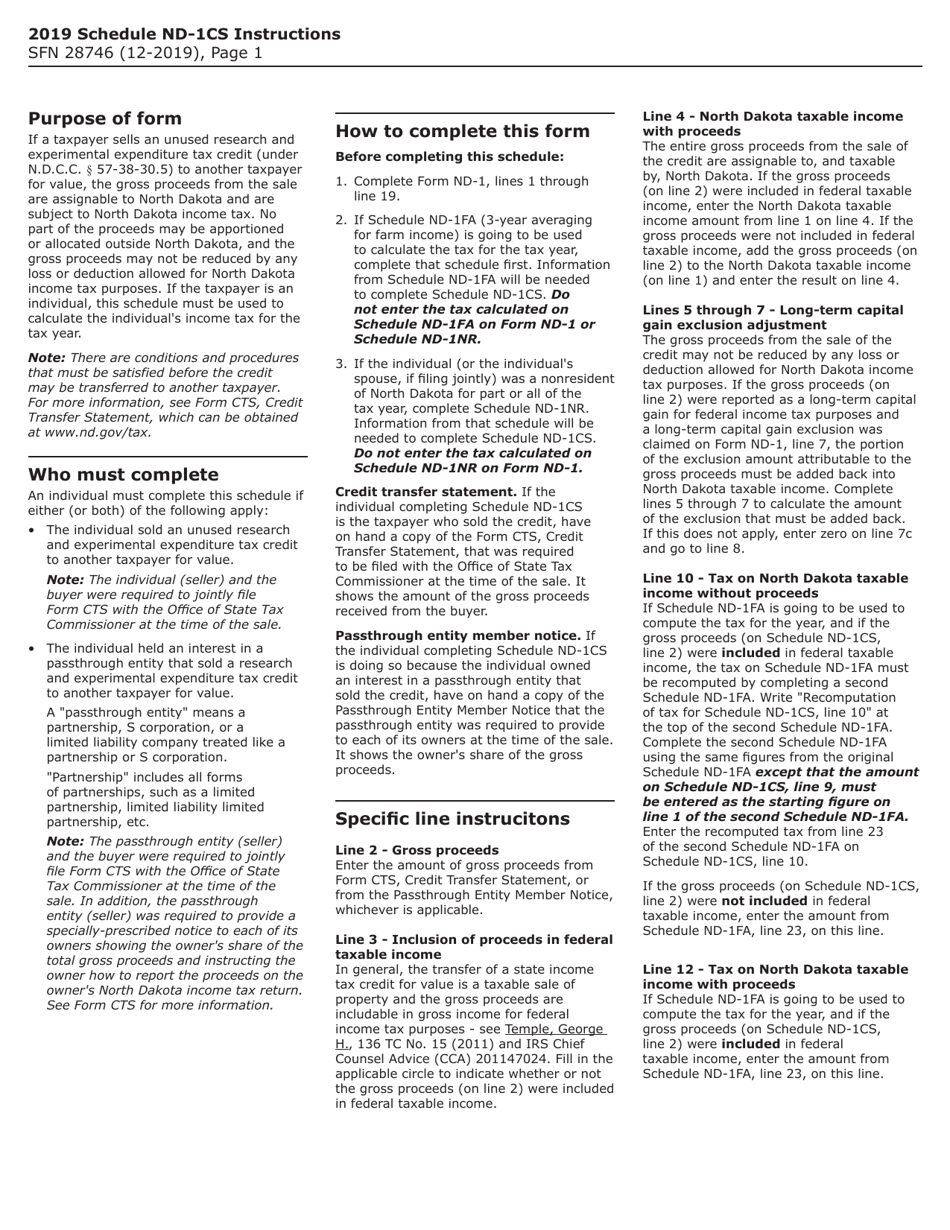

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28746?

A: Form SFN28746 is the Schedule ND-1CS Calculation of Tax on Proceeds From Sale of Income Tax Credit form used in North Dakota.

Q: What is the purpose of Schedule ND-1CS?

A: The purpose of Schedule ND-1CS is to calculate the tax on the proceeds from the sale of income tax credit in North Dakota.

Q: Who needs to file Schedule ND-1CS?

A: Individuals or businesses who have sold income tax credits in North Dakota need to file Schedule ND-1CS.

Q: What information does Schedule ND-1CS require?

A: Schedule ND-1CS requires information about the sale of income tax credits, including the name of the buyer, sale amount, and sale date.

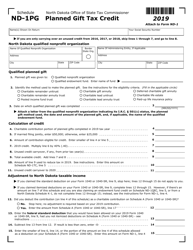

Q: Are there any other forms or schedules associated with Schedule ND-1CS?

A: Yes, you may need to complete other forms or schedules, such as the North Dakota Individual Income Tax Return (Form ND-1) or the North Dakota Corporate Income Tax Return (Form 40), depending on your tax situation.

Q: When is the deadline to file Schedule ND-1CS?

A: The deadline to file Schedule ND-1CS is the same as the deadline for your North Dakota income tax return, which is generally April 15th.

Q: Are there any penalties for not filing Schedule ND-1CS?

A: Yes, if you are required to file Schedule ND-1CS and fail to do so, you may face penalties and interest on the tax owed.

Q: Can I e-file Schedule ND-1CS?

A: Yes, you can e-file Schedule ND-1CS if you are filing your North Dakota income tax return electronically.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28746 Schedule ND-1CS by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.