This version of the form is not currently in use and is provided for reference only. Download this version of

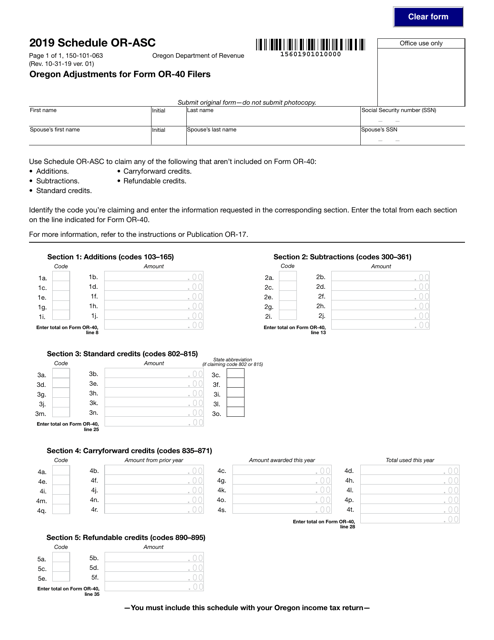

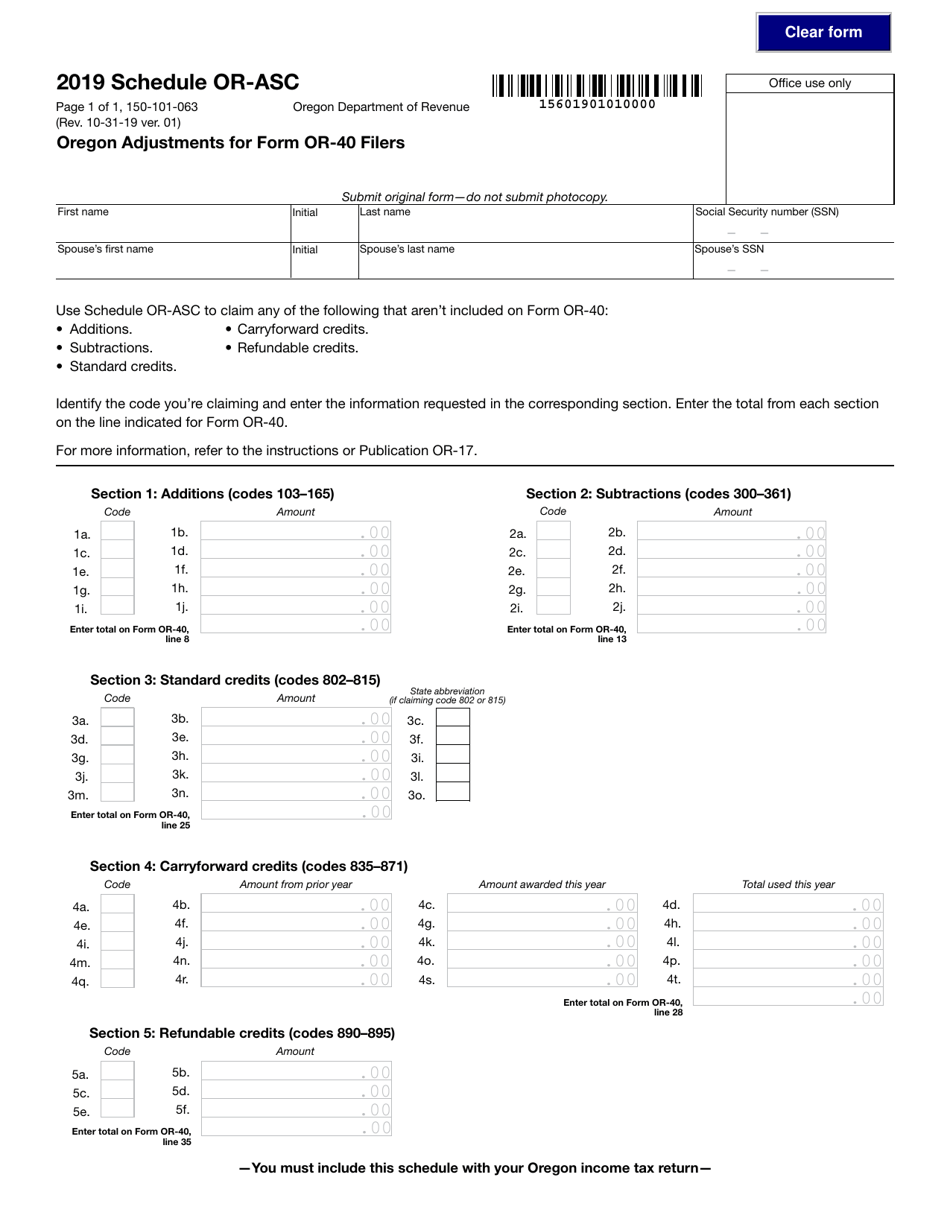

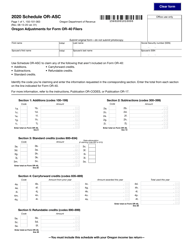

Form 150-101-063 Schedule OR-ASC

for the current year.

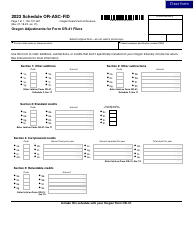

Form 150-101-063 Schedule OR-ASC Oregon Adjustments for Form or-40 Filers - Oregon

What Is Form 150-101-063 Schedule OR-ASC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-063?

A: Form 150-101-063 is a schedule used by Oregon taxpayers who file Form OR-40 to report any adjustments to their income.

Q: What is OR-ASC?

A: OR-ASC stands for Oregon Adjustments for Form OR-40 Filers, which is the name of the schedule.

Q: Who needs to use Schedule OR-ASC?

A: Oregon taxpayers who file Form OR-40 and have adjustments to their income need to use Schedule OR-ASC.

Q: What are Oregon adjustments?

A: Oregon adjustments are modifications made to the taxpayer's federal adjusted gross income to calculate their Oregon taxable income.

Q: When is Schedule OR-ASC due?

A: Schedule OR-ASC is due at the same time as your Form OR-40, typically on or before April 15th of the following year.

Q: What if I don't have any adjustments to report?

A: If you don't have any adjustments to report, you do not need to fill out Schedule OR-ASC.

Q: Can I e-file Schedule OR-ASC?

A: Yes, you can e-file Schedule OR-ASC if you are filing your Form OR-40 electronically.

Q: Is there a separate form for Oregon adjustments?

A: No, Schedule OR-ASC is the only form used to report Oregon adjustments for Form OR-40 filers.

Q: Are Oregon adjustments the same as federal deductions?

A: No, Oregon adjustments are specific to calculating Oregon taxable income and may differ from federal deductions.

Form Details:

- Released on October 31, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-063 Schedule OR-ASC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.