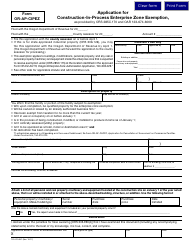

This version of the form is not currently in use and is provided for reference only. Download this version of

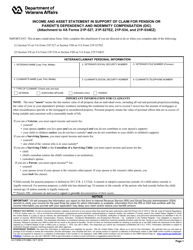

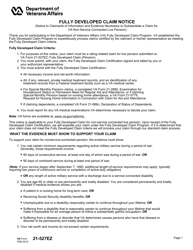

Form OR-EZ-EXCLM (150-310-075)

for the current year.

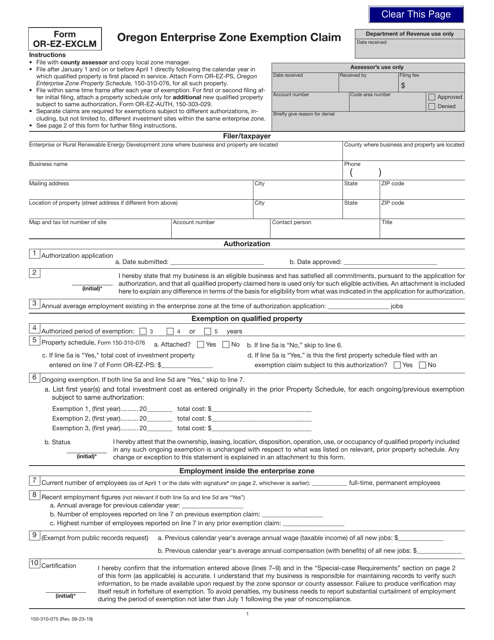

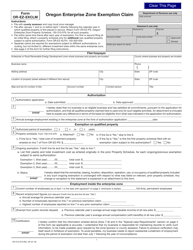

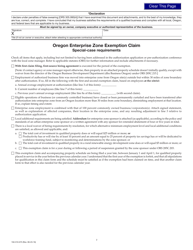

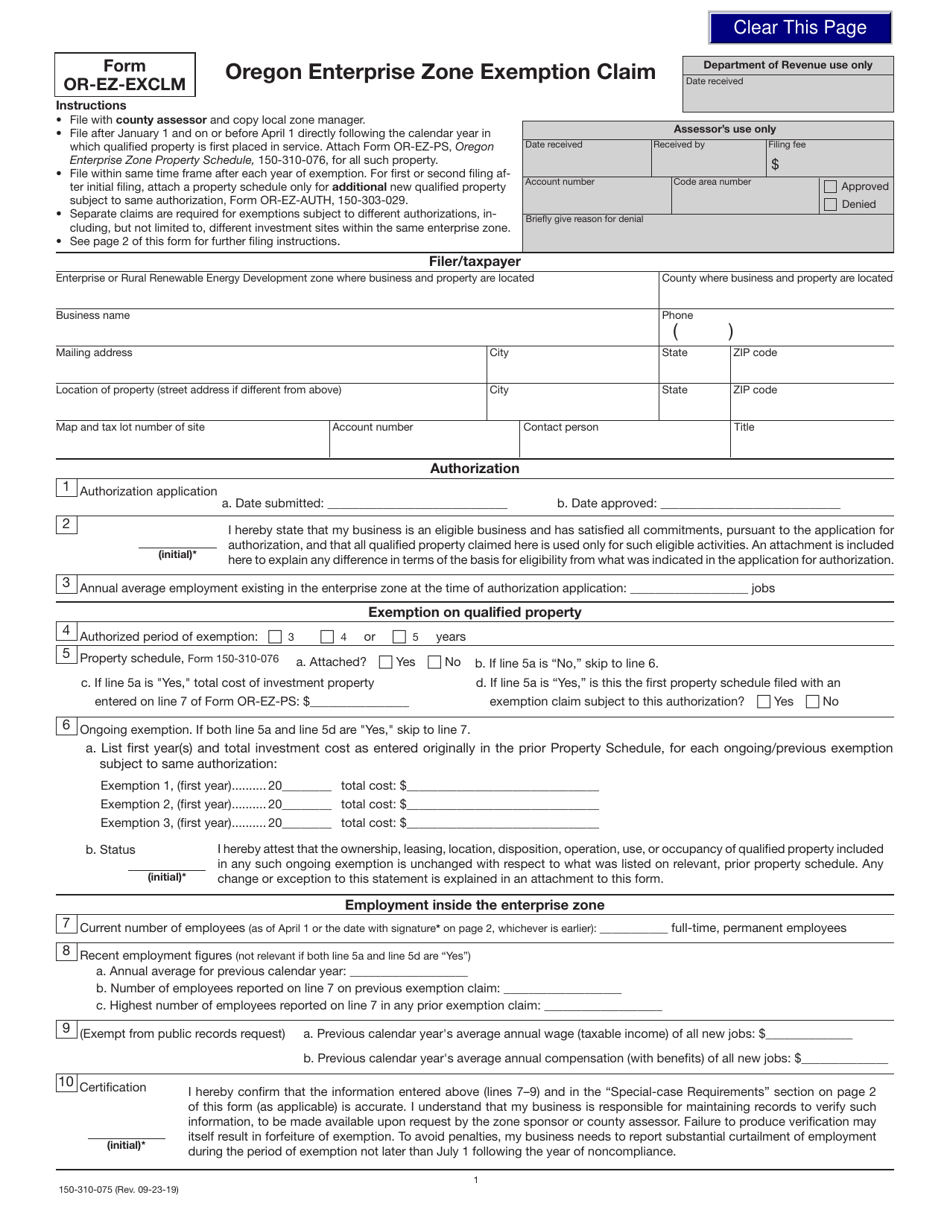

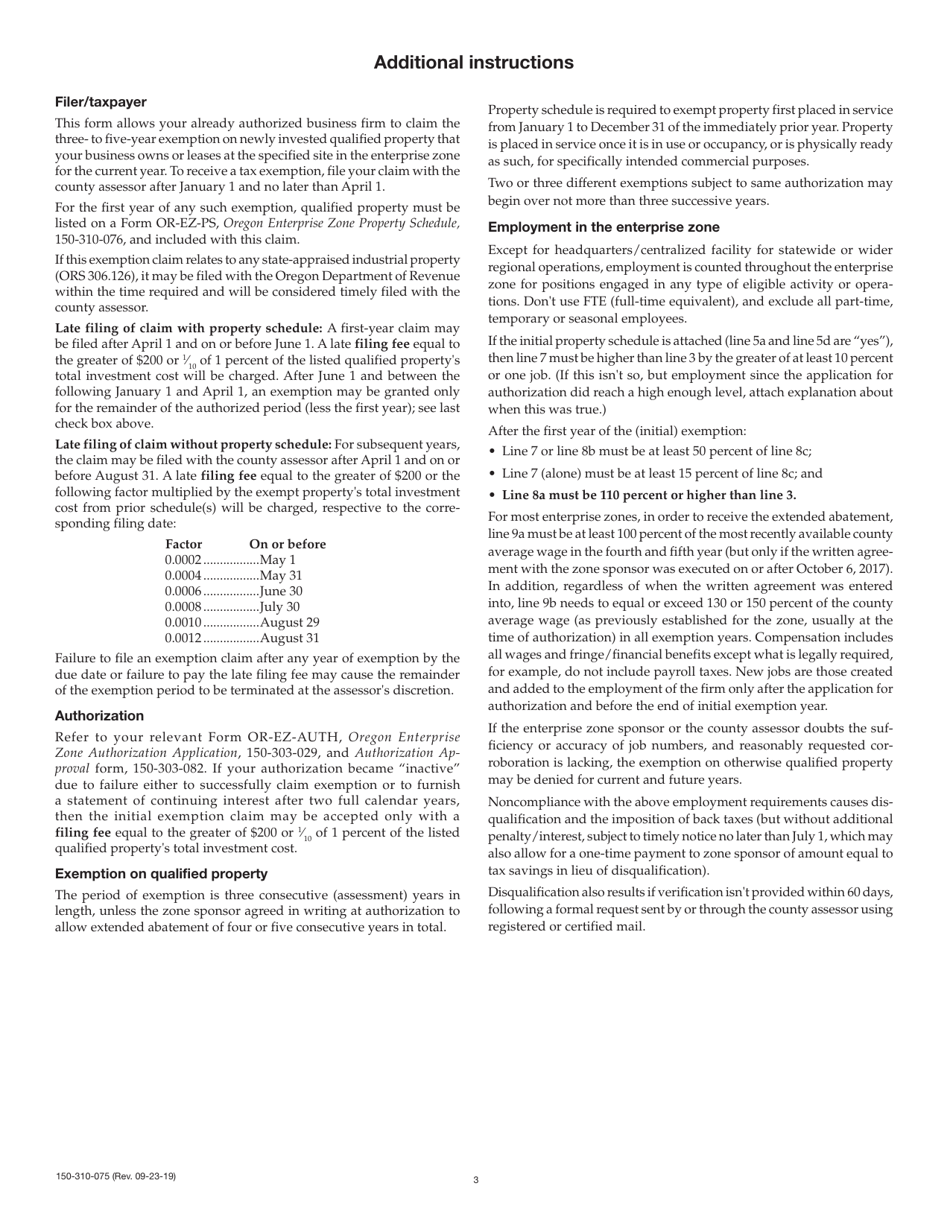

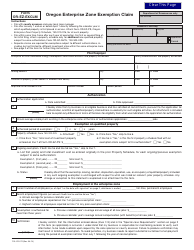

Form OR-EZ-EXCLM (150-310-075) Oregon Enterprise Zone Exemption Claim - Oregon

What Is Form OR-EZ-EXCLM (150-310-075)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OR-EZ-EXCLM (150-310-075) form?

A: The OR-EZ-EXCLM form is the Oregon Enterprise Zone Exemption Claim.

Q: What does the Oregon Enterprise Zone Exemption Claim form do?

A: The form allows businesses to claim exemptions for eligible property located within an Oregon enterprise zone.

Q: Who can use the OR-EZ-EXCLM form?

A: Businesses that have property located within an Oregon enterprise zone can use this form.

Q: What is the purpose of the Oregon Enterprise Zone Exemption?

A: The purpose is to encourage businesses to invest and create jobs in designated areas of Oregon by providing property tax exemptions.

Form Details:

- Released on September 23, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-EZ-EXCLM (150-310-075) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.