This version of the form is not currently in use and is provided for reference only. Download this version of

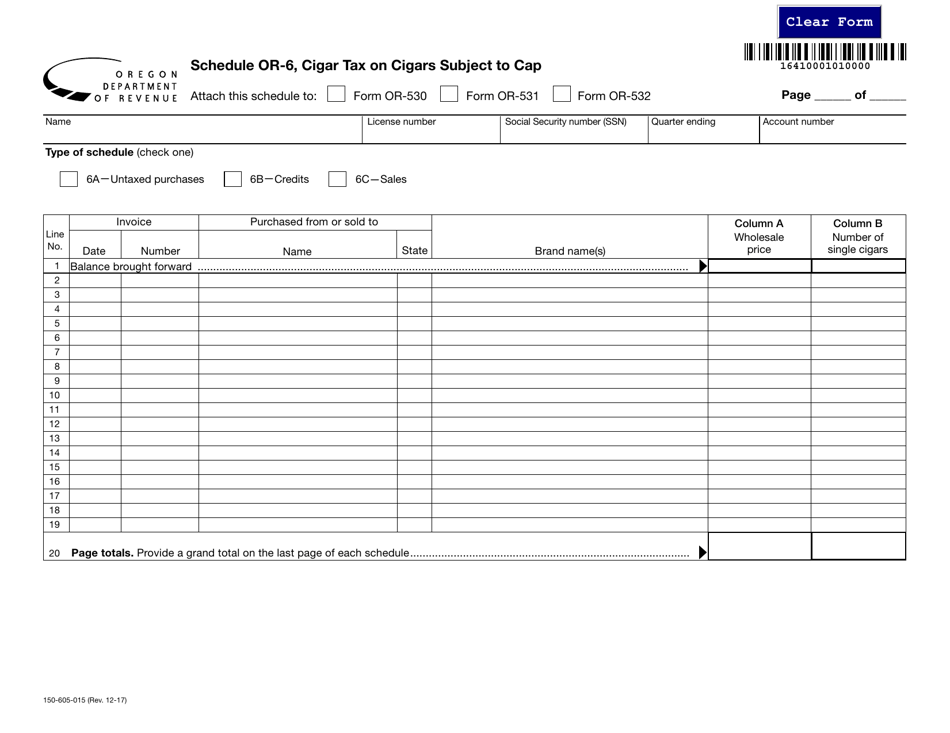

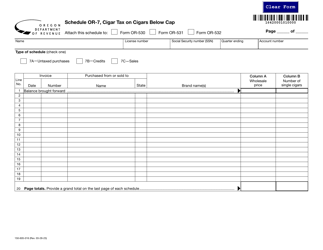

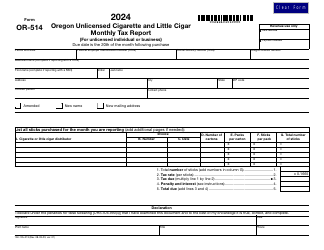

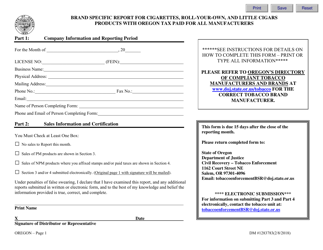

Form 150-605-015 Schedule OR-6

for the current year.

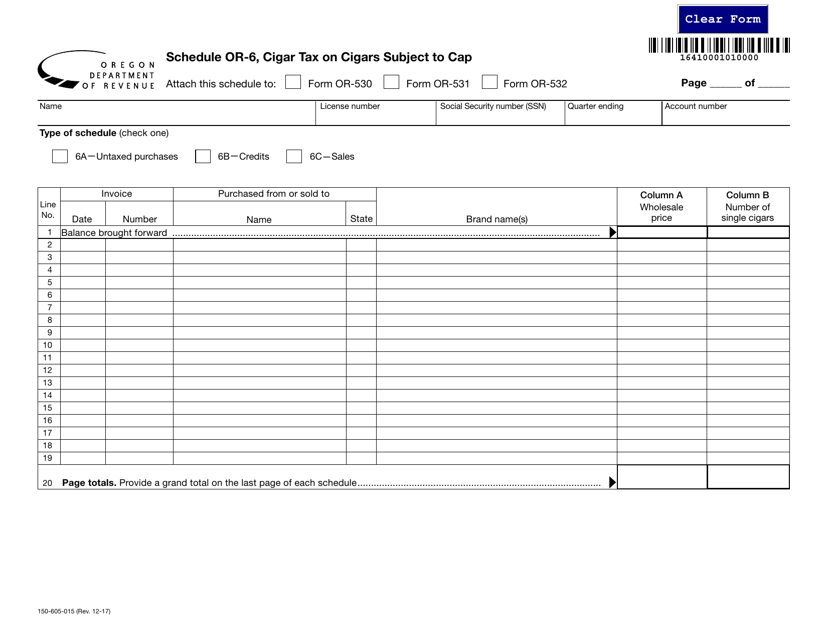

Form 150-605-015 Schedule OR-6 Cigar Tax on Cigars Subject to Cap - Oregon

What Is Form 150-605-015 Schedule OR-6?

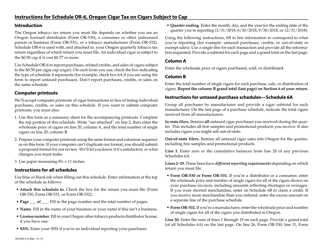

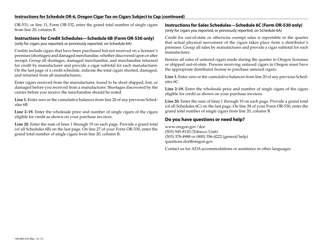

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-605-015?

A: Form 150-605-015 is a schedule used in Oregon to report cigar tax on cigars subject to a cap.

Q: What is cigar tax in Oregon?

A: Cigar tax in Oregon is a tax imposed on the sale or use of cigars.

Q: What is Schedule OR-6?

A: Schedule OR-6 is a specific form or schedule used in Oregon to report cigar tax on cigars subject to a cap.

Q: What is the purpose of Form 150-605-015?

A: The purpose of Form 150-605-015 is to report and calculate the cigar tax on cigars subject to a cap in Oregon.

Q: Who needs to file Form 150-605-015?

A: Anyone who sells or uses cigars subject to a cap in Oregon needs to file Form 150-605-015 to report cigar tax.

Q: Is Schedule OR-6 specific to Oregon?

A: Yes, Schedule OR-6 is specific to Oregon and is used to report cigar tax in the state.

Q: Are all cigars subject to a cap in Oregon?

A: No, only certain cigars are subject to a cap in Oregon. Other types of cigars may have different tax rules.

Q: What happens if I don't file Form 150-605-015?

A: If you are required to file Form 150-605-015 and fail to do so, you may be subject to penalties and interest on the unpaid cigar tax.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-605-015 Schedule OR-6 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.