This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-531 (150-605-006)

for the current year.

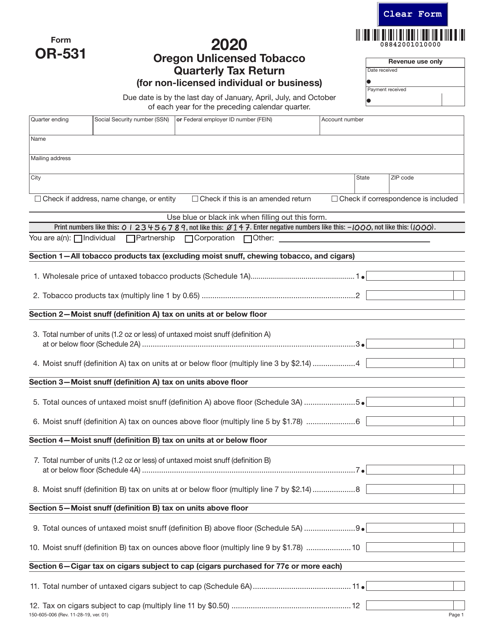

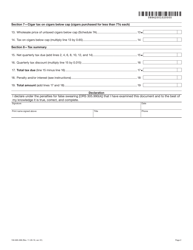

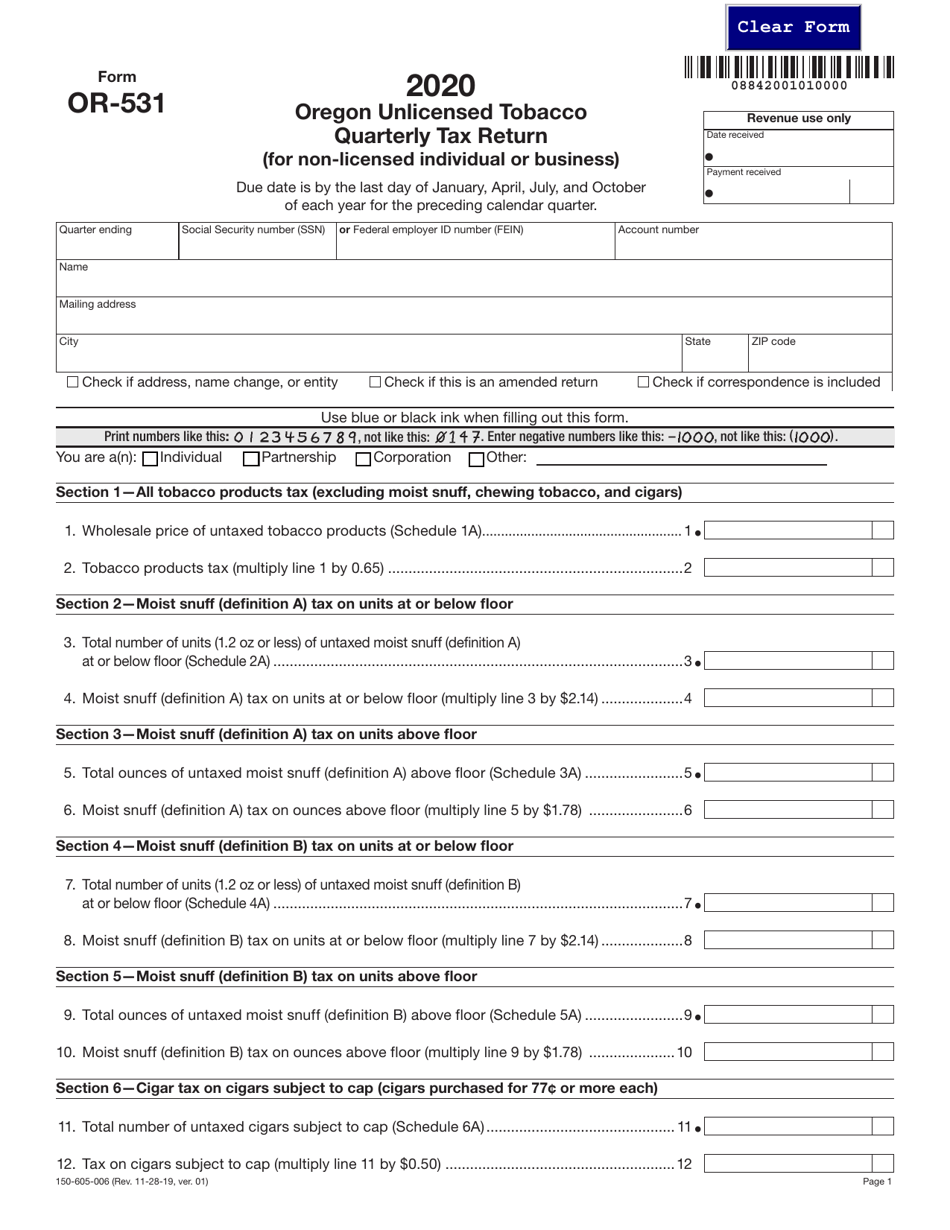

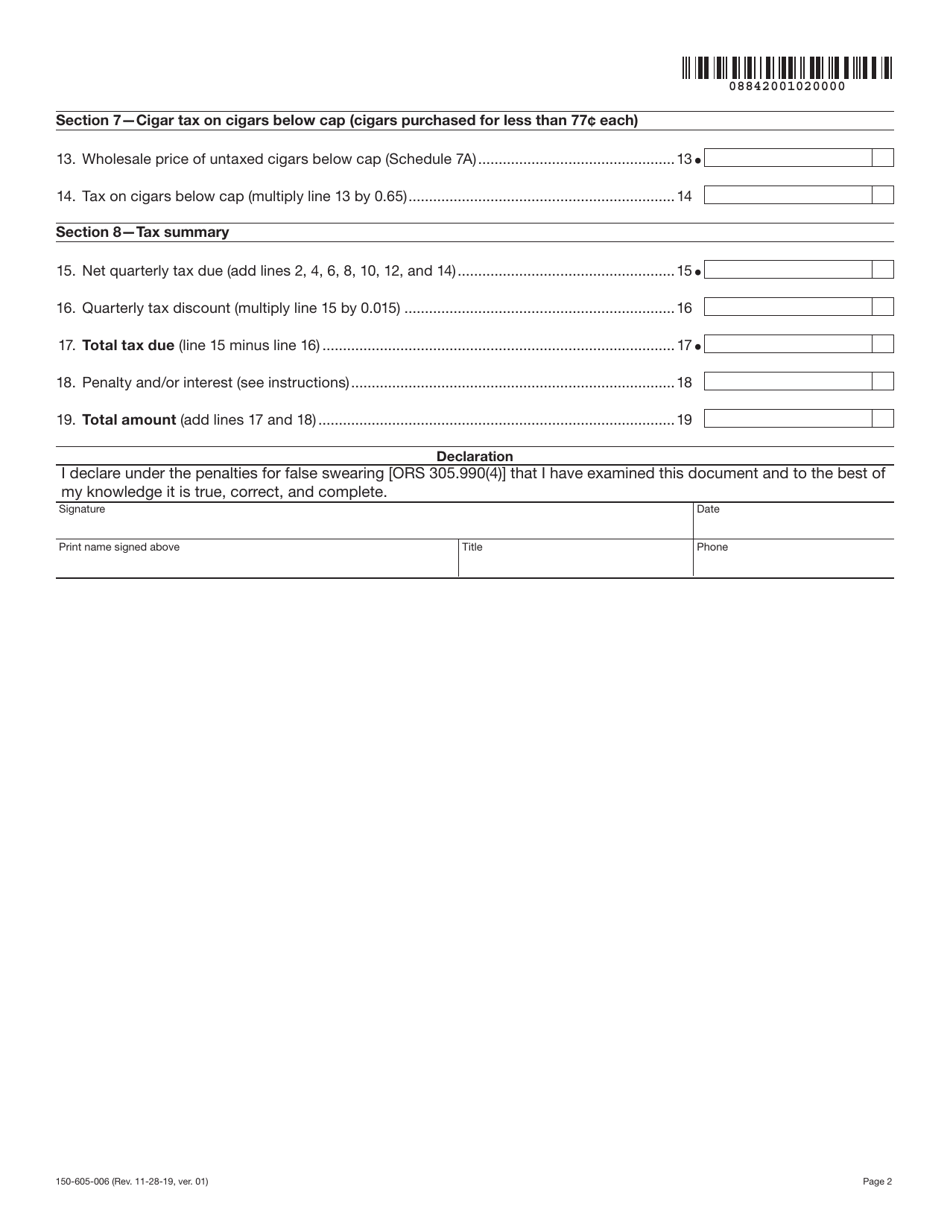

Form OR-531 (150-605-006) Oregon Unlicensed Tobacco Quarterly Tax Return (For Non-licensed Individual or Business) - Oregon

What Is Form OR-531 (150-605-006)?

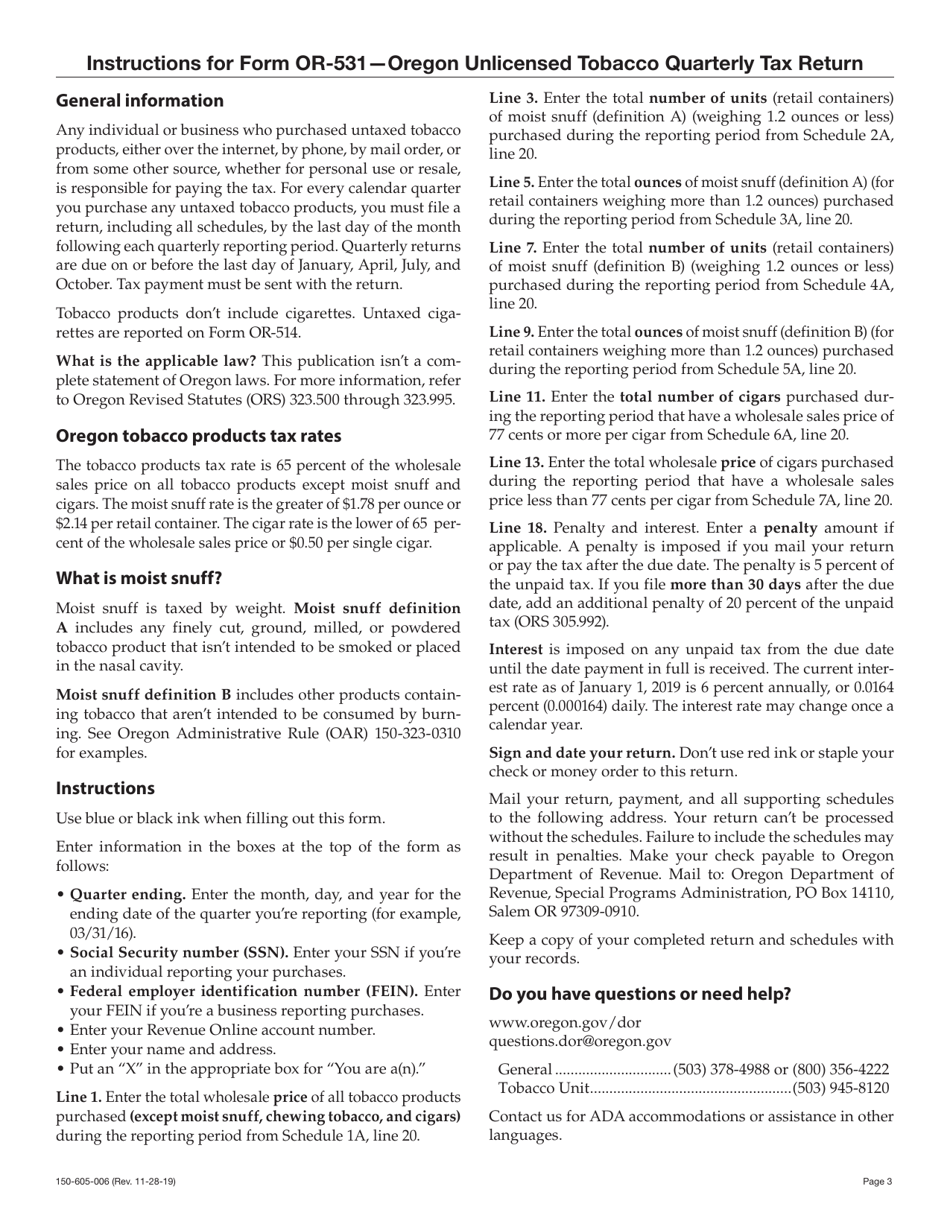

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-531?

A: Form OR-531 is the Oregon Unlicensed Tobacco Quarterly Tax Return.

Q: Who needs to file Form OR-531?

A: Individuals or businesses who are not licensed to sell tobacco products in Oregon need to file Form OR-531.

Q: What is the purpose of Form OR-531?

A: The purpose of Form OR-531 is to report and pay the quarterly tobacco tax for non-licensed individuals or businesses in Oregon.

Q: When is Form OR-531 due?

A: Form OR-531 is due on the last day of the month following the end of the quarter. For example, the first quarter return is due by April 30th.

Form Details:

- Released on November 28, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-531 (150-605-006) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.