This version of the form is not currently in use and is provided for reference only. Download this version of

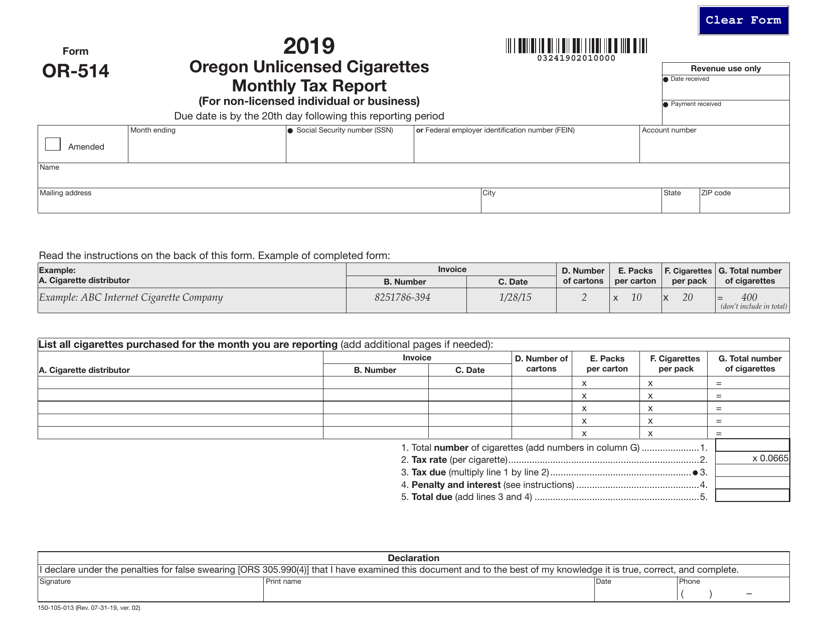

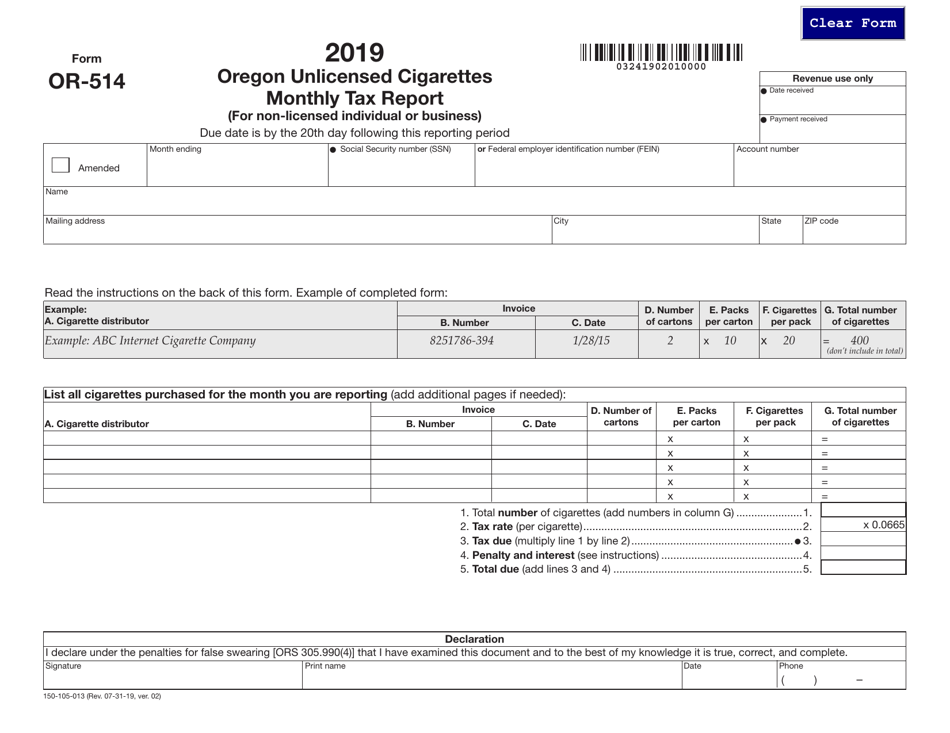

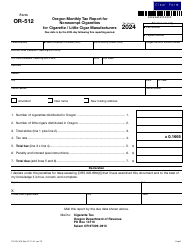

Form OR-514 (150-105-013)

for the current year.

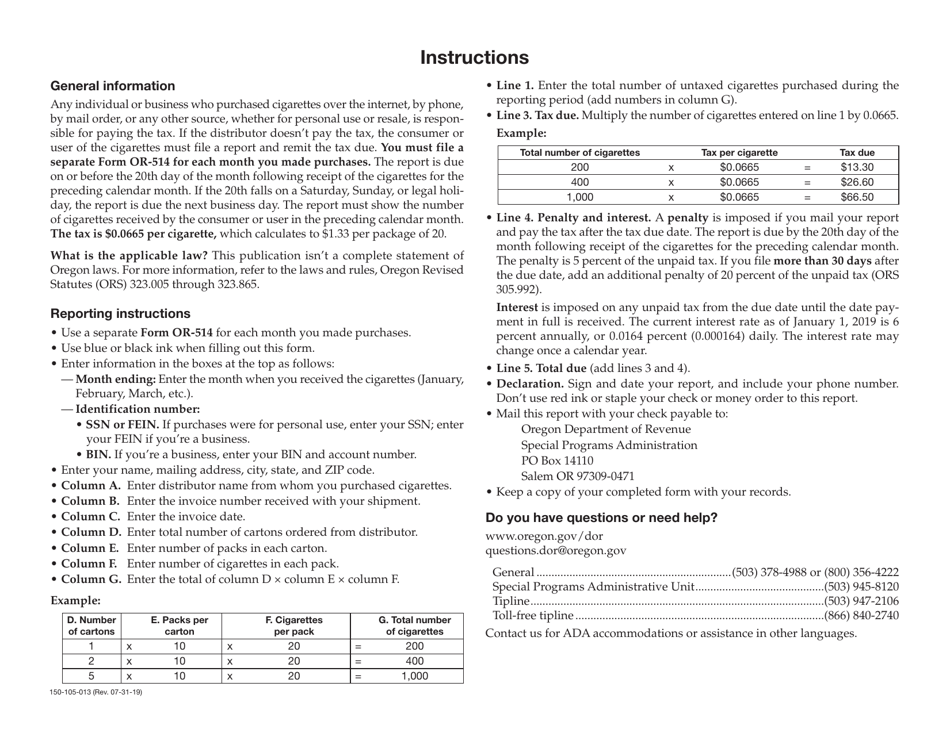

Form OR-514 (150-105-013) Oregon Unlicensed Cigarettes Monthly Tax Report - Oregon

What Is Form OR-514 (150-105-013)?

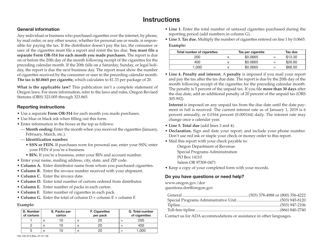

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-514?

A: Form OR-514 is the Oregon Unlicensed Cigarettes Monthly Tax Report.

Q: Who needs to file Form OR-514?

A: Businesses or individuals who sell unlicensed cigarettes in Oregon need to file Form OR-514.

Q: What is the purpose of Form OR-514?

A: The purpose of Form OR-514 is to report and pay the monthly tax on unlicensed cigarettes sold in Oregon.

Q: When is Form OR-514 due?

A: Form OR-514 is due by the 20th day of the following month.

Q: Is there a penalty for not filing Form OR-514?

A: Yes, there may be penalties for failing to file Form OR-514, including interest on the unpaid tax amount.

Form Details:

- Released on July 31, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-514 (150-105-013) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.