This version of the form is not currently in use and is provided for reference only. Download this version of

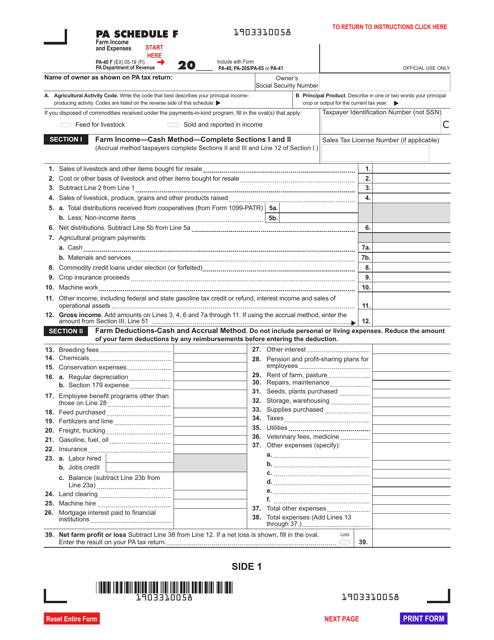

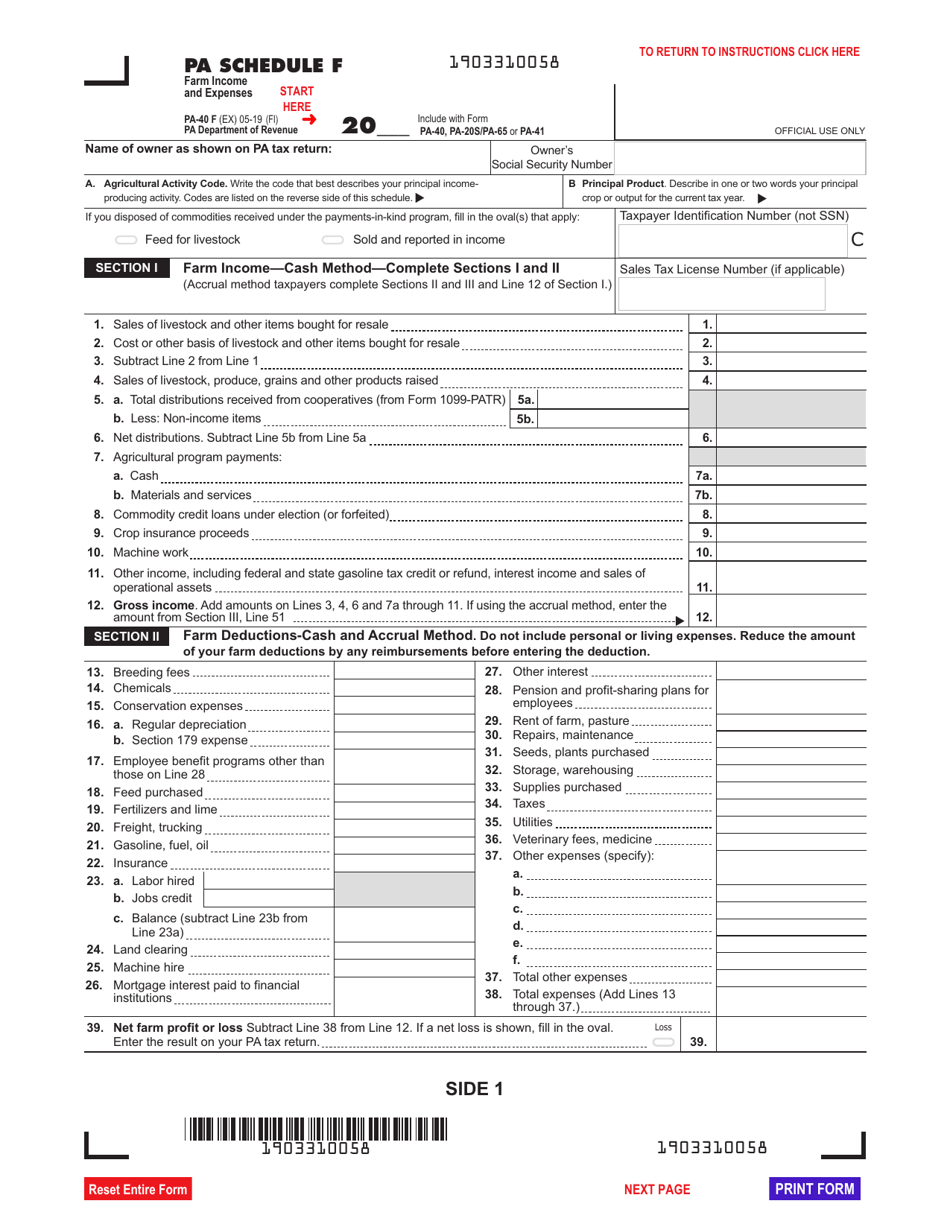

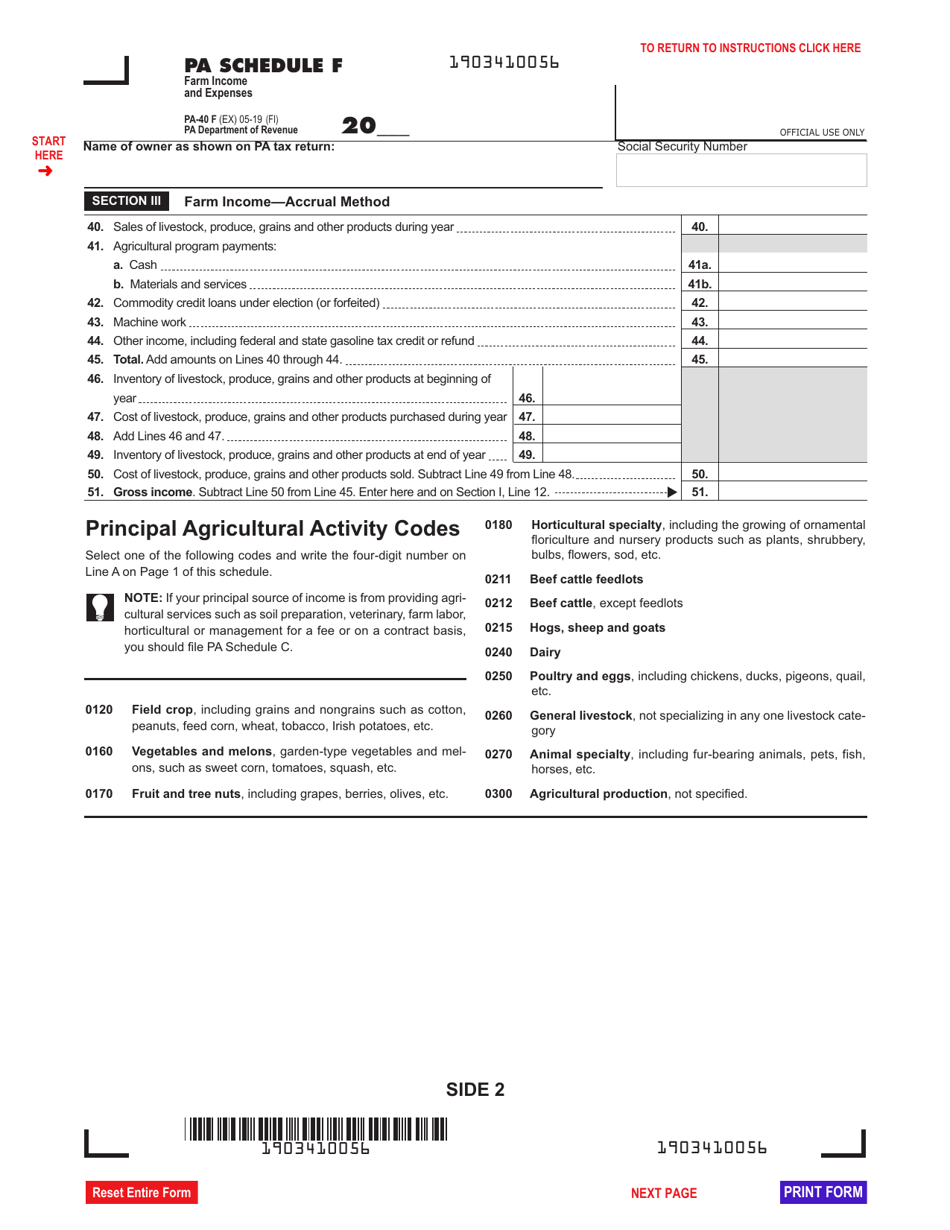

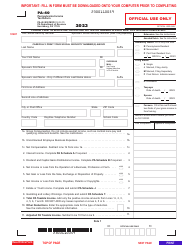

Form PA-40 Schedule F

for the current year.

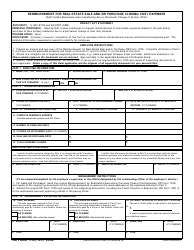

Form PA-40 Schedule F Farm Income and Expenses - Pennsylvania

What Is Form PA-40 Schedule F?

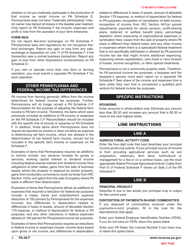

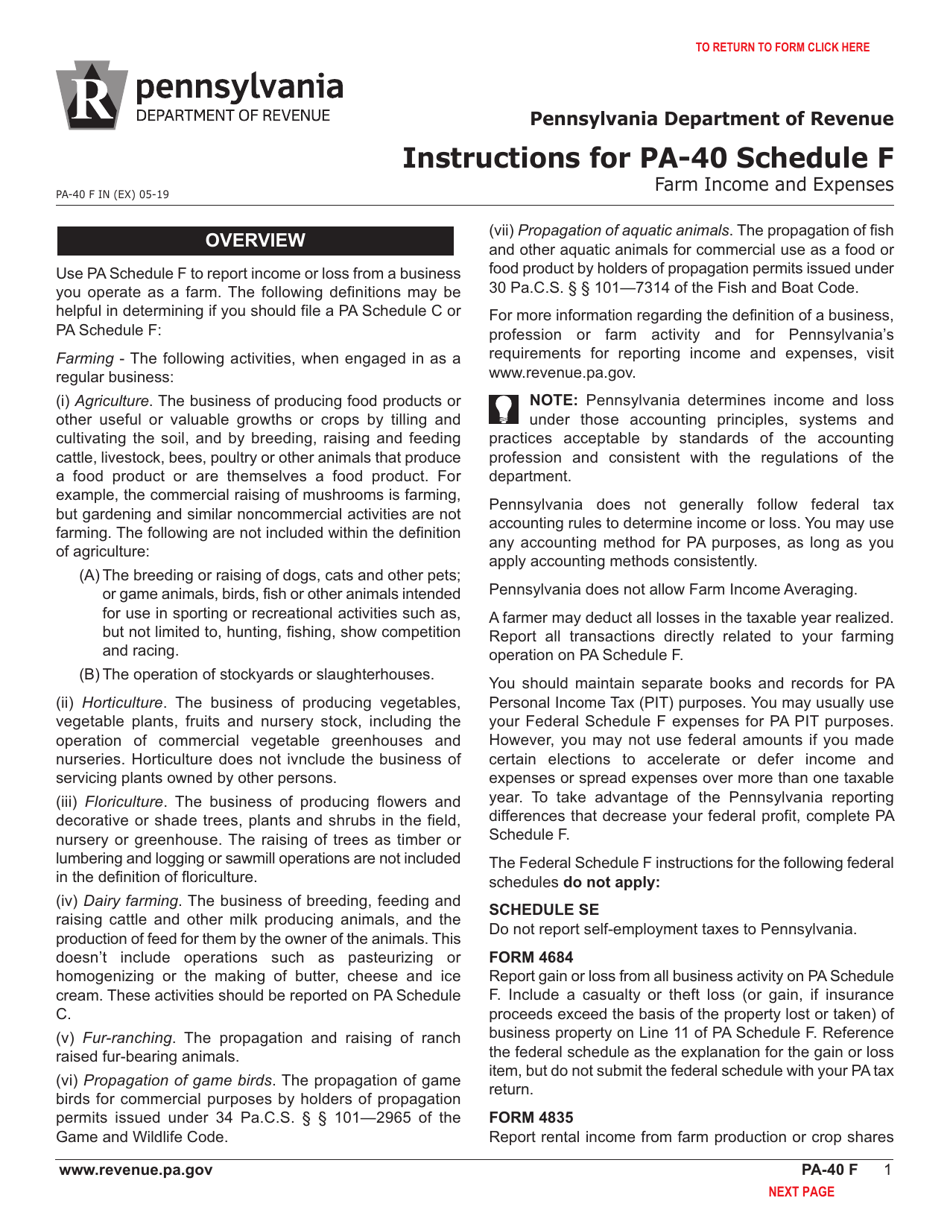

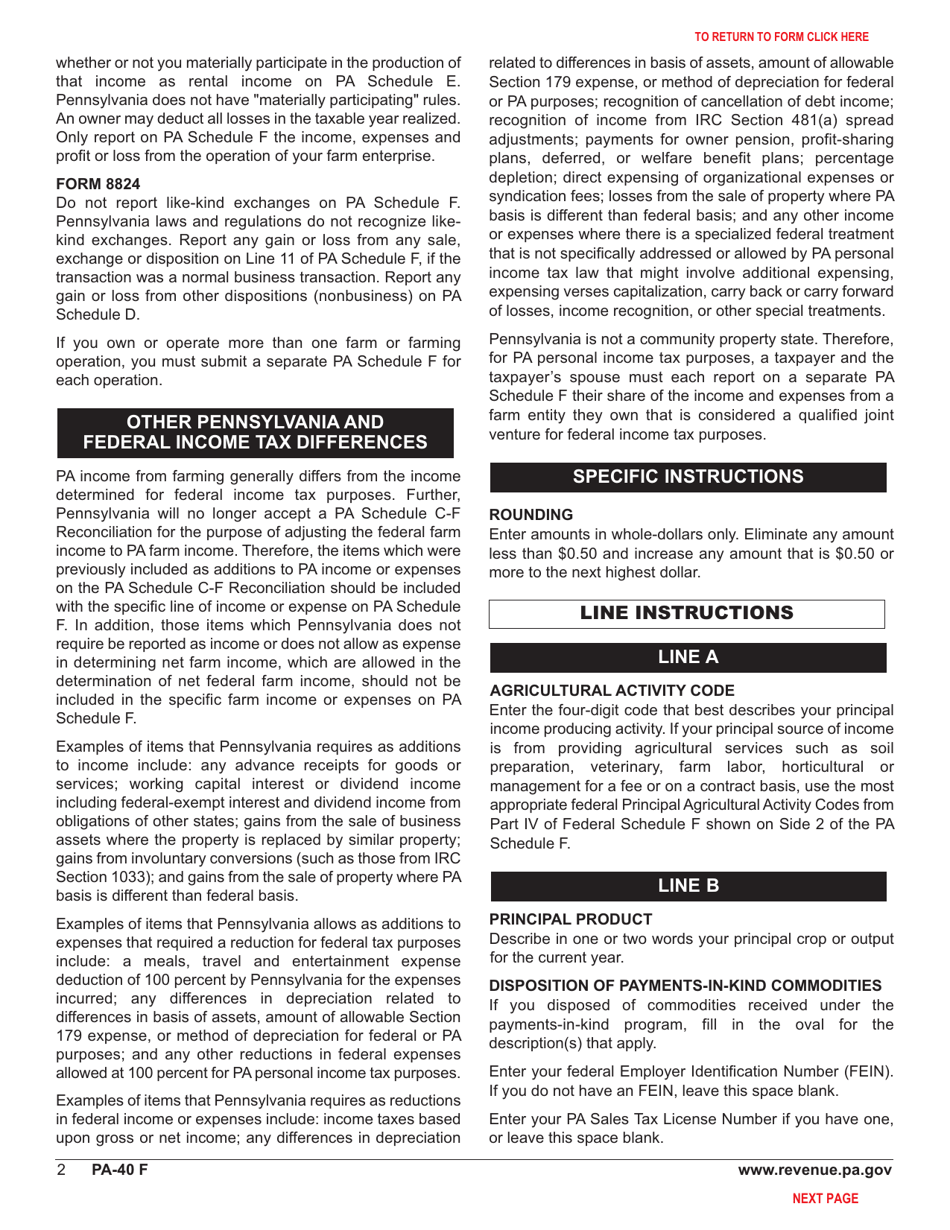

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule F?

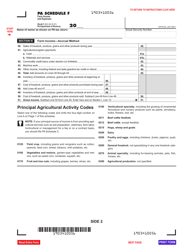

A: Form PA-40 Schedule F is a tax form used by farmers in Pennsylvania to report their farm income and expenses.

Q: Who needs to file Form PA-40 Schedule F?

A: Farmers in Pennsylvania who have income and expenses related to their farming activities need to file Form PA-40 Schedule F.

Q: What information is required on Form PA-40 Schedule F?

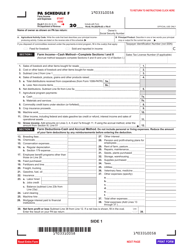

A: Form PA-40 Schedule F requires farmers to report their farm income, deductible expenses, and calculate their taxable income.

Q: What types of income should be reported on Form PA-40 Schedule F?

A: Farmers should report income from the sale of agricultural products, as well as any other income related to their farming activities.

Q: What expenses can be deducted on Form PA-40 Schedule F?

A: Farmers can deduct expenses related to their farming activities, such as seeds, fertilizer, livestock feed, and equipment maintenance.

Q: When is the deadline to file Form PA-40 Schedule F?

A: The deadline to file Form PA-40 Schedule F is generally April 15th, or the same date as the federal income tax deadline.

Q: Are there any penalties for not filing Form PA-40 Schedule F?

A: Failure to file Form PA-40 Schedule F or reporting inaccurate information may result in penalties and interest charges by the Pennsylvania Department of Revenue.

Q: Can I e-file Form PA-40 Schedule F?

A: Yes, farmers in Pennsylvania have the option to e-file Form PA-40 Schedule F.

Q: Do I need to keep records of my farm income and expenses?

A: Yes, it is important to maintain accurate records of farm income and expenses for tax purposes and potential audits.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule F by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.