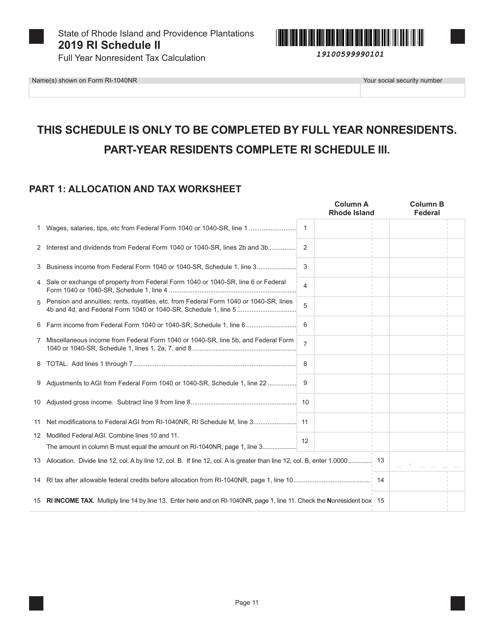

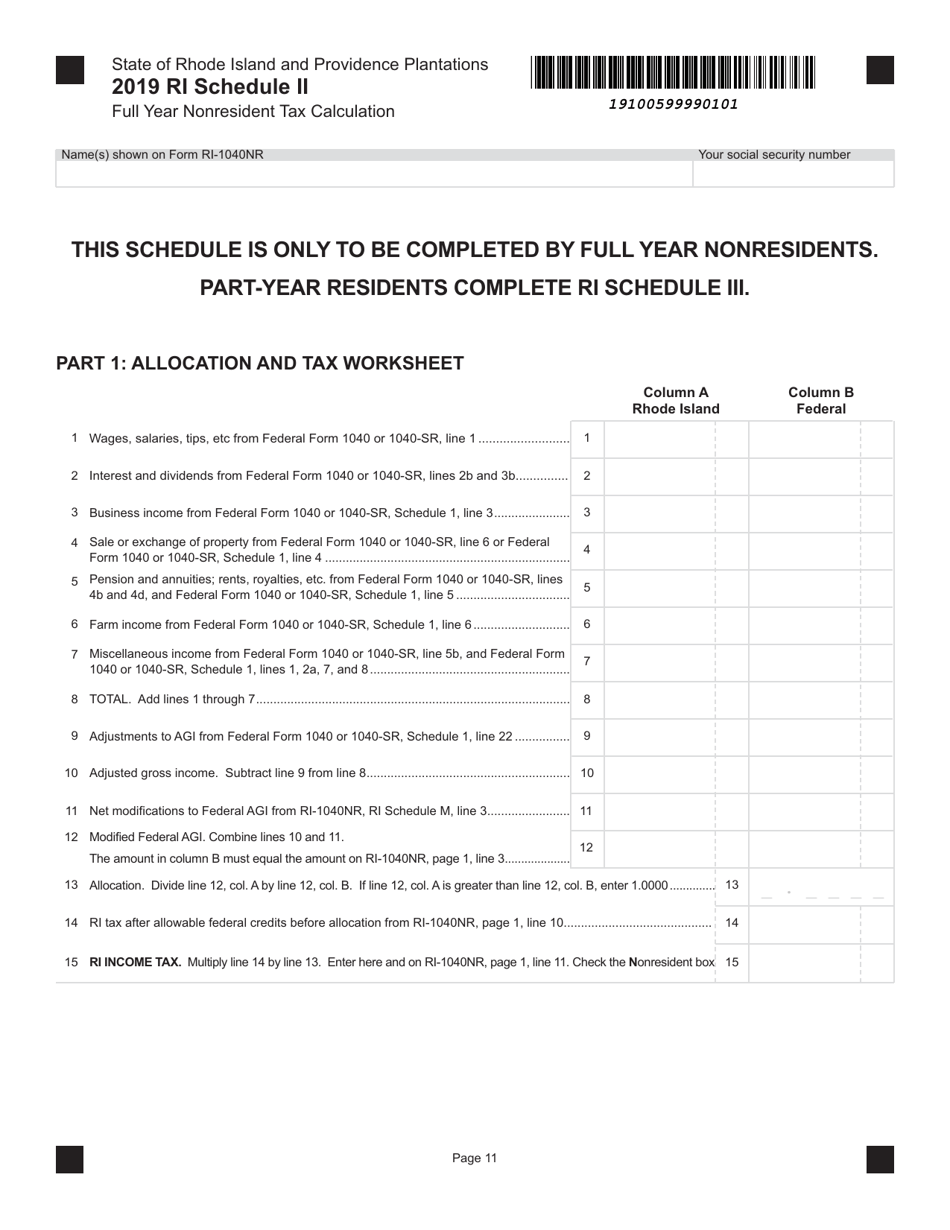

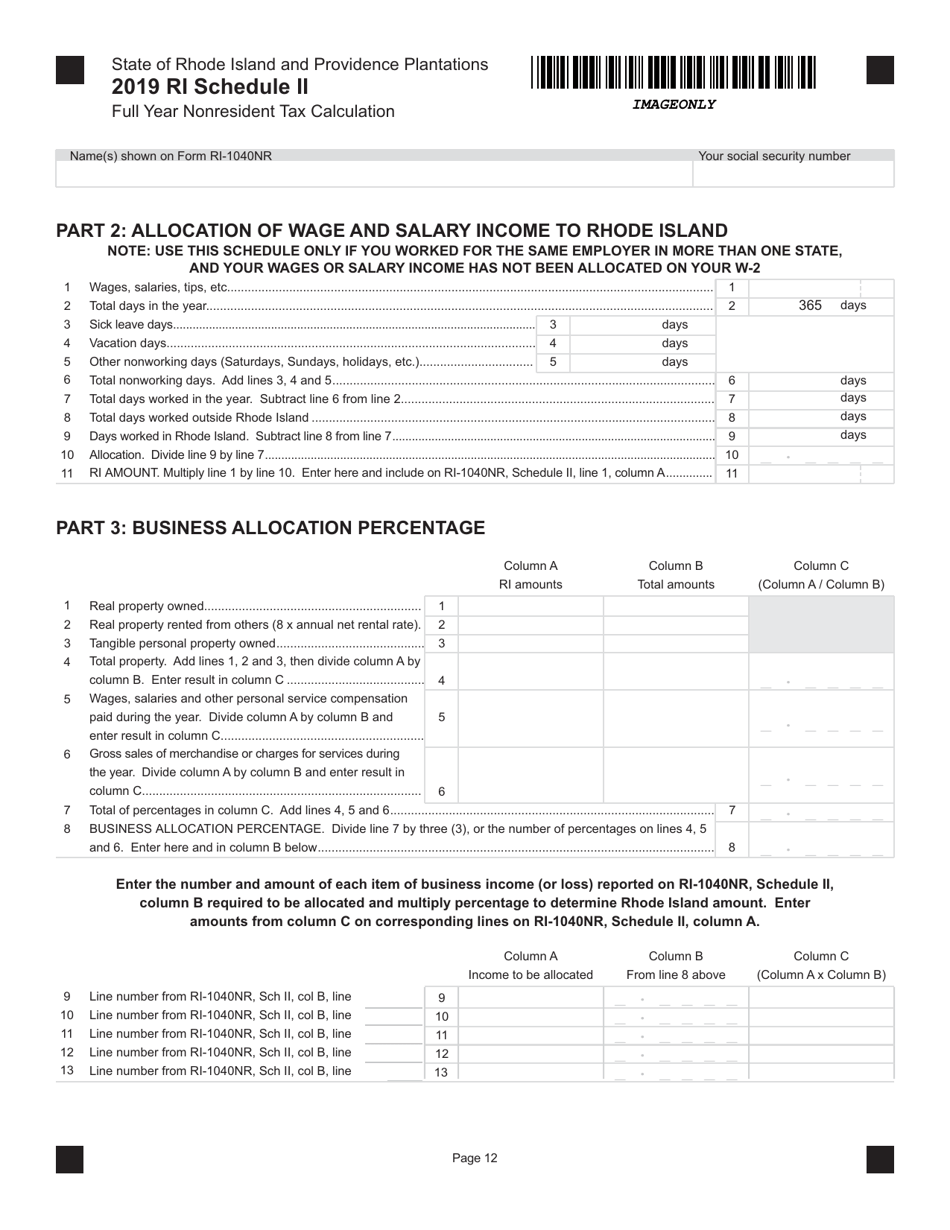

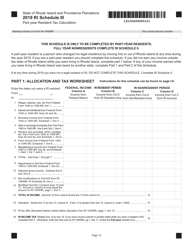

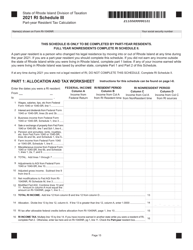

Form 1040NR Schedule II Full Year Nonresident Tax Calculation - Rhode Island

What Is Form 1040NR Schedule II?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040NR Schedule II?

A: Form 1040NR Schedule II is a tax form used by nonresident aliens to calculate Rhode Island state taxes.

Q: Who needs to use Form 1040NR Schedule II?

A: Nonresident aliens who earned income in Rhode Island and are required to file state taxes should use Form 1040NR Schedule II.

Q: What is the purpose of Form 1040NR Schedule II?

A: The purpose of Form 1040NR Schedule II is to calculate the Rhode Island state tax liability for nonresident aliens.

Q: What information is required to fill out Form 1040NR Schedule II?

A: To fill out Form 1040NR Schedule II, you will need information about your income earned in Rhode Island, deductions, credits, and any taxes withheld.

Q: When is the deadline to file Form 1040NR Schedule II?

A: The deadline to file Form 1040NR Schedule II is usually April 15th, but it may vary depending on the tax year. Check with the Rhode Island Division of Taxation for the specific deadline.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040NR Schedule II by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.