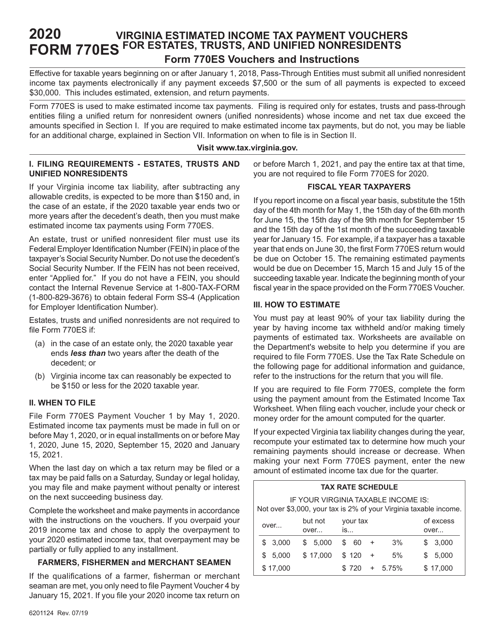

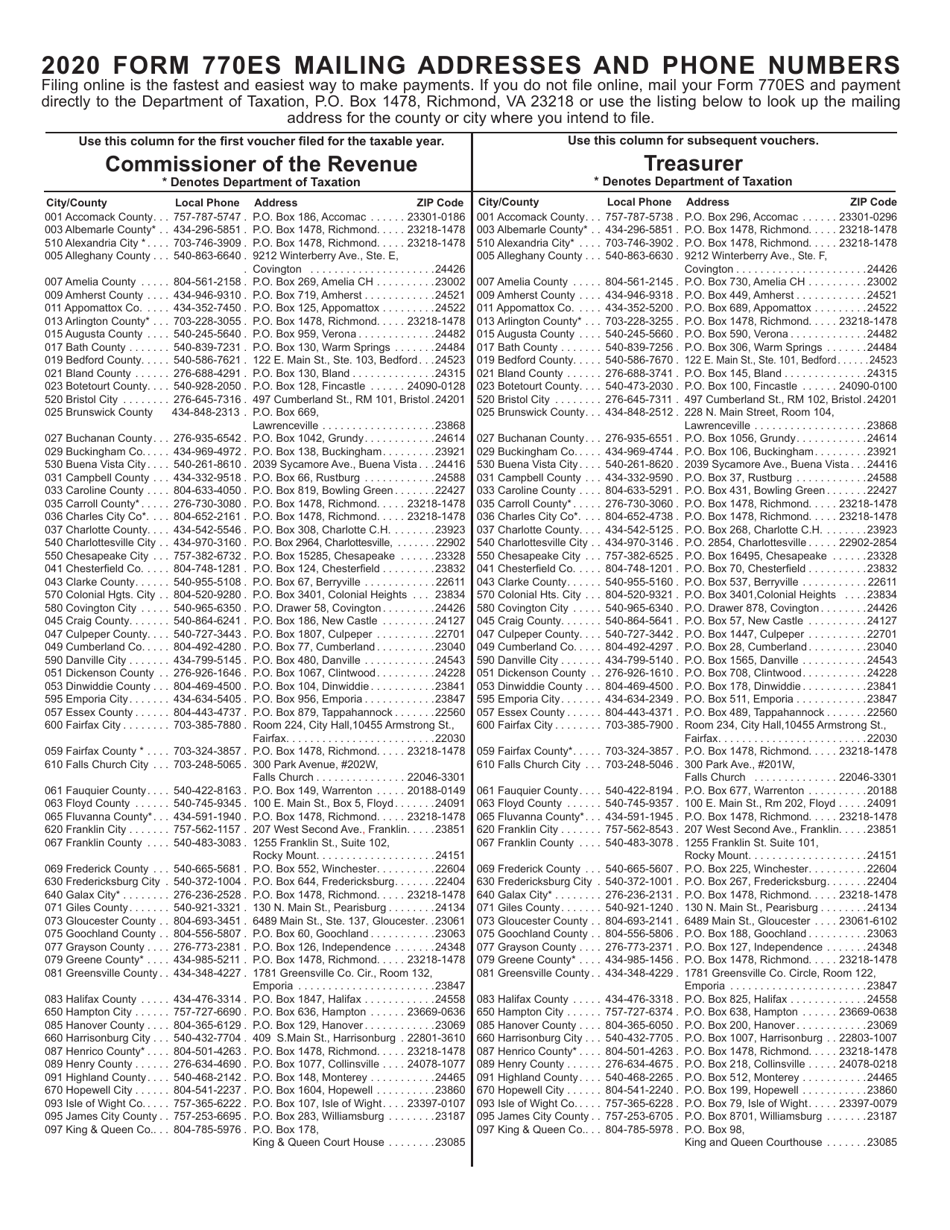

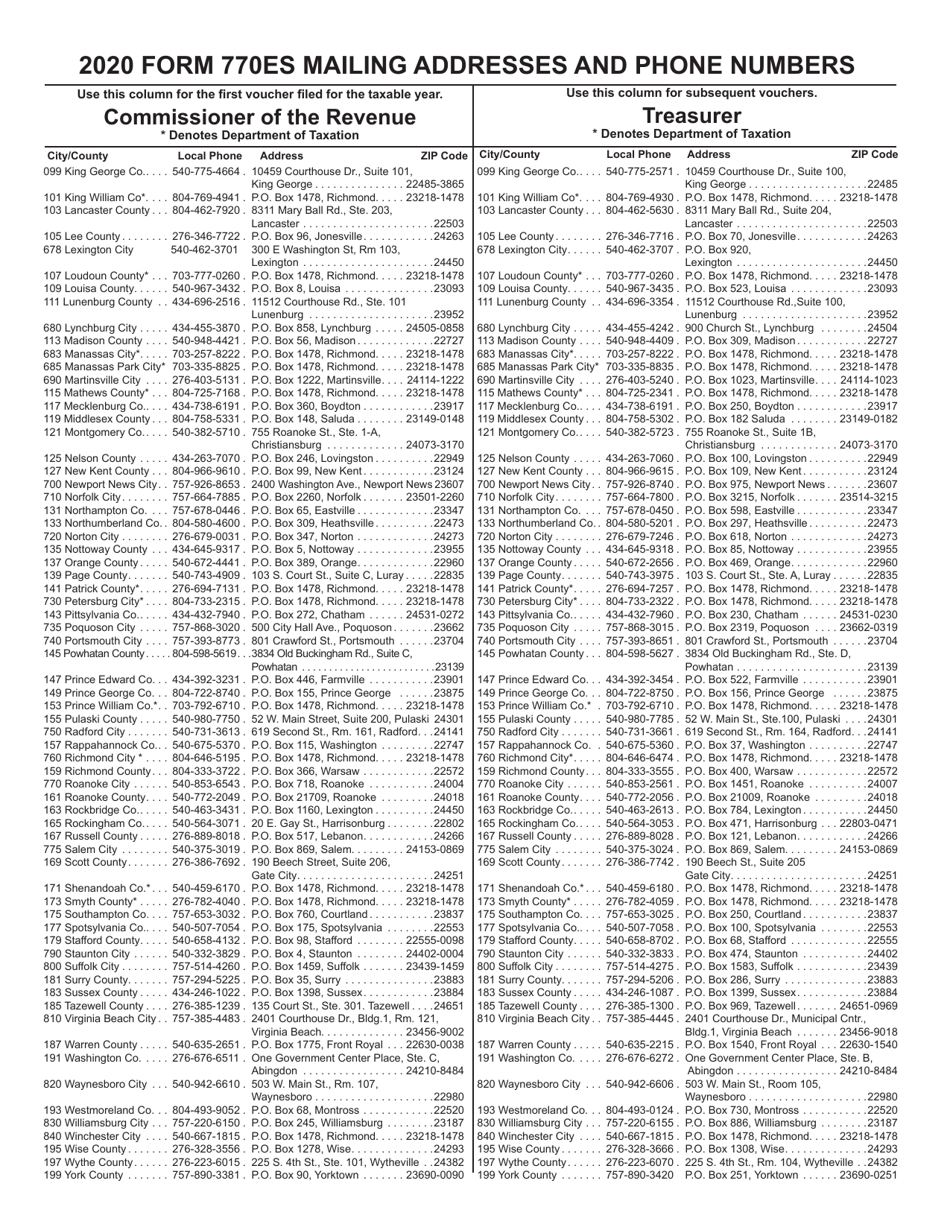

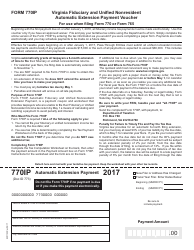

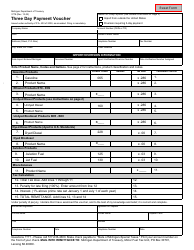

Instructions for Form 770ES Virginia Estimated Payment Vouchers for Estates, Trusts and Unified Nonresidents - Virginia

This document contains official instructions for Form 770ES , Virginia Estimated Payment Vouchers for Estates, Trusts and Unified Nonresidents - a form released and collected by the Virginia Department of Taxation.

FAQ

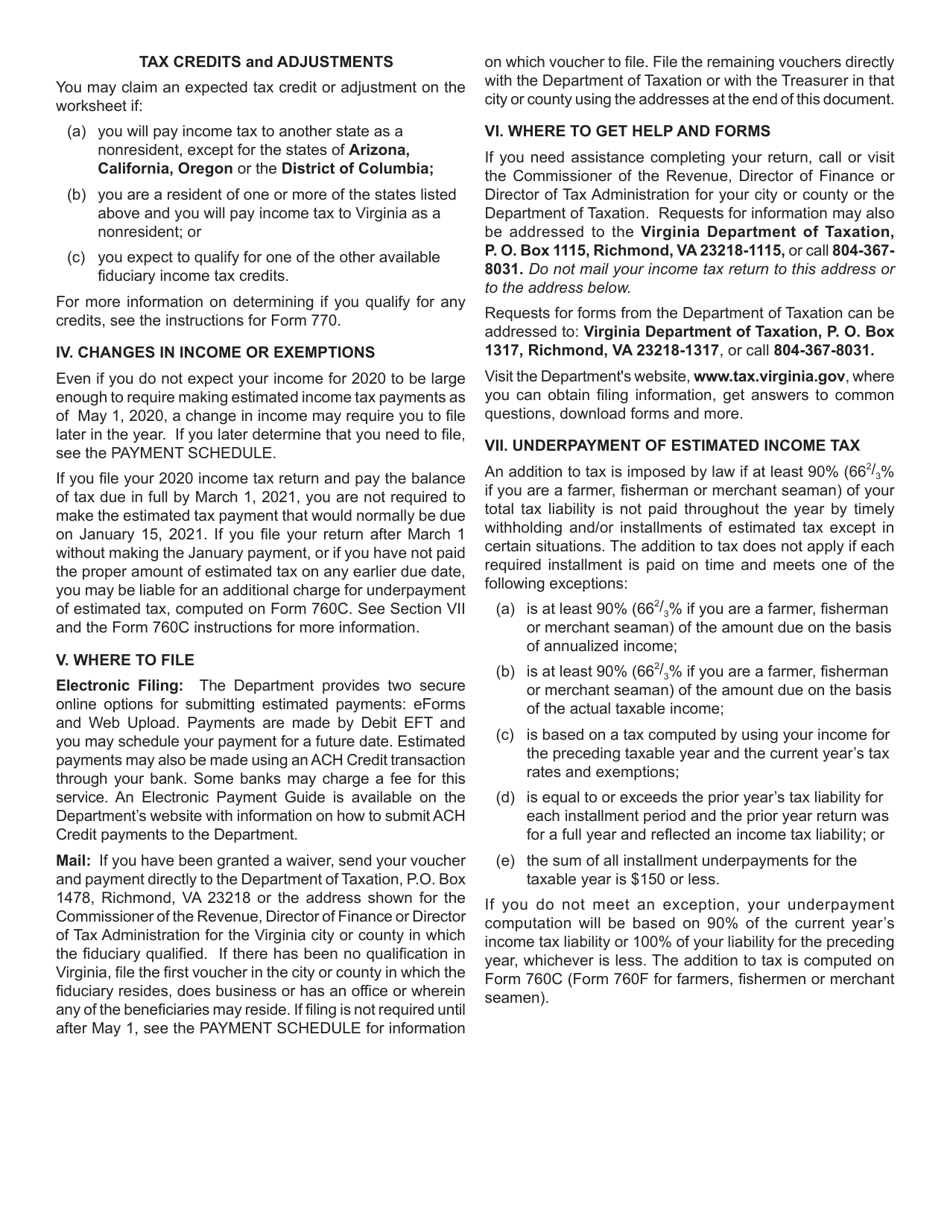

Q: What is Form 770ES?

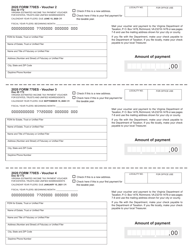

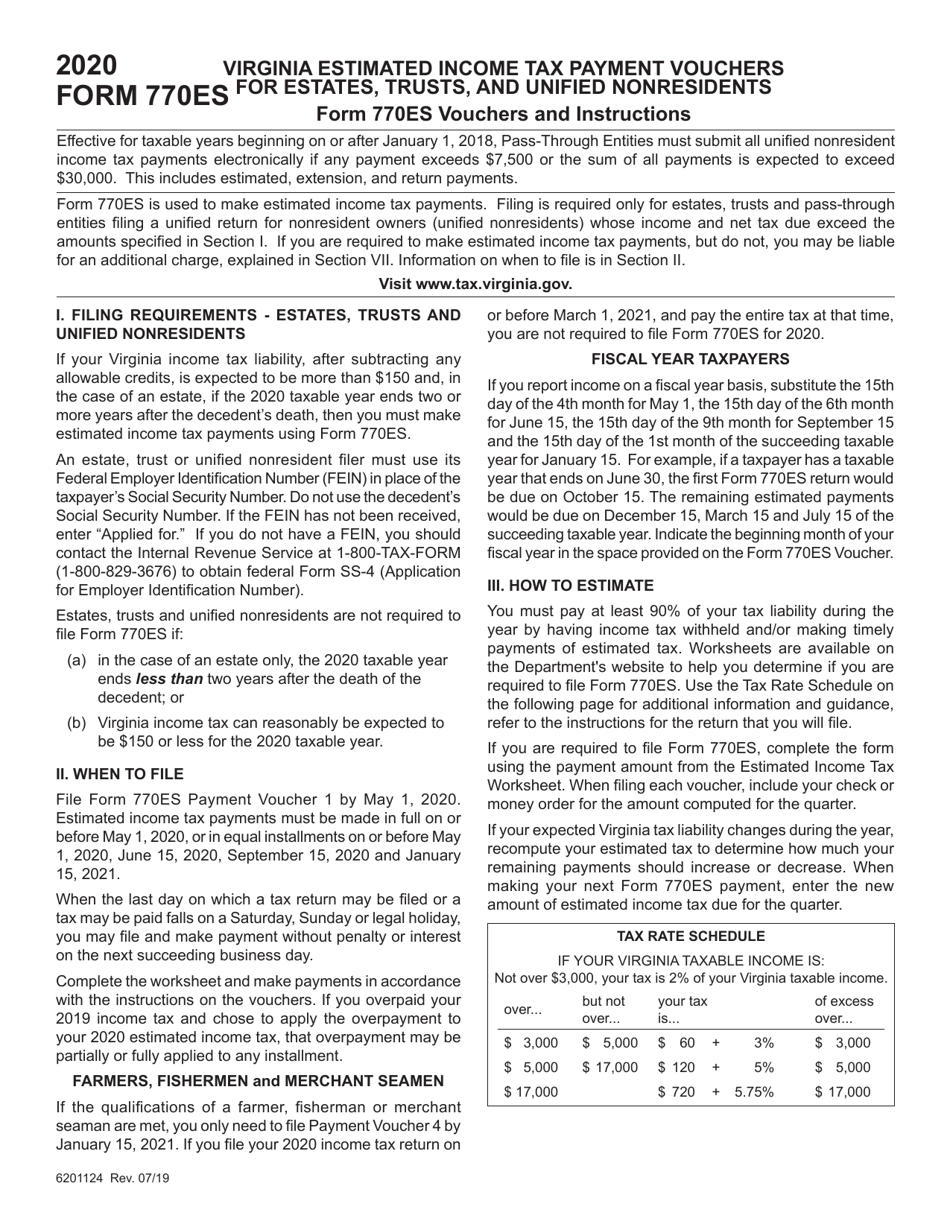

A: Form 770ES is an estimated payment voucher for estates, trusts, and unified nonresidents in Virginia.

Q: Who needs to file Form 770ES?

A: Estates, trusts, and unified nonresidents in Virginia need to file Form 770ES.

Q: What is the purpose of Form 770ES?

A: Form 770ES is used to make estimated tax payments for estates, trusts, and unified nonresidents in Virginia.

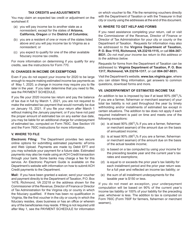

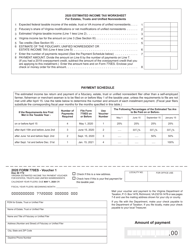

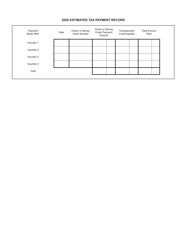

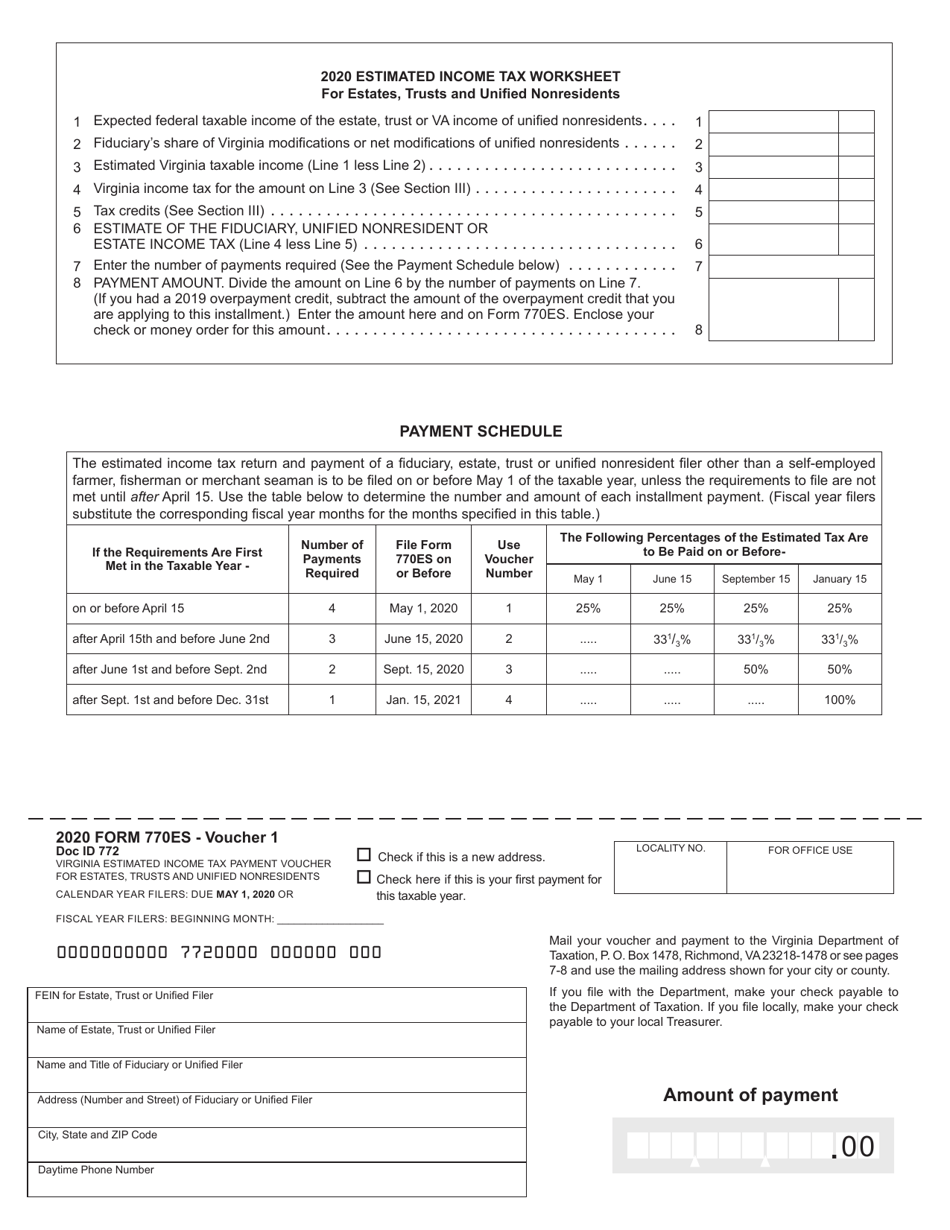

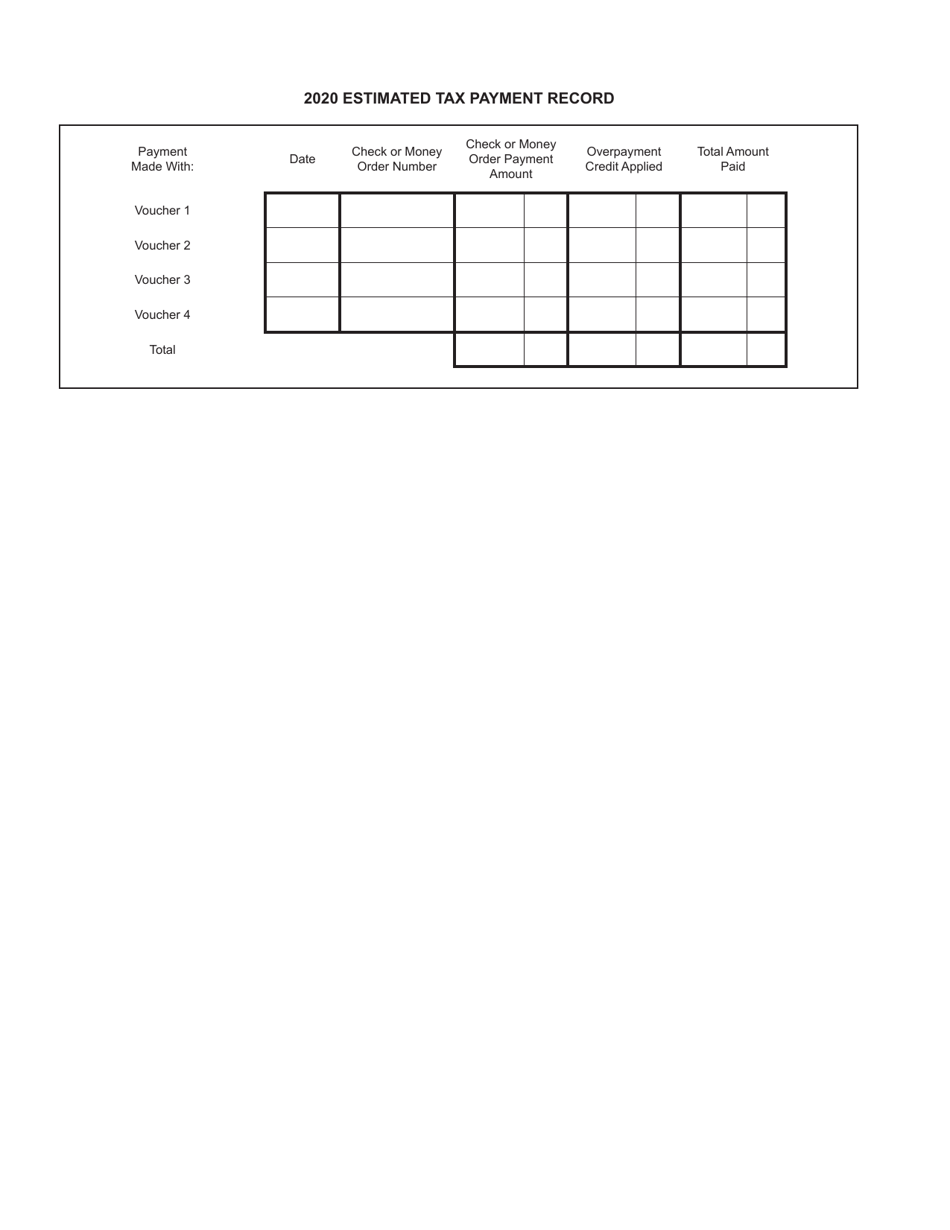

Q: How often do I need to file Form 770ES?

A: Form 770ES must be filed on a quarterly basis.

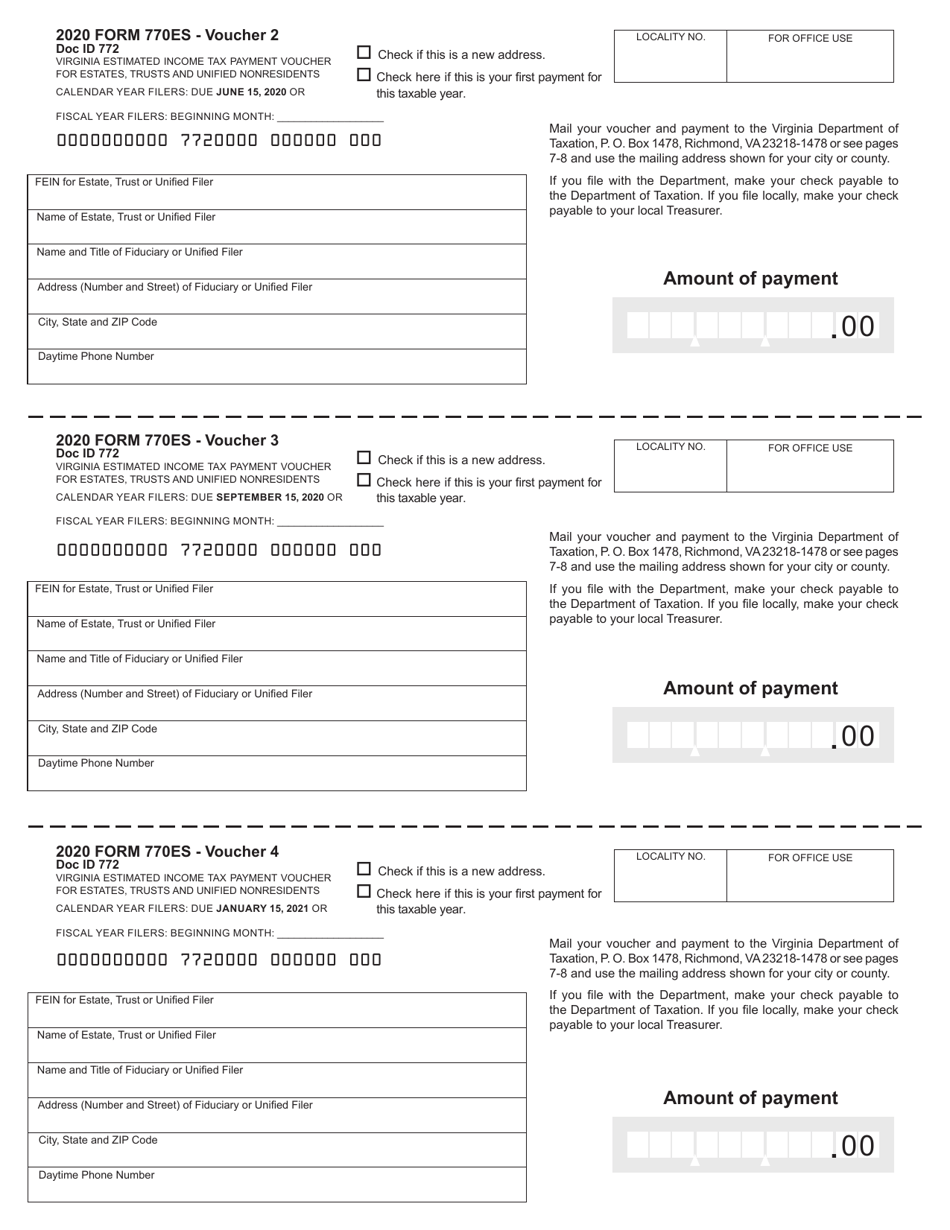

Q: What are the due dates for filing Form 770ES?

A: The due dates for filing Form 770ES are April 15, June 15, September 15, and January 15 of the following year.

Q: Do I need to include a payment with Form 770ES?

A: Yes, Form 770ES must be accompanied by a payment for the estimated tax amount due.

Q: What happens if I don't file Form 770ES?

A: Failure to file Form 770ES or pay the estimated tax amount may result in penalties and interest.

Q: Are there any exceptions or special rules for filing Form 770ES?

A: There may be exceptions or special rules depending on the circumstances. It is best to consult the instructions provided with the form or seek professional tax advice.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.